Municipal investment bankers play a crucial role in the financial landscape, facilitating transactions and providing advisory services to local governments and public entities. However, the demanding nature of their work often raises questions about their working hours. In this paragraph, we will explore the typical work patterns of municipal investment bankers, examining the factors that influence their schedules and the impact on their careers and personal lives. Understanding the work-life balance of these professionals is essential to appreciate the challenges they face and the strategies they employ to manage their time effectively.

| Characteristics | Values |

|---|---|

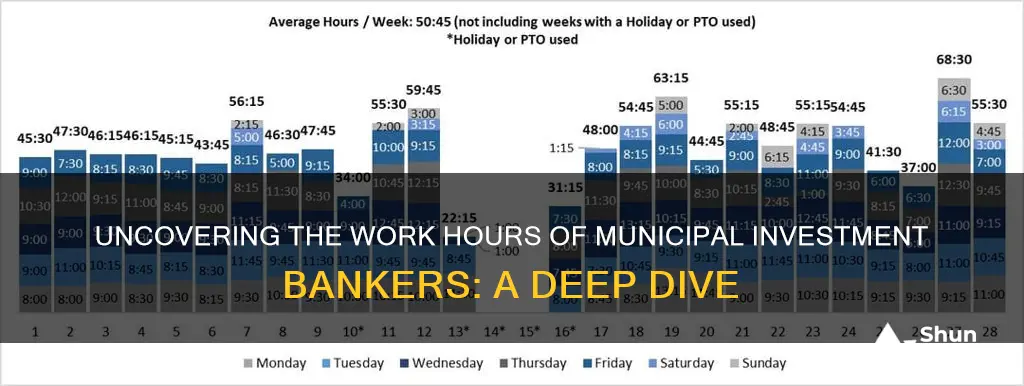

| Typical Workweek | 50-60 hours |

| Overtime | Common, especially during busy periods |

| Flexibility | Some firms offer flexible hours or remote work options |

| Industry Demand | High demand for municipal finance expertise |

| Job Security | Generally stable, but can be competitive |

| Education | Advanced degrees (MBA, CFA) are common |

| Skills | Financial analysis, project management, communication |

| Salary | Competitive, with potential for bonuses |

| Benefits | Comprehensive health insurance, retirement plans |

| Work Environment | Often in office, but may involve travel |

What You'll Learn

- Work-Life Balance: Municipal investment bankers often work long hours, but may have flexible schedules

- Stress and Burnout: High-pressure work can lead to stress and burnout, requiring self-care strategies

- Client Demands: Demanding clients may require bankers to work extended hours to meet expectations

- Project Deadlines: Tight project deadlines can result in long work hours and potential overtime

- Industry Norms: Work hours in municipal finance vary, influenced by industry norms and company culture

Work-Life Balance: Municipal investment bankers often work long hours, but may have flexible schedules

The demanding nature of municipal investment banking often requires professionals to work long hours, especially during peak periods or when dealing with high-profile deals. These extended work hours can be a significant aspect of the job, impacting the work-life balance of bankers. However, it's important to note that the culture and expectations within the industry can vary, and many firms are increasingly recognizing the value of a healthy work-life balance for their employees.

In the fast-paced world of municipal finance, investment bankers often juggle multiple projects and client demands simultaneously. This can lead to a situation where they consistently work beyond the standard 40-hour workweek. Late nights and weekends are not uncommon, particularly when closing deals or managing crisis situations. The pressure to deliver results and meet deadlines can be intense, often requiring bankers to dedicate significant time and effort to their work.

Despite the long hours, many municipal investment bankers enjoy a certain level of flexibility in their schedules. This flexibility is a result of the nature of the job, which often involves a high degree of autonomy and the ability to manage one's own time. Bankers can often set their own hours to some extent, allowing them to prioritize tasks and manage their workload effectively. This flexibility can be a double-edged sword, as it provides the freedom to work when one is most productive but can also blur the lines between work and personal time.

Maintaining a healthy work-life balance is crucial for the well-being of municipal investment bankers. The industry's demands can lead to high-stress levels and burnout if not managed properly. To address this, many firms are implementing initiatives to promote a healthier work environment. These may include flexible work arrangements, wellness programs, and regular reviews of workload and expectations to ensure a sustainable pace.

In summary, while municipal investment bankers often work long hours, the nature of the job also provides opportunities for flexibility. Achieving a balanced approach to work and personal life is essential for long-term success and satisfaction in this demanding profession. It is a delicate balance that firms and individuals must strive to maintain.

