Mendez Company, McCann Co., and Seaborn Co. have all identified investment projects with expected cash flows. Mendez Company's investment project is expected to yield cash flows of $1,090, $940, $1,490, and $1,850 over four years. Similarly, McCann Co. anticipates cash flows of $760, $1,010, $1,270, and $1,375 over the same period. Meanwhile, Seaborn Co.'s investment project cash flows are undisclosed, but the company is interested in determining the present value of these cash flows at discount rates of 10%, 18%, and 24%.

| Characteristics | Values |

|---|---|

| Company Name | McCann Co. |

| Year 1 Cash Flow | $760 |

| Year 2 Cash Flow | $1,010 |

| Year 3 Cash Flow | $1,270 |

| Year 4 Cash Flow | $1,375 |

| Company Name | Mendez Company |

| Year 1 Cash Flow | $1,090 |

| Year 2 Cash Flow | $940 |

| Year 3 Cash Flow | $1,490 |

| Year 4 Cash Flow | $1,850 |

What You'll Learn

Calculating present value

Present value (PV) is a fundamental concept in corporate finance and valuation. It is the current value of a future sum of money or stream of cash flows. In other words, it calculates how much a future cash flow is worth today.

The core principle behind the concept of present value is the time value of money (TVM), which states that a dollar today is worth more than a dollar received in the future. This is because, if you have the money today, you could invest it and earn a return. Therefore, receiving cash today is more valuable (and thus preferable) than receiving the same amount at some point in the future.

The present value of a future sum of money can be calculated using the following formula:

Present Value Formula

Present Value = Future Value / (1 + Discount Rate) ^ Number of Periods

Where:

- Future Value is the projected cash flow expected to be received in the future.

- Discount Rate is the expected rate of return (interest) and is a function of the riskiness of the cash flow.

- Number of Periods is the duration between the date the cash flow occurs and the present date, equal to the number of years multiplied by the compounding frequency.

For example, let's say you loaned a friend $10,000 and they promised to repay the full amount in five years. How much is that $10,000 worth on the date of the initial loan? Assuming a discount rate of 5%, the calculation would be:

Present Value = $10,000 / (1 + 5%)^5 = $7,835

So, the $10,000 your friend repays in five years is only worth $7,835 today, assuming a 5% discount rate.

Calculating the present value of a stream of future cash flows involves repeating the formula for each cash flow and then totalling them. This can be done using software or an online calculator.

The discount rate used in present value calculations is a critical assumption. It represents the opportunity cost of capital, or the rate of return you could earn by investing today's dollars for a period of time. A higher discount rate will result in a lower present value, and vice versa.

Net Present Value (NPV)

Net present value (NPV) is a related concept that is used to evaluate the profitability of a project or investment. It is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. The formula for NPV is as follows:

NPV = Sum of (Cash Flow / (1 + Discount Rate) ^ Number of Periods) - Initial Investment

NPV calculations are commonly used in capital budgeting and investment planning to determine if a project is worth undertaking. Generally, projects with a positive NPV are considered worthwhile, while those with a negative NPV are not.

Temporary Investments: Are They Really Cash?

You may want to see also

Discount rates

The discount rate reflects the opportunity cost of capital and the level of risk associated with a project. It is usually derived from the company's cost of capital, which includes both the cost of debt and equity. A higher discount rate implies that investors require a higher return due to increased risk or opportunity costs.

For instance, let's consider an example of an investment project with the following cash flows:

| Year | Cash Flow |

| --- | --- |

| 1 | $760 |

| 2 | $1,010 |

| 3 | $1,270 |

| 4 | $1,375 |

If we apply a discount rate of 11%, the present value of these cash flows is $3,338.79. However, as the discount rate increases to 18%, the present value decreases to $2,851.60. And at an even higher discount rate of 24%, the present value further decreases to $2,517.46.

This example illustrates how the choice of discount rate can significantly impact the evaluation of an investment project. A higher discount rate makes future cash flows less valuable in present value terms, potentially making the project less attractive.

It is important to note that the selection of an appropriate discount rate is critical. A rate that is too low may lead to an overly optimistic view of the project, while a rate that is too high may undervalue the project. Companies often use a weighted average cost of capital (WACC) as a starting point for their discount rate, and then adjust it based on the specific risks and characteristics of the project.

Free Cash Flow: Investment Costs and Their Inclusion

You may want to see also

Future value

The formula used to calculate the future value is:

Where:

- PV = Present value (initial investment amount)

- R = Interest rate per period

- N = Number of compounding periods

For example, if you invest $100 at an interest rate of 10% with a compounding frequency of 1 (annual compounding), the investment should be worth $110 at the end of one year.

It is important to note that future value calculations rely on certain assumptions, and these assumptions may not always hold true. Market volatility and uncertainty can affect future profits. Therefore, it is important to regularly review and adjust assumptions to fit the market's twists and an individual's changing financial plan.

