As of 2023, there are 7.9 million high-net-worth individuals (HNWIs) in North America, the highest concentration in the world. HNWIs are defined as those with liquid assets of at least $1 million. This figure does not include illiquid assets such as property or collectibles.

In 2020, 11.6 million American households held a net worth between $1 million and $5 million, excluding the value of their primary residence.

What You'll Learn

The number of high-net-worth individuals (HNWIs) in North America in 2023

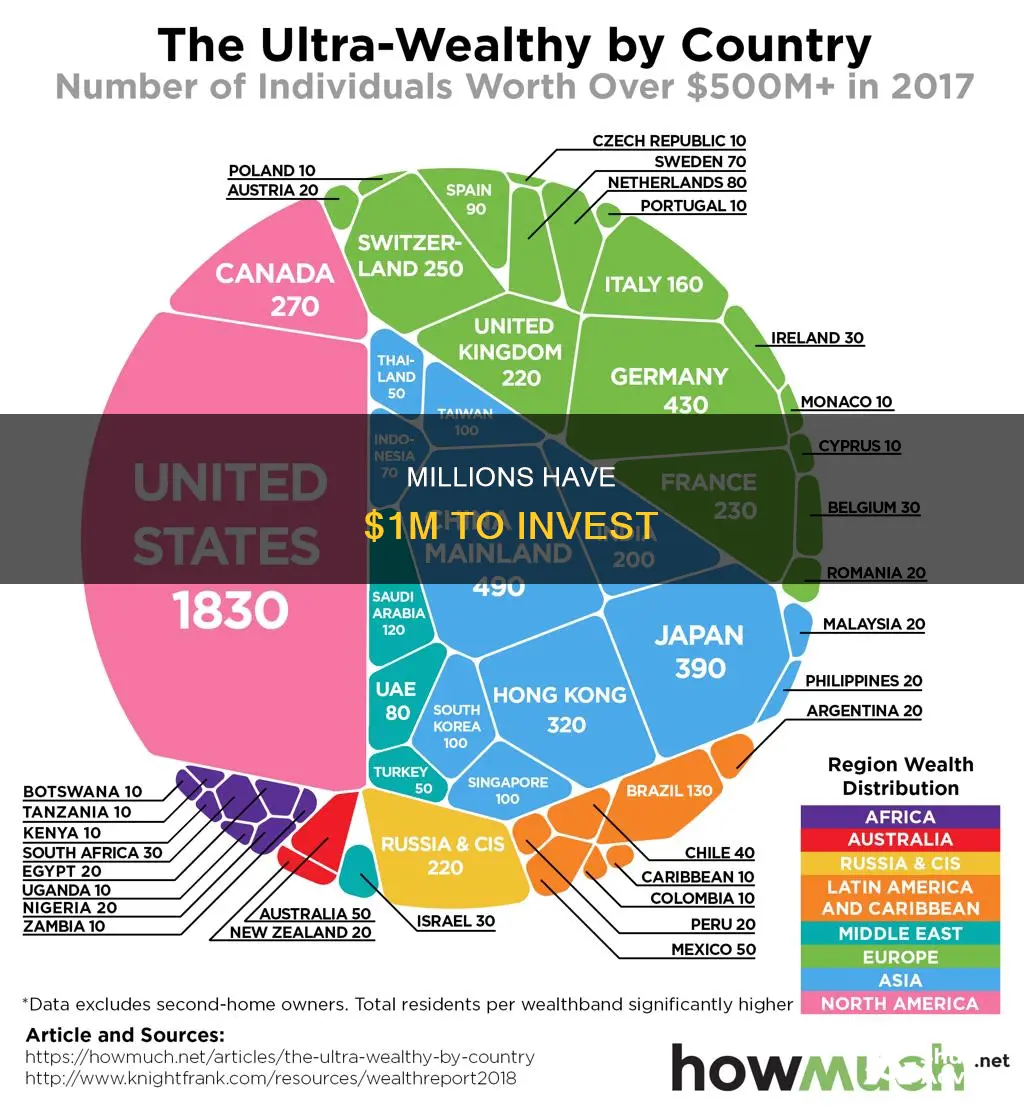

North America had a record number of high-net-worth individuals (HNWIs) in 2023, with 7.9 million people. This is the highest concentration of HNWIs in the world, followed by the Asia-Pacific region, with 7.4 million individuals. HNWIs in Europe totalled 5.8 million in 2023, Latin America had 600,000, the Middle East had 900,000, and Africa had 200,000.

Collectively, the total number of HNWIs around the world increased by 5.1% from 2022 to 2023, with North America experiencing the largest increase of 7.1%. The HNWI population reached 22.8 million in 2023, with a total wealth of $86.8 trillion.