The Debt Dilemma: Navigating the Path to Financial Freedom

You may want to see also

Stress and Burnout: High-pressure work can lead to stress and burnout, requiring self-care strategies

The demanding nature of municipal investment banking can take a toll on professionals in this field, often requiring them to work long hours and manage high-pressure situations. While the exact number of hours can vary depending on the specific role, industry trends, and individual circumstances, it is not uncommon for municipal investment bankers to work upwards of 60 hours per week. This demanding work schedule can significantly contribute to stress and burnout if not managed effectively.

Stress and burnout are significant concerns in high-pressure work environments like investment banking. The fast-paced nature of the job, coupled with the need to meet deadlines and deliver results, can lead to chronic stress. This stress can manifest in various physical and mental health issues, including anxiety, depression, and even cardiovascular problems. Burnout, a state of emotional, physical, and mental exhaustion, can also develop when individuals consistently work beyond their limits without adequate rest and recovery.

To combat these issues, investment bankers must prioritize self-care and implement stress management strategies. Here are some practical approaches:

- Set Boundaries: Establishing clear boundaries between work and personal life is essential. This may involve setting specific work hours and ensuring that personal time is dedicated to relaxation and hobbies. Learning to say 'no' to additional tasks when workload or personal commitments are at risk of being compromised is crucial.

- Practice Time Management: Effective time management techniques can help individuals stay organized and reduce stress. Prioritizing tasks, breaking them into manageable chunks, and setting realistic deadlines can make a significant difference. Utilizing tools like to-do lists, calendars, and productivity apps can also enhance focus and efficiency.

- Engage in Physical Activity: Regular exercise is a powerful stress reliever. Incorporating physical activity into daily routines, such as going for a walk during lunch breaks or engaging in team sports after work, can help reduce tension and improve overall well-being.

- Prioritize Sleep: Adequate sleep is vital for maintaining energy levels and cognitive function. Establishing a consistent sleep schedule and creating a relaxing bedtime routine can improve sleep quality. Avoiding stimulants like caffeine close to bedtime and ensuring a comfortable sleep environment can also contribute to better rest.

- Seek Support: Building a strong support network is essential for managing stress. Connecting with colleagues, friends, or family members who can provide emotional support and understanding can help individuals feel less overwhelmed. Additionally, seeking professional help from a therapist or counselor can offer valuable tools for stress management and emotional well-being.

By implementing these self-care strategies, municipal investment bankers can better manage their workload, reduce the risk of burnout, and maintain a healthier work-life balance. It is crucial to recognize that while the job demands dedication and long hours, personal well-being should never be compromised.

Nifty: Invest Now or Later?

You may want to see also

Client Demands: Demanding clients may require bankers to work extended hours to meet expectations

In the world of municipal investment banking, the demands of clients can often be intense and may require bankers to work beyond the traditional 9-to-5 schedule. This is particularly true when dealing with demanding clients who have high expectations and specific requirements. The pressure to meet these demands can lead to extended work hours, sometimes requiring bankers to work late into the night or even on weekends.

Client demands can vary widely and may include the need for rapid response to market changes, quick decision-making, and personalized attention. For instance, a client might request an urgent meeting to discuss a complex deal, or they may need frequent updates and progress reports. These demands can be challenging, especially when they conflict with personal time or other commitments. Investment bankers often find themselves working long hours to ensure that client expectations are met, which can lead to a demanding and high-pressure work environment.

The nature of the job often requires bankers to be available and responsive at all times. This includes being on call outside regular working hours to address any urgent matters or to provide immediate support. For example, a client might need a quick response to a market development, and the banker must be prepared to dedicate the necessary time and effort to resolve the issue promptly. Such a level of responsiveness can significantly impact work-life balance and may result in bankers working extended hours.

Managing client demands effectively is crucial for the success of the business and the satisfaction of clients. Investment bankers must develop strong organizational skills and time management strategies to prioritize tasks and allocate time efficiently. They should also foster open communication with clients to set clear expectations and manage their demands. By doing so, bankers can ensure that they provide the required level of service without compromising their own well-being.

While the job may require extended hours, it is essential for municipal investment bankers to maintain a healthy work-life balance. This can be achieved by setting boundaries, managing time effectively, and prioritizing self-care. Regular breaks, exercise, and hobbies can help bankers recharge and maintain productivity. Additionally, employers can play a role in supporting a healthy work environment by promoting a culture that values productivity over long hours and encourages a sustainable work-life integration.

