Understanding how to allocate investment management fee deductions to unrealized gains is an important aspect of financial planning and investing. Unrealized gains refer to the increase in the value of an asset that has not yet been sold, and they represent potential profits for investors. On the other hand, investment management fees are expenses incurred for advice and services related to managing investment portfolios. The allocation of these fee deductions to unrealized gains can impact an investor's taxable income and overall tax liability.

| Characteristics | Values |

|---|---|

| What is an unrealized gain? | An increase in the value of an asset that an investor has not yet sold. |

| When is an unrealized gain realized? | When the investment is sold. |

| How are unrealized gains recorded? | Recorded differently depending on the type of security. Securities that are held to maturity are not recorded in financial statements, but the company may include a disclosure about them in the footnotes. Securities that are held for trading are recorded on the balance sheet at their fair value, and the unrealized gains and losses are recorded on the income statement. |

| How are unrealized gains taxed? | Unrealized gains are not usually taxed. |

| How are realized gains taxed? | Realized gains are taxed at different rates depending on how long the investment was owned. Long-term capital gains are taxed at a rate of 0%, 15%, or 20% and short-term capital gains are taxed as ordinary income. |

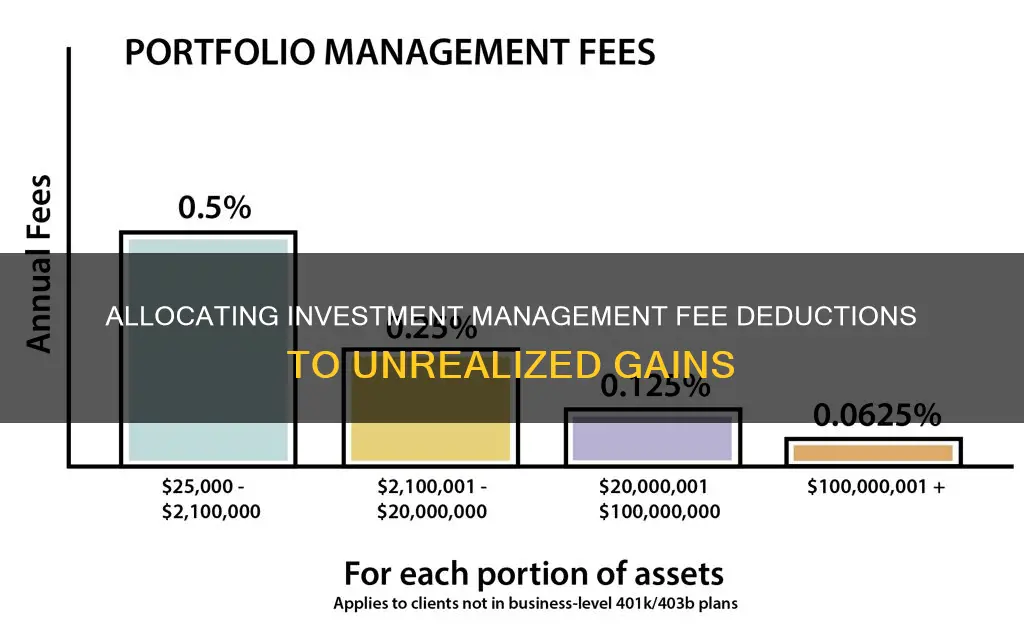

| How to allocate investment management fee deductions to unrealized gains | Investment management fees are not tax-deductible until 2025. However, investors who own an IRA can choose to pay financial planning or investment management fees directly out of the account being managed. Since the fees are considered investment expenses, they are paid on a pre-tax basis. |

What You'll Learn

Investment interest expenses

The deduction for investment interest expenses is limited to the amount of taxable investment income earned in the same year. Interest incurred from a 'passive activity' investment generally does not qualify for the investment interest deduction.

