Accumulated depreciation is a bookkeeping method that does not directly affect net income. It is a contra account, which is an asset whose natural balance is a credit, offsetting the negative value balance (debit) of the asset account it is linked to. Accumulated depreciation is recorded as a credit over the asset's useful life and, when the asset is sold or retired, it is marked as a debit against the asset's credit value. This does not impact net income. However, depreciation is a type of expense that is used to reduce the carrying value of an asset and is found on the income statement, balance sheet, and cash flow statement.

So, does accumulated depreciation decrease net cash in investing activities?

| Characteristics | Values |

|---|---|

| Definition of Accumulated Depreciation | The total amount of depreciation of an asset from the point that it started being used |

| Accumulated Depreciation as a Contra Account | An asset whose natural balance is a credit, as it offsets the negative value balance (debit) of the asset account it is linked to |

| Accumulated Depreciation During an Asset's Useful Life | Marked as a credit |

| Accumulated Depreciation When an Asset is Removed from Service | Marked as a debit |

| Impact of Accumulated Depreciation on Net Income | Does not directly affect net income |

| Impact of Depreciation on Net Income | Reduces net income |

| Impact of Depreciation on Cash Flow | Does not have a direct impact on cash flow but has an indirect effect on cash flow because it changes the company's tax liabilities, which reduces cash outflows from income taxes |

| Depreciation in Cash Flow Statement | Depreciation is added back to the cash flow statement in the operating activities section, alongside other expenses such as amortization and depletion |

| Impact of Accumulated Depreciation on Cash Flow Statement | An increase in accumulated depreciation is added to net income, while a decrease in accumulated depreciation must be subtracted from net income |

What You'll Learn

- Accumulated depreciation is a bookkeeping method that does not directly affect net income

- Depreciation is a non-cash expense that influences cash flow indirectly

- Depreciation is tax-deductible, reducing a company's tax bill and increasing net income

- Accumulated depreciation is a balance sheet contra account

- Accumulated depreciation increases over time as depreciation is charged against company assets

Accumulated depreciation is a bookkeeping method that does not directly affect net income

Accumulated depreciation is calculated as the sum of all recorded depreciation of an asset up to a specific date. In other words, it is the total depreciation of an asset over its life up to a certain point. This figure can be found on a company's balance sheet below the line for related capitalised assets.

Accumulated depreciation is recorded as a credit over the asset's useful life. When an asset is removed from service, the accumulated depreciation is marked as a debit and the value of the asset as a credit. This does not impact net income.

Net income is the amount of revenue left after all expenses, depreciation, taxes, and interest have been accounted for. While depreciation is a cost that affects net income, accumulated depreciation does not. Depreciation is an expense that reduces net income when the asset's cost is allocated on the income statement.

Accumulated depreciation is important because it provides a transparent view of a company's assets' declining value. It also ensures compliance with Generally Accepted Accounting Principles (GAAP), which standardises financial reporting and provides comparability among entities.

There are several methods to calculate accumulated depreciation, including the straight-line method, declining balance method, double-declining balance method, sum-of-the-years' digits method, units of production method, and half-year recognition. The choice of method depends on the asset's usage and the company's financial strategy.

Investing: Negative Cash Flow's Impact and Insights

You may want to see also

Depreciation is a non-cash expense that influences cash flow indirectly

Depreciation is a tricky concept in accounting, especially when it comes to its effect on a business's cash flow. It is a non-cash expense that influences cash flow indirectly.

In simple terms, depreciation is an accounting concept that refers to the loss of value of an asset over its useful life. This loss of value is due to wear and tear and expected obsolescence. It is important to note that depreciation is not an explicit expense but rather an estimated one. It is used to reduce the carrying value of an asset.

When a company purchases a fixed asset, such as machinery, computing equipment, or vehicles, the asset's value decreases over time. Depreciation is used to spread the cost of that asset over its useful life, instead of recording the entire loss at the time of purchase. This helps companies avoid taking a significant expense deduction on the income statement in the year the asset is acquired.

