Financial statements are an essential tool for investors to determine a company's financial health and growth potential. Before investing in stocks, it is crucial to assess a company's financial statements to gauge its performance and long-term growth potential. These statements include the income statement, balance sheet, and cash flow statement, offering insights into a company's profitability, financial position, and ability to generate revenue. By analyzing these statements, investors can make informed decisions about a company's stock worthiness, stability, and potential for future growth.

What You'll Learn

How to read a financial statement

Before investing in stocks, it is important to assess the financial health of a company. This can be done by reviewing a company's financial statements, which are: the income statement, the balance sheet, the cash flow statement, and the annual report.

The income statement, also known as the profit and loss statement, or P&L, includes revenue, expenses, and operational transactions over a period of time. It is a snapshot of how a company performs over a specific period, summarising its business activities and helping to determine whether the company is profitable and therefore a good investment.

Comparing income statements over different periods can help identify trends and chronic issues. A vertical analysis of an income statement reviews transactions as percentages, allowing investors to evaluate a company's performance by comparing different line items. A horizontal analysis looks for changes over time, helping investors determine whether a company shows consistent growth and how it is performing against competitors.

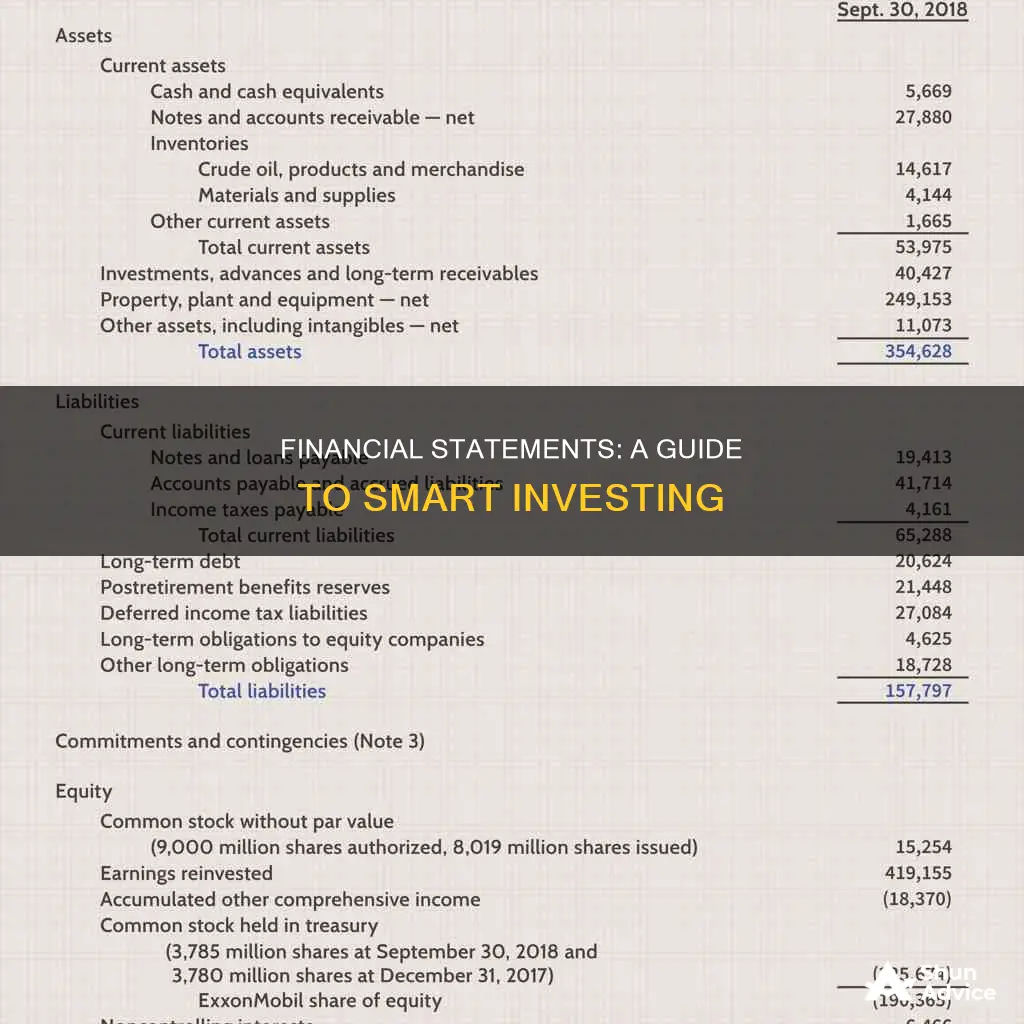

The balance sheet shows a company's assets, liabilities, and owners' equity. It tells investors what resources a company has to expand its operations and whether those resources were obtained with too much debt. A balanced sheet should show that assets equal liabilities plus owners' equity.

The cash flow statement details the cash flow from operating activities, investing activities, and financing activities. It shows how much money is flowing into and out of a company and whether it can continue operating based on existing business activities.

