Understanding how to calculate and add up investment interest rates is crucial for anyone looking to make informed financial decisions. Whether you're an investor, a business owner, or simply someone looking to grow your savings, knowing how to calculate interest can help you maximize your returns and make the most of your money. In this guide, we'll explore the basics of investment interest rates, how to calculate them, and provide practical tips on how to add them up effectively. By the end of this article, you'll have a clear understanding of how to navigate the world of interest rates and make your money work harder for you.

What You'll Learn

- Understanding Interest Rates: Learn the basics of interest rate calculations and their impact on investments

- Compounding Frequency: Explore how often interest is compounded and its effect on returns

- Interest Rate Types: Differentiate between fixed, variable, and floating interest rates in investments

- Calculating Future Value: Use formulas to determine the future value of an investment with interest

- Comparing Investment Options: Analyze interest rates to choose the best investment strategy

Understanding Interest Rates: Learn the basics of interest rate calculations and their impact on investments

Interest rates are a fundamental concept in finance, representing the cost of borrowing money or the reward for lending it. When it comes to investments, understanding how interest rates work is crucial as they significantly influence the growth and profitability of your financial assets. Here's a breakdown of the basics:

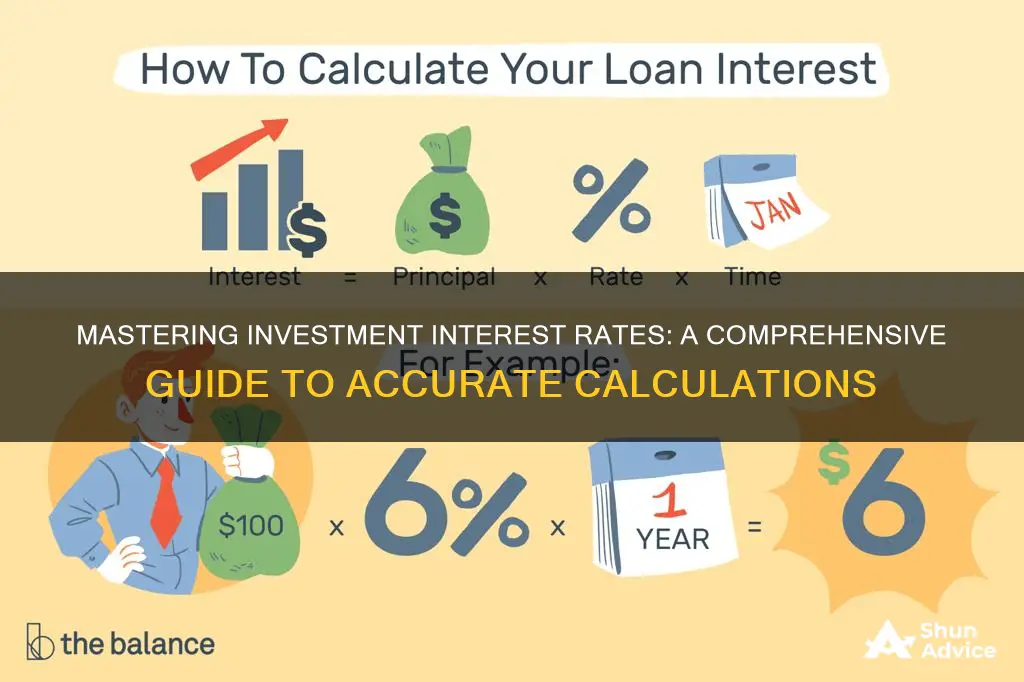

Interest rates are typically expressed as a percentage and indicate the amount of interest accrued over a specific period, often a year. For instance, a 5% interest rate means that for every $100 invested, you can expect to earn $5 in interest over a year. This simple concept forms the basis of how interest is calculated and added to your investments.

The calculation of interest on investments is straightforward. It is calculated as a percentage of the principal amount (the initial amount invested) and is applied over a defined period. The formula is: Interest = Principal * Interest Rate * Time. For example, if you invest $1,000 at an annual interest rate of 4% for 2 years, the interest earned would be $80 (1000 * 0.04 * 2).

Interest rates play a pivotal role in investment decisions. Higher interest rates generally attract investors as they offer more attractive returns on their money. This can lead to increased investment in certain markets or assets, potentially driving up their value. Conversely, lower interest rates might discourage investment, causing a shift towards alternative investments or savings accounts.

Understanding interest rate calculations is essential for investors to make informed decisions. It allows you to estimate the potential growth of your investments accurately. Moreover, keeping track of interest rates and their fluctuations can help investors time their investments strategically, taking advantage of favorable market conditions.

