Cash flow analysis is a critical aspect of a company's financial management, and a cash flow statement is an important tool for investors, analysts, and managers to evaluate a company's financial performance and make informed decisions. The cash flow statement is divided into three main sections: cash flow from operations, cash flow from investing, and cash flow from financing. This paragraph focuses on the analysis of cash flow from investing activities, which includes the purchase and sale of long-term assets, such as property, plant, and equipment, as well as investments in marketable securities and acquisitions of other businesses. A positive cash flow from investing activities indicates that a company is divesting its assets, while a negative cash flow suggests that the company is investing heavily in its fixed asset base for future growth. Analyzing cash flow from investing activities helps evaluate a company's investment activities, financial health, and potential for successful growth.

| Characteristics | Values |

|---|---|

| Definition | Cash Flow from Investing Activities (CFI) is a section of a company's cash flow statement that shows the cash generated by or spent on investment activities. |

| Purpose | To show how much cash has been generated or spent from various investment-related activities in a specific period. |

| Types of Activities | Purchases of physical assets, investments in securities, or the sale of securities or assets. |

| Types of Investments | Capital expenditures (CapEx), lending money, and the sale of investment securities. |

| Importance | It shows how a company is allocating cash for the long term and can indicate the company's financial health and stability. |

| Positive vs Negative CFI | Positive CFI indicates the company is divesting its assets, while negative CFI suggests heavy investment in fixed assets for future revenue growth. |

| Formula | Cash Flow from Investing Activities = (Capital Expenditures) + (Purchase of Long-Term Investments) + (Business Acquisitions) – Divestitures |

| Calculation Example | A hypothetical company spent $30 billion on CapEx, $5 billion on investments, $1 billion on acquisitions, and realised a positive inflow of $3 billion from the sale of investments, resulting in an annual CFI of -$33 billion. |

| Analysis Steps | 1. Look at the overall net cash flow. 2. Analyse cash flows from operating activities. 3. Analyse cash flows from investing activities. 4. Analyse cash flows from financing activities. 5. Calculate free cash flow. 6. Compare to other financial statements. 7. Interpret for red flags. |

What You'll Learn

Capital expenditures

The purchase of PP&E is considered a capital expenditure and is often the largest cash outflow for a company. This type of expenditure is a core, recurring expense that is necessary to maintain and add to a company's physical assets to support its operations and competitiveness.

The purchase of PP&E is also an important indicator of a company's financial health and stability. If the purchase of PP&E is fairly proportional to depreciation, it indicates that the company is consistently reinvesting to keep its assets in good shape. This is a positive sign for investors as it shows that the company is investing in its long-term health and future growth.

On the other hand, negative cash flow from capital expenditures may indicate that a company is investing heavily in its fixed asset base to generate revenue growth in the coming years. This is not necessarily a cause for concern as it implies that management is investing in the long-term growth of the company.

Oakmark's Cash Strategy: Liquidated Investments and Holdings

You may want to see also

Long-term investments

Positive cash flow from long-term investments occurs when a company sells investment securities or assets. This does not always indicate good financial health, as the company may be selling off assets to cover operating expenses, which is unsustainable in the long term.

On the other hand, negative cash flow from long-term investments occurs when a company purchases long-term assets, lends money, or invests in marketable securities. This is often a positive sign, indicating that the company is investing in its long-term health and growth. Examples include investing in property, plant, and equipment (PPE), research and development (R&D), and acquisitions of other businesses.

When analyzing long-term investments, it is important to consider the context and overall financial health of the company. A company may have a negative cash flow from long-term investments in the short term, but if these investments are managed well, they can lead to significant growth and gains in the long term.

Apple's Cash: Where Does it Go?

You may want to see also

Business acquisitions

When a company acquires another business, the cash outflow associated with the purchase is recorded as a negative cash flow from investing activities. This outflow reflects the cost of acquiring the business, including any cash paid, assets transferred, or liabilities assumed. Conversely, if a company divests or sells a business unit, the cash inflow from the sale is recorded as a positive cash flow from investing activities.

Analysing business acquisitions in the cash flow statement is essential for understanding a company's growth strategy and capital allocation decisions. Acquiring another business can be a significant investment, and investors need to assess whether it will generate positive returns in the long term. It is important to note that negative cash flow from business acquisitions is not always a negative sign, as it may indicate that the company is investing in its future growth and competitiveness.