The annual report describes a company's operational and financial conditions, providing investors with greater insight into a company's mission and goals. It includes a company's income statement, balance sheet, and cash flow statement, as well as industry insights, management's analysis, accounting policies, and additional investor information.

Financial statements are important tools for investors to determine a company's financial health, growth potential, and whether it has the right team in place to execute its strategy. They can also be used to look for trends over time and across different companies in an industry.

Physical Cash Investment: Strategies for Smart Money Allocation

You may want to see also

How to analyse an income statement

Income statements, also known as profit and loss (P&L) statements, are one of the most important financial documents for investors to analyse. They summarise a company's income and expenses over a given period, including the cumulative impact of revenue, gains, expenses, and loss transactions.

Understand the Basics of an Income Statement:

- An income statement shows a company's profit and loss over a specific period.

- It includes total revenue, total expenses, and net income, along with other figures that contribute to these core values.

- Other figures include the cost of goods sold (COGS), gross profit, expenses, and taxes.

Know the Limitations of Income Statements:

- Income statements don't include details about capital structure or cash flow.

- They often rely on estimates and may not always provide precise figures.

- Accounting methods and practices can vary between companies, affecting the numbers presented.

Conduct Vertical Analysis:

- Vertical analysis involves reviewing transactions as percentages, allowing investors to evaluate a company's performance by comparing different line items.

- This analysis can show which activities generate the most revenue or require higher expenses.

- It helps determine how each line item affects cash flow and how the cost of one item stands up against another.

Perform Horizontal Analysis:

- Horizontal analysis involves looking for changes over time by comparing multiple reporting periods.

- This method helps identify trends and can be used to predict a company's future performance.

- It allows investors to determine consistent growth and compare performance against competitors.

Compare with Other Companies:

- Compare income statement metrics, such as revenue growth and gross profit margin, with similar companies in the same industry.

- This comparative analysis provides context to the numbers and helps assess a company's financial performance relative to its peers.

- It enables investors to make informed decisions and identify potential investment opportunities.

Safely Investing Corporate Cash: Strategies for Smart Money Management

You may want to see also

How to analyse a balance sheet

A balance sheet is a financial statement that provides a snapshot of a company's finances at a specific point in time. It is a key statement that, along with the income statement and cash flow statement, forms the cornerstone of a company's financial statements. It is important for investors to know how to read and analyse a balance sheet to gain insight into a company and its operations.

The balance sheet is split into three sections: assets, liabilities, and owner's equity (also known as shareholders' equity). A balance sheet must balance out, with the value of assets equalling the combined value of liabilities and owner's equity.

Assets

Assets are what a company uses to operate its business. They are broken down into current assets and non-current assets. Current assets are expected to be converted to cash within a year and include cash, accounts receivable, and inventory. Non-current assets are harder to convert into cash and include tangible assets such as machinery, computers, buildings, and land, as well as intangible assets such as goodwill, patents, or copyrights.

Liabilities

Liabilities are the financial obligations a company owes to outside parties. They are also split into current and non-current liabilities. Current liabilities are those that will come due or must be paid within a year, such as short-term borrowings or accounts payable. Non-current liabilities are debts and other non-debt financial obligations that are due after a year, such as corporate bonds.

Owner's Equity (Shareholders' Equity)

Owner's equity is the remainder value when liabilities are subtracted from assets. In a publicly traded company, it is the amount of money initially invested into the company plus any retained earnings.

Analysing a Balance Sheet

Analysing a balance sheet involves understanding the company's financial position and using financial ratios to gain further insight. Here are some key ratios to consider:

- Current ratio: Current assets divided by current liabilities. A value between 1.5 and 2 is ideal, indicating a balance between using assets for growth and maintaining sufficient assets to pay off liabilities.

- Quick ratio: Sum of cash, cash equivalents, short-term investments, and current receivables divided by current liabilities. A value of 1 is considered normal, indicating the ability to pay off current liabilities.

- Asset turnover ratio: Compares net sales with average total assets to determine how efficiently a company is utilising its assets to generate sales.

- Inventory turnover ratio: Indicates how often a company sells and replaces its stock, reflecting product demand and sales performance.

- Debt-to-equity ratio: Total liabilities divided by owner's equity. Indicates the company's long-term ability to generate income and make payments.

Analysing a balance sheet helps investors assess a company's financial health, stability, and growth potential. It is important to note that a balance sheet is just a snapshot of a company's financial position at a single point in time, and should be considered alongside other financial statements for a comprehensive understanding.

Maximizing Cash Balance Plans: Strategies for Savvy Investors

You may want to see also

How to analyse a cash flow statement

A cash flow statement is one of the three required financial statements of public entities, the other two being the balance sheet and the income statement. It is a crucial tool for investors to determine the financial health of a company and its potential for future growth.

