Carbon credits are a way of valuing or pricing how much a company is reducing its greenhouse gas emissions. Companies that directly reduce their own emissions can earn credits for doing so. These credits can then be sold to other companies that are unable to meet their reduction targets.

There are two types of carbon markets: the Emissions Trading Systems (ETS) and the Voluntary Carbon Market (VCM). The ETS is a mandatory market managed by governments, while the VCM is a smaller, voluntary market where carbon credits are created and traded.

There are several ways to invest in carbon credits, including:

- Carbon Credit ETFs: Exchange-traded funds that track the performance of carbon markets.

- Carbon Credit Futures: Derivatives linked to underlying carbon credit assets.

- Individual Companies: Investing in stocks of companies that generate or trade carbon credits.

- Brokers: Intermediaries that can help companies locate and purchase carbon credits.

- Retailers: Companies that sell carbon credits, often with additional information about the projects they support.

- Exchanges: Platforms that allow people to buy, sell, and trade carbon credits.

When investing in carbon credits, it is important to consider factors such as budget, time frame, number of credits needed, and level of involvement. It is also crucial to ensure that the carbon credits are verified by a major standard, such as the Gold Standard or VERRA.

While investing in carbon credits offers potential profitability and environmental benefits, it is important to remember that the market is relatively new and volatile, with limited data available. Additionally, carbon credits may not directly reduce a company's ecological impact, as they can simply be used as permits to pollute.

| Characteristics | Values |

|---|---|

| Why invest in carbon credits? | To address emissions that cannot be removed from operations; to support climate action and environmental projects; to gain green business certifications; to make a profit. |

| What is a carbon credit? | A transaction instrument or commodity of carbon markets. Verified carbon credits are created when an entity removes or reduces carbon dioxide emissions. |

| How do carbon credits work? | One carbon credit offsets or permits one tonne of carbon emissions. |

| How do carbon credits mitigate emissions? | The mandatory Emissions Trading Systems (ETS) market is designed to remove overall emissions over time by providing a yearly cap on emissions, which is lowered annually. The voluntary carbon market (VCM) allows companies to go beyond the ETS caps and fund projects that remove or reduce carbon from the atmosphere. |

| How to invest in carbon credits? | Buy directly from projects; use a broker; buy from a retailer; buy from an exchange. |

| Risks of carbon credit investing | Fraud; investing in projects that have not been completed yet; insufficient funds to cover potential losses; purchasing illegitimate credits. |

| How to be careful when investing in carbon credits | Research the company; ensure sufficient funds to cover potential losses; consider the cost per tonne of carbon dioxide emissions reduction; buy from reputable ETFs or brokers. |

| Types of carbon markets | ETS (mandatory, managed by governments) and VCM (voluntary, where carbon credits are created and traded). |

What You'll Learn

- Understand the difference between the mandatory Emissions Trading Systems (ETS) and the voluntary carbon market (VCM)

- Research the risks of carbon credit investing, such as fraud and investing in incomplete projects

- Consider the timing, number of credits, price and level of engagement required for the transaction

- Decide whether to buy directly from projects, through a broker, retailer or exchange

- Look at carbon credit ETFs, carbon credit futures and individual companies that generate or trade carbon credits

Understand the difference between the mandatory Emissions Trading Systems (ETS) and the voluntary carbon market (VCM)

The two types of carbon markets—mandatory and voluntary—operate very differently. The mandatory market is referred to as Emissions Trading Systems (ETS), while the voluntary market is known as the Voluntary Carbon Market (VCM). Here are the key differences between the two:

Mandatory Emissions Trading Systems (ETS):

- ETS is a much larger market compared to VCM, with jurisdictions making up 55% of global GDP using ETS and covering 17% of global greenhouse gas emissions.

- Examples of ETS include the EU Emissions Trading System (EUAs), schemes in Mexico, California, Oregon, Washington, Quebec, the United Kingdom, Kazakhstan, Japan, and China.

- ETS is a regulated market with high visibility and ease of verification. It is approved by the IIGCC, a group representing pension funds with around $33 trillion in AUM and 250 pension funds globally.

- In ETS, governments set a cap on the amount of carbon dioxide that can be emitted. Companies must purchase allowances to cover their emissions, and the supply of allowances is reduced each year to reduce pollution.

- ETS operates as a "cap-and-trade" system, where companies can trade allowances with each other. If a company emits less than its allowance, it can sell the extra credits.

- ETS is designed to be tradable through futures contracts, and the allowances are not considered credits but rather permissions to pollute a specified amount.

- ETS is mandatory for companies in certain industries, and non-compliance can result in fines.

- ETS has a significant impact on pollution reduction, with emissions within the EU ETS declining by 34.6% since 2005.

- ETS auctions can be quite volatile, especially in the months leading up to the annual compliance deadline.

Voluntary Carbon Market (VCM):

- VCM is a much smaller market, where individuals, corporations, or governments can voluntarily purchase carbon credits or invest in projects to mitigate greenhouse gas emissions.

