Millennials face a unique set of challenges when it comes to planning for retirement. With stagnant wages, rising living costs, and record levels of student loan debt, it's no surprise that many in this generation are struggling to save for the future. However, it's important to remember that saving for retirement is a long-term endeavour, and there are steps that millennials can take to improve their financial security in the long run.

Millennials, defined as those born between 1981 and 1996, are often characterised by their ambition to pursue their passions and their desire for a better work-life balance than previous generations. However, this can sometimes result in a delay in establishing stable careers and building retirement savings.

So, what can millennials do to ensure a comfortable retirement?

| Characteristics | Values |

|---|---|

| Age range | 28-43 |

| Retirement savings | 15% of gross income |

| Retirement savings by age | 1x annual salary by 29, 3x by 40 |

| Retirement savings by lifestyle | Frugal: 8x annual salary by 67, High: 12x by 67 |

| Investment portfolio | 90-100% stocks |

| Emergency fund | 6 months of living expenses |

| Retirement income | 40-55% of pre-retirement income |

| Retirement age | 70 |

What You'll Learn

How to save for retirement when paying off debt

Millennials face a unique set of challenges when it comes to investing for retirement. They often carry a heavy burden of student loan debt, face stagnant wages, and may have difficulty accessing employer-sponsored retirement plans. However, it is not impossible for millennials to build a secure financial future. Here are some strategies for how millennials can save for retirement while paying off debt:

Evaluate Your Debt

Not all debt is created equal. Prioritize paying off high-interest debt, such as credit card balances, as these can be detrimental to your financial health. Make sure you are meeting the minimum payment requirements for all your debts, and consider using a debt repayment strategy such as the snowball method, which focuses on paying off the smallest debts first to build momentum.

Take Advantage of Employer Matching

If your employer offers a retirement plan with matching contributions, such as a 401(k) or 403(b) plan, take advantage of it. This is essentially free money that can significantly boost your retirement savings. Contribute at least enough to capture the full matching amount.

Build an Emergency Fund

Unexpected expenses, such as car repairs, can derail your financial plans. Build an emergency fund to cover at least three to six months' worth of living expenses. This will help you avoid taking on additional debt or dipping into your retirement savings to cover unforeseen costs.

Set Debt Reduction Goals

Debt can impact your ability to achieve other financial goals, such as buying a home. Create a plan to reduce your debt over time, focusing on high-interest debt first. This may involve increasing your monthly payments or finding ways to cut back on expenses.

Save for Retirement While Paying Off Debt

You don't have to be completely debt-free before you start saving for retirement. It's important to find a balance between paying down debt and saving for the future. Even if you can only make minimal contributions to your retirement fund, you are establishing good habits and taking advantage of compound interest.

Seek Professional Advice

If you feel overwhelmed or unsure about your financial decisions, consider consulting a financial advisor. They can help you create a personalized plan that takes into account your unique circumstances and goals.

The Mortgage-Investing Conundrum: Seeking Financial Freedom

You may want to see also

How to save for retirement when you don't have an employer-sponsored plan

If you're a millennial without an employer-sponsored retirement plan, there are several ways to save for retirement. Here are some strategies to build your retirement wealth:

End the Waiting Game

Don't delay investing, as it could be costly if you miss out on the power of compounding interest. The earlier you start, the more your money can grow. For example, a 28-year-old who opens a Roth IRA and contributes $6,000 per year would have $910,000 by age 67, assuming a 7% annual rate of return. Waiting until age 35 to start saving would result in only $565,000.

Get Educated on Risk

Understand the difference between risk tolerance and risk capacity. Risk tolerance refers to the amount of risk an investor is comfortable with, while risk capacity is the level of risk needed to achieve investment goals. Consult a professional advisor to help shape your savings plan and ensure it aligns with your risk profile.

Look, But Don't Touch

As your retirement balance grows, you may be tempted to withdraw money for things like a home purchase. However, doing so will reduce long-term growth and delay your retirement. Taking a loan from a 401(k) can also trigger tax consequences if you change jobs. It's best to avoid dipping into your retirement savings and maintain a hands-off approach.

Don't Plan for Retirement Alone

Don't rely solely on a 401(k) plan at work. Take the time to research and consider meeting with a professional advisor to develop a tailored retirement planning strategy. Robo-advisors and online investment platforms, such as Schwab, offer self-directed online trading and access to investment specialists.

Open a Roth IRA

If you don't have an employer-sponsored 401(k), consider opening a Roth individual retirement account (IRA). With a Roth IRA, you contribute with after-tax dollars, and your money grows tax-free. In 2022, you can save up to $6,000 in a Roth IRA, or $7,000 if you're age 50 or older. This option is especially attractive for young investors, as they are typically in a lower tax bracket early in their careers.