The purpose of a cash flow statement is to show where a company's cash is being generated (inflows) and spent (outflows) over a specific period, usually quarterly or annually. It is important for analysing a company's liquidity and long-term solvency. Unlike the balance sheet and income statement, the cash flow statement uses cash-basis accounting, which is important because a company may accrue accounting revenues but not actually receive the cash.

Cash Flow from Operations:

This is the key source of a company's cash generation, produced internally rather than from external investing or financing activities. It includes cash inflows from day-to-day business operations and cash outflows from operating expenses. To calculate cash flow from operations, start with the net income from the income statement and then add back non-cash expenses like depreciation and amortization. Also, consider any gains or losses from the sale of assets and any changes in current and non-current assets and liabilities.

Cash Flow from Investing Activities:

This section includes cash outflows from the purchase of long-term assets, such as land, buildings, or equipment, and inflows from the sale of such assets. Most cash flow investing activities are outflows as companies invest in long-term assets for operations and future growth.

Cash Flow from Financing Activities:

This section covers cash inflows from issuing stocks or bonds and outflows from payments to investors, such as interest to bondholders or dividends and stock buybacks to shareholders.

Net Change in Cash:

The net change in cash is calculated by summing or subtracting the cash flows from operations, investing, and financing activities. This should reconcile with the change in cash balances reported on the balance sheet.

Ratios and Comparisons:

To analyse a cash flow statement further, investors can calculate ratios such as Operating Cash Flow/Net Sales, which indicates how many dollars of cash are generated for every dollar of sales. Another key ratio is Free Cash Flow, calculated as net operating cash flow minus capital expenditures. A steady and growing free cash flow is a highly favourable indicator of a company's financial health.

It is important to compare these ratios to those of peer companies in the same industry, as financial ratios can vary widely across sectors. Additionally, compare the company's current ratios to its historical performance to identify any significant variances or trends over time.

Choosing the Right Investment Tools: Maximizing Your Returns

You may want to see also

How to compare financial statements

Comparing financial statements is a crucial aspect of investment decision-making. It provides insights into the financial health and performance of companies, helping investors identify profitable investment opportunities. Here's a detailed guide on how to compare financial statements effectively:

Understanding the Basics:

Firstly, it's important to know the types of financial statements available for comparison. The three primary statements are the income statement, the balance sheet, and the cash flow statement. These statements offer different perspectives on a company's financial position and performance.

Compare Apples to Apples:

Ensure that you are comparing financial statements of companies within the same industry. Length of operation, business location, and types of products can significantly impact financial results, so comparing companies in different sectors may not provide meaningful insights.

Common-Size Statements:

Common-size statements express each item on a financial statement as a percentage of another value, typically total income, total positive cash flow, or total assets. This approach allows for a comparison of the relative size and significance of different items. For example, on a common-size income statement, each income and expense item is listed as a percentage of total income, showing the contribution of each income type and the burden of each expense.

Ratio Analysis:

Ratio analysis is a powerful tool for comparing financial statements. It involves calculating and comparing various financial ratios, such as liquidity ratios, asset turnover ratios, and financial leverage ratios. Some key ratios include:

- Net Profit Ratio: Calculated by dividing pre-tax profit by net sales, this ratio indicates a company's profitability relative to its revenue.

- Return on Assets Ratio: This ratio is calculated by dividing pre-tax profit by total assets and helps determine how effectively a company is utilising its assets to generate profit.

- Quick Ratio/Acid-Test Ratio: This ratio, calculated by dividing current assets (excluding inventory) by current liabilities, indicates a company's ability to meet its short-term obligations.

Compare Over Time:

Comparing financial statements of the same company over different periods can reveal trends and the impact of financial decisions. This analysis can provide insights into the effects of past choices and guide future decision-making.

Standardise Reporting Procedures:

When comparing financial statements from different companies, ensure that the statements are prepared using similar reporting procedures. For example, some companies may report net sales differently, so adjustments may be necessary for accurate comparisons.

Consider Key Performance Indicators (KPIs):

Investors should also consider other KPIs that indicate a company's financial health and growth potential. These include sales and revenue growth, profit margins, customer acquisition costs, churn rates, and debt levels.

Seek Expert Advice:

Comparing financial statements can be complex, so it's advisable to consult certified public accountants (CPAs) or financial analysts to ensure accurate interpretation and comparison.

In conclusion, comparing financial statements is a critical step in investment decision-making. It provides a deeper understanding of a company's financial health, stability, and growth potential. By following these steps and seeking expert advice, investors can make more informed choices and identify profitable investment opportunities.

A Beginner's Guide to Investing with eToro

You may want to see also

Frequently asked questions

The primary financial statements an investor will want to review before investing in stocks are the income statement, balance sheet, cash flow statement, and annual report.

The income statement tells us if the company made a profit. It shows the revenue, costs, and income of a company.

The balance sheet shows what a company owns (assets), how much it owes (liabilities), and what it is worth (shareholders' equity).

The cash flow statement is one of the easier statements to understand, as it simply tracks how much cash comes in and how much cash goes out during a period.