Master Limited Partnerships (MLPs) are publicly traded limited partnerships that combine the tax benefits of private partnerships with the liquidity of publicly traded companies. They are considered low-risk, long-term investments that provide a slow but steady income stream. MLPs are typically found in the natural resources, energy, and real estate sectors.

MLPs have two types of partners: general partners, who manage the MLP and oversee its operations, and limited partners, who are investors in the MLP. Limited partners purchase shares in the MLP and provide capital in return for cash distributions.

MLPs are considered tax-advantaged investments as they are not subject to corporate taxation. Instead, tax liability is passed on to investors, who are known as unitholders. MLPs must meet certain criteria to maintain their tax-advantaged status, including earning at least 90% of their income from qualifying income in natural resources or real estate.

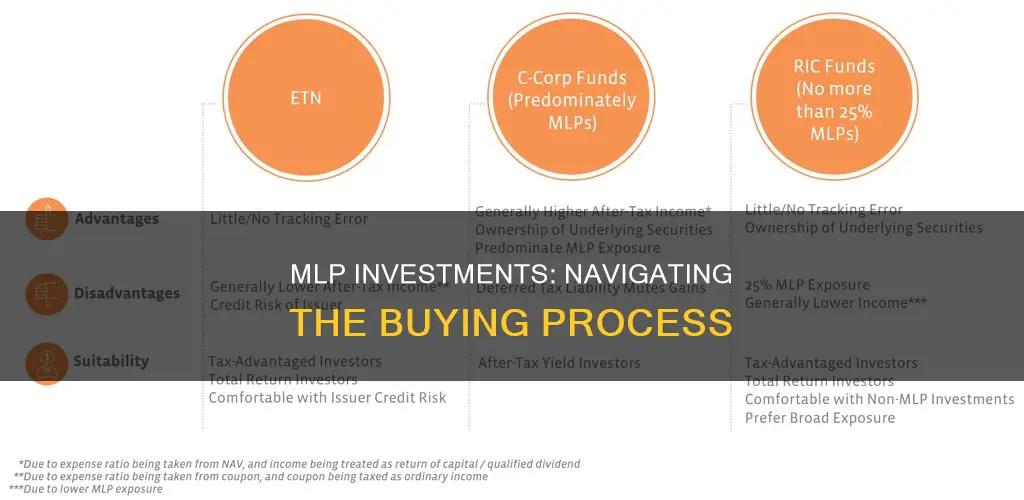

MLPs can be purchased through a brokerage account or via managed portfolio solutions.

| Characteristics | Values |

|---|---|

| Type of entity | Publicly traded limited partnership |

| Tax treatment | Pass-through entity |

| Tax advantages | No federal income tax, higher yields than bonds and stocks |

| Liquidity | Traded on national exchanges |

| Risk | Low-risk, long-term investment |

| Partners | General partners and limited partners |

| General partners | Manage day-to-day operations |

| Limited partners | Investors who purchase shares |

| Cash distributions | Significant percentage of income distributed to investors each quarter |

| Tax liabilities | Limited partners report their share of gains, income, losses, and deductions on personal tax returns |

| Filing requirements | Schedule K-1 form |

| Sectors | Real estate, natural resources, energy |

What You'll Learn

Understanding MLPs

Understanding Master Limited Partnerships (MLPs)

A master limited partnership (MLP) is a publicly traded limited partnership that combines the tax benefits of a private partnership with the liquidity of a publicly traded company. MLPs are considered low-risk, long-term investments that provide a slow but steady income stream. They are typically focused on the real estate or natural resources sector.

MLPs are a hybrid legal entity that combines elements of a partnership and a corporation. They are considered the aggregate of their partners, rather than a separate legal entity, and they have no employees – general partners are responsible for providing operational services and typically hold a 2% stake in the venture. MLPs issue units instead of shares, and these units are traded on national stock exchanges, making them a liquid security.