For example, if a company buys a vehicle for $30,000 and plans to use it for five years, the depreciation expense would be $6,000 per year. Each year, the depreciation expense is recorded as a debit, while the accumulated depreciation is recorded as a credit. After five years, the vehicle is fully depreciated and has a value of $0 on the company's books.

Depreciation is entered as a debit on the income statement as an expense and a credit to the asset's value. It is also reflected in the balance sheet and cash flow statement. While depreciation does not directly impact cash flow, it does have an indirect effect. When a company prepares its income tax return, depreciation is listed as an expense, reducing taxable income and, consequently, the amount of cash paid out in income taxes.

Additionally, depreciation can be tax-deductible, further reducing a company's tax burden. This, in turn, can lead to increased net income, which is used as a starting point for calculating operating cash flow. As a result, depreciation can indirectly increase the amount of cash on a company's cash flow statement.

However, it is important to remember that depreciation is associated with the purchase of a fixed asset, which initially resulted in a cash outflow. Therefore, the positive impact of depreciation on cash flow is offset by the original payment for the asset.

Restricted Cash: A Viable Investment Option?

You may want to see also

Depreciation is tax-deductible, reducing a company's tax bill and increasing net income

Depreciation is a non-cash expense that can be listed as an expense on a company's income tax return. It is a tax-deductible expense, which can have a major impact on a company's bottom line. This is because listing depreciation as an expense reduces the amount of taxable income that needs to be reported to the government, which in turn reduces the amount of cash that goes out of the business. In other words, depreciation reduces a company's tax bill.

For example, if a company has a net income of $100,000 in a year and can claim $20,000 in total depreciation deductions, the amount of taxable income is reduced to $80,000. At a corporate tax rate of 21%, the company would save $4,200 on taxes.

Depreciation is an accounting method used to calculate decreases in the value of a company's tangible assets or fixed assets over their useful life. It is used to spread the cost of a tangible asset over its "useful life". Depreciation can happen with almost any type of fixed asset, including machinery, computing equipment, and office supplies.

There are several methods for calculating depreciation, including straight-line basis, declining balance, double declining, units of production, and sum-of-the-years' digits. Each method recognises depreciation expense differently, which changes the amount by which the depreciation expense reduces a company's taxable earnings and, therefore, its taxes.

While depreciation reduces a company's tax bill, it does not directly impact its operating cash flow. This is because depreciation is a non-cash expense. However, it does have an indirect effect on cash flow because it changes the company's tax liabilities, reducing cash outflows from income taxes.