Additionally, business acquisitions can impact a company's financial statements in various ways. The acquired assets, liabilities, and equity of the purchased business are reflected in the balance sheet, while the cost of the acquisition is recorded as an expense or investment on the income statement. The cash flow statement provides a clear picture of the cash impact of these acquisitions by showing the net change in cash resulting from these transactions.

Overall, analysing cash flow from business acquisitions is a critical aspect of financial statement analysis. It provides insights into a company's growth strategy, capital allocation, and financial health, helping investors and analysts make informed decisions about the company's future prospects.

Depreciation's Impact on Cash Flow: Investing Activities

You may want to see also

Sale of assets

The sale of assets is a critical component of cash flow from investing activities, which is one of the sections of a company's cash flow statement. This section provides insights into the company's investment-related activities over a specific period, including both purchases and sales of physical assets, securities, or other investments.

The sale of assets can generate positive cash flow, contributing to the overall cash flow from investing activities. It represents the inflow of cash resulting from the disposal of assets, which can include fixed assets, property, plant, and equipment (PP&E), or even the sale of other businesses. For example, in Amazon's 2017 financial statements, one of the investing activities that generated positive cash flow was the sale of property and equipment.

When analyzing the cash flow statement, it's important to consider the impact of the sale of assets on the company's financial health. A positive cash flow from the sale of assets indicates a successful liquidation of investments, which can provide funds for other strategic initiatives or improve the company's liquidity position. However, if the sale of assets is used to cover operating expenses, it could be a cause for concern as it may not be a sustainable long-term strategy.

It's worth noting that the sale of assets is just one aspect of cash flow from investing activities, and it should be analyzed in conjunction with other investing activities, such as purchases of assets or investments, to get a comprehensive understanding of the company's financial decisions and their impact on cash flow.

