Shareholders in an S-Corp must reduce their basis for non-deductible corporate losses. This is because basis must be decreased to preserve the non-deductible nature of the expenses. For example, if a shareholder earned $100 of tax-exempt interest, and failed to increase their basis from $500 to $600, they would recognise $100 of gain, effectively converting what was intended to be $100 of tax-exempt income into taxable gain. Shareholders may elect to have the S Corporation’s pass-through losses reduce basis before basis is reduced by non-deductible, noncapital expenses. This may allow the shareholder to deduct more pass-through losses.

| Characteristics | Values |

|---|---|

| Common basis increases | capital contributions, ordinary income, investment income and gains |

| Common basis decreases | Sec. 179 deductions, charitable contributions, nondeductible expenses and distributions |

| Basis adjustments are normally calculated | at the end of the corporation’s taxable year |

| Basis adjustments order | First, they are increased by income items; then decreased by distributions; and, finally, decreased by deduction and loss items |

| S corporation shareholder’s basis in stock is reduced by | current-year losses, regardless of whether the loss or deduction is disallowed under another rule, such as the passive loss rules |

| S corporation shareholder’s basis in stock can never go negative | If basis is positive before distributions but would be negative if all deduction items were subtracted, then the excess loss is suspended rather than the excess distributions being taxable |

| S corporation shareholder must reduce basis for | non-deductible corporate loss |

| S corporation shareholder may elect to have the S corporation’s pass-through losses reduce basis before basis is reduced by | non-deductible, noncapital expenses |

| S corporation shareholder’s basis in stock is reduced by | nondeductible loss |

| Business interest expense from an S corporation is treated as | interest derived from a trade or business in the hands of the shareholder, even if the shareholder does not materially participate in the S corporation’s trade or business |

What You'll Learn

Shareholder basis in stock is reduced by current-year losses

Shareholders of S corporations can elect to have the corporation's pass-through losses reduce basis before it is reduced by non-deductible, non-capital expenses. This election can allow the shareholder to deduct more pass-through losses. It must be made with the tax return and can only be reversed with IRS approval.

If decreases exceed the adjusted basis amount, the basis can never go negative. Instead, the excess loss is suspended and carried over to the next taxable year.

Under Section 311(a), the IRS concluded that a nondeductible loss must reduce the shareholders' basis. This is because, for the purposes of Section 1367, non-deductible expenses are only those items for which no loss or deduction is allowable.

Under the passive loss rules, business interest expense from an S corporation is treated as interest derived from a trade or business in the hands of the shareholder, even if the shareholder does not materially participate in the trade or business.

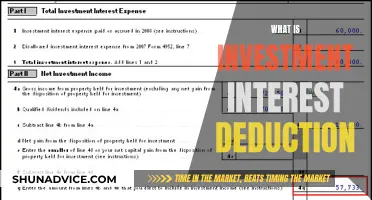

Understanding Interest Expense: Carry Forward Rules for Investors

You may want to see also

Tax-exempt income and non-deductible expenses

Shareholders in S corporations must reduce their basis for non-deductible corporate losses. Basis adjustments are calculated at the end of the corporation's taxable year. First, they are increased by income items, then decreased by distributions, and finally, decreased by deduction and loss items. The order is important because if the basis is positive before distributions but would be negative if all deduction items were subtracted, then the excess loss is suspended rather than the excess distributions being taxable.

A shareholder may elect to have the S corporation's pass-through losses reduce basis before basis is reduced by non-deductible, noncapital expenses. Making this election may allow the shareholder to deduct more pass-through losses. The election must be made with the tax return and can only be reversed by IRS approval.

Under Section 311(a), the corporation was barred from deducting a loss on the property. The IRS concluded that the non-deductible loss must reduce the shareholders' basis, drawing a parallel to the reasoning employed in Ball. Citing Reg. Section 1.1367-1(c)(2), the Service noted that for purposes of Section 1367, non-deductible expenses are only those items for which no loss or deduction is allowable and do not include items the deduction for which is deferred to a later taxable year.