There are two types of partners in an MLP: general partners, who manage the MLP and oversee its operations, and limited partners, who are investors that provide capital in return for cash distributions. Limited partners receive periodic distributions, typically every quarter, and are also known as silent partners.

MLPs are treated as limited partnerships for tax purposes, which provides a significant tax advantage for investors. A limited partnership has a pass-through tax structure, where all profits and losses are passed through to the limited partners, who pay income taxes on their portions of the MLP's earnings. MLPs themselves do not pay corporate taxes. To maintain their pass-through status, MLPs must earn at least 90% of their income from qualifying sources, which includes income from the exploration, production, or transportation of natural resources or real estate.

MLPs offer several benefits, including high cash returns in the form of quarterly distribution payments, tax advantages through pass-through entities, and estate planning benefits. However, they also have some drawbacks, such as complex tax consequences, limited capital appreciation potential, and the risk of volatility in the energy and commodities markets.

QQQ Retirement Investing: A Guide to Navigating the Power of Tech

You may want to see also

MLP tax advantages

Master Limited Partnerships (MLPs) offer several tax advantages to investors. Firstly, they are considered pass-through entities, meaning that partnership income is only taxed at the level of the partner. Distributions from MLPs are not taxed when received, unlike stock dividends, which are taxed the year they are realised. Instead, these distributions are considered a reduction in the cost basis of the MLP investment. If an investor holds the MLP long enough for their cost basis to reach zero, distributions are then taxed as capital gains in the year of distribution. This delay in taxation results in MLPs being a tax-deferred investment.

Another advantage is that MLPs help investors avoid double taxation. Income from an MLP is not taxed at the corporate level, avoiding the common issue of dividends and capital gains being taxed for both the corporation and the investor.

MLPs also tend to generate higher yields than bonds and stocks due to their favourable tax structure. Since MLP tax liability is deferred, the longer an investor holds onto their MLP units, the more they can benefit from tax deferral. This makes MLPs an attractive option for estate planning, providing income for retirees while potentially reducing the tax burden for heirs.

It is important to note that MLPs may not be the best investment option for individual retirement accounts (IRAs) due to the tax-deferred nature of these accounts. The tax benefits of MLPs are largely wasted in such accounts, and there may be additional tax complications, such as Unrelated Business Taxable Income (UBTI). Therefore, financial advisors often recommend owning MLPs in taxable accounts to maximise their tax advantages.

Paying CKS Prime Investments: A Step-by-Step Guide

You may want to see also

MLP investment risks

Master Limited Partnerships (MLPs) are considered low-risk investments, but they do carry some risks that investors should be aware of. Here are some key risks associated with investing in MLPs:

- Interest rate risk: MLPs are sensitive to changes in interest rates due to their high distribution yields. Rising interest rates can make MLPs less attractive relative to traditional stocks, potentially impacting their demand and market price.

- Volatility risk: MLPs have historically experienced higher volatility than stocks and bonds. This means that the value of MLPs can fluctuate more widely, increasing the risk of losses for investors.

- Legislative and regulatory risk: MLPs face legislative risks, including changes to the tax code and Federal and State legislation affecting the oil and gas industry. Additionally, MLPs are highly regulated businesses, and any changes in regulations by governing bodies like the Federal Energy Regulatory Commission (FERC) can significantly impact their cash flows and distribution growth.

- Underperformance risk: MLPs have historically underperformed relative to common stock and other investment products. There is no guarantee that the tax advantages and higher yields of MLPs will translate to superior future returns.

- Dependence on capital markets: MLPs often depend on capital markets for cash distribution growth. Borrowing money or issuing new units to grow distributable cash flows can strain their balance sheets, especially during challenging economic conditions.

- High debt loads: Most MLPs carry substantial debt loads, and rising interest rates can increase their cost of capital. Additionally, a freeze in capital markets, similar to what happened in 2008, could result in significant volatility for MLPs.

- Commodity price risk: Despite the perception of safety provided by take-or-pay contracts, a prolonged slump in commodity prices can affect the ability of MLP customers to honour their contracts. This can lead to contract renegotiations or bankruptcies, impacting the cash flows of MLPs.

