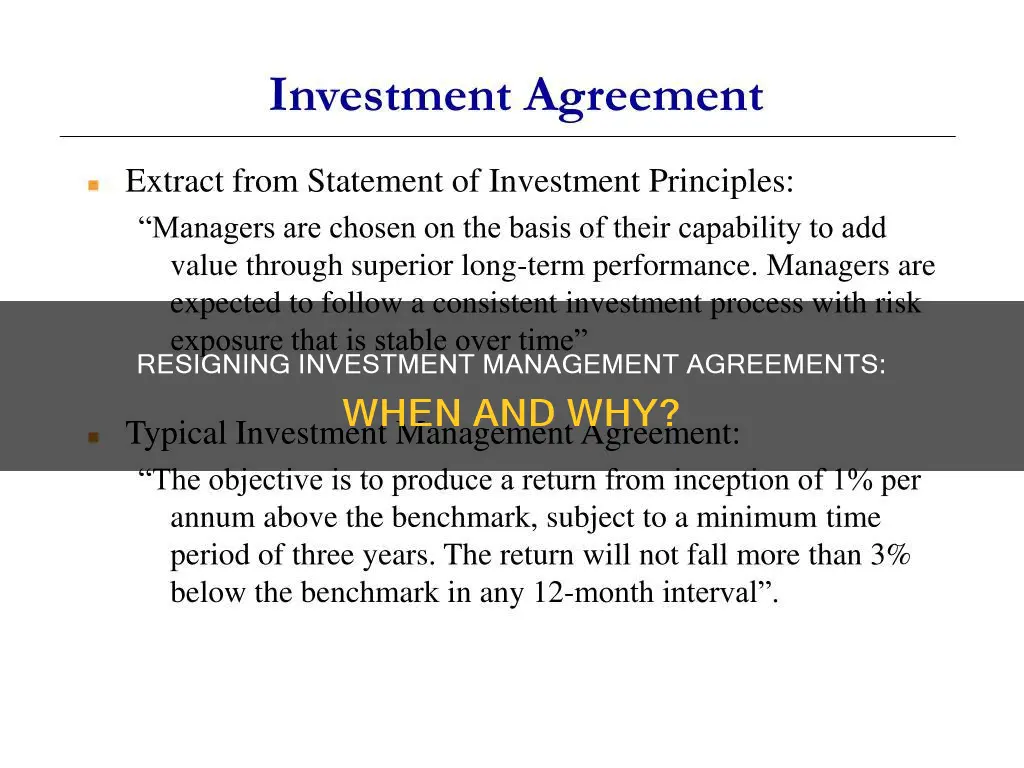

Investment management agreements (IMAs) are legal documents that give investment managers the authority to manage capital on behalf of investors. They detail the terms and conditions under which a client will invest in a shared vehicle while agreeing to pay investment management service fees and direct expenses.

IMAs are similar in appearance to standard contracts, but it is always recommended to get the terms and conditions in writing to avoid or resolve future disputes.

There are several best practices to follow when resigning from an employer, and the same goes for resigning from an investment management agreement. It is important to note that most advisors are employees at will, meaning they can be terminated at any time for little reason. Therefore, it is advisable not to tell anyone about contemplating a move or resigning, except perhaps a spouse, business coach, or consultant. When it comes time to resign, it is customary to do so on a Friday afternoon, and a financial advisor should not give a manager two weeks' notice as they will almost always be escorted to the door immediately.

It is also crucial to have a confirmed job lined up before resigning, with all paperwork signed and the background check cleared. This ensures that there are no issues with the new job, which could leave one without any job at all. Additionally, when resigning, it is best to write a resignation letter that resembles a thank-you letter, expressing gratitude to the bank and praising managers for the learning opportunities provided.

Overall, while the specifics may vary depending on the situation and location, following these general guidelines can help ensure a smooth transition when resigning from an investment management agreement.

| Characteristics | Values |

|---|---|

| Nature of the agreement | Legal document that gives investment managers the authority to manage a client's portfolio |

| Parties involved | Investment managers, clients, company founders, shareholders, custodians |

| Key terms | Warranties, investor consent, shared vehicles, reporting, investment principles, expenses and fees |

| Termination | Resignation letter, immediate exit, transition plan, serving notice period |

What You'll Learn

What is an Investment Management Agreement (IMA)??

An Investment Management Agreement (IMA) is a legal document that gives investment managers the authority to manage capital on behalf of investors. It outlines the terms and conditions under which an investor will invest in a shared vehicle, such as mutual funds, hedge funds, or bank funds, while agreeing to pay investment management service fees and direct expenses. An IMA also includes other standard provisions, such as monitoring fees, the scope of activities, and managerial indemnification.