The basis must be increased to preserve the tax-exempt nature of the income, and decreased to preserve the non-deductible nature of the expenses. If the shareholder fails to increase his basis to account for the interest, when the shareholder sells his stock, he would recognise a gain, effectively converting what was intended to be tax-exempt income into taxable gain.

Savings Accounts: Lower Interest Rates than Investments?

You may want to see also

Pass-through losses

Shareholders of an S corporation may elect to have the company's pass-through losses reduce their basis before it is reduced by non-deductible, non-capital expenses. This election can allow the shareholder to deduct more pass-through losses. It must be made with the tax return and can only be reversed with IRS approval.

The order of basis adjustments is important. First, the basis is increased by income items, then decreased by distributions, and finally decreased by deduction and loss items. If the basis is positive before distributions but would be negative if all deduction items were subtracted, the excess loss is suspended rather than the excess distributions being taxable. This is because an S corporation shareholder's basis in stock is reduced by current-year losses, regardless of whether the loss or deduction is disallowed under another rule, such as the passive loss rules.

Under Section 311(a), the IRS has ruled that nondeductible losses must reduce shareholders' basis. This means that if an S corporation incurs a loss that is not deductible, the shareholders' basis in the corporation must be reduced by that amount. This ruling helps to preserve the nondeductible nature of the expenses.

Investments and Interest: Multiple Bets, Better Returns?

You may want to see also

Business interest expense

The S corporation shareholder's basis in stock is reduced by current-year losses, regardless of whether the loss or deduction is disallowed under another rule, such as the passive loss rules.

A shareholder may elect to have the S Corporation’s pass-through losses reduce basis before basis is reduced by non-deductible, noncapital expenses. Making this election may allow the shareholder to deduct more pass-through losses. The election must be made with the tax return and can only be reversed by IRS approval.

The IRS concluded that the non-deductible loss must reduce the shareholders’ basis, drawing a parallel to the reasoning employed in Ball. Citing Reg. Section 1.1367-1 (c) (2), the Service noted that for purposes of Section 1367, non-deductible expenses are only those items for which no loss or deduction is allowable and do not include items the deduction for which is deferred to a later taxable year.

Under the passive loss rules, business interest expense from an S corporation continues to be treated as interest derived from a trade or business in the hands of the shareholder, even if the shareholder does not materially participate in the S corporation’s trade or business.

How Interest Rates Affect Spending and Investment

You may want to see also

Nondeductible expenses

An S corporation shareholder’s basis in stock is reduced by current-year losses, regardless of whether the loss or deduction is disallowed under another rule, such as the passive loss rules. The S corporation shareholder must reduce basis for non-deductible corporate loss.

Nondeductible business expenses are those that are not directly related to your business. This includes things like meals and entertainment, car payments, and home office deductions. For example, if you purchase a new TV for your home office, the cost of the TV would not be a deductible expense.

Compounding Interest: Annual vs. Quarterly, Which is Better?

You may want to see also

Frequently asked questions

Yes, investment interest expense reduces shareholder basis in an S-corp.

An S-corp is a type of corporation that is taxed differently from a traditional corporation. S-corps are taxed as pass-through entities, which means that the corporation's profits and losses are passed through to the shareholders, who then pay taxes on their individual tax returns.

Shareholder basis refers to the value of a shareholder's investment in an S-corp. It is calculated by adding the shareholder's initial investment to any additional contributions and then subtracting any distributions or losses.

Investment interest expense is considered a nondeductible expense, which means that it reduces the shareholder's basis. This is because the expense is not allowed to be deducted from the corporation's taxable income.

Yes, there may be exceptions depending on the specific circumstances of the S-corp and the shareholder. For example, if the shareholder elects to have the S-corp's pass-through losses reduce basis before basis is reduced by nondeductible, noncapital expenses, they may be able to deduct more pass-through losses.