General Partners: Cash Investment Strategies and Decisions

You may want to see also

Accumulated depreciation is a balance sheet contra account

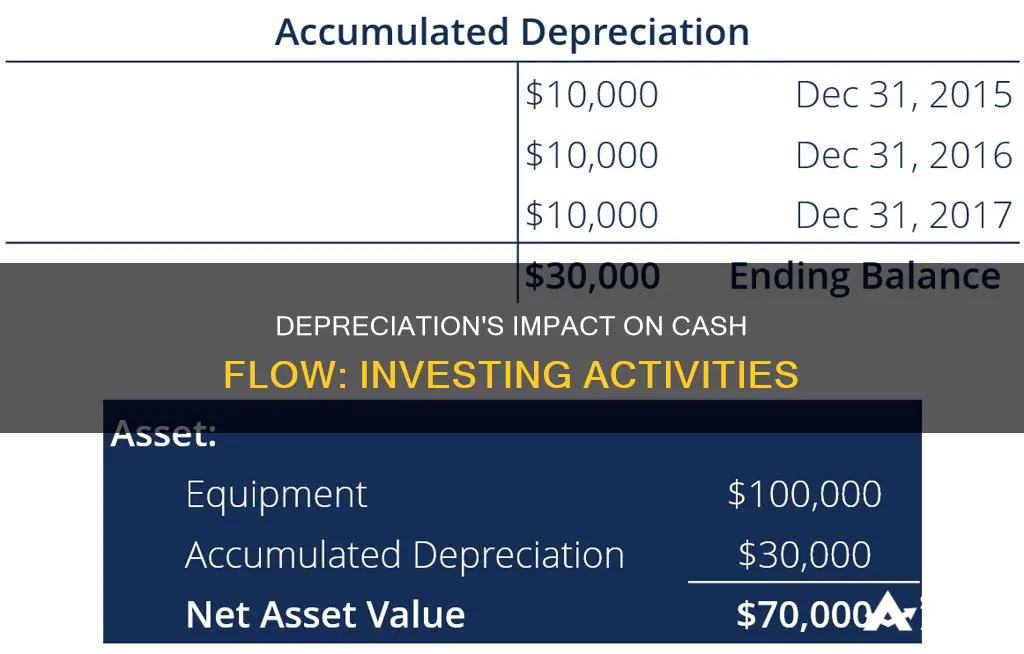

Accumulated depreciation is the sum of all recorded depreciation of an asset over time up to a specific date. It is recorded to tie the cost of a long-term capital asset to the benefit gained from its use over time.

Accumulated depreciation is presented on the balance sheet below the related capital asset line. It is recorded as a contra asset with a natural credit balance instead of an asset account with natural debit balances. The carrying value of an asset is its historical cost minus accumulated depreciation.

Accumulated depreciation is neither an asset nor a liability. It is a way to measure the total change in value of a fixed asset so that its value can be allocated over its usable life. When recording accumulated depreciation, it is recorded as a contra asset on the asset side of the balance sheet.

Accumulated depreciation is an important tool for measuring the change in value of an asset. Common assets like buildings, vehicles, and equipment decline in value over their lifetimes, so measuring accumulated depreciation can help calculate how much of their economic value has been used up to the present date.

On a company balance sheet, an accumulated depreciation account is recorded as a contra asset account in the asset section to the fixed asset current book value.

Extra Cash: Smart Investment Strategies for Beginners

You may want to see also

Accumulated depreciation increases over time as depreciation is charged against company assets

Accumulated depreciation is a method of accounting for the annual reduction of an asset's value over its useful life. It is the sum of all recorded depreciation of an asset from the point it is acquired and enters into use. It is a contra account, meaning it has a credit balance that reduces the gross amount of a fixed asset. Accumulated depreciation is recorded as a credit over the asset's useful life and does not directly affect net income.

Each time a company charges depreciation as an expense on its income statement, accumulated depreciation increases by the same amount for that period. As a result, a company's accumulated depreciation increases over time as depreciation continues to be charged against the company's assets.

Accumulated depreciation is calculated using one of six methods: the straight-line method, declining balance method, double-declining balance method, sum-of-the-years' digits method, units of production method, or half-year recognition method. The straight-line method is the most common approach, where a company deducts the asset's salvage value from the purchase price to find a depreciable base, which is then divided evenly over the anticipated useful life of the asset.

For example, if a company buys a vehicle for $30,000 and plans to use it for the next five years, the depreciation expense would be $6,000 per year. Each year, depreciation expense is debited for $6,000, and the fixed asset accumulation account is credited for the same amount. After five years, the expense of the vehicle has been fully accounted for, and the vehicle is worth $0 on the books.

Accumulated depreciation is essential for companies to expense the cost of a tangible asset over its useful life and avoid significant costs when purchasing new assets. It also helps with tax deductions, as depreciation is tax-deductible and reduces taxable income.

Investment Bankers: Crafting Precise Cash Flow Statements

You may want to see also

Frequently asked questions

No, accumulated depreciation does not decrease net cash in investing activities. Accumulated depreciation is a bookkeeping method that does not directly affect net income. It is a non-cash expense that needs to be added back to the cash flow statement in the operating activities section.

Depreciation reduces net income when the asset's cost is allocated on the income statement. It is an accounting measure that allows a company to earn revenue from an asset and pay for it over the time it is used.

Depreciation does not have a direct impact on cash flow but does have an indirect effect because it changes the company's tax liabilities, reducing cash outflows from income taxes.