In summary, interest rates are a critical component of investment strategies. By grasping the fundamentals of interest rate calculations, investors can better assess the potential returns on their investments and make more informed choices. This knowledge empowers investors to navigate the financial markets with confidence and potentially maximize their investment gains.

Understanding Carry-Forward Rules for Investment Interest Expenses

You may want to see also

Compounding Frequency: Explore how often interest is compounded and its effect on returns

The concept of compounding frequency is a crucial aspect of understanding how investment interest rates work and how they can impact your returns over time. When you invest, the interest you earn can either be compounded or not, and the frequency of compounding directly affects the growth of your investment.

Compounding refers to the process of earning interest on both the initial principal amount and the accumulated interest from previous periods. The more frequently interest is compounded, the faster your investment can grow. This is because the interest earned in each period is added to the principal, and then interest is calculated on this new, larger amount in the subsequent period. As a result, your investment grows exponentially.

For example, let's consider two investments with the same interest rate but different compounding frequencies. Investment A compounds annually, while Investment B compounds monthly. If both investments start with a principal amount of $10,000 and earn an annual interest rate of 5%, the difference in returns over 10 years will be significant. With annual compounding, the final amount would be approximately $25,937.42. In contrast, with monthly compounding, the final amount would be roughly $26,536.14, a difference of over $600. This illustrates how often compounding occurs can significantly impact the overall growth of your investment.

The effect of compounding frequency is particularly notable when comparing different investment products. For instance, a savings account with daily compounding will grow faster than one with weekly compounding, which, in turn, will grow faster than a monthly-compounding account. This is why it's essential to pay attention to the compounding frequency when evaluating investment options.

In summary, understanding the impact of compounding frequency is vital for making informed investment decisions. By choosing investments that compound more frequently, you can maximize the potential for higher returns over the long term. It's a powerful tool to consider when calculating and comparing investment interest rates, ensuring that your money works harder for you.

Maximizing Returns: Strategies for Charging Interest on Investments

You may want to see also

Interest Rate Types: Differentiate between fixed, variable, and floating interest rates in investments

When it comes to investments, understanding the different types of interest rates is crucial for making informed financial decisions. Here's a breakdown of the three primary interest rate categories:

Fixed Interest Rates: This type of interest rate remains constant throughout the investment period. When you invest at a fixed rate, you know exactly how much interest you will earn, and it provides a stable and predictable return. For example, if you invest $1,000 at a fixed annual interest rate of 5%, you will earn $50 in interest each year, and the total amount grows by $50 annually. Fixed-rate investments are ideal for those seeking a consistent income stream and a guaranteed return. These are often associated with savings accounts, certificates of deposit (CDs), and some fixed-income securities.

Variable or Floating Interest Rates: In contrast, variable interest rates fluctuate based on market conditions and economic factors. These rates are often tied to a reference rate, such as the prime rate, and can change over time. For instance, if the central bank increases the prime rate, your variable-rate investment might also increase, and vice versa. Floating-rate investments offer the potential for higher returns during periods of rising interest rates but carry the risk of lower returns when rates fall. This type of interest rate is common in certain loans, bonds, and some investment accounts.

Floating Interest Rates: Floating rates are similar to variable rates and are often used interchangeably. They are market-driven and can change periodically, providing a dynamic return on investment. For investors, this means that the interest earned can vary, and it may be higher or lower depending on economic conditions. Floating-rate securities are attractive to those who want to capitalize on market fluctuations and are often used in corporate bonds and certain mortgage products.

Understanding these interest rate types is essential for investors to make strategic choices. Fixed rates offer stability, variable rates provide potential for higher returns, and floating rates represent a balance between the two. Each type has its advantages and risks, and investors should consider their financial goals, risk tolerance, and the current economic climate when deciding on an investment strategy.

Unlocking Investment Potential: The Power of Interest Rates

You may want to see also

Calculating Future Value: Use formulas to determine the future value of an investment with interest

To calculate the future value of an investment, you can use the concept of compound interest, which takes into account the interest earned on both the initial investment and the accumulated interest from previous periods. This calculation is particularly useful for understanding the growth of an investment over time. Here's a step-by-step guide on how to determine the future value using formulas:

Identify the Variables:

- Present Value (PV): This is the initial amount of money you invest or borrow. It represents the current value of your investment.

- Interest Rate (r): The annual interest rate you earn on the investment, expressed as a decimal. For example, if you have a 5% interest rate, r = 0.05.

- Time (t): The number of years the money is invested for.

- Future Value (FV): This is the value of the investment at the end of the specified period, which you want to calculate.