The management consulting firm Capgemini separates the HNWI population into three wealth bands: millionaires next door, mid-tier millionaires, and ultra-HNWIs. Globally, the ultra-HNWI population numbered 220,000 in 2023, an increase of 5.0%. Mid-tier millionaires numbered 2.08 million, while the millionaires next door category made up the largest group, at 20.53 million.

The exact amount that defines an HNWI can often differ by financial institution and region. It generally excludes an individual's primary residence, as well as possessions like fine art and antiques that are relatively difficult to sell and volatile in value.

A high-net-worth individual typically has liquid assets of at least $1 million after accounting for their liabilities. Liquid assets held by HNWIs include cash and investments that can be easily liquidated or converted to cash, including stocks. The term HNWI is commonly used within the financial industry to identify individuals who need tailored financial and money management services due to their net worth.

Who Really Knows How to Invest?

You may want to see also

How to calculate your net worth

Net worth is a quantitative concept that measures the value of an individual or entity. It is calculated by subtracting all liabilities from all assets. Assets refer to anything owned that has monetary value, such as cash, investments, retirement accounts, vehicles, and real estate. Liabilities are financial obligations that deplete resources, including loans, mortgages, credit card balances, and accounts payable.

- Identify your assets: Begin by listing all your assets, such as cash, investments, retirement accounts, vehicles, and real estate. These are possessions that you own and have monetary value.

- Determine the value of your assets: Assess the current market value or resale value of each asset. For example, if you own a house, determine its market value. If you have savings or investments, check their current balance.

- Calculate the total value of your assets: Add up the value of all your assets. This includes both liquid assets (e.g. cash, stocks) and fixed assets (e.g. property, vehicles) that you could sell if needed.

- Identify your liabilities: Make a list of all your financial debts and obligations. This includes loans, mortgages, credit card debt, student loans, accounts payable, and any other money owed to others.

- Calculate the total value of your liabilities: Add up the value of all your liabilities, including both long-term debts (e.g. mortgages) and short-term debts (e.g. credit card balances).

- Subtract your liabilities from your assets: Use the formula: Assets - Liabilities = Net Worth. Subtract the total value of your liabilities from the total value of your assets. The resulting figure is your net worth.

It is important to note that net worth can be positive or negative. A positive net worth indicates that your assets exceed your liabilities, suggesting good financial health. On the other hand, a negative net worth means your liabilities exceed your assets, which may be a cause for concern.

Additionally, some items, like your home or car, can be both assets and liabilities. In such cases, consider the part you own as an asset and the part you owe as a liability. For example, if you have a mortgage on a house, the market value of the house is an asset, but the outstanding mortgage balance is a liability.

Calculating your net worth provides a snapshot of your financial position and can help you make informed financial decisions. It is a useful tool to understand your financial health and stability, and it can also be used to determine your eligibility for certain investment opportunities or financial products.

Why Education is a Worthy Investment

You may want to see also

The benefits of being an HNWI

While there is no official or legal definition of a high-net-worth individual (HNWI), the term generally refers to someone with liquid assets of $1 million or more. HNWIs are highly sought-after clients for wealth managers and receive a range of benefits and privileges due to their substantial wealth. Here are some advantages of being an HNWI:

Exclusive Services and Perks

HNWIs often receive exclusive services and perks from financial institutions, banks, and other professionals. They may have access to 24/7 customer service, luxury products and services, higher credit limits, and personalized financial advice. They also tend to become members of elite clubs or networks, granting them access to private art tours, VIP sporting events, and other exclusive activities.

Investment Opportunities

High-net-worth individuals can access investment opportunities that are not available to the general public. They can invest in hedge funds, private equity (PE) funds, and venture capital (VC) funds. Additionally, HNWIs may have the opportunity to invest in real estate and other alternative assets that are typically out of reach for most people. They can also participate in initial public offerings (IPOs) and invest in startups with high financial potential.

Reduced Fees and Special Rates

Due to their substantial assets, HNWIs often qualify for reduced fees, special rates, and discounts on banking, investment, and other financial services. Their wealth makes them attractive clients for wealth managers, who typically earn fees based on a percentage of the total assets they manage. As a result, HNWIs may receive more personalized services and attention from financial professionals.

Estate and Tax Planning

The complexity of managing substantial wealth often leads HNWIs to seek specialized estate and tax planning services. They can work with experts to develop strategies that protect their assets, minimize tax liabilities, and ensure the efficient transfer of wealth to future generations.

Higher Chances of Securing Loans

The substantial wealth of HNWIs makes them attractive borrowers for financial institutions. They are more likely to secure loans for businesses or investments and may be eligible for higher returns. This enables them to make significant purchases, such as luxury cars or jewelry, without facing financing delays.

Shiba Inu: Who's Invested?

