Interest rates are a vital economic factor that can shape financial markets and determine the future of economies worldwide. In recent years, interest rates have increased significantly, after a prolonged period of historic lows. This shift has far-reaching implications, particularly for Foreign Direct Investment (FDI). This article will explore the intricate ties between surging interest rates and FDI, providing insights into the role and factors affecting interest rates and their impact on foreign investment attraction.

| Characteristics | Values |

|---|---|

| Interest rates | The cost of borrowing money and the return on investment for lenders |

| Impact on foreign investment | Higher interest rates attract foreign investment, increasing the demand for and value of the home country's currency |

| Impact on currency | Higher interest rates increase the value of a country's currency |

What You'll Learn

- How higher interest rates increase the value of a country's currency?

- How lower interest rates decrease the value of a country's currency?

- How interest rates impact Foreign Direct Investment (FDI)?

- How interest rates are vital economic factors that shape financial markets?

- How interest rates determine the future of economies worldwide?

How higher interest rates increase the value of a country's currency

Interest rates are vital economic factors that shape financial markets and determine the future of economies worldwide. Foreign Direct Investment (FDI) is impacted by interest rates, as higher interest rates tend to attract foreign investment, increasing the demand for and value of the home country's currency.

When a country raises its interest rates, it becomes more attractive to foreign investors. This is because higher interest rates mean that investors can earn a higher return on their investments. As a result, there is an increased demand for the home country's currency, which drives up its value.

Conversely, lower interest rates tend to be unattractive for foreign investment. When a country lowers its interest rates, the return on investment decreases, making it less appealing to foreign investors. This can lead to a decrease in the demand for and value of the country's currency.

The impact of interest rates on FDI is a key consideration for investors when analysing the overall economic health of a country. Working with experienced financial advisors can help navigate the complexities of FDI amid changing interest rates.

Overall, higher interest rates can increase the value of a country's currency by attracting foreign investment and driving up demand for the currency. This relationship between interest rates and FDI is an important factor in shaping the global economy.

Investment Interest Expense: What Can Be Deducted?

You may want to see also

How lower interest rates decrease the value of a country's currency

Interest rates are vital economic factors that shape financial markets and determine the future of economies worldwide. Foreign Direct Investment (FDI) is impacted by interest rates, as higher interest rates tend to attract foreign investment, increasing the demand for and value of the home country's currency.

Conversely, lower interest rates tend to be unattractive for foreign investment and decrease the currency's relative value. This is because when interest rates decrease, the supply of the currency increases as loans become cheaper, but savings rates decline. This lessens demand and weakens the currency.

For example, if interest rates in the UK were to drop, the British pound (GBP) might lose value against the US dollar (USD). This would mean that you would receive less USD for each pound when transferring money to the United States.

It is important to note that the relationship between interest rates and currency values is complex and influenced by a host of other factors, such as inflation, political and economic stability, and the demand for a country's goods and services.

Higher Interest Rates: Investing Incentive or Hindrance?

You may want to see also

How interest rates impact Foreign Direct Investment (FDI)

Interest rates are vital economic factors that shape financial markets and determine the future of economies worldwide. Foreign Direct Investment (FDI) is one key area of the global economy that is impacted by interest rates.

Rising interest rates play a significant role in FDI. Generally, higher interest rates increase the value of a given country's currency. The higher interest rates that can be earned tend to attract foreign investment, increasing the demand for and value of the home country's currency. Conversely, lower interest rates tend to be unattractive for foreign investment and decrease the currency's relative value.

When interest rates are high, foreign investors are incentivised to invest in a country as they can expect a higher return on their investment. This is because interest rates are the cost of borrowing money and the return on investment for lenders. Therefore, when interest rates are high, foreign investors can expect to earn more on their investments.

However, it is important to note that the impact of interest rates on FDI is not always positive. While high interest rates can attract foreign investment, they can also make it more expensive for companies to borrow money, which may deter investment. Additionally, rising interest rates can impact the overall economic health of a country, which foreign investors consider when making investment decisions. Working with experienced financial advisors can help navigate the intricacies of FDI amid changing interest rates.

