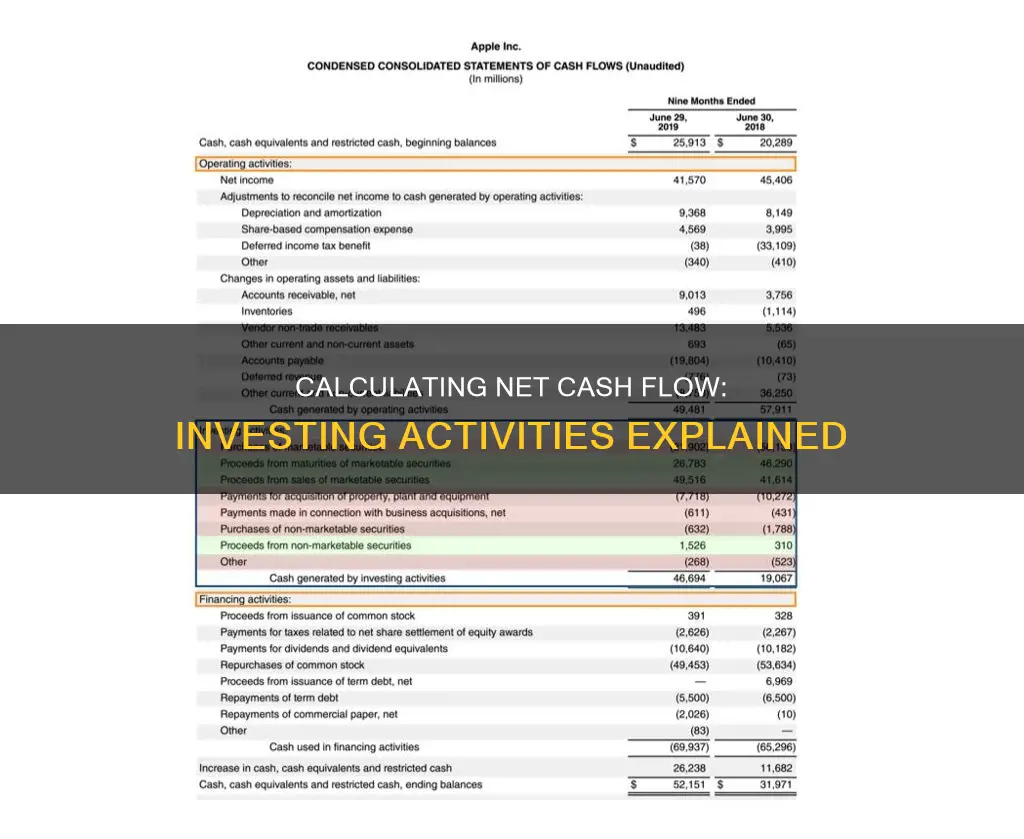

Net cash flow is a profitability metric that indicates a company's financial health and viability. It is the difference between the total cash inflows and outflows of a company over a specific period. Net cash flow can be calculated by adding up the net cash flow from operating activities, financial activities, and investing activities. Operating activities refer to the capital generated and used by a company's basic operations, financial activities refer to capital generated through debt agreements or cash issued to pay off debts, and investing activities refer to capital generated by profitable investments or cash issued to make an investment or purchase fixed assets.

Net cash flow is an important metric as it helps determine a company's performance and financial stability. It is also used to address the shortcomings of accrual-based net income, which can be misleading in measuring a company's actual cash flow.

What You'll Learn

Capital generated by profitable investments

Profitable investments can contribute significantly to positive cash flow from investing activities. These investments may include the purchase of physical assets, such as real estate, manufacturing plants, machinery, or other long-term assets. For example, a company may invest in new equipment or technology that improves efficiency, reduces costs, increases output, or enhances the quality of goods produced.

Additionally, companies may generate capital through investments in securities, such as stocks or bonds. These investments can provide returns in the form of dividends, interest, or capital gains. Profitable investment activities can also include the sale of securities or assets, resulting in capital gains that contribute to positive cash flow.

It is important to note that negative cash flow from investing activities is not always a negative indicator of a company's financial health. It may indicate that the company is investing in long-term growth strategies, such as research and development, which may lead to significant gains in the future.

Overall, capital generated by profitable investments is an essential aspect of a company's cash flow from investing activities and can provide valuable insights into the company's financial performance and growth prospects.

By assessing the cash inflows and outflows from these investment activities, stakeholders and analysts can evaluate the financial health and viability of a company, making informed decisions about its future prospects.

Investing Activities: Computing Cash Flows with GAAP

You may want to see also

Cash issued to make an investment

When a company issues cash to make an investment, it is recorded as a negative cash flow from investing activities. This is because the company is spending money on investments, which generates negative cash flow. However, it is important to note that negative cash flow from investing activities does not always indicate poor financial health. It is often a sign that the company is investing in assets, research, or other long-term development activities that are crucial for the company's health and continued operations.

A company's cash flow from investing activities is one of the sections of its cash flow statement. This statement shows how much cash has been generated or spent on investment-related activities during a specific period. The cash flow statement is one of the three main financial statements used by businesses, the other two being the balance sheet and the income statement. The cash flow statement bridges the gap between the income statement and the balance sheet by detailing how much cash is generated or spent on operating, investing, and financing activities.

Investing activities include the purchase of physical assets, investments in securities, or the sale of securities or assets. These investments can be made to generate income or as long-term investments in the company's health and performance. For example, a company may invest in fixed assets such as property, plant, and equipment to expand its business. While this may result in a negative cash flow from investing activities in the short term, it has the potential to generate positive cash flow in the long term.

