Investing in the SMP 500 index can be a complex decision, as it involves assessing the safety and potential risks associated with this investment. The SMP 500 is a stock market index that tracks the performance of 500 large-cap companies listed on the New York Stock Exchange. While it is generally considered a reliable and diversified investment, understanding the factors that influence its safety is crucial for investors. This paragraph will explore the various aspects that contribute to the safety of investing in the SMP 500, including market volatility, company performance, and the role of economic indicators.

What You'll Learn

- Market Volatility: Understand historical price swings and potential risks

- Diversification: Learn how to spread investments to minimize risk

- Long-Term Trends: Research historical performance and growth patterns

- Expert Analysis: Seek insights from financial advisors on investment safety

- Regulatory Oversight: Explore government regulations protecting investors

Market Volatility: Understand historical price swings and potential risks

The concept of market volatility is crucial when considering investments in the SMP 500 index, as it directly impacts the potential risks and rewards associated with such an investment. Volatility refers to the rate at which the price of an asset, in this case, the SMP 500, fluctuates over a specific period. Understanding historical price swings is essential for investors to grasp the potential risks they are taking on.

Historically, the SMP 500 has demonstrated significant price volatility, with periods of rapid growth followed by sharp declines. For instance, the index experienced a substantial surge during the tech boom in the early 2000s, only to witness a dramatic crash during the 2008 financial crisis. These price swings can be attributed to various factors, including economic policies, geopolitical events, and shifts in market sentiment. Investors should be aware that such volatility can lead to substantial losses, especially for those who are not prepared for the market's unpredictable nature.

Analyzing past performance can provide valuable insights into the potential risks. By examining the index's historical data, investors can identify patterns and trends. For example, studying the SMP 500's performance over the last decade might reveal that it tends to experience heightened volatility during periods of global economic uncertainty. This knowledge can help investors make more informed decisions, especially when considering the timing of their investments.

To manage the risks associated with market volatility, investors can employ several strategies. Diversification is a key approach, where investors spread their investments across various assets to reduce the impact of any single asset's performance. Additionally, investors can consider using risk management tools such as options or futures contracts to hedge against potential losses. It is also crucial to have a long-term investment perspective, as short-term price swings can be common in volatile markets.

In summary, when investing in the SMP 500, it is imperative to recognize and understand the historical price volatility it has experienced. This knowledge enables investors to make more strategic decisions, manage risks effectively, and potentially benefit from the index's long-term growth prospects. Staying informed about market trends and economic factors can further enhance an investor's ability to navigate the volatile nature of the SMP 500 and other financial markets.

Foreign Investment in India: Global Money Magnet?

You may want to see also

Diversification: Learn how to spread investments to minimize risk

When it comes to investing, diversification is a key strategy to minimize risk and protect your portfolio. It involves allocating your investments across various asset classes, sectors, and geographic regions to ensure that your risk exposure is spread out. By diversifying, you reduce the impact of any single investment's performance on your overall portfolio, making it a powerful tool for long-term wealth creation.

The concept is simple: instead of putting all your eggs in one basket, you invest in a variety of assets. This approach helps to balance out potential losses from one investment with gains from others. For example, if you invest solely in the stock market, a downturn in a particular sector could significantly impact your portfolio. However, by diversifying into other asset classes like real estate, bonds, or commodities, you create a more resilient investment strategy.

One effective way to diversify is by considering different asset classes. Stocks, bonds, real estate, and commodities are common asset classes. Stocks offer ownership in companies, providing potential for capital appreciation and dividends. Bonds, on the other hand, offer a steady income stream and are generally considered less risky than stocks. Real estate investments can provide both rental income and potential capital gains, while commodities like gold or oil can serve as a hedge against market volatility.

Additionally, sector diversification is crucial. Different sectors within the stock market can perform differently based on economic conditions and industry-specific factors. By investing in various sectors, you reduce the risk associated with any single industry's performance. For instance, diversifying across healthcare, technology, consumer goods, and energy sectors can help mitigate the impact of a downturn in any one of these areas.

Geographic diversification is another important aspect. Investing in companies or funds based in different countries can help reduce the impact of regional economic or political events. International investments can provide exposure to emerging markets and potentially higher returns, but they also come with increased risk due to factors like currency fluctuations and political instability.