The IMA grants the investment manager discretionary or non-discretionary authority. With discretionary authority, the manager can invest the client's account without prior consultation. Non-discretionary authority, on the other hand, requires the manager to obtain the client's consent for each transaction. Regardless of the type of authority, the IMA should clearly specify the assets to be managed, typically by referencing specific accounts held by the client.

The agreement should also set forth the investment guidelines, including the investment objectives, allocations, and limitations. These guidelines are crucial for controlling the activities of the adviser and ensuring they align with the client's circumstances and risk tolerances. The IMA should also specify the custodian who will hold the account's assets, usually a reputable financial institution independent of the investment manager.

The fees payable to the investment adviser are typically outlined in the IMA or an appendix. These fees are commonly stated as a percentage of account assets and are payable in advance or arrears on a quarterly basis. In addition to the adviser's fees, the client is also responsible for brokerage commissions, custodian fees, and any other service providers' fees.

The IMA should also describe the nature and frequency of written and oral reports. Reports typically cover general market conditions, account activity, current holdings, and performance. Additionally, the agreement should outline how the adviser will trade assets in the account once a buy or sell decision is made, including any affiliated brokers they may use.

Overall, an IMA is a comprehensive document that outlines the rights, responsibilities, and expectations of both the investment manager and the client, ensuring a clear and mutually beneficial relationship.

Homeownership: Impact on Your Investment Portfolio Choices

You may want to see also

What are the key terms of an IMA?

Investment Management Agreements (IMAs) are legal documents that outline the terms and conditions of how an investor's funds will be managed by an investment manager. Here are the key terms of an IMA:

Parties Involved:

The IMA should correctly identify all parties to the agreement, including company founders, shareholders, and investors. All parties should sign the agreement.

Warranties:

Warranties are contractual representations that the company's statements are true and accurate as of the completion date. Investors can sue company founders for willful or negligent misrepresentations, so investors prefer that warranties are expressly included in the contract.

Investor Consent:

Investors seek a provision prohibiting managers from making significant decisions without their consent. The level of consent depends on the number of investors in the business. If there is only one investor, they are the sole decision-maker.

Shared Vehicles:

Investment managers often invest client funds in mutual funds, hedge funds, bank funds, and other shared vehicles. They manage these vehicles directly or through unaffiliated managers. The IMA should specify the custodian who will hold the account's assets, typically a reputable financial institution separate from the investment manager.

Reporting:

The IMA should specify the type and frequency of written or verbal reports. Reports typically cover general market conditions, account activity, current holdings, and performance, and are issued quarterly.

Investment Principles:

The IMA should specify the investment principles used for managing the account. These principles should be discussed collectively and transparently, based on the client's circumstances and risk tolerance, and should be regularly revisited.

Expenses and Fees:

The investment manager's fees are typically specified in an appendix and are expressed as a percentage of account assets. Clients are also responsible for brokerage commissions, custodial fees, and other service providers, except for wrap accounts.

Investment Strategy and Risk Tolerance:

The IMA should outline the investment strategy, including asset allocation, risk management techniques, and benchmarks. The strategy should be tailored to the investor's financial objectives, time horizon, income needs, and risk appetite. The IMA also specifies the investor's risk tolerance and any restrictions on investment instruments.

Confidentiality and Non-Disclosure:

The IMA should include provisions to maintain the confidentiality of investment strategies, personal information, and proprietary processes. This safeguards sensitive information and protects the fund manager's competitive advantage.

Termination Clauses:

The IMA should outline the circumstances and procedures for terminating the agreement, including notice periods, mandatory negotiation, and potential financial implications.

Dispute Resolution:

The IMA should include provisions for resolving disputes, such as arbitration or mediation, to minimize the impact on both parties and avoid costly litigation.

California's Deduction Policy for Investment Management Expenses

You may want to see also

What does a discretionary IMA entail?

A discretionary investment management agreement (IMA) is a legal document that establishes the terms between a client and an investment manager. The agreement gives the investment manager the authority to make buying and selling decisions on behalf of their client. This is in contrast to a standard investment management agreement, where the client retains sole decision-making authority.

Under a discretionary IMA, the investment manager has broad powers. As such, clients must carefully select their investment manager and have complete faith in their capabilities and resources. The client can monitor the progress of their investments through quarterly reports.

In general, an IMA is a legal document that gives investment managers the authority to manage a client's portfolio while setting expectations and legal guidelines. An IMA details the terms and conditions under which a client will invest in a shared vehicle, such as mutual funds, hedge funds, or bank funds, while agreeing to pay investment management service fees and direct expenses.

- All investment management agreement parties must be correctly identified and should sign the agreement. This includes company founders and shareholders.

- Warranties are contractual representations that the company's statements are true and accurate as of the completion date. Investors prefer that companies expressly include warranties in the contract.

- Investor consent is important, especially when there is only one investor. The investor will seek a contractual provision prohibiting managers from making significant decisions without their consent.

