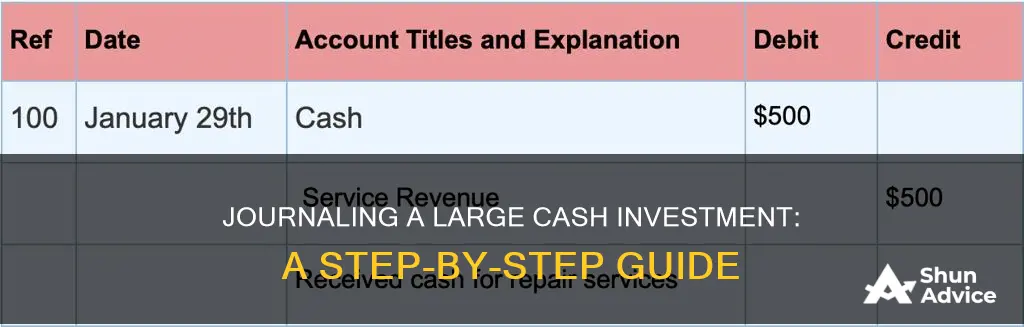

Journal entries are a crucial aspect of accounting, serving as the first place where information is entered into a business's accounting system. When an owner or partner invests cash or other assets into a business, it is recorded as capital, with the capital account credited and the cash or assets brought in debited. This process involves making journal entries that detail the date, debit and credit accounts, amounts, and a short description. These entries are then transferred to T-accounts, which represent each account in the general ledger. The general ledger provides a comprehensive record of each account and its balance, making it easier to extract account and balance information.

| Characteristics | Values | |

|---|---|---|

| Type of Investment | Journal Entry | $20,000 credited to the Capital Account |

| Date of Transaction | Journal Entry | 3rd January 2019 |

| Type of Account | Journal Entry | Debit the cash or assets brought in |

| Credit the Capital Account |

Retirement savings

Step 1: Prioritize Retirement Accounts

Maxing out your retirement accounts is a crucial first step. This includes contributing to your 401(k) and individual retirement account (IRA). The annual contribution limits for these accounts vary by year, so be sure to stay updated. For example, in 2024, the 401(k) limit is $23,000, and the IRA limit is $7,000 for those under 50. If you're 50 or older, you can take advantage of catch-up contributions, allowing you to contribute up to $30,500 in your 401(k) and $8,000 in your IRA.

Step 2: Understand Your Workplace Benefits

If your employer offers retirement benefits, such as matching contributions, be sure to take full advantage of them. Contribute at least enough to earn the full match offered by your employer. This is essentially free money that can boost your retirement savings significantly over time.

Step 3: Evaluate Your Risk Tolerance

Before investing, it's important to understand your risk tolerance. If you're planning to invest for the long term, you may be able to take on more risk, as you have time to recover from any market downturns. However, if you're unsure when you'll need the money, consider lower-risk options like high-yield savings accounts or government bonds.

Step 4: Diversify Your Investments

Diversification is a key aspect of investing. While you may be eager to invest in various options, it's important to spread your $20,000 across multiple avenues to minimize risk. Consider a mix of low-risk and higher-risk investments to balance your portfolio.

Step 5: Take Advantage of Tax Benefits

Investing in retirement accounts often comes with tax benefits. Contributions to traditional IRAs may be tax-deductible, while Roth IRAs offer tax breaks when you make withdrawals in retirement. Additionally, any funds you invest in retirement accounts should be left untouched until retirement age to maximize their growth potential.

Step 6: Stay Informed and Seek Advice

Stay informed about market trends and investment options. Research different types of investments, such as stocks, mutual funds, exchange-traded funds (ETFs), and more. If you're unsure where to start, consider seeking advice from a financial consultant or advisor who can provide personalized guidance based on your goals and risk tolerance.

By following these steps, you can effectively journal a $20,000 cash investment for retirement savings. Remember to stay disciplined and consistent in your contributions, and you'll be well on your way to a comfortable retirement.

Understanding Proceeds From Equipment Sales: Cash From Investing?

You may want to see also

Robo-advisors

Wealthfront

Wealthfront is a popular robo-advisor service that offers a range of features, including fee-free stock investing, low-interest rate borrowing, and daily tax-loss harvesting. It has a low required minimum investment of $500 and provides users with tailored investment portfolios spanning 17 asset classes. It also offers a high-yield cash account and debit card through partner banks.

