Bitcoin and other cryptocurrencies have become increasingly popular investments, with some investors holding the currency long-term or buying and selling over a short period. However, financial experts view cryptocurrency as a riskier asset class, prone to volatility and sharp increases and drops in value. So, how much of your portfolio should you invest in Bitcoin? Most financial experts recommend investing only a small percentage of your portfolio in Bitcoin, with a commonly quoted figure being 5% or less. This is because Bitcoin is a volatile asset, and investors could face severe losses if the market takes a downturn. Other experts suggest that anywhere from 1% to 10% of a portfolio can be allocated to Bitcoin, depending on an investor's risk tolerance and financial circumstances.

| Characteristics | Values |

|---|---|

| Optimal portfolio allocation | 6% |

| Maximum portfolio allocation | 19.4% |

| Minimum portfolio allocation | 1% |

| Commonly quoted allocation | 5% |

| Conservative allocation | 0.5% to 6% |

| Aggressive allocation | 20% |

| Very aggressive allocation | 33% |

What You'll Learn

How much is too much?

When it comes to investing in Bitcoin, it's important to remember that it is a risky and volatile asset. As such, experts generally recommend that investors allocate only a small percentage of their portfolio to Bitcoin and other cryptocurrencies. The specific allocation can vary depending on an individual's risk tolerance, financial circumstances, and investment goals.

Some experts suggest that allocating 5% or less of your total portfolio to Bitcoin is a safe approach. This amount is considered small enough to minimise risk while still potentially providing positive returns. However, it's important to remember that even this small allocation can result in significant losses if the market takes a downturn.

On the other hand, some investors choose to allocate a larger portion of their portfolio to Bitcoin, with some recommending up to 20% or even 30%. These higher allocations are often based on the potential for substantial gains in the volatile crypto market. However, it's crucial to remember that these investments come with a much higher risk of loss.

It's worth noting that Bitcoin and cryptocurrency investing may not be suitable for everyone. Before investing, it's important to assess your financial situation, risk tolerance, and investment goals. It's generally recommended that investors first ensure they are meeting all their other financial obligations and have a diversified portfolio that includes less risky assets.

Additionally, it's important to remember that the crypto market is subject to rapid swings and high volatility. As such, it's crucial to be comfortable with the potential for significant losses before investing.

In conclusion, while there is no one-size-fits-all answer to how much is too much when it comes to Bitcoin investing, it's generally recommended to allocate a relatively small portion of your portfolio to this risky asset class. By doing so, investors can potentially benefit from the upside of Bitcoin while minimising their downside risk.

The Future of Bitcoin: Invest or Avoid?

You may want to see also

Bitcoin's risk/reward profile

Bitcoin's risk profile is characterised by extreme volatility and significant drawdown risk. Since September 2015, Bitcoin has been nearly five times as volatile as US stocks, and its value has experienced breathtaking highs and painful lows. Bitcoin has suffered losses of 40% or more during at least five periods over the past decade. As a result, many financial experts recommend investing only a small percentage of your portfolio, with some suggesting 5% or less, and others recommending even lower allocations of 1-3%. This is because a small amount of cryptocurrency can dramatically increase a portfolio's overall risk.

