Bitcoin is a highly volatile cryptocurrency with no central authority to intervene in the market. As of February 2024, if you had invested $1000 in Bitcoin a year ago, it would have grown by 133% and be worth $2331. If you had invested $1000 five years ago, it would have grown by 1352% and be worth $14,524. If you had invested $1000 ten years ago, it would have grown by 7644% and be worth $77,443. However, it's important to note that past performance doesn't guarantee future results, and financial experts recommend investing no more than you're willing to lose.

What You'll Learn

Bitcoin's volatility

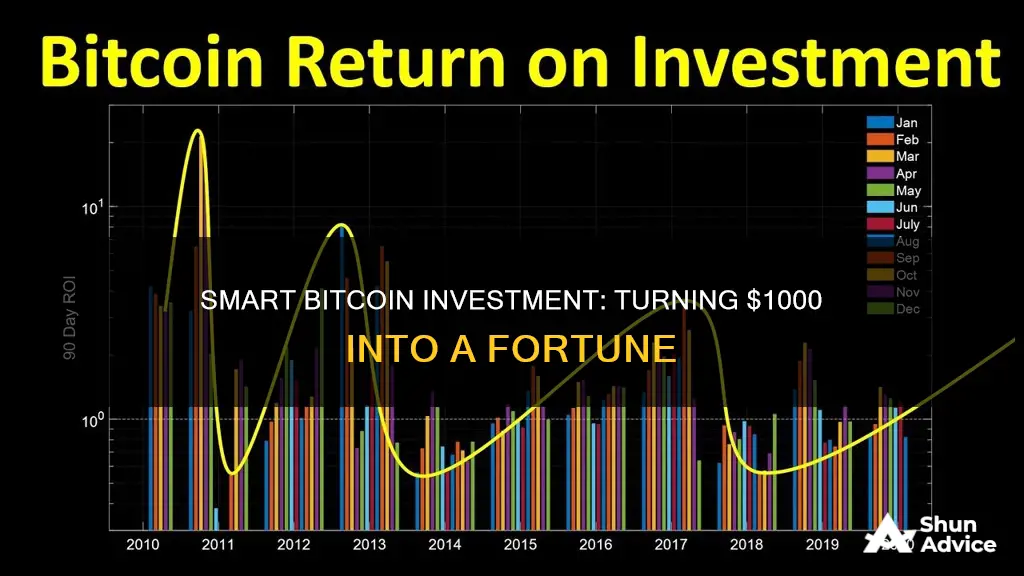

Bitcoin is a highly volatile asset. Volatility is a measure of how much the price of a financial asset varies over time. The volatility of Bitcoin is measured by how much its price fluctuates relative to the average price in a given period.

While Bitcoin is a volatile asset, it has delivered substantial returns for investors. For example, if you had invested $1,000 in Bitcoin five years ago, your investment would have grown by 1,352% and be worth around $14,524 as of February 14, 2024.

Strategizing Bitcoin Investments: Maximizing Returns

You may want to see also

How much $1000 in Bitcoin would be worth in a year

Bitcoin is a highly volatile cryptocurrency with no central authority to intervene in the market. Its value is influenced by various factors, including media attention, public perception, and the news of governments potentially regulating or banning it.

If you had invested $1000 in Bitcoin a year ago, it would have grown by about 133% and be worth around $2331. However, it's important to note that the value of Bitcoin fluctuates, and there are no guarantees of future returns.

Bitcoin's value has experienced significant highs and lows over the years. In November 2021, it reached an all-time high of nearly $69,000, but it lost more than 75% of its value following the collapse of FTX, the largest cryptocurrency exchange at the time.

The recent rise in Bitcoin's price is attributed to the launch of spot Bitcoin exchange-traded funds (ETFs), which allow everyday investors to buy Bitcoin on regulated stock exchanges. This has attracted renewed investor interest, with the value of all Bitcoin in circulation exceeding $1 trillion for the first time since 2021.

While Bitcoin has the potential for significant gains, it is also subject to substantial losses. It is essential to do your research and understand the risks before investing.

Some experts predict that Bitcoin's price could reach $1 million by 2030, while others caution that it is a highly speculative investment. Financial experts generally recommend investing no more than you are willing to lose due to its volatile nature.

If you decide to invest in Bitcoin, it is advisable to take a long-term approach and use strategies like dollar-cost averaging, investing a fixed amount at regular intervals, to smooth out the volatility.

Bitcoin or Stocks: Where to Invest Your Money?

You may want to see also

How much $1000 in Bitcoin would be worth in five years

Investing in Bitcoin is risky due to its volatility, and financial experts recommend investing no more than you are willing to lose. That said, a small amount of crypto can be part of a diversified investment strategy.

If you had invested $1,000 in Bitcoin five years ago, your investment would have grown by 1,352% and would be worth around $14,524 as of February 14, 2024. This estimate is based on a token price of $51,793.

If you had invested $1,000 in Bitcoin on January 15, 2019, it would have been worth $11,540 on January 15, 2024. This represents a significant gain, but it's important to remember that the value of Bitcoin can fluctuate widely, and there is a risk of sudden downswings and long periods of negative returns.