Betterment

Betterment is a robo-advisor platform that is ideal for beginners. It has a $0 account minimum, with a $10 minimum to start investing. It offers a range of portfolio choices, including smart beta, three socially responsible investing options, and crypto portfolios. Betterment also provides access to financial advisors for accounts with a balance of over $100,000.

SoFi Automated Investing

SoFi Automated Investing offers fee-free investment management and access to financial advisors at no additional cost. It has a very low minimum investment requirement of just $1. However, it does not offer tax-loss harvesting, and there are no portfolio customization options available.

Vanguard Digital Advisor

Vanguard Digital Advisor is a good option for those seeking a simple, user-friendly tool. It has a low annual net advisory fee of no more than 0.20% and offers access to Vanguard's range of low-cost ETFs. It provides robust retirement planning tools and a personalised risk assessment to determine the best asset allocation for your needs.

CDs: Cash or Investment?

You may want to see also

Brokerage accounts

With a cash account, you must pay for securities using the cash available in your account, and the purchase must be made in full. For example, if you want to buy $1,000 worth of stock, you must have that amount in cash in your account before the buy order settles, usually the day after placing the order.

On the other hand, a margin account allows you to borrow money from the brokerage firm to buy securities. This is the only type of account that enables investors to engage in short selling. In a margin account, you deposit a portion of the security's purchase price and borrow the rest from the firm. It's important to note that investing on margin comes with notable risks, so it's crucial to understand the specifics of margin accounts before proceeding.

When opening a brokerage account, the firm will ask for personal information, including your age, employment status, financial situation, investment experience, objectives, and tolerance for risk. They will also require your Social Security or tax identification number for reporting purposes and identity verification.

Additionally, brokerage firms typically offer cash management programs for uninvested cash in your account. These programs ensure that your uninvested cash is readily available when you need it, whether for investing or other purposes like paying bills. Some programs even provide a debit card or check-writing capabilities.

It's worth noting that uninvested cash left in your brokerage account is known as a "free credit balance," and firms may or may not pay interest on this balance. You have the option to move this uninvested cash to seek higher interest rates, even if you're enrolled in your firm's default cash management program.

When it comes to managing your uninvested cash, you have several options. You can leave it in your brokerage account, "sweep" it to a bank deposit account through a bank sweep program, or transfer it to a money market mutual fund as part of a money market sweep program. It's important to research the available alternatives and their associated interest rates to make an informed decision.

Furthermore, brokerage accounts offer flexibility regarding contribution limits and how you utilise your funds. However, unlike retirement accounts, brokerage accounts do not provide tax benefits. Profits from selling investments within a brokerage account are subject to capital gains taxes, which is why they are often referred to as "taxable accounts."

Lastly, it's worth mentioning that brokerage accounts can be opened quickly online, and many firms do not require an upfront deposit. Nonetheless, you will need to fund the account before making any investments.

Is Buying Furniture an Investment or Cash Flow Expense?

You may want to see also

Stocks

Investing a lump sum of $20,000 in stocks is a great way to generate wealth over the long term. Here are some options to consider:

Individual Stocks

Investing in individual stocks gives you control over your investment portfolio, allowing you to align your investments with your values, goals, and desired performance. It is easier than ever to purchase individual shares of a company. However, investing in individual stocks increases your exposure to the performance of specific companies, so it is essential to diversify your stock holdings by investing in at at least 10 to 15 different stocks. With $20,000 to invest, you can allocate approximately $1,500 to $2,000 per company.

The key to investing in individual stocks is to buy and hold them for the long term. The prices of individual stocks can be volatile, so focus on the business fundamentals and your original reasons for purchasing the stock, rather than getting caught up in short-term price fluctuations.

Stock Exchange-Traded Funds (ETFs)

Stock ETFs, like the SPDR S&P 500 ETF, offer a simple and diversified way to invest in the broad market. ETFs own a basket of stocks aimed at tracking a particular market index, such as the S&P 500. The SPDR S&P 500 ETF Trust is the largest ETF in existence, with over $500 billion in assets under management as of August 2024.

One advantage of investing in ETFs is their "set-it-and-forget-it" nature. You don't need to choose individual stocks or make buying and selling decisions; you can simply buy and hold the ETF investment for the long term.

