When it comes to retirement investments, there is no one-size-fits-all strategy. The best approach depends on several factors, such as your age, risk tolerance, and financial goals. Allocating your investments across stocks, bonds, and cash in a way that suits your circumstances and comfort with risk is crucial.

Stocks offer the best long-term growth potential but can be volatile, while bonds preserve capital with limited returns, and cash assets are risk-free but earn minimal returns. As you approach retirement, it's recommended to start reducing risk and exposure to stocks, gradually shifting to a more conservative portfolio.

Various investment funds and strategies, such as target-date funds, balanced funds, and model portfolios, can help you achieve the right mix of assets and risk for your retirement goals. Consulting a financial advisor can also help tailor an allocation strategy to your specific needs.

| Characteristics | Values |

|---|---|

| Age | The older you are, the less you should invest in stocks. A rule of thumb is to subtract your age from 100 or 110 to find the percentage of your portfolio that should be in stocks. |

| Risk tolerance | Evaluate your own risk tolerance. If you have a large social security benefit or pension income, you may be comfortable taking on more risk. |

| Time until retirement | If you're retiring early, your stock allocation might be higher; if you're retiring later, it might be lower. |

| Time in retirement | Your portfolio should become more conservative over time to reflect the fact that you have less time to wait out downturns. |

| Investment options | Choose investments with a track record of producing returns and avoid deals that seem too good to be true. |

| Financial advice | Consider working with a financial advisor to devise an allocation strategy tailored to your goals, needs, and financial situation. |

What You'll Learn

Stocks, bonds, and cash allocation

Age and Risk Tolerance

It is generally recommended to adjust your asset allocation according to your age. When you are younger, you can afford to take more risks by investing heavily in stocks. As you approach retirement age, it is advisable to shift towards more conservative investments, such as bonds and cash. The "Rule of 100" suggests subtracting your age from 100 to determine the percentage of your portfolio that should be in stocks. However, with increasing life expectancy, some financial planners suggest using 110 or 120 instead.