- VCM is not regulated and can be opaque, difficult to verify, and lacks consensus on its size.

- VCM is not approved by IIGCC pension funds.

- Companies in VCM can choose to offset as little or as much of their pollution as they want, and the efficacy of the offset can be challenging to verify.

- VCM is largely uncontrolled, with multiple parties running the market infrastructure. It is managed by independent standards, such as Verra's VCS and Gold Standard, which ensure the credibility and quality of carbon credits.

- Any entity can participate in VCM, and credits are typically verified by third-party organisations.

- VCM uses a project-based system rather than a cap-and-trade system, allowing for the creation of more carbon credits through environmental projects.

- VCM credits tend to be cheaper than ETS credits due to their voluntary nature and the lack of regulatory obligations.

- VCM provides companies with the opportunity to demonstrate their commitment to sustainability, enhance their reputation, and meet net-zero targets.

- Examples of VCM include the Kyoto Protocol, the California Carbon Market, and companies like Microsoft, Google, and Starbucks using it to achieve carbon neutrality goals.

Why Invest in Entertainment?

You may want to see also

Research the risks of carbon credit investing, such as fraud and investing in incomplete projects

Carbon credit investing is not without its risks. The first and most prominent risk is fraud. Some companies sell fake carbon credits, meaning that you could lose money if you place an order for fake carbon credits and receive real ones instead. Scammers often target consumers searching for investments online through search engines like Google and Bing, offering high returns to tempt investors. These scammers may also offer more realistic returns to appear more legitimate.

Another risk of carbon credit investing is that you may be investing in something that hasn't hit its target yet. For example, some projects claim to avoid deforestation but do not offset carbon. These projects are based on already existing forests that are never threatened and do not do much on their own to reduce carbon emissions.

Additionally, carbon credit markets can be volatile, and the value of a carbon credit can vary over time and by place. Selling carbon credits also comes with expenses, including those related to verification and the opportunity cost of engaging in offsetting activities.

To avoid scams and reduce investment risk, it is important to do your research and be transparent with your investment partners. Look for companies that have been in business for a long time and have positive customer reviews. Ensure there is sufficient money in your account to cover potential losses, and consider the cost of carbon credits per tonne of carbon dioxide emissions reduction.

XRP Investors: How Many?

You may want to see also

Consider the timing, number of credits, price and level of engagement required for the transaction

When considering investing in carbon credits, there are several factors to take into account, including timing, the number of credits, price, and the level of engagement required.

Timing

The timing of your purchase will depend on your specific needs and goals. If you require carbon credits for offsetting purposes, you will need to calculate your carbon footprint in tonnes and then purchase the equivalent amount in carbon credits. It is important to note that the delivery of carbon credits can take time, especially when investing in projects early in their lifecycle. Therefore, if you need credits immediately, you may opt for purchasing from projects that have already been completed and have leftover credits available. However, the availability of credits may be limited in such cases.

Number of Credits

The number of carbon credits you need to acquire will depend on your carbon footprint and the extent to which you want to offset your emissions. Each carbon credit represents one tonne of carbon dioxide emissions. If your company emitted 1,000 tonnes of GHG in a year, you would need to buy 1,000 carbon credits to offset all of them.

Price

The price of carbon credits can vary widely and is influenced by factors such as project costs and carbon quality control or standards. Generally, the earlier you purchase in the credit lifecycle, the better the price and terms will be. However, there may be a greater delivery risk, and it could take longer to receive the credits. It is important to assess your budget and determine how much you are willing to invest in carbon credits.

Level of Engagement

The level of engagement required for the transaction depends on your preferences and the type of investment you choose. Some options, such as purchasing through a broker or retailer, may be more hands-off, while others, like buying directly from projects, can provide more control over the projects you support. It is essential to consider the level of involvement you want to have in the investment process and choose an option that aligns with your preferences.

Thorpe Mason's Investment Advisory: Navigating the Markets with Will Thorpe

You may want to see also

Decide whether to buy directly from projects, through a broker, retailer or exchange

There are several ways to buy carbon credits, each with its own advantages and disadvantages. Here are some things to consider when deciding whether to buy directly from projects, through a broker, retailer, or exchange:

Buying Directly from Projects

Buying directly from projects is the most hands-on approach and allows you to have more control over the projects you support. You will be providing funding to projects early on, helping them get off the ground quicker. These credits are often less expensive since you are joining the project early on, but they also carry an element of risk as there is a chance that the number of credits you purchase won't be delivered. This option requires patience, as you may have to wait years before receiving the credits. If you want to buy directly from a project but don't want to wait, you can seek out a completed project with leftover credits. However, the number of credits available may be lower than what you need.

Buying Through a Broker

Brokers can shop around for the credits you need on your behalf, making this one of the easier ways to purchase carbon credits. This option is ideal for companies that want a customised credit investment plan without doing all the work themselves. However, it will be more expensive than buying directly from projects as you will have to compensate the broker in addition to paying for the credits.

