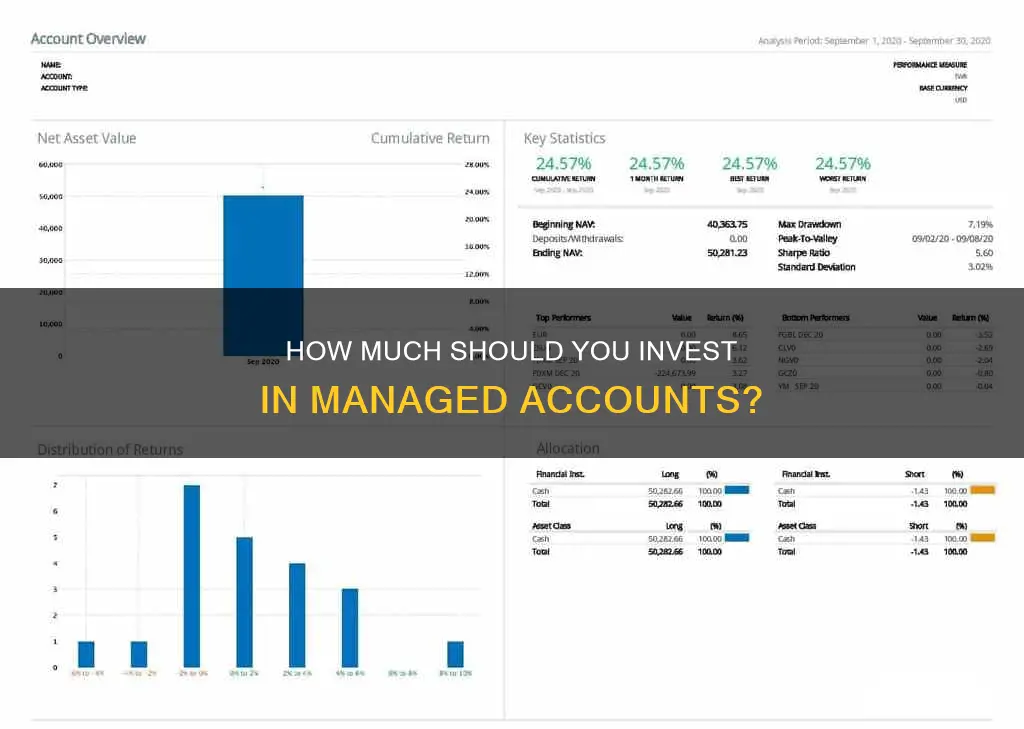

Managed accounts are a popular investment vehicle where a professional manager oversees a pool of assets on behalf of a client. The average investment for these accounts varies depending on the firm and the type of managed account. Some firms offer managed accounts with no minimum investment requirement, while others require a minimum investment of $2,000, $5,000, or even six figures. On average, many money managers require a minimum investment of $250,000, with some accepting $100,000 or $50,000 accounts. These accounts often come with annual fees, which can impact the overall return, and the manager's compensation is typically calculated as a set percentage of the assets under management (AUM).

| Characteristics | Values |

|---|---|

| Minimum investment amount | $2,000, $5,000, $25,000, $50,000, $100,000, $250,000 |

| Annual fees | 0.25% to 2% of AUM |

What You'll Learn

- Managed accounts require a high minimum investment, often $250,000

- Robo-advisors offer a low-cost alternative to managed accounts

- The average fee for a managed account is 1-2% of assets under management (AUM)

- Managed accounts are customised to the client's risk tolerance, goals and needs

- Managed accounts are often used by high-net-worth individuals

Managed accounts require a high minimum investment, often $250,000

Managed accounts are investment accounts owned by an investor but managed by someone else. The investor can be an institutional or individual retail investor, and the manager is a professional money manager hired by the investor to oversee the account and its trading activity.

Money managers often demand six-figure minimum investments to manage accounts, and these minimums usually start at $250,000. Some managers will accept $100,000 or even $50,000 accounts. Robo-advisors, or digital platforms that provide automated portfolio management, are available for everyday investors with low starting balances. These platforms are typically cheaper, charging around 0.25% of assets under management (AUM) and may only require $5 to get started.

The high minimum investment requirements of managed accounts are due to the personalised and comprehensive nature of the service. Managed accounts are tailored to the specific risks, goals, and needs of the account holder. The money manager has discretionary authority over the account, allowing them to make investment decisions that consider the client's needs and goals, risk tolerance, and asset size. The manager actively oversees the account because the markets in which the funds are invested are continually changing.

The high minimum investment requirements of managed accounts can be a barrier for some individuals. However, it's important to note that the larger the portfolio, the smaller the percentage fee charged by the manager. Additionally, the manager has a fiduciary duty to act in the best interest of the client, which can provide investors with confidence and security.

What's the Difference: Investment vs Wealth Management?

You may want to see also

Robo-advisors offer a low-cost alternative to managed accounts

Managed accounts are investment accounts owned by an investor and managed by a professional money manager. These managers are compensated by a fee, which is usually a set percentage of the assets under management (AUM). The average minimum investment for a managed account is between $100,000 and $250,000, although some managers will accept lower amounts. The annual fees for these services typically range from 1% to 2% of AUM.