Looking ahead, it's challenging to predict how much $1,000 in Bitcoin will be worth in five years. However, several factors could influence its value. The launch of Bitcoin exchange-traded funds (ETFs) could drive the price higher, as it allows everyday investors to buy Bitcoin on regulated stock exchanges. Additionally, the upcoming Bitcoin halving events, where the computing power required to mine new Bitcoins is increased, are typically followed by a strong bull run in Bitcoin prices.

Cathie Wood, the CEO of Ark Invest, has predicted that Bitcoin could reach $400,000 to $500,000 by 2030. In their 2023 Big Ideas report, Ark Invest laid out several price targets for Bitcoin, including $257,500 in a bearish forecast, $682,000 in an average market, and $1.48 million in a bullish market. If these predictions come true, a $1,000 investment in Bitcoin today could be worth anywhere from $5,946 to $34,040 in 2030.

It's important to note that these are just predictions, and the actual value of Bitcoin in five years could differ significantly. The cryptocurrency market is highly speculative, and past performance is not necessarily indicative of future success.

Bitcoin's 7-Year Investment: Millions Made from 300 Coins

You may want to see also

How much $1000 in Bitcoin would be worth in ten years

Bitcoin is a highly volatile cryptocurrency with no central authority to intervene in the market. This makes it a risky investment. If you had invested $1000 in Bitcoin ten years ago, your investment would have grown by 7644% and would be worth around $77,443 as of February 14, 2024.

However, it is important to note that the value of Bitcoin fluctuates. In November 2021, Bitcoin hit an all-time high of just under $69,000, but as of June 2024, it was worth around $24,000. This means that if you had bought Bitcoin at its peak, you would have made a loss. On the other hand, if you had bought Bitcoin in January 2021 and sold it at its peak price, you would have made a 115% profit.

Looking further back, in July 2016, $1000 would have bought you 1.52 Bitcoin at a price of $656.17 per coin. By July 2021, this investment would have been worth $58,900, representing growth of 5,805%July 2011, two years after Bitcoin was created, $1000 would have bought you 71.89 Bitcoin, which would have been worth $2,785,737.50 in July 2021—a growth of 278,476.56%.

It is worth noting that these calculations are based on historical data, and past performance is not necessarily indicative of future success. Bitcoin's value can be extremely volatile, and investors need to keep a close eye on their profits. Additionally, experts recommend investing no more than you are willing to lose due to the high risk and volatility of cryptocurrencies.

The Ultimate Guide to Getting Started with Bitcoin

You may want to see also

How to calculate Bitcoin profits

Calculating your Bitcoin profits is a straightforward process. There are several online tools available to help you calculate your profits, but you can also do it manually.

Using an Online Tool

Several online tools can help you calculate your Bitcoin profits. These tools will ask you to input the following information:

- The date you purchased your Bitcoin

- The amount of money you invested

- The date you sold your Bitcoin

- The amount of money you sold your Bitcoin for

- Any fees you paid when buying or selling Bitcoin

Once you have entered this information, the calculator will determine your profits or losses.

Calculating Manually

You can also calculate your Bitcoin profits manually. To do this, you will need the same information as above. Follow these steps:

- Subtract the amount of money you invested in Bitcoin from the amount of money you sold your Bitcoin for. This will give you your profit or loss.

- To calculate the percentage return on your investment, divide your profit or loss by the amount of money you invested. Then, multiply this number by 100.

For example, if you invested $1,000 in Bitcoin and sold it for $2,000, your profit would be $1,000. To calculate the percentage return, divide $1,000 by $1,000, which equals 1. Multiply 1 by 100, and your percentage return is 100%.

Important Considerations

When calculating your Bitcoin profits, it is important to remember that cryptocurrencies are highly volatile and speculative. Past performance does not guarantee future results. Additionally, taxes may apply to any profits you make from selling or trading Bitcoin. Be sure to consult with a financial advisor or tax professional for guidance on investing in Bitcoin and calculating your profits.

Fast Bitcoin: Earn Without Investment

You may want to see also

Frequently asked questions

The amount of money you can make by investing $1000 in Bitcoin depends on several factors, including the price of Bitcoin when you buy it and how long you hold it for. For example, if you bought $1000 worth of Bitcoin in July 2016, your investment would be worth $58,900 as of February 2024, representing growth of 5,805%. On the other hand, if you bought $1000 worth of Bitcoin in July 2020, your investment would be worth $3,525.65 as of July 2021.

Bitcoin is extremely volatile. For example, it hit an all-time high of nearly $69,000 in November 2021 but was trading at less than a third of that value in November 2022.

Due to its volatility, investing in Bitcoin is a risky proposition. Financial experts recommend investing no more than you are willing to lose.

In the US, the IRS treats cryptocurrencies as capital assets, meaning you will pay capital gains taxes when you sell Bitcoin for a profit. The percentage amount will be dictated by your federal tax bracket, which varies between 10% and 37%.

Instead of investing in individual cryptocurrencies, experts often recommend investing in low-cost index funds or ETFs, which offer automatic diversity. The S&P 500, for example, is considered a relatively reliable investment and has a long track record of providing returns for investors.