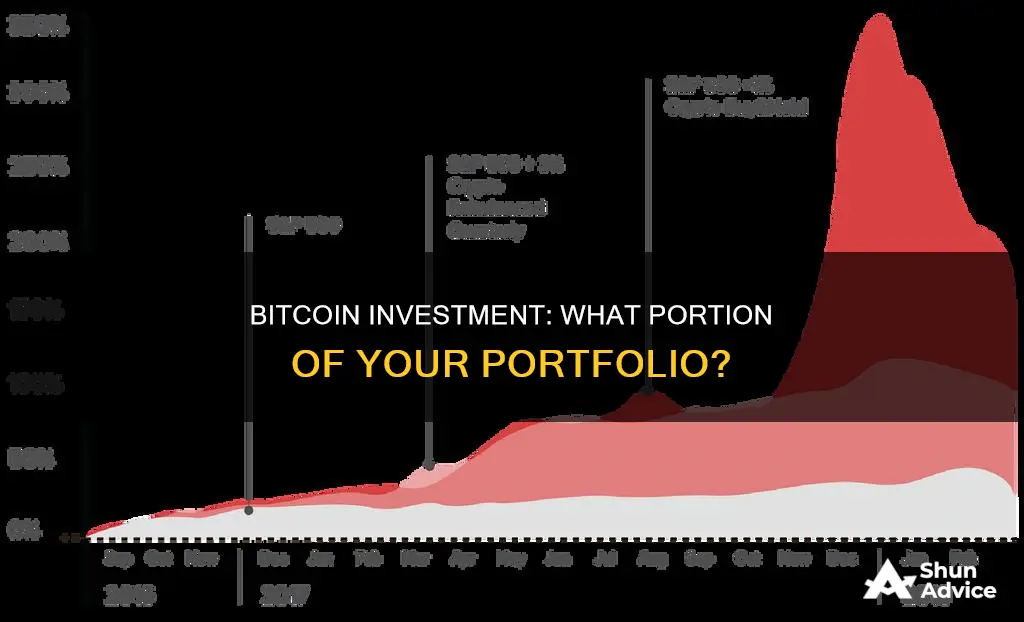

On the other hand, Bitcoin's reward profile is also significant. Bitcoin has outperformed every major asset class over long time horizons. Between January 2014 and September 2020, a 2.5% allocation to Bitcoin improved returns from a traditional portfolio by nearly 24%. Over the last seven years, the annualised return for Bitcoin was 44%, compared to just 5.7% for traditional asset classes. Bitcoin's low correlation with other asset classes, with a correlation coefficient of just 0.27, also makes it attractive for portfolio diversification.

In conclusion, Bitcoin's risk/reward profile is characterised by high volatility and the potential for significant gains or losses. Investors considering adding Bitcoin to their portfolio should carefully weigh the risks and rewards based on their financial circumstances, risk tolerance, and investment goals. While Bitcoin has the potential to deliver impressive returns, it is a risky investment that may not be suitable for everyone.

Bitcoin Tax: Understanding Your Investment's Tax Implications

You may want to see also

How to manage your crypto portfolio

Investing in cryptocurrencies is risky and highly speculative. However, if you are considering investing in crypto, here are some tips on how to manage your crypto portfolio.

Most financial experts recommend investing a small percentage of your portfolio in cryptocurrency due to its volatile nature. The recommended percentage varies, with some sources suggesting 1-2% for beginners, while others recommend up to 5% or even 20% for those with a higher risk tolerance.

Diversification

When deciding which cryptocurrencies to invest in, it is important to diversify your portfolio. Bitcoin and Ethereum are the two most widely used cryptocurrencies and are good options to consider as they account for a large portion of the crypto market cap and trading volume. However, you can also explore other types of cryptocurrencies such as stablecoins and altcoins.

Long-Term Perspective

It is important to take a long-term perspective when investing in crypto, typically recommending holding onto your investments for at least a decade. Cryptocurrencies are subject to extreme highs and lows, so a long-term perspective can help you ride out the volatility.

Dollar-Cost Averaging Strategy

Consider using a dollar-cost averaging strategy, where you buy or sell a fixed dollar amount regardless of market movements. This approach can help to reduce the impact of emotions on your investment decisions.

Regular Rebalancing

Periodically reevaluate your portfolio and rebalance it based on your evolving investment goals and the market performance. This ensures that your portfolio remains aligned with your risk tolerance and investment strategy.

Do Your Research

Crypto investments are complex and carry significant risks. It is crucial to thoroughly research the cryptocurrencies you are considering, understand the technology behind them, and be aware of the regulatory environment.

Risk Management

Remember that crypto investments are risky, and there is a possibility of losing your entire investment. Only invest what you can afford to lose, and ensure that your portfolio is appropriately diversified to manage risk.

Taxes and Regulations

Stay informed about tax implications and regulatory changes related to cryptocurrency investments. These factors can impact your investment strategy and the overall performance of your crypto portfolio.

Free Ways to Earn Bitcoin: No Investment Needed

You may want to see also

How much crypto is enough to boost diversification?

Crypto is an emerging asset class that is becoming increasingly popular with investors looking to diversify their portfolios. However, despite its rising popularity, financial experts view cryptocurrency as a riskier asset. Crypto is volatile and prone to major bull or bear runs.