In summary, diversification is a powerful strategy to minimize investment risk. By spreading your investments across asset classes, sectors, and regions, you create a more balanced and resilient portfolio. This approach allows you to take advantage of potential gains while reducing the impact of any single investment's poor performance, ultimately contributing to long-term financial success. Remember, diversification does not guarantee profit or protect against losses in a declining market, but it is a valuable tool to manage risk effectively.

Vanguard Value Index Portfolio: What's Inside?

You may want to see also

Long-Term Trends: Research historical performance and growth patterns

When considering the safety and potential of investing in the SMP 500, it's crucial to delve into the long-term trends and historical performance of this index. The SMP 500, representing a basket of 500 large and mid-cap companies listed on the Singapore Exchange, offers a comprehensive view of the local market's performance. By examining its historical data, investors can gain valuable insights into the index's volatility, growth patterns, and overall market behavior.

Researching the past performance of the SMP 500 reveals several key trends. Firstly, the index has demonstrated a strong upward trajectory over the long term, with an average annual growth rate of approximately 10% over the past decade. This consistent growth indicates the overall health and resilience of the Singapore market, attracting investors seeking stable and reliable returns. However, it's important to note that this growth has not been linear, and the index has experienced periods of decline, particularly during global economic downturns and market corrections.

One notable trend is the index's sensitivity to economic cycles. During periods of economic expansion, the SMP 500 tends to thrive, reflecting the robust performance of local companies across various sectors. Conversely, during economic downturns, the index may experience a temporary setback, but historical data suggests that it typically recovers and continues its upward trajectory once the economy stabilizes. This cyclical behavior highlights the importance of a long-term investment strategy, as short-term market fluctuations can be mitigated over an extended period.

Additionally, analyzing the SMP 500's historical performance provides insights into the impact of specific events and market conditions. For instance, the global financial crisis of 2008 significantly affected the index, causing a sharp decline in its value. However, the recovery that followed showcases the index's ability to bounce back, demonstrating the underlying strength of the Singapore market. Investors can use these historical events as reference points to assess the potential risks and rewards associated with investing in the SMP 500.

In summary, researching long-term trends and historical performance is essential for understanding the safety and prospects of investing in the SMP 500. The index's consistent growth, sensitivity to economic cycles, and resilience during market downturns are key factors to consider. By studying these trends, investors can make informed decisions, adapt their strategies accordingly, and potentially benefit from the long-term prospects of the Singapore market.

Creating a Profitable Investment Club: Strategies for Success

You may want to see also

Expert Analysis: Seek insights from financial advisors on investment safety

When considering the safety of investing in the SMP 500, it's crucial to seek expert analysis and insights from financial advisors. These professionals possess the knowledge and experience to provide valuable guidance tailored to your specific financial goals and risk tolerance. Here's why consulting financial advisors is essential:

Financial advisors offer a comprehensive understanding of the SMP 500 and its associated risks. They can explain the index's historical performance, volatility, and potential future trends. By analyzing these factors, advisors can help investors make informed decisions. For instance, they might discuss the impact of economic cycles, market fluctuations, and industry-specific risks on the SMP 500. This analysis ensures that investors are aware of potential challenges and opportunities.

One of the key benefits of seeking expert advice is the ability to customize investment strategies. Financial advisors can create personalized plans based on an individual's financial situation, risk appetite, and investment objectives. They can recommend appropriate asset allocations, including investments in the SMP 500, and suggest diversification strategies to manage risk effectively. This tailored approach ensures that investors can navigate the market with confidence, knowing their portfolio aligns with their goals.

Additionally, advisors provide ongoing support and monitoring. They regularly review investment performance, rebalance portfolios when necessary, and offer adjustments to adapt to changing market conditions. This proactive approach is vital for long-term success, as it allows investors to stay on track and make necessary modifications to their investment strategy. Financial advisors can also provide timely advice on market events or news that may impact the SMP 500, helping investors make quick decisions when needed.

In summary, consulting financial advisors is a prudent step for anyone considering investing in the SMP 500. Their expertise ensures a thorough understanding of the investment's risks and potential, enabling investors to make well-informed choices. By providing personalized strategies, ongoing support, and market insights, financial advisors empower investors to navigate the complexities of the financial markets with confidence. This expert analysis is invaluable for anyone seeking to build a robust and sustainable investment portfolio.