The federal tax code includes a number of incentives to encourage investment, including the deduction for investment interest expenses. In general, you can deduct interest paid on money you borrow to invest, although there are restrictions on how much you can deduct and which investments actually qualify you for the deduction.

The interest on a loan taken to buy a house to rent out is not deductible as investment interest but can usually be deducted as an expense item for operating costs of the rental property.

To actually claim the deduction for investment interest expenses, you must itemize your deductions. Investment interest goes on Schedule A, under "Interest You Paid." You may also have to file Form 4952, which provides details about your deduction.

If you itemize, you may be able to deduct the interest paid on money you borrowed to purchase taxable investments, for example, margin loans to buy stock or loans to buy investment property. The amount that you can deduct is capped at your net taxable investment income for the year. Any leftover interest expense gets carried forward to the next year and can potentially be used to reduce your taxes in the future.

Let's look at an example. Here, Mary has $150,000 of total income, $8,000 of net investment income (from ordinary dividends and interest income), $10,500 of investment interest expenses from a margin loan, and $13,000 of other itemized deductions (such as mortgage interest and state taxes).

Because of the investment interest expense deduction and other itemized deductions, Mary's taxable income has been reduced from $150,000 to $129,000.

Qualified dividends that receive preferential tax treatment aren't considered investment income for these purposes. However, you can opt to have your qualified dividends treated as ordinary income. In the right circumstances, electing to treat qualified dividends as ordinary income can increase your investment interest expense deduction, which could allow you to pay 0% tax on the dividends instead of the 15% or 20% tax that qualified dividends normally receive.

Note: The election to treat qualified dividends as ordinary dividends should not be taken lightly. Once made, the election can only be revoked with IRS consent. Consult with your tax professional before implementing this tax strategy.

Losing money is never fun, but there might be a silver lining. Capital losses can be used to offset your capital gains. If your capital losses exceed your capital gains, up to $3,000 of those losses (or $1,500 each for married filing separately) can be used to offset ordinary income and lower your tax bill. Net losses of more than $3,000 can be carried forward to offset gains in future tax years.

Liquid Investment Portfolios: Dynamic, Flexible, and Fluid Capital

You may want to see also

Qualified dividends

To be considered a qualified dividend, the shareholder must hold the stock for a specified minimum period, known as the holding period. For common stocks, this period is 61 days within a 121-day period that starts 60 days before the ex-dividend date. The ex-dividend date is the day before the dividend's record date, which is when a shareholder must be on the company's books to receive the dividend.

The tax rate on qualified dividends is 0% if the taxpayer's income is below $44,625 for singles and $89,250 for joint-married filers. For those with higher incomes, the tax rate increases to 15% or 20%, with an additional 3.8% net investment income tax (NIIT) for higher earners.

When filing taxes, qualified dividends are reported on Form 1099-DIV in Box 1b, while ordinary dividends are reported in Box 1a. It is important to note that not all dividends reported as qualified may have met the holding period requirement, and these non-qualified dividends may be taxed at the ordinary income tax rate.

Overall, qualified dividends offer investors a tax break on their dividend income, incentivizing them to hold onto their stocks for longer periods to take advantage of the lower capital gains tax rates.

Investment Portfolio Strategies for a Comfortable Retirement

You may want to see also

Tax-loss harvesting

- Sell securities that have lost value: Identify investments that have negative returns and sell them at a loss. It is important to consider the opportunity cost of selling an investment due to the wash-sale rule, which prohibits repurchasing the same or a "substantially identical" security within 30 days of the sale.

- Use the capital loss to offset capital gains: The loss from the sale can be used to offset capital gains on other sales, reducing the taxes owed on those gains.

- Replace the exited investments: After the waiting period required by the wash-sale rule, the investor can use the proceeds from the sale to purchase a similar investment, thus maintaining their desired level of exposure to that sector.