Retirement Accounts

Investing in retirement accounts like a 401(k) or an Individual Retirement Account (IRA) is a great option, especially if you haven't invested much yet. These accounts offer tax advantages as an incentive, allowing you to keep more of your money. Some employers will match your contributions to a certain extent, so it is generally a good idea to invest at least up to the matching amount. IRAs tend to give you more control over your investments, while 401(k)s may have more restrictions.

Brokerage Accounts

Brokerage accounts are investment accounts opened with a broker, such as an online broker, and they offer even more freedom than IRAs as they have no early withdrawal penalties. However, brokerage accounts lack the tax advantages of retirement accounts, so they are generally best suited for investing money you plan to use before reaching retirement age. With a brokerage account, you can withdraw money slowly as your investments grow, providing you with passive income.

Dividend Stocks

If you are looking for passive income, dividend stocks are worth considering. Dividend stocks often pay quarterly, with yields typically ranging from 2% to 5%. These stocks tend to be from well-known, financially stable companies, so the risk is relatively low compared to other stocks. However, when interest rates are high, you may find similar or better rates with a high-yield savings account.

In summary, investing $20,000 in stocks and other financial instruments can be a great way to build wealth over time. Remember to consider your financial goals, investment timeline, and risk tolerance when deciding how to allocate your funds. Diversification is key to managing risk and maximizing returns.

Understanding the Relationship Between Cash and Investments

You may want to see also

High-yield savings accounts

The best high-yield savings accounts have annual percentage yields, or APYs, that are about 10 times higher than the national average rate of 0.45%. Many of the rates in this list top 4%. High-yield savings accounts are ideal places to park your money when you want your savings to grow.

- Barclays Tiered Savings Account: 4.50% APY for $0 to <$250k; 4.80% APY for $250k+ balance. No minimum balance for APY.

- SoFi Checking and Savings: 4.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. No minimum balance requirement.

- CIT Bank Platinum Savings: 4.55% APY on balances of $5,000 or more. $100 minimum opening deposit.

- American Express® High Yield Savings Account: 4.00% APY. $0 minimum balance for APY.

- Forbright Bank Growth Savings: 5.00% APY. $0 minimum balance for APY.

- Capital One 360 Performance Savings™: 4.00% APY. $0 minimum balance for APY.

- UFB Portfolio Savings: 4.31% APY. $0 minimum balance for APY.

- EverBank Performance℠ Savings: 4.75% APY. $0 minimum balance for APY.

When choosing a high-yield savings account, it's important to look beyond just the advertised rate. Consider how you plan to use the account, your banking preferences, and how much you plan to keep in savings. It's also crucial to pick an account that meets your overall banking needs, such as having both checking and high-yield savings accounts at the same bank.

Some key benefits of high-yield savings accounts include:

- Earning higher rates than other savings accounts.

- Federal deposit insurance (up to $250,000 per depositor) through the FDIC or NCUA.

- The ability to open an account online without leaving your home.

However, there are also some drawbacks to consider:

- High-yield savings accounts sometimes require a higher minimum opening balance compared to regular savings accounts.

- Online-only accounts may not offer face-to-face customer service.

Securities Trading: Part of Investing Cash Flow?

You may want to see also

Frequently asked questions

The amount invested in the business in cash or kind by the proprietor or owner of the business is called capital. The capital account will be credited and the cash or assets brought in will be debited.

Partners (or owners) can invest cash or other assets in their business. They can even transfer a note or mortgage to the business if one is associated with an asset the owner is giving the business. Assets contributed to the business are recorded at the fair market value. Anytime a partner invests in the business, the partner receives capital or ownership in the partnership.

Once net income is calculated from the income statement (revenues – expenses), net income or loss is allocated or divided between the partners and closed to their individual capital accounts. The partners should agree upon an allocation method when they form the partnership. The partners can divide income or loss anyway they want but the 3 most common ways are: 1) Agreed upon percentages: Each partner receives a previously agreed upon percentage. 2) Percentage of capital: Each partner receives a percentage of capital calculated as Partner Capital / Total capital for all partners. 3) Salaries, Interest, Agreed upon percent: Since owners are not employees and typically do not get paychecks, they should still be compensated for work they do for the business.