Asset Allocation Models

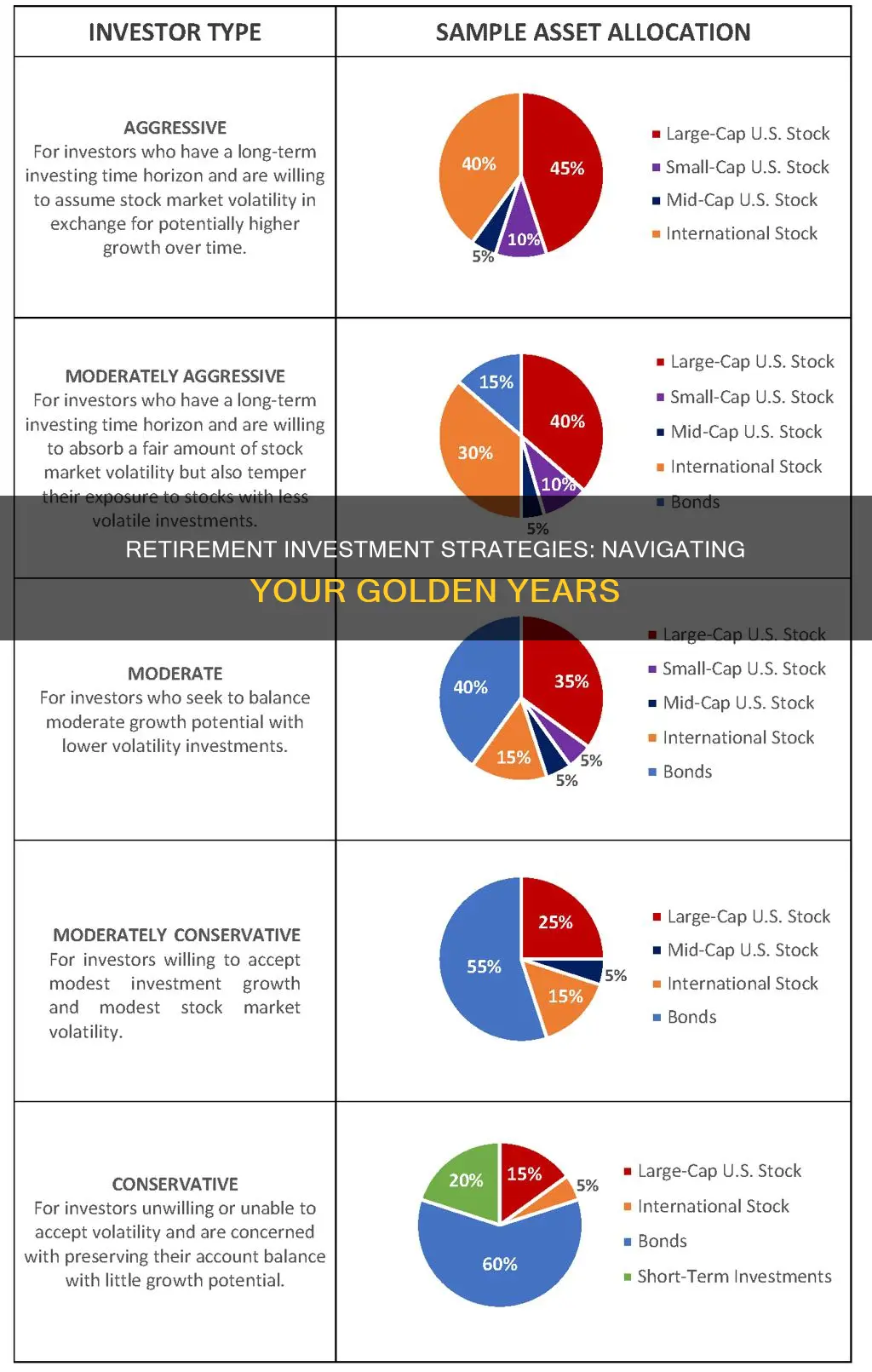

There are various asset allocation models that you can consider:

- Income Portfolio: This model focuses on capital preservation and generates stable income. It typically consists of 70% to 100% bonds and is suitable for retirees who want a conservative approach.

- Balanced Portfolio: This model aims for a balance between growth and income. It allocates 40% to 60% to stocks and is often recommended for long-term retirement investors.

- Growth Portfolio: This model emphasizes capital appreciation and is suitable for investors with a higher risk tolerance. It allocates 70% to 100% to stocks.

Diversification

Diversification within asset classes is essential. For stocks, you can diversify by investing in individual companies across different sectors and market capitalizations. For bonds, you can diversify by investing in bond funds, varying maturities, and different types such as municipal, corporate, and government bonds. Cash can be held in high-yield savings accounts or money market funds to maximize liquidity and interest earnings.

Personal Circumstances

It is crucial to consider your personal circumstances when determining your asset allocation. If you have multiple income streams or significant alternative assets, you may be able to take on more risk in your stock and bond portfolio. Additionally, if you are an early retiree or have a long investment horizon, you may opt for a more aggressive allocation.

Dynamic Approach

Remember that your asset allocation should evolve over time. As your age, financial goals, and risk tolerance change, adjust your allocation accordingly. Regularly review and rebalance your portfolio to ensure it aligns with your current circumstances and objectives.

The Student Debt Dilemma: Invest or Repay?

You may want to see also

Risk tolerance

An individual's risk tolerance is influenced by various factors, including age, investment goals, income, net worth, and investment experience. It is essential to assess your risk tolerance honestly and regularly, especially as you near retirement. Your risk tolerance will determine the types of investments you choose and how you allocate your portfolio.

- Time horizon: The time until you need your funds is a critical factor in risk tolerance. If you have a long-term investment horizon, you may be able to tolerate more risk, as you have more time to recover from potential losses. Conversely, if you have a shorter time horizon, you may prefer more conservative investments to protect your capital.

- Investment goals: Consider what you are saving and investing for. If you are investing for retirement, how much risk are you willing to take with those funds? Are you comfortable with potential losses, or do you want more stable investments?

- Income and net worth: Your financial circumstances play a significant role in risk tolerance. Individuals with higher incomes, higher net worth, and more liquid capital can often tolerate more risk, as they have more financial resources to absorb potential losses.

- Investment experience: Your level of investing experience can also impact your risk tolerance. If you are new to investing, you may want to proceed with caution and gain experience before taking on more risk.

- Volatility and loss tolerance: Risk tolerance is about understanding how comfortable you are with fluctuations in your savings and the potential for losses. Some investors are comfortable with more volatile investments, while others prefer stability.

To help determine your risk tolerance, you can consider taking a risk tolerance questionnaire or assessment, which can provide valuable insights into your comfort with risk. These assessments are widely available online and can guide you in making informed decisions about your retirement investments.

Should I Liquidate My Investments to Pay Off Debt?

You may want to see also

Investment selection

Understanding Asset Allocation:

Asset allocation refers to dividing your investment portfolio among different asset classes, such as stocks (equities), bonds (fixed-income), cash, real estate, and more. The basic idea is to balance risk and return potential. Stocks typically offer the best long-term growth but with higher volatility, while bonds preserve capital with lower returns, and cash assets are risk-free but earn minimal returns.

Determining Your Stock/Bond Mix:

A common rule of thumb for determining your stock/bond allocation is to subtract your age from 110 (or 100, for a more conservative approach). This percentage represents the portion of your assets that should be in stocks, with the remainder in bonds. For example, if you're 70, this implies 40% in stocks and 60% in bonds.

Evaluating Risk Tolerance:

Consider your risk tolerance, or how comfortable you are with potential losses. Could you handle a 50% drop in your portfolio value? Remember that fixed-income investments can help offset but not eliminate this risk. Evaluate your financial situation, including any pension or Social Security benefits, to determine if you can tolerate more or less risk.

Choosing Specific Investments:

Not all stock and bond investments carry the same level of risk. For example, small-cap or emerging-market stocks tend to be more volatile than large-cap stocks. Retirees often favour lower-volatility stock investments, such as dividend-paying stocks from mature, stable companies. Similarly, short-term Treasury bonds are less risky than high-yield corporate bonds.