It is important to note that tax-loss harvesting does not permanently cancel your tax obligation but rather defers it. Additionally, it may not be suitable for all investors, especially those with smaller portfolios, as it assumes ideal conditions that may not always be met in the real world. Before implementing this strategy, it is crucial to consult a tax and investment professional to ensure it aligns with your specific circumstances.

US Investment Managers: How Many Exist?

You may want to see also

Financial advisory fees

Prior to the Act, financial advisory fees could be deducted as a miscellaneous itemized deduction on Schedule A of the tax return if they exceeded 2% of adjusted gross income (AGI). For example, if your AGI was $150,000 in 2017 and you paid $4,000 in financial advisory fees, $1,000 of this amount would be tax-deductible.

The suspension of miscellaneous deductions under the TCJA may end in 2025, meaning the deductibility of financial advisory fees could be reinstated.

It is important to note that there are still some ways to effectively reduce taxable income related to financial advisory fees. For instance, if you own a traditional IRA, you can pay the account fees directly from the IRA's balance, essentially giving yourself a tax deduction as you are paying the fees with pre-tax dollars. Commissions linked to investment trades also decrease an investor's taxable gain, acting as a form of deduction.

Additionally, according to the Income Tax Act, a taxpayer is allowed to deduct fees charged for advice on the buying or selling of specific shares or securities, or for the administration or management of securities held, provided that the fee amounts are reasonable. Furthermore, deductible fee-based services must be provided by an entity or person whose principal business involves providing such advice or services.

However, it is important to distinguish that fees for general financial counselling or planning, subscription fees for financial publications, and fees associated with registered accounts such as Tax-Free Savings Accounts (TFSAs) or Registered Retirement Savings Plans (RRSPs) are not tax-deductible.

Investment Portfolio Tools: Your Ultimate Guide to Choosing Wisely

You may want to see also

Investment management fees

Prior to the Tax Cuts and Jobs Act (TCJA) of 2017, these fees were tax-deductible. However, since the implementation of the TCJA, the deductibility of investment management fees has been eliminated. This means that, at least until 2025, investment management fees are not tax-deductible.

Despite this, there are still a few ways that investors can reduce taxes on investment-related spending:

- Investment interest expenses: Investors who borrow funds to buy assets may be able to claim the interest as a deduction on their tax returns. The deductible amount is limited to the taxpayer's net investment income for the year, and any excess interest expense can be carried forward to the next year.

- Qualified dividends: Qualified dividends are taxed at the capital gains rate, which is lower than the ordinary income tax rate. However, investors can choose to treat qualified dividends as ordinary income, which may increase their investment interest expense deduction and reduce the tax they pay.

- Tax-loss harvesting: Investors can use their capital losses to offset capital gains by selling underperforming assets. The IRS allows individual investors to deduct up to $3,000 in capital losses from their ordinary income each year. Any excess amount can be carried forward to future years.

- Financial advisory fees for IRAs: Investors who own an IRA can choose to pay financial planning or investment management fees directly from their IRA. Since these fees are considered investment expenses, they are paid on a pre-tax basis, avoiding income tax.

It is important to note that the TCJA is set to expire in 2025, so the elimination of deductions on investment management fees may be temporary. After this period, the tax laws may change again, and the deductibility of these fees may be reinstated.

Traders' Transparency: Publicly Sharing Their Investment Portfolios

You may want to see also

Frequently asked questions

An unrealized gain is the increase in the value of an asset that an investor has not yet sold. It is sometimes called a ""paper" gain, as it only exists as an accounting entry until it is realized.

Unrealized gains are not taxed until they are realized, i.e., when the investment is sold. If an investment is held for longer than a year, the profit is taxed at the long-term capital gains tax rate, which is either 0%, 15%, or 20% depending on one's income.

Investment management fees are generally not tax-deductible until 2025, according to the Tax Cuts and Jobs Act (TCJA). However, if you own an IRA, you can choose to pay investment management fees directly from the account, which are then considered pre-tax investment expenses.