You may want to see also

How to become an HNWI

The term "millionaire" is becoming less and less common to refer to the wealthy. Instead, the new term is "high-net-worth individual" or HNWI. An HNWI is someone with liquid assets valued at $1 million or more. This generally does not include assets like a primary residence, collectibles, or durable goods.

To become an HNWI, financial discipline is required. This involves continuously investing and minimising household debt. Here are some strategies to help you become an HNWI:

Use Time to Your Advantage

The earlier you start investing, and the longer you stay invested, the higher the potential returns thanks to compound interest. Despite the volatility of the stock market in the short term, it has consistently delivered impressive returns over the long term. For example, the benchmark S&P 500 index has provided average annual returns of about 10% over the past 100 years.

Become a Disciplined Investor

Setting up a systematic investment strategy and contributing regularly can lead to positive investment outcomes over time. For example, a 25-year-old needs to save only $158 per month to have $1 million by age 65, assuming a 10% annual return on investment.

Earn a Higher Income

Earning a higher income can help you save and invest more. It can also give you access to experts who can help manage your money and plan for the future. About 70% of wealthy Americans work with a financial advisor, according to Northwestern Mutual.

Boost Your Savings

Consider switching to a high-yield savings account to get a higher interest rate on your savings. You can also grow your wealth by investing in the stock market or finding ways to supplement your income, such as renting out a spare room or monetising a hobby.

Investments: Where People Put Their Money

You may want to see also

How to invest $1 million

While $1 million is still a lot of money, it can disappear quickly if not managed wisely. Understanding your financial goals, timeline, and risk tolerance are key elements in deciding how to invest $1 million.

Financial Goals

First, define your financial goals. Are you investing for retirement? Are you looking to buy real estate or save for a child's education? Depending on your current finances, boosting charitable contributions could be important. Record what you want to achieve and quantify your goals. Determine the annual return you'll need to generate to achieve your objectives.

Time Horizon

With your goals in hand, factor in your current age and when you'll want to spend your returns. These considerations determine your timeline, commonly referred to as your investing time horizon. The longer the time horizon, the greater the allocation to equities. Shorter timelines should be allocated more towards low-risk fixed-income assets.

Risk Tolerance

Risk tolerance and investing timeline are two sides of the same coin. The longer your time horizon, the more risk you can take on. But as the years pass and you get older, risk tolerance declines because there is less time to recover from a market downturn. Your temperament is a decisive factor when it comes to risk, and it's hard to quantify. Ask yourself: how would you respond if the value of your investments declined significantly? Do financial decisions make you anxious? Do you have the fortitude to stick to a strategy even if the market plummets?

Stocks

Stocks are the foundation of every investment portfolio. How much of your portfolio is in stocks depends on your goals, time horizon, and risk appetite. Your equity investment can take lots of different forms. If you have a strong risk tolerance, you might buy individual stocks. More risk-averse investors might choose equity mutual funds or exchange-traded funds (ETFs).

Bonds

Bonds are a key component of a balanced investment portfolio. They offer the benefits of cash flow, diversification, and capital preservation. When the stock market dips, bonds tend to increase in value, and allocating fixed-income assets is vital in any portfolio. Companies and governments issue bonds to borrow money. Bonds have a par value, and each issue has a specified maturity date and rate of interest, commonly called the coupon. The lowest-risk bonds are issued by the US Treasury and are available in maturities ranging from several weeks to 30 years.

Real Estate

Investing in real estate is potentially lucrative, but it takes more work and might be riskier since the property market is volatile and prone to bubbles. For most people, a home is their biggest investment. Homeowners usually take out a mortgage and aim to pay it off by retirement. If they want to downsize later, they sell the property and move somewhere cheaper, pocketing the difference between the sale price and the price of a smaller residence.

Alternative Assets

Alternative investments include more obscure financial vehicles like hedge funds, private equity, and venture capital, as well as commodities, real estate, and collectibles like art, wine, or antiques. They have a low correlation to traditional asset classes, thus improving portfolio diversification. They're less vulnerable to market volatility, and some alternatives, like gold and oil, can hedge inflation. They also offer potentially strong returns versus traditional securities.

Hire an Advisor

With $1 million to invest, it makes little sense to go it alone. A financial advisor can provide objective and informed guidance to help you attain your financial goals. Some financial advisors have a fiduciary duty to their clients, meaning they are legally obligated to work in their clients' best interest. Their fees can be based on a percentage of assets under management (AUM), an hourly rate, or a flat rate.

Investments: Are They for Everyone?

You may want to see also

Frequently asked questions

As of 2023, North America had about 7.9 million HNWIs (high-net-worth individuals).

A HNWI is a person with liquid assets of at least $1 million.

Liquid assets are cash and investments that can be easily liquidated or converted to cash, including stocks.