Land Investment Interest: What You Need to Know

You may want to see also

How interest rates are vital economic factors that shape financial markets

Interest rates are vital economic factors that shape financial markets and determine the future of economies worldwide. In recent years, we have seen significant increases in interest rates, after a prolonged period of historic lows. While this shift has far-reaching implications, one key area of the global economy that stands to be impacted is Foreign Direct Investment (FDI).

Interest rates are the cost of borrowing money and the return on investment for lenders. Generally, higher interest rates increase the value of a given country's currency. The higher interest rates that can be earned tend to attract foreign investment, increasing the demand for and value of the home country's currency. Conversely, lower interest rates tend to be unattractive for foreign investment and decrease the currency's relative value.

Rising interest rates play a significant role in FDI. When interest rates are high, foreign investors are incentivised to invest in a country's economy as they can benefit from higher returns on their investments. This increased demand for the country's currency can lead to an appreciation in its value, making it more expensive for locals to purchase foreign goods and services, which can impact the country's trade balance.

On the other hand, when interest rates are low, foreign investors may be less inclined to invest in a country's economy as the potential returns on their investments are lower. This can result in a decrease in the demand for the country's currency, leading to a depreciation in its value. A lower-valued currency can make a country's exports more competitive in the global market, potentially improving its trade balance.

Analysing the overall economic health of a country, including its interest rates, is crucial for foreign investors when making investment decisions. Working with experienced financial advisors can help navigate the complexities of FDI amid changing interest rates and ensure that investment strategies are aligned with the economic landscape.

Understanding Investment Interest: How to Make Your Money Work

You may want to see also

How interest rates determine the future of economies worldwide

Interest rates are vital economic factors that shape financial markets and determine the future of economies worldwide. In recent years, we have seen significant increases in interest rates, after a prolonged period of historic lows. While this shift has far-reaching implications, one key area of the global economy that stands to be impacted is Foreign Direct Investment (FDI).

FDI is a key component of the global economy, and interest rates play a significant role in shaping the flow of FDI into a country's economy. Generally, higher interest rates increase the value of a given country's currency. The higher interest rates that can be earned tend to attract foreign investment, increasing the demand for and value of the home country's currency. Conversely, lower interest rates tend to be unattractive for foreign investment and decrease the currency's relative value.

For example, if a country has a high interest rate, it may attract more foreign investment, as investors seek to take advantage of the higher returns on investment. This can lead to an increase in the demand for the country's currency, as foreign investors need to purchase the local currency to invest in the country. This, in turn, can lead to an appreciation in the value of the currency.

On the other hand, if a country has a low interest rate, it may be less attractive to foreign investors, as they may seek higher returns on investment elsewhere. This can lead to a decrease in the demand for the country's currency, potentially leading to a depreciation in its value.

Therefore, interest rates can have a significant impact on the flow of foreign investment into a country, which can, in turn, affect the country's economy. By influencing the demand for and value of a country's currency, interest rates can play a key role in determining the future of economies worldwide.

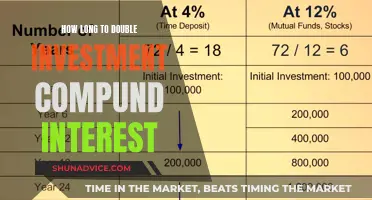

The Magic of Compound Interest for Long-Term Investments

You may want to see also

Frequently asked questions

Interest rates are a vital economic factor that shape financial markets and determine the future of economies worldwide. Higher interest rates increase the value of a given country's currency, which tends to attract foreign investment.

Interest rates play a significant role in shaping the flow of foreign investment into a country's economy. Higher interest rates tend to increase the demand for and value of the home country's currency, making it more attractive for foreign investment.

Rising interest rates can impact foreign direct investment (FDI) by making a country's currency more or less attractive to foreign investors. Working with experienced financial advisors can help navigate the intricacies of FDI amid changing interest rates.

Not necessarily. While higher interest rates can increase the value of a country's currency and attract foreign investment, other factors such as economic health and stability may also play a role in investment decisions.

Lower interest rates tend to decrease the relative value of a country's currency and make it less attractive for foreign investment. However, it's important to consider other economic factors and market conditions that may influence investment decisions.