Traditional IRA

If you're in a higher tax bracket now than you expect to be later, consider a traditional IRA. For 2022, the contribution limit is $6,000, or $7,000 if you're 50 or older. With a traditional IRA, you can defer taxes, similar to a 401(k). Additionally, if you don't have a 401(k) through work, some contributions to a traditional IRA may be tax-deductible.

Health Savings Account (HSA)

If you have a high-deductible health plan through your employer, you may also have access to an HSA. The pre-tax money you contribute to an HSA can count towards your retirement savings. In 2018, individuals could contribute up to $3,450, while families could contribute up to $6,900. Unlike flexible spending accounts, HSA balances can be carried over from year to year.

Traditional Brokerage Account

If you don't want to open an IRA, you can save for retirement by investing in a traditional brokerage account. This option provides the most flexibility in terms of contributing and withdrawing. However, it doesn't offer the tax benefits of an IRA, so you could face a large tax bill if you trade frequently.

Investing: Lessons and Strategies

You may want to see also

How to calculate how much you need to save for retirement

Millennials, born between 1981 and 1996, face a unique set of challenges when it comes to investing for retirement. From the impact of the Great Recession to record levels of student loan debt, this generation has a more uncertain economic future than previous ones. However, there are several strategies that millennials can employ to ensure a comfortable retirement. Here are some tips on how to calculate how much you need to save for your retirement:

Determine Your Retirement Goals

The first step in calculating your retirement savings is defining what you want your retirement to look like. Do you plan to travel extensively or live a more frugal lifestyle? Knowing your retirement goals will help you estimate the annual income you'll need to maintain your desired standard of living. As a general rule, financial experts suggest that you will need about 70%-80% of your pre-retirement income to sustain your current lifestyle after retiring.

Assess Your Current Financial Situation

Take stock of your current finances by evaluating your income, expenses, and savings. Calculate your annual pre-tax income, including any business earnings or other regular sources of income. Then, determine your monthly budget in retirement, considering how your spending might change. This will give you an idea of how much you will need to save to meet your retirement goals.

Factor in Inflation and Life Expectancy

Remember to account for inflation when planning for retirement, as it will impact the purchasing power of your savings. Assume an average inflation rate of around 2%-3% per year. Additionally, consider your life expectancy and aim for a longer retirement period. While it may seem daunting, planning for a longer retirement will ensure that your savings and income last throughout your life.

Calculate Your Savings Rate

To achieve your retirement goals, you need to save consistently. Financial advisors recommend saving 10%-15% of your pre-tax income annually. You can use online retirement calculators to estimate how much you should contribute monthly to reach your target retirement savings. These calculators take into account factors such as your age, current savings, desired retirement age, and expected rate of return on investments.

Maximize Employer-Sponsored Plans

If your employer offers a retirement plan, such as a 401(k), take advantage of it, especially if they provide matching contributions. These plans allow you to save on a tax-deferred basis, and the employer match is essentially free money, boosting your savings. If you don't have access to an employer-sponsored plan, consider opening a traditional or Roth IRA to start building your retirement nest egg.

Invest in Stocks and Diversify Your Portfolio

As a millennial, you have time on your side, so consider investing a significant portion of your portfolio in stocks to benefit from long-term compounding gains. Diversify your stock holdings across different sectors, such as socially responsible investments, tech stocks, or consumer staples. Additionally, allocate a smaller portion to bonds to balance your portfolio.

Plan for the Unexpected

Life is unpredictable, so it's essential to have an emergency fund to cover unexpected expenses. Aim to save at least six months' worth of living expenses in a readily accessible savings account. This will ensure that you don't have to dip into your retirement savings or incur high-interest debt during financial setbacks.

Remember, retirement planning is a highly personalized process, and there is no one-size-fits-all solution. By following these steps and seeking professional financial advice when needed, you can make informed decisions about your retirement savings and look forward to a secure future.

Investments: Where People Put Their Money Now

You may want to see also

How to save for retirement when you have a low income

Saving for retirement when you have a low income can be challenging, but with the right strategies, it is possible to secure your financial future. Here are some tips to help you get started:

Understand your financial situation

Calculate your current income and expenses to estimate your potential retirement income. Use a retirement calculator to get an idea of your trajectory towards retirement age. This will help you plan for either adjusting to a low-income retirement or increasing your savings before retirement.

Take advantage of employer-sponsored plans

If your employer offers a 401(k) or similar retirement plan, contribute as much as you can, especially if they offer matching contributions. This is essentially free money that can boost your retirement savings. If you don't have access to an employer-sponsored plan, consider opening an Individual Retirement Account (IRA).