- Limited upside potential: MLPs have limited capital appreciation potential. Most of the returns for investors come from cash distributions rather than unit price appreciation.

- Tax complexity: MLPs offer tax advantages, but their tax treatment can be complex. Investors may need to deal with complicated tax filings, such as the Schedule K-1 form, and consult tax professionals to navigate the tax implications of investing in MLPs.

Mutual Funds: Why Invest?

You may want to see also

MLP investment strategies

Master Limited Partnerships (MLPs) are publicly listed limited partnerships that trade on national securities exchanges. They combine the tax benefits of a private partnership with the liquidity of a publicly traded company. MLPs are considered low-risk, long-term investments that provide a slow but steady income stream.

Understand the MLP Structure:

MLPs have two types of partners: general partners and limited partners. General partners manage the MLP's operations, while limited partners are the investors who purchase shares and provide capital. As an investor, it is important to understand the rights and responsibilities of each partner type.

Tax Advantages:

MLPs offer tax advantages due to their pass-through entity structure. They are not subject to corporate taxation, and investors receive tax-sheltered distributions. The income is passed through to the investors, who pay taxes at their individual tax rates. This avoids double taxation, and MLP distributions may be tax-deferred until the units are sold.

Focus on Qualifying Sectors:

MLPs primarily operate in specific sectors, including natural resources, energy, and real estate. To maintain their tax-advantaged status, they must derive at least 90% of their income from these sectors. When investing in MLPs, focus on those that meet the qualifying income requirements to ensure they can maintain their favourable tax status.

Diversification:

Consider diversifying your MLP investments across different sectors to reduce risk. Look for MLPs in real estate, infrastructure, and renewable energy, in addition to the traditional energy and natural resources sectors. Diversification can help smooth out the impact of market volatility and provide a more stable portfolio.

Long-Term Investment Strategy:

MLPs are generally considered low-risk, long-term investments. They offer stable and consistent cash distributions, making them ideal for investors seeking passive income. However, MLPs may have limited capital appreciation potential, so they are better suited for those seeking steady income rather than rapid growth.

Understand the Risks:

MLPs come with certain risks, including interest rate risk, volatility risk, and legislation risk. Rising interest rates can make MLPs less attractive compared to traditional stocks. MLPs have historically experienced higher volatility than stocks and bonds. Additionally, legislative changes related to the tax code and regulations in the oil and gas industry can impact the attractiveness of MLPs.

Remember, before investing in MLPs, it is important to do your own research and consult with a financial advisor to ensure these investments align with your financial goals and risk tolerance.

Rights Transfer: Investment Inheritance

You may want to see also

Examples of MLPs

Master Limited Partnerships (MLPs) are publicly listed limited partnerships that trade on national securities exchanges. They are typically focused on natural resource-related activities, such as oil, gas, coal, timber, and the transportation of commodities.

- Buckeye Partners: Involved in the gathering, processing, compression, transportation, and storage of oil and gas.

- DCP Midstream: Focuses on the gathering, processing, and compression of natural gas.

- Energy Transfer: A large-scale energy midstream company that operates a coast-to-coast asset base.

- Enterprise Products Partners: One of the largest publicly traded partnerships, operating a diversified and fully integrated energy midstream platform.

- Magellan Midstream Partners: Involved in the transportation and storage of oil and gas.

- NuStar Energy: Focuses on the gathering, processing, and transportation of oil and gas.

- Plains All American Pipeline: Specialises in the transportation and storage of oil and gas.

- TC PipeLines: Involved in the transportation of natural gas.

- TransMontaigne Partners: Focuses on the storage and transportation of oil and gas.

Other examples of companies that operate as MLPs include AllianceBernstein, Apollo Global Management, Brookfield Property Partners, and The Blackstone Group.

Millionaires' Mindset: Pay Off Debt or Invest?

You may want to see also