To calculate the net cash flow from investing activities, the following formula can be used:

Net Cash Flow = Operating Cash Flow + Cash Flow from Financial Activities (Net) + Cash Flow from Investing Activities (Net)

Alternatively, the net cash flow from investing activities can be calculated by summing up all the positive and negative investing activities listed on the cash flow statement. This includes both the purchases and sales of investments.

Cash or Invest: Where Should Your Money Go?

You may want to see also

Cash used to buy fixed assets

Fixed assets are physical or tangible assets that a company owns and uses in its business operations to generate income. They are also known as property, plant, and equipment (PP&E) and are listed in the noncurrent asset section of a company's balance sheet. Fixed assets include buildings, computer equipment, software, furniture, land, machinery, and vehicles. These assets are not expected to be sold or used within a year and are subject to depreciation, which is the practice of accounting for an asset's decrease in value over time.

When a company purchases fixed assets, it represents a cash outflow, while the sale of fixed assets is a cash inflow. The acquisition or disposal of fixed assets is recorded on a company's cash flow statement under the cash flow from investing activities. This is an important aspect of a company's cash flow statement as it indicates how the company is investing in its long-term health.

The purchase of fixed assets is a capital expenditure, which is a popular measure of capital investment used in the valuation of stocks. An increase in capital expenditures means the company is investing in future operations, but it also represents a reduction in cash flow. Companies with significant capital expenditures are typically in a state of growth.

When calculating net cash flow, the purchase of fixed assets is considered a negative cash flow from investing activities. This means that money has been spent on long-term assets that will deliver value in the future. Despite being a negative cash flow, this does not necessarily indicate poor financial health. Instead, it shows that the company is investing in assets that are important to its long-term operations and health.

To calculate the net cash flow from investing activities, the cash outflow from the purchase of fixed assets is subtracted from the cash inflow from the sale of fixed assets. This value is then added to the cash inflows and outflows from the other investing activities to determine the total net cash flow from investing activities.

Investments and Cash Equivalents: What's the Real Difference?

You may want to see also

Capital generated through debt agreements

When it comes to generating capital for investment activities, companies have a few options, one of which is debt financing. This is when a company raises money by selling debt instruments to investors, such as bonds, bills, or notes. The company receives the capital needed for its operations, and the investors become creditors, receiving the promise of repayment with interest.

Debt financing is often used by small and new companies to buy resources that facilitate growth. It allows businesses to leverage a small amount of money to enable more rapid growth and retain ownership and control. It can also be more cost-effective than equity financing, as debt is often less expensive and, once repaid, the relationship with the lender ends.

However, there are some disadvantages to debt financing. Interest must be paid to lenders, and these payments must be made regardless of business revenue. This can be particularly risky for smaller businesses with inconsistent cash flow. High levels of debt can also negatively impact a company's balance sheet, making it appear riskier to investors and leading to higher borrowing costs.

There are various types of debt financing, including:

- Term loans: Borrowing a lump sum that must be repaid over a predetermined period, often with regular monthly payments that include principal and interest.

- Lines of credit: A flexible loan that provides access to a specific amount of capital that can be drawn upon as needed, with interest paid only on the funds used.

- Revolving credit facilities: Similar to lines of credit but larger, and the business can draw from and repay the capital multiple times.

- Equipment financing: Borrowing funds to purchase critical equipment, with the equipment itself serving as collateral.

- Merchant cash advances: A lump sum payment in exchange for a percentage of future credit card sales.

- Trade credit: A form of short-term financing where a company can buy something and pay for it at a later date.

- Convertible debt: A hybrid form where loans can be converted into equity shares at a later date.

When calculating net cash flow, debt financing would fall under the category of "cash flow from financing activities". The formula for this is:

Financing Cash Flow = Cash Inflows from Issuing Equity or Debt - (Dividends Paid + Repurchase of Debt and Equity)

This can be found on a cash flow statement.

Capital Investment Project: Cash Flows Strategy

You may want to see also

Cash used to pay off debts

When it comes to paying off debts, it's important to consider the interest rates on those debts. Credit card debt, for instance, tends to have very high interest rates, and it's generally a good idea to pay off these debts as soon as possible.

One strategy for paying off debts is to employ the "debt avalanche" method. This involves making minimum payments to all creditors and focusing on paying off the debt with the highest interest rate first. Once that debt is cleared, you move on to the debt with the next-highest interest rate, and so on. This approach saves you money on interest payments in the long run. However, it requires patience, especially if the high-interest debt is also one of your largest debts.

Another strategy is the "debt snowball" method. This involves making minimum payments to all creditors while focusing on clearing the debt with the smallest balance first. Once that balance is paid off, you move on to the next smallest balance. The benefit of this approach is that it gives you quick wins, which can be motivating. However, it can also be costlier, as you continue to accrue interest on your higher-balance debts.

If you're struggling with debt, it's a good idea to create a budget to help you manage your finances and identify areas where you can cut down on spending. You could also consider taking on a part-time job to increase your income and pay off your debts faster.

If you have multiple debts with varying interest rates, debt consolidation may be an option. This involves taking out a new loan to pay off all your existing debts, leaving you with a single payment to make each month. This can be helpful if you're struggling to manage multiple payments, but it's important to ensure that the interest rate on the new loan is lower than your existing debts.

Finally, remember that you don't have to accept the terms of your lender. It's possible to negotiate with creditors to access lower interest rates or create payment plans that work for your budget.

Journaling a Large Cash Investment: A Step-by-Step Guide

You may want to see also