Unraveling the Workweek: Investment Banking Hours Demystified

You may want to see also

Project Deadlines: Tight project deadlines can result in long work hours and potential overtime

Tight project deadlines are a common challenge in the fast-paced world of municipal investment banking. When a project has a strict timeline, it often requires investment bankers to dedicate extended hours to meet the requirements. This can lead to a significant increase in work hours, especially during the critical phases of a project. The pressure to deliver within a limited time frame can be intense, and bankers may find themselves working late nights and weekends to ensure all tasks are completed on schedule.

In many cases, these extended work hours can result in overtime, which is a common occurrence in the industry. Overtime is often necessary to ensure that projects are completed efficiently and to meet client expectations. However, it can also take a toll on the well-being of the bankers involved. Long work hours may lead to fatigue, decreased productivity, and increased stress levels, which can negatively impact their overall performance and job satisfaction.

To manage this challenge, investment banking firms should prioritize a healthy work-life balance for their employees. This can be achieved by implementing strategies such as setting realistic project timelines, providing adequate resources, and encouraging a culture of open communication. By allowing for a more flexible approach to deadlines, firms can ensure that bankers have the necessary time to deliver high-quality work without compromising their personal well-being.

Additionally, effective time management and prioritization skills are essential for municipal investment bankers. They should be trained to assess the complexity of tasks and allocate time accordingly. By breaking down projects into manageable tasks and setting milestones, bankers can work more efficiently and avoid the pitfalls of last-minute rushes. This approach can help reduce the need for excessive overtime and promote a more sustainable work environment.

In conclusion, while tight project deadlines are an inevitable aspect of municipal investment banking, it is crucial to recognize the potential impact on work hours and employee well-being. By implementing strategies to manage deadlines effectively, investment banking firms can ensure that their bankers maintain a healthy work-life balance while still delivering exceptional results. Finding a balance between meeting project requirements and preserving the long-term health of the workforce is essential for the success and sustainability of the industry.

The Old Tool That Will Revolutionize Investing

You may want to see also

Industry Norms: Work hours in municipal finance vary, influenced by industry norms and company culture

The working hours in the municipal finance sector can vary significantly, and several factors contribute to this variability. One of the primary influences is the industry norms and the specific company culture within which the municipal investment bankers operate. These norms often dictate the expected work hours and the overall pace of the job.

In the municipal finance industry, the nature of the work can vary greatly. It often involves a mix of deal-based projects, ongoing advisory services, and regulatory compliance. Some days might be more demanding, requiring long hours to meet deadlines or close deals, especially during peak periods or when managing complex transactions. On the other hand, there may be quieter periods where the workload is lighter, allowing for more flexible work hours.

Company culture plays a pivotal role in shaping the work-life balance of municipal investment bankers. Some firms may have a more traditional, rigid approach to work hours, emphasizing long hours and a strong work ethic. These companies often expect a high level of dedication and presence, which can lead to a culture of working late and arriving early. In contrast, other organizations might adopt a more modern, flexible approach, prioritizing results over strict hours, and allowing for a better work-life integration.

The impact of industry norms and company culture on work hours is further amplified by the individual's role and level of experience. Senior-level professionals might be expected to work longer hours, especially when managing client relationships or leading deals. Junior analysts or associates may also face pressure to put in extra hours, particularly during their initial years to gain experience and establish themselves.

Understanding these industry norms and company-specific cultures is essential for municipal investment bankers to navigate their careers effectively. It allows professionals to manage their time, set expectations, and maintain a healthy work-life balance while contributing to the success of their firms and clients.

Amazon's Physical Storefronts: A Worthy Investment?

You may want to see also

Frequently asked questions

The typical workweek for municipal investment bankers can vary depending on the specific role, industry, and company. However, it is common for these professionals to work long hours, often exceeding 40 hours per week. The job demands can be intense, especially during deal-making processes, project deadlines, or when managing multiple clients with varying needs.

Overtime is not uncommon in this profession, particularly for senior analysts and associates. Long working hours are often required to meet client expectations, complete research, and prepare financial models. While some companies may offer flexible work arrangements, many investment bankers value the opportunity to work extra hours to advance their careers and gain experience.

Yes, certain periods can be busier than others. For instance, the end of a fiscal year or the start of a new one might see an increase in activity as companies and municipalities rush to meet financial goals or initiate new projects. Additionally, election seasons can be hectic, as municipal investment bankers advise clients on bond issuance and financial strategies related to public elections.

Achieving a healthy work-life balance in this field can be challenging but not impossible. Here are some strategies: prioritize tasks, set realistic deadlines, and learn to delegate when possible. Taking regular breaks during work hours, practicing stress management techniques, and ensuring adequate sleep can also help. Additionally, maintaining a strong support network and making time for personal activities outside of work can contribute to overall well-being.