Use the Compound Interest Formula:

The formula to calculate the future value (FV) is:

FV = PV * (1 + r)^t

Here, you are essentially calculating the present value (PV) multiplied by the factor that accounts for the interest earned over time.

Understanding the Formula:

- PV: This is the starting point. It represents the initial investment amount.

- (1 + r): This part of the formula adds 1 to the interest rate. It's a way to account for the interest earned in the first period.

- ^t: This indicates raising the result of (1 + r) to the power of the number of years (t). It calculates the cumulative effect of interest over time.

Example Calculation:

Let's say you invest $1000 at a 4% annual interest rate for 3 years.

PV = $1000

R = 0.04

T = 3 years

Using the formula:

FV = $1000 * (1 + 0.04)^3

FV = $1000 * (1.04)^3

FV = $1000 * 1.124864

FV ≈ $1124.86

So, after 3 years, your investment would grow to approximately $1124.86.

Remember, this formula provides a simple way to estimate the future value of an investment, assuming a constant interest rate. In reality, interest rates can fluctuate, and other factors may influence investment growth.

Unlocking Compound Interest: Does Investing Offer More Than Meets the Eye?

You may want to see also

Comparing Investment Options: Analyze interest rates to choose the best investment strategy

When evaluating investment opportunities, understanding and comparing interest rates is crucial for making informed financial decisions. Interest rates play a significant role in determining the potential returns on your investments, and they can vary widely depending on the type of investment and the market conditions. Here's a step-by-step guide to help you analyze interest rates and choose the best investment strategy:

- Understand Interest Rate Basics: Begin by grasping the concept of interest rates. Interest is essentially the cost of borrowing money, and it is expressed as a percentage of the principal amount. When you invest, you essentially lend your money to an entity, such as a bank or a company, and they pay you interest in return. Interest rates can be simple or compound, and understanding the difference is essential. Simple interest is calculated as a percentage of the principal, while compound interest is calculated on the principal and any accumulated interest.

- Research and Compare Interest Rates: Start by researching the interest rates offered by different investment options. This includes savings accounts, certificates of deposit (CDs), bonds, and various investment funds. Compare the annual percentage yield (APY) or annual percentage rate (APR) for each option. APY and APR represent the actual interest rate you earn or pay, taking into account any compounding effects. Online financial calculators and comparison websites can help you quickly compare rates from various financial institutions.

- Consider Investment Time Horizons: Interest rates can vary based on the time period for which you invest. Short-term investments might offer higher interest rates but may not be as stable. Long-term investments often provide lower interest rates but can be more secure. Evaluate your investment goals and risk tolerance. If you need quick access to your funds, a high-yield savings account or a money market fund might be suitable. For longer-term goals, consider bonds or fixed-income securities.

- Account for Compounding and Fees: When comparing interest rates, consider how often interest is compounded. Compounding can significantly impact your returns over time. Annual compounding means interest is calculated and added to the principal once a year, while monthly or continuously compounding means interest is calculated and added more frequently. Additionally, be aware of any associated fees, such as account maintenance fees or early withdrawal penalties, as these can affect your overall returns.

- Diversify Your Investment Portfolio: Interest rates can fluctuate, and it's essential to diversify your investments to manage risk. Consider a mix of investment options with varying interest rates to create a balanced portfolio. For example, you might allocate a portion of your funds to high-yield savings accounts, a fixed percentage to bonds, and the rest to a diversified investment fund. Regularly reviewing and rebalancing your portfolio ensures that you stay on track with your financial goals.

By carefully analyzing interest rates and considering various factors, you can make informed decisions when comparing investment options. Remember, the best investment strategy is one that aligns with your financial objectives, risk tolerance, and time horizon. Staying informed and regularly reviewing your investments will help you navigate the dynamic world of finance and make the most of your hard-earned money.

Foreign Investment and Interest Rates: A Global Economic Relationship

You may want to see also

Frequently asked questions

When you have investments in multiple accounts, the total interest rate can be calculated by summing up the individual interest rates. Simply add the annual interest rates of each account to get the combined rate. This method ensures you understand the overall growth potential of your investments.

To compare interest rates effectively, you should consider the compounding frequency and the time period over which the interest is calculated. Interest rates can be annualized, meaning they represent the rate over a year. However, some products may compound interest monthly, quarterly, or continuously. To make an accurate comparison, convert all rates to an annualized basis and consider the compounding impact over a specific period.

Yes, you can add interest rates from different currencies, but it's essential to convert the rates to a common currency first. Exchange rates fluctuate, so you'll need to use the current exchange rate to convert each interest rate to a single currency. After conversion, you can sum up the rates to get a comprehensive view of your international investment returns.