Robo-advisors are digital platforms that provide automated, algorithm-driven portfolio management with little to no human supervision. They are a low-cost alternative to managed accounts, typically charging around 0.25% of AUM. Some robo-advisors have no account minimums, while others may require a minimum investment of as little as $5 or up to $500.

Robo-advisors use computer algorithms to build and manage investment portfolios based on the client's goals and risk tolerance. While financial professionals design the investing strategies, the day-to-day management of the portfolios is handled by software. This automated approach helps to keep fees low and makes robo-advisors a more accessible option for everyday investors with low starting balances.

In addition to low costs, robo-advisors offer several other benefits. They provide diversified investment portfolios, automated tax-loss harvesting, and goal-based planning tools. Some robo-advisors also give clients access to human financial advisors for an additional fee.

Overall, robo-advisors are a low-cost alternative to managed accounts, offering a range of features that make them a compelling option for investors, especially those with limited funds to invest.

Savings or Investment Plans: Where Should Your Money Go?

You may want to see also

The average fee for a managed account is 1-2% of assets under management (AUM)

While the fees for managed accounts vary, most tend to average around 1% to 2% of the AUM. This fee structure is designed to incentivize the manager to act in the client's best interests and achieve specific financial objectives. The manager is expected to exercise fiduciary duty, acting with loyalty and good faith, as they have the authority to buy and sell assets without the client's prior approval.

The fee for a managed account is typically an annual fee and is influenced by the account's asset size. Many managers offer discounts based on the portfolio's size, resulting in a smaller percentage fee for larger portfolios. It's important to note that these fees are no longer considered tax-deductible investment expenses by the Internal Revenue Service.

Compared to other investment options, such as mutual funds, managed accounts offer a more personalized approach. They take into account the client's specific risks, goals, and needs, and the manager has full discretion to make investment decisions accordingly. However, managed accounts typically have substantial minimum investment requirements, often starting at $250,000, and may require six-figure minimum investments.

Building an Australian Investment Portfolio: Strategies for Success

You may want to see also

Managed accounts are customised to the client's risk tolerance, goals and needs

A managed account is an investment account owned by an investor and managed by a financial expert or professional money manager. The manager has discretionary authority over the account, allowing them to make investment decisions that align with the client's goals, needs, risk tolerance, and asset size.

Managed accounts are highly customizable and tailored to the client's specific needs. The manager considers the client's risk tolerance, which is a crucial factor in determining the investment strategy. For example, a client with a low-risk tolerance may prefer more conservative investments, while a client with a higher risk tolerance may be open to more aggressive strategies.

The investment goals of the client are also central to the management of the account. The manager will work towards achieving these goals, whether they are long-term growth, current income, or capital appreciation. The manager will employ various investment strategies, such as buying, selling, and trading assets, to meet the client's objectives.

In addition to risk tolerance and goals, the client's needs are also considered. The manager will take into account factors such as the client's age, income, investment experience, and other assets to create a comprehensive investment plan. Regular reporting and disclosure of transactions ensure that the client is well-informed about their portfolio's performance and that the manager is acting in their best interest.

While managed accounts typically have substantial minimum investment requirements, ranging from $2,000 to $250,000, they offer clients a high level of customization and personalized financial advice. The manager's expertise and investment strategies aim to grow the client's investments and provide them with profits, making it a popular choice among high-net-worth individuals.

Global Macro Strategy: Investment Management Explained

You may want to see also

Managed accounts are often used by high-net-worth individuals

The high minimum investment requirements of managed accounts are due to the personalised nature of the service. A dedicated manager is armed with discretionary authority over the account and actively makes investment decisions based on the individual's needs and goals, risk tolerance, and asset size. The manager is responsible for buying, selling, and trading assets such as financial assets, cash, or titles to property, and must act in the best interest of the client.

The fees associated with managed accounts are typically calculated as a set percentage of the assets under management (AUM). The average fee is around 1-2% of AUM, but this can vary greatly. Managers may provide discounts based on the account's asset size, with larger portfolios resulting in smaller percentage fees.

Managed accounts offer several benefits, including professional supervision, the ability to time transactions to reduce tax burden, and transparency in disclosing transactions to the investor. However, the high minimum investment requirements and annual fees can be considered drawbacks for some individuals.

Diverse Investment Portfolios: Strategies, Risks, and Benefits

You may want to see also

Frequently asked questions

The average investment for managed accounts varies, with some money managers requiring a minimum investment of $250,000, while others may accept accounts starting from $100,000 or even $50,000. There are also options for investors with lower starting balances, such as robo-advisors, which may only require a minimum of $5.

A managed account is an investment account owned by an investor and managed by a professional money manager. The manager has discretionary authority to make investment decisions on behalf of the account owner, considering their needs, goals, risk tolerance, and asset size.

Managed accounts offer several benefits, including professional investment expertise, customized financial advice, and time savings for the account owner. The manager's experience and knowledge can help identify risks and benefits, build an effective portfolio, and make sound investment decisions.

Some potential drawbacks of managed accounts include high minimum investment requirements, annual fees, and restricted access to assets. The high minimum investment may restrict individuals from opening an account, and the annual fees can impact overall returns. Additionally, it may take several days for clients to invest or withdraw funds from their managed accounts.