Periodically Reevaluating Your Portfolio:

Retirement planning is not a one-time exercise. As you age, your investment needs may change, and market performance can distort your allocations. Therefore, it's crucial to periodically reevaluate your asset allocation, especially after significant life changes or every few years.

Utilising Available Options:

If you have a 401(k) or similar retirement plan, you may have access to various investment options, such as:

- Target-date funds: Automatically adjust their asset allocation based on your targeted retirement year, becoming more conservative as you approach retirement.

- Balanced funds: Typically maintain a 60/40 split between stocks and bonds.

- Model portfolios: Crafted by investment advisors, these offer a mathematically-constructed asset allocation based on your risk tolerance.

Seeking Professional Advice:

Consider working with a financial advisor to tailor your investment strategy to your specific goals, needs, and financial situation. They can help coordinate your investments with your spouse's and provide guidance on picking suitable funds.

Remember, investing for retirement is a long-term endeavour, and it's essential to strike a balance between growth and capital preservation. By understanding asset allocation and evaluating your risk tolerance, you can select investments that align with your retirement goals.

Smart Ways to Invest Your $50

You may want to see also

Expense ratios

When it comes to determining a "good" expense ratio, it depends on various factors, such as whether the fund is actively or passively managed. Actively managed funds tend to have higher expense ratios due to the need for a team of portfolio managers to operate the fund. On the other hand, passively managed funds, like index funds and ETFs, tend to have lower expense ratios as they track an index rather than relying on a professional manager.

For actively managed funds, a good expense ratio generally falls between 0.5% and 0.75%. Anything above 1.5% is typically considered high. In contrast, passive funds have lower average expense ratios, with 0.12% being the average.

To find funds with low expense ratios, consider passively managed index funds or ETFs that track a major index like the S&P 500. These funds often have some of the lowest expense ratios available. Additionally, larger funds can sometimes offer lower expense ratios as they can spread out costs across a wider base of assets.

It's important to note that while expense ratios are essential, they are just one type of fee investors pay. Other costs to consider include administrative fees, mutual fund sales loads, and trading commissions.

By understanding expense ratios and shopping around for funds with competitive ratios, investors can keep their costs low and maximize their investment returns.

Pay-for-Performance: Unraveling the Investment Advisor's Fee Structure

You may want to see also

Age and retirement date

When it comes to allocating your retirement investments, your age is a primary consideration. The older you are, the less investment risk you can afford to take. As you get closer to retirement age, your risk tolerance decreases, and you can't afford any wild swings in the stock market.

In your 20s and 30s:

- Focus on the growth potential of stocks in your retirement savings.

- You can consider investing heavily in stocks if you're younger than 50. You have plenty of time until retirement to ride out any market turbulence.

- Young investors might choose an asset allocation of 80% in stock funds and 20% in bond funds because they have the advantage of time.

- The old rule of thumb was that you should subtract your age from 100 – and that's the percentage of your portfolio that you should keep in stocks. For example, if you're 30, you should keep 70% of your portfolio in stocks.

- However, with people living longer, many financial planners now recommend using 110 or 120 minus your age. That's because if you need to make your money last longer, you'll need the extra growth that stocks can provide.

In your 40s:

- Continue to focus on stocks, but also consider adding some exposure to bonds.

- By this stage, investors must get serious about their retirement funds, commit to saving 15% of their annual income, and continue to max out contributions to their retirement accounts.

In your 50s:

- Those close to retirement may want to switch some of their investments from more aggressive stocks to more stable, low-earning funds like bonds and money market funds.

- In your 50s, you may want to consider allocating 60% of your portfolio to stocks and 40% to bonds, adjusting based on your risk tolerance.

In your 60s and 70s:

- Retirees commonly shift their focus from growth to income and stocks that provide dividend income or fixed-income bonds.

- Once retired, you may prefer a more conservative allocation of 50% in stocks and 50% in bonds, adjusting based on your risk tolerance.

- At this stage, your portfolio will move gradually from more aggressive to more conservative.

It's important to note that these are general guidelines, and your individual circumstances, risk tolerance, and investment goals may vary. It's always a good idea to consult with a financial advisor to determine the best allocation strategy for your retirement investments.

Retirement Investments: Where Do Seniors Put Their Money?

You may want to see also

Frequently asked questions

Ask yourself if you could deal with your portfolio dropping by 50%. The stock market has done this before and will likely do it again, so don't invest any money in stocks if you wouldn't be comfortable with this level of volatility.

A rule of thumb is to subtract your age from 110 or 100 to find the percentage of your portfolio that should be invested in stocks, with the remainder invested in bonds. For example, if you're 30, you should keep 70% or 80% of your portfolio in stocks.

A:

- Target-date funds: These funds automatically choose how much of each asset class you own based on your retirement year. They become more conservative as you near your retirement date, reducing your risk.

- Balanced funds: These funds allocate your contributions across stocks and bonds, usually with around 60% in stocks and 40% in bonds. They are considered "balanced" because the bonds minimise the risk of the stocks.

- Model portfolios: These portfolios are based on a mathematically-constructed asset allocation approach and are crafted by skilled investment advisors.