Buying from a Retailer

Carbon credit retailers offer a list of carbon credits that you can purchase and should be able to provide information about the origin of the credits and the projects they support. This option can be quick, and it is often preferred by those who need a small number of credits quickly.

Buying from an Exchange

Carbon exchange platforms allow people to buy, sell, and trade carbon credits. This option provides a single platform for all your carbon credit needs. It is also a quick and simple way to get carbon credits. However, some credits traded on exchanges do not have all the information needed to ensure they are validated, so there is some risk involved.

Retirement and Beyond: Exploring the Benefits of Investing Outside Your Nest Egg

You may want to see also

Look at carbon credit ETFs, carbon credit futures and individual companies that generate or trade carbon credits

Carbon Credit ETFs

An exchange-traded fund (ETF) is a pooled investment fund that tracks the performance of a certain group of underlying assets. There are carbon credit ETFs that track the performance of carbon markets. Some ETFs track a certain group of companies, while others track indices, futures contracts, or other asset groups.

Carbon Credit Futures

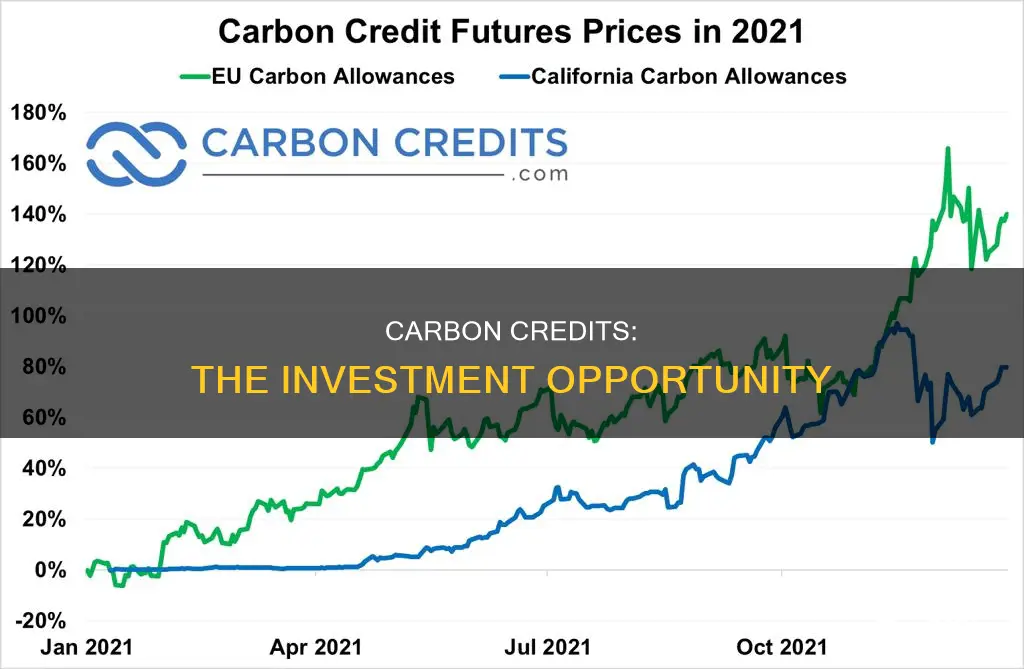

Another way to consider investing in carbon credits is through carbon credit futures contracts. Futures contracts are derivatives linked to underlying assets. A buyer and seller enter into an agreement to trade a particular asset for a certain price on a certain future date. With carbon credit futures, the underlying asset is the carbon credit certificate.

Carbon credits such as the European Union Allowances and the California Carbon Allowances have futures available on exchanges. However, carbon credit futures are complicated investments, so they are only recommended for more experienced investors.

Individual Companies

A third way for investors to get involved in carbon markets is by investing in stocks of individual companies that generate or actively trade carbon credits. By investing in those companies, investors can indirectly invest in carbon credits.

Other companies are investing significantly in decarbonization and decreasing their carbon footprint. These are sometimes referred to as green stocks.

Some companies have a business model focused on investing in carbon projects, so investing in those provides a targeted exposure to carbon credits.

Retiree Investments: Unveiling the Unknown Numbers

You may want to see also

Frequently asked questions

Carbon credits are the transaction instruments or commodities of carbon markets. Verified carbon credits are created when an entity removes or reduces carbon dioxide emissions. The amount of carbon removal is verified by a third party, and a carbon credit is issued—one tonne equals one credit.

There are several ways to buy carbon credits. You can buy them directly from projects, through a broker, from a retailer, or on an exchange.

Carbon credits should be verified by a major carbon standard, such as the Gold Standard, VERRA, or the American Carbon Registry.

As with any investment, there are risks involved in carbon credit investment. The market is relatively new and limited, and there is a risk of fraud or volatility. It's important to do your research and only invest what you can afford to lose.