Investing: Negative Cash Flow's Impact and Insights

You may want to see also

Cash flow analysis

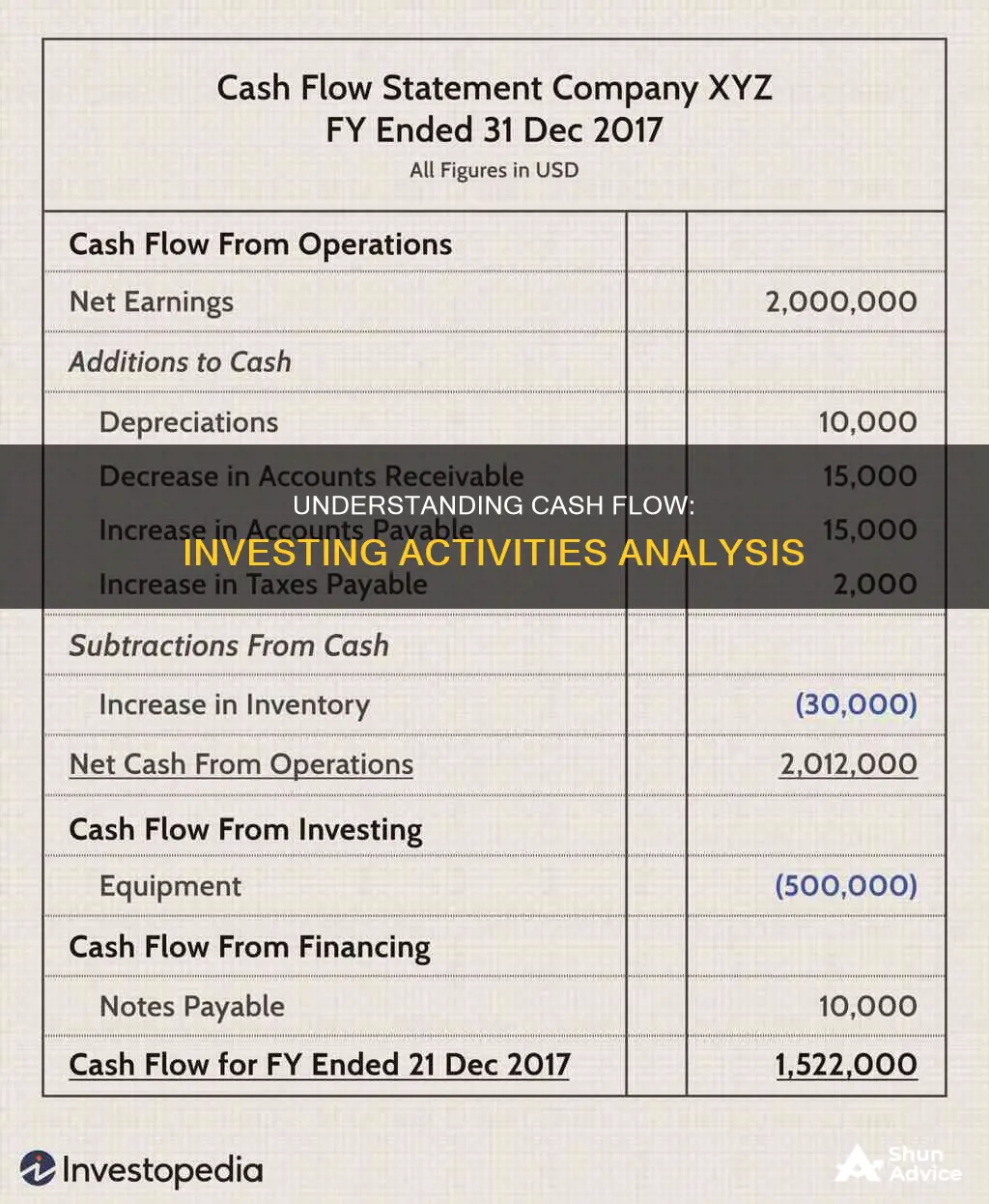

The cash flow statement is a financial statement that outlines the sources and uses of cash within a company over a specific period, usually a fiscal quarter or year. It is divided into three main sections: cash flow from operations, cash flow from investing, and cash flow from financing.

Cash Flow from Operations

This section details the cash flow generated from the company's regular goods or services, including both revenue and expenses. It includes accounts receivable, accounts payable, and income taxes payable.

Cash Flow from Investing

This section records the cash inflows and outflows from the purchase and sale of long-term assets, such as physical property (real estate, vehicles) and non-physical property (patents). It also includes business acquisitions and the purchase of investment securities.

Cash Flow from Financing

This section details the cash flow from debt and equity financing. It includes transactions such as the payment of dividends, the repurchase or sale of stocks and bonds, and cash received from loans or used to pay down debt.

Performing Cash Flow Analysis

To perform a cash flow analysis, follow these steps:

- Look at the overall net cash flow to determine whether the company generated a profit or loss during the period.

- Analyse cash flows from operating activities by examining trends and changes in net income, depreciation, and working capital.

- Analyse cash flows from investing activities by identifying trends and changes in the company's investments in assets, such as property, and the purchase or sale of assets or investments.

- Analyse cash flows from financing activities by examining trends and changes in the company's financing activities, such as issuing bonds, repaying debt, and paying taxes and dividends.

- Calculate the company's free cash flow by subtracting capital expenditures from cash from operating activities.

- Compare the cash flow statement to the income statement and balance sheet to gain a comprehensive understanding of the company's financial health and performance.

- Interpret the cash flow statement for any red flags, such as a significant negative net cash flow or consistently negative free cash flow.

Important Indicators in Cash Flow Analysis

- Operating Cash Flow/Net Sales: This ratio expresses the percentage of a company's net operating cash flow relative to its net sales or revenue. A higher percentage indicates stronger financial health.

- Free Cash Flow (FCF): FCF is calculated as net operating cash flow minus capital expenditures. It measures a company's ability to generate cash and is a key indicator for investors.

- Comprehensive Free Cash Flow Coverage: This ratio is calculated by dividing FCF by net operating cash flow, providing a percentage that indicates the efficiency of a company's free cash flow relative to its operations.

Limitations of Cash Flow Analysis

It's important to consider the limitations of cash flow analysis:

- The cash flow statement presents historical data, which may not be as useful for evaluating future investments.

- It does not depict a company's net income as it excludes non-cash items, which must be examined through the income statement.

- While it provides a snapshot of available cash at the end of a period, it does not offer a comprehensive view of the company's overall liquidity.

Cash Investments: What Are They?

You may want to see also

Frequently asked questions

A cash flow statement is a financial statement that outlines the sources and uses of cash within a company over a specific period, usually a fiscal quarter or year. It is divided into three sections: cash flow from operations, cash flow from investing, and cash flow from financing.

Cash flow from investing activities includes the money generated from or used in the buying or selling of long-term assets, such as property, plant, and equipment. It also includes the proceeds from the sale of investments and the acquisition of other businesses.

To analyse cash flow from investing activities, look for trends and changes in a company's investments in assets, such as property, and the buying and selling of assets and investments. Compare this to the company's other financial statements to get a full picture of its financial health.