Start saving early

Even if you're only able to contribute a small amount, consistently saving over time can add up to a substantial nest egg for retirement. Automate your savings by setting up direct deposits or payroll deductions into your retirement account. This way, you save without having to take any action each month.

Increase your savings rate over time

Start with a small contribution, such as 1% of your salary, and gradually increase it over time. If your income increases, consider allocating a portion of the additional funds to your retirement savings. Aim to save at least 15% of your gross income to ensure a comfortable retirement.

Make smart investment choices

Consider low-risk investments such as government bonds or certain mutual funds, which offer decent returns without a high risk of losing your investment. If you have a longer time horizon until retirement, you may also want to invest in higher-risk assets with the potential for higher returns, such as stocks.

Seek professional advice

Consider working with a financial advisor to help you navigate the complexities of retirement planning and make the most of your savings. They can provide guidance on investment choices and overall money management.

Ebooks: Eco-Friendly, Accessible, Affordable

You may want to see also

How to save for retirement when you have a high income

Saving for retirement can be intimidating, especially for millennials, who may be facing student loan debt, rising housing costs, and stagnant wages. However, there are several strategies that can help high-income earners maximize their retirement savings. Here are some tips for how to save for retirement when you have a high income:

- Take advantage of employer-sponsored plans: If your employer offers a retirement plan such as a 401(k), contribute as much as you can. In 2024, individuals can contribute up to $23,000 as a tax-deferred benefit. Some employers may also offer matching contributions, further boosting your savings.

- Utilize tax-favored accounts: Consider investing in tax-favored retirement accounts such as 401(k)s and IRAs. If you're a high-income earner, you may want to look into a Backdoor Roth IRA. This strategy allows you to contribute to a traditional IRA and then convert it into a Roth IRA, offering tax advantages.

- Maximize Health Savings Accounts (HSAs): If you have a high-deductible health plan, you can contribute to an HSA. These accounts offer triple tax breaks: you can invest with pre-tax money, enjoy tax-free growth, and make tax-free withdrawals for qualified medical expenses.

- Explore after-tax 401(k) contributions: If you've maxed out your pre-tax 401(k) contributions, some employers allow you to make after-tax contributions. This option provides flexibility and simplifies your investments by keeping them in one place.

- Consider brokerage accounts: Once you've maxed out your tax-favored plans, you can invest in brokerage accounts or taxable investment accounts. While you won't get tax advantages, you can still grow your money instead of keeping it in a low-interest savings account.

- Diversify your portfolio: It's important to have a mix of assets in your portfolio. Millennials, in particular, should consider making stocks a large portion of their portfolio to reap the benefits of long-term compounding gains while they can tolerate higher-risk investments.

- Start saving early: Compound interest works in your favor when you start saving early. The power of compounding interest can significantly increase your retirement savings over time.

- Educate yourself on risk: Understand the difference between risk tolerance (the amount of risk you're comfortable with) and risk capacity (the level of risk required to achieve your investment goals). This knowledge will help shape your savings plan.

- Don't touch your retirement savings: It may be tempting to dip into your retirement funds for a large purchase, such as a home. However, doing so can delay your retirement and reduce long-term growth.

- Seek professional advice: Don't plan for retirement alone. Consider working with a financial advisor or utilizing online investment research tools to develop a tailored retirement strategy.

Remember, saving for retirement is a marathon, not a sprint. It's important to make steady progress toward your retirement goals, no matter your age or income level.

College: A Risky Bet?

You may want to see also

Frequently asked questions

This depends on a number of factors, such as your current age, how much you've already saved, your lifestyle aspirations, and other factors like inflation, future employment, and Social Security benefits. A common rule of thumb is to save at least 15% of your gross income. Another recommendation is to aim for savings and other sources of income that will generate at least 80% of your pre-retirement income each year.

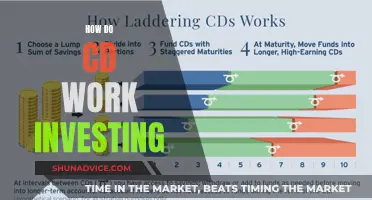

If your employer offers a retirement plan, take advantage of it, especially if they offer a company match. You can also open an individual retirement account (IRA), such as a traditional IRA or a Roth IRA, which both have unique tax advantages. In addition, consider investing in the stock market, using ladder CDs, or opening a high-yield money market account.

Millennials often face challenges such as student loan debt, rising housing costs, and stagnant wages. They may also have different priorities and life trajectories than previous generations, such as pursuing their ambitions while they're young and seeking a better work-life balance. Additionally, millennials may not have access to employer-sponsored retirement plans or may be unsure of how to invest their money effectively.