Calculating Equity Percentage: Understanding Investment Value

You may want to see also

Regulatory Oversight: Explore government regulations protecting investors

The safety and security of investors in any financial market, including the SMP 500 (Stock Market Index), are of utmost importance and are heavily regulated by governments worldwide. Regulatory oversight plays a crucial role in ensuring fair practices, protecting investors' interests, and maintaining market integrity. Here's an overview of the government regulations that safeguard investors:

Securities and Exchange Commission (SEC): In the United States, the SEC is the primary regulatory body responsible for investor protection. It enforces laws and regulations to ensure fair and transparent markets. The SEC requires companies listed on the stock exchange to disclose comprehensive financial information, including annual reports, quarterly earnings, and any material events. This transparency allows investors to make informed decisions. Additionally, the SEC oversees brokerage firms, investment advisors, and mutual funds, ensuring they adhere to ethical standards and provide accurate advice to clients.

Financial Conduct Authority (FCA): In the UK, the FCA is the regulatory authority that oversees financial markets and businesses. It implements rules to protect consumers and maintain market integrity. The FCA requires listed companies to disclose relevant information, such as financial statements, business updates, and potential risks. This ensures that investors have access to necessary data to assess the risks and benefits of an investment. The FCA also regulates investment firms, ensuring they provide fair treatment to clients and maintain high standards of conduct.

Government-Mandated Reporting: Governments often mandate specific reporting requirements for listed companies. These reports provide investors with detailed insights into a company's financial health, business operations, and potential risks. For instance, companies may be required to disclose major transactions, changes in management, or any significant events that could impact their performance. Such reporting ensures that investors have access to critical information, enabling them to make well-informed investment choices.

Market Surveillance and Enforcement: Regulatory bodies employ advanced surveillance systems to monitor market activities for any suspicious behavior or potential fraud. These systems detect unusual trading patterns, price manipulations, or insider trading activities. When violations are identified, regulatory authorities take swift action, which may include fines, suspensions, or even criminal charges. Market surveillance ensures a level playing field and protects investors from fraudulent practices.

Investor Education and Protection: Governments also focus on educating investors about their rights and responsibilities. They provide resources and guidelines to help investors understand complex financial products and markets. This includes offering advice on risk assessment, investment strategies, and the importance of diversification. By empowering investors with knowledge, governments contribute to informed decision-making and reduce the likelihood of investors falling victim to fraudulent schemes.

In summary, regulatory oversight is a critical component of ensuring the safety of investments in the SMP 500 and other financial markets. Governments and regulatory bodies implement various measures to protect investors, maintain market integrity, and promote transparency. These regulations provide a framework for investors to make informed choices, while also holding market participants accountable for their actions.

India's Investment Landscape: 2000's Challenges and Opportunities

You may want to see also

Frequently asked questions

The SMP 500 Index, or the Standard & Poor's 500 Index, is a stock market index that tracks the performance of 500 large-cap U.S. companies. It is a widely followed benchmark and a popular investment vehicle for those seeking broad exposure to the U.S. stock market.

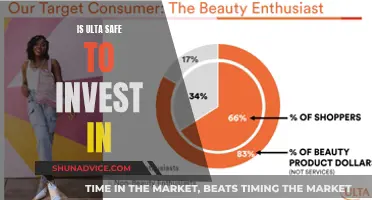

Investing in the SMP 500 is generally considered relatively safe compared to other investment options. The index is designed to represent a diverse range of industries and sectors, reducing the risk associated with individual stock volatility. The index's performance is influenced by the collective performance of these 500 companies, which are typically well-established and financially stable.

While the SMP 500 offers a diversified approach, there are still risks to consider. Market risks, such as economic downturns or recessions, can impact the overall performance of the index. Additionally, individual companies within the index may face specific risks, such as industry-specific challenges or financial issues, which could affect the index's performance.

The SMP 500 is often seen as a safer investment compared to individual stocks, especially for long-term investors. The index's broad coverage and diversification can help mitigate the impact of specific company risks. However, it's important to note that no investment is entirely risk-free, and market conditions can still influence the index's performance.

Investors should consider various factors, including their investment time horizon, risk tolerance, and financial goals. While the SMP 500 is generally considered safe, investors should also evaluate their own risk profile and diversify their portfolio accordingly. Additionally, staying informed about market trends, economic indicators, and company-specific news can help investors make more informed decisions.