Most financial experts recommend investing only a small percentage of your portfolio in cryptocurrency because it is an emerging and volatile asset class. Some advisors advocate allocating 5% or less of your total portfolio toward crypto, while others recommend starting with just 1% investment in cryptocurrency.

Most experts agree that cryptocurrencies should make up no more than 5% of your portfolio. This amount is "small enough to keep an investor comfortable in periods of high volatility but also large enough to have a positive impact on the portfolio if crypto prices rise," says Bruno Ramos de Sousa, head of global expansion at Hashdex.

Some experts, like Anjali Jariwala, a CFP and CPA, recommend a range of 2% to 25% of a client's portfolio in crypto. It is important to note that the percentage allocated to crypto will depend on your age, financial situation, risk tolerance, and goals.

When diversifying your crypto portfolio, it is recommended to include a mix of large-cap cryptocurrencies like Bitcoin and Ethereum, which are more stable and established, as well as some mid and low-cap coins, which offer higher potential returns but come with higher risks.

- Invest in a variety of coins with different use cases and functions, such as privacy coins, utility tokens, stablecoins, and blockchain protocols.

- Consider industry diversification by investing in cryptocurrencies from different sectors, such as DeFi, borrowing/lending, supply chain management, AI, NFTs, oracles, video streaming, gaming, and cloud storage.

- Remember that true diversification involves spreading your investments beyond the world of crypto into other asset classes like real estate, stocks, bonds, and gold.

In conclusion, the amount of crypto that is enough to boost diversification will depend on your individual circumstances and risk tolerance. A good starting point is to allocate around 5% of your portfolio to crypto, with a mix of large-cap, mid-cap, and low-cap coins. However, it is important to do your own research and consult with a financial advisor before making any investment decisions.

A Beginner's Guide: Investing in Bitcoin with Luno

You may want to see also

How much should experts invest?

Experts and financial advisors are divided on how much of Bitcoin or other cryptocurrencies an investor should include in their portfolio. Some experts recommend a maximum allocation of 5% of one's portfolio towards crypto, while others suggest a range of 25%.

A Yale study by economist Aleh Tsyvinski suggests that BTC should make up about 6% of an optimal portfolio, with even skeptics maintaining at least a 4% allocation. Billionaire investor and Shark Tank host Mark Cuban, a supporter of cryptocurrency, advises that investors should do their research before investing in crypto, especially in less established altcoins.

Bruno Ramos de Sousa, head of global expansion at Hashdex, states that a 5% allocation to crypto is "small enough to keep an investor comfortable in periods of high volatility, but also large enough to have a truly positive impact on the portfolio if crypto prices rise."

Ric Edelman, the founder of the Digital Assets Council of Financial Professionals, agrees that a small allocation can "materially improve your overall returns without leaving you at risk of financial harm if your cryptocurrency investment declines significantly or even falls to zero."

Anjali Jariwala, a CFP and CPA, recommends no more than 3% of a client's portfolio be in crypto, while Alex Doll, a CFP and president of Anfield Wealth Management, suggests a maximum of 10% of an investor's "risky" assets be allocated to cryptocurrencies.

Some experts recommend starting with a 1% investment in cryptocurrency, allowing investors to test out the market and assess their risk tolerance.

It's important to note that investing in cryptocurrencies is highly risky and speculative, and investors should carefully consider their financial circumstances, risk tolerance, and investment goals before making any decisions.

Borrowing to Buy Bitcoin: Getting a Loan to Invest

You may want to see also

Frequently asked questions

This depends on your risk tolerance and financial circumstances. Most financial experts recommend investing only a small percentage of your portfolio in Bitcoin, with some suggesting 5% or less, and others recommending a more conservative 1-3%.

Bitcoin is considered a riskier asset due to its volatility and proneness to major bull or bear runs. It is important to approach investing in Bitcoin with as much context as possible and to only invest what you can afford to lose.

Bitcoin has outperformed every major asset class over long time horizons. Over the last seven years, the annualized return for Bitcoin was 44%, compared to just 5.7% across all traditional asset classes. Bitcoin also has a low correlation with traditional asset classes, making it a good asset for diversification.