- The investment management agreement should specify the custodian who will hold the account's assets, typically a reputable financial institution separate from the investment manager.

- Reporting is crucial, and the agreement should specify the type and frequency of written or verbal reports. Reports typically include general market conditions, account activity, current holdings, and performance.

- Investment principles should be specified in the agreement and discussed collectively and transparently with the client.

- Expenses and fees, including brokerage commissions, custodial fees, and service providers' fees, should be outlined in the IMA.

It is important to note that discretionary IMAs may vary in their specific provisions depending on the firm, client, instruments used, reporting measures, and other factors. Seeking legal help when drafting and negotiating an IMA is recommended to ensure a favourable outcome for both parties.

Balancing Your Investment Portfolio: Strategies for Success

You may want to see also

What are the steps to quitting an IMA professionally?

Steps to Quitting an IMA Professionally

Quitting an IMA role is a significant event in an advisor's career, and there are several best practices to follow to ensure you protect yourself and leave professionally. Here are the steps to quitting an IMA role professionally:

- Confide in trusted individuals only: Do not tell anyone at your firm, except perhaps your spouse, business coach, or consultant, that you are considering a move. Gossip spreads quickly, and word could get back to management, potentially making your professional life difficult or leading to termination before you have a chance to resign.

- Resign on a Friday afternoon: It is customary for financial advisors to resign on a Friday afternoon. Do not give a two-weeks' notice, as you will likely be escorted out immediately. Resigning on a Friday gives you the weekend to reach out to your clients.

- Have a concise resignation letter ready: Keep your resignation letter very short and to the point. Include only the date, your name, signature, and a simple statement such as, "I resign my position effective immediately." This protects you in the rare case of a lawsuit, as anything you write in the letter can be used against you in litigation.

- Be prepared to leave immediately: When you resign, you will likely be escorted out of the building immediately, so be ready to go to the hiring firm and complete the necessary paperwork.

- Contact your clients: Use the weekend after your resignation to start contacting your clients and informing them of your move. Be informative and patient, as moving a book takes time, and clients do not always share your sense of urgency.

- Do not put anything in writing to your clients until their accounts are moved: While it is your fiduciary responsibility to inform your clients that you are no longer their assigned advisor, do not put anything in writing until their accounts have been transferred.

- Highlight the positives of the new firm: When speaking to your clients, focus on the benefits of the new firm rather than criticising the old one. Emphasising the positives will make your clients more likely to want to move with you.

- Seek legal advice if necessary: If you have a non-solicit agreement, seek advice from a securities attorney.

Argus Investment Management: Performance and Strategy Analysis

You may want to see also

What are the steps to resigning from a banking job without burning bridges?

Steps to resigning from a banking job without burning bridges

Resigning from a job in the financial sector can be tricky, especially if you work in a competitive environment such as investment banking. Here are some steps you can take to ensure you leave your job on good terms:

- Have a confirmed job lined up: Ensure that you have a legally binding job offer before informing your current employer of your intention to leave. This means having a signed offer letter, confirmation from HR, and a cleared background check. You don't want to find yourself in a situation where you've burnt bridges with your current employer, only to find out that something has gone wrong with your new job.

- Resign on a Monday: It is advisable to resign at the beginning of the week as this gives you the weekend to pack your belongings without people noticing. If you can't resign on a Monday, consider staying late the night before and bringing your belongings home after everyone has left. Be careful what you take with you as all your activity on the company's system will be reviewed by the compliance team.

- Write a resignation letter: Your resignation letter should be short and resemble a thank-you letter. Express gratitude to your employer for the opportunity and praise your managers for the learning experience. Keep the letter positive and avoid any criticism or negative comments.

- Break the news: If you have several bosses in your reporting chain, the most respectful way to resign is to contact the most senior person with whom you have regular contact. Do not resign to your immediate reports. You may want to compose a leaving email to your coworkers, which should remain professional and respectful.

- Prepare for the attempts to keep you: You will likely have an exit interview where you will be asked the reasons for your departure. Your boss and HR staff may try to persuade you to stay, usually by offering more money or a better position. Have a thought-out, non-political answer that maintains a good relationship with your old team. Avoid criticising your current role and do not mention the exact name of where you are going unless legally required.

- Prepare the logistics: Consult your boss about how to handle the logistics of your exit in the least disruptive manner. You will need to hand back your work phone, clear your desk, and take care of other administrative tasks.

- Handle the transition: If asked to serve your notice period, introduce your replacement to internal and external contacts, make a list of outstanding tasks and relevant information, and leave your personal contact details with key team members. Continue to perform your role to a high standard during your notice period and offer to train other staff.

Remember that resigning is a fact of life, and while you can't control how your employer acts, you can control your response. Leaving on good terms can benefit you in the long run, as you never know when a connection will come in handy.

Saving or Investing: Where Should Your Money Go?

You may want to see also