Schwab's Cash Investment Options: What You Need to Know

You may want to see also

Capital expenditures

When analysing cash flow, it is important to consider the operations/net sales ratio, free cash flow, and comprehensive free cash flow coverage. The operations/net sales ratio indicates how many dollars of cash are generated for every dollar of sales. Free cash flow is an important metric as it shows how efficiently a company generates cash. It is calculated by taking cash flow from operations and subtracting capital expenditures, and potentially other cash outflows such as dividends. A comprehensive free cash flow ratio can be calculated by dividing free cash flow by net operating cash flow, with a higher percentage indicating more efficient generation of free cash.

Overall, capital expenditures are an important aspect of a company's financial management and growth strategy. They represent a company's investment in future operations, but also result in a reduction of cash flow. By analysing cash flow statements, investors can gain insights into a company's financial stability, health, and potential for growth.

Cash is Not King: Exploring Investment Alternatives

You may want to see also

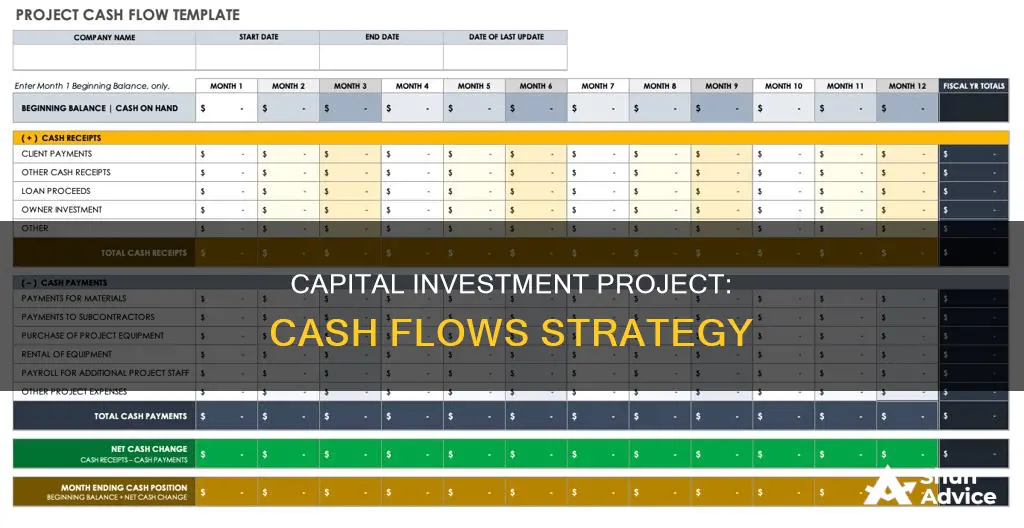

Cash flow statements

A cash flow statement is a crucial financial statement for a business, alongside the balance sheet and income statement. It provides an overview of the cash generated or spent on operating, investing, and financing activities over a specific period.

Cash Flow from Operating Activities

This section of the cash flow statement details the cash generated or spent on the company's day-to-day business operations. It includes cash received from sales, salary and wages paid, and payments to suppliers.

Cash Flow from Investing Activities

This section reports the cash flow from the purchase and sale of long-term investments and assets, such as fixed assets, securities, or physical assets like vehicles, furniture, buildings, or land. It also includes capital expenditures and business acquisitions.

Cash Flow from Financing Activities

The final section of the cash flow statement covers debt and equity transactions. It includes cash flows related to dividends, the repurchase or sale of stocks and bonds, and cash received from loans or used to pay down long-term debt.

Example Calculation

Let's take the example of Mendez Company, which has identified an investment project with the following cash flows over four years:

Year 1: $1,090

Year 2: $940

Year 3: $1,490

Year 4: $1,850

If we want to calculate the present value of these cash flows at a discount rate of 12%, we can use the formula:

> PV = CF / (1 + r)^n

Where PV is the present value, CF is the cash flow, r is the discount rate, and n is the number of years.

Plugging in the values, we get:

PV for Year 1 = $1,090 / (1 + 0.12)^1 = $973.21

PV for Year 2 = $940 / (1 + 0.12)^2 = $762.79

PV for Year 3 = $1,490 / (1 + 0.12)^3 = $1,070.03

PV for Year 4 = $1,850 / (1 + 0.12)^4 = $1,253.96

The total present value of these cash flows at a 12% discount rate is $4,059.99.

CDs: Cash or Investment?

You may want to see also

Frequently asked questions

To calculate the present value of these cash flows, we use the formula: PV = CF / (1 + r)^n. The present value at a discount rate of 12% is $5,866.15.

Using the same formula, the present value at a discount rate of 15% is $5,302.63.

The present value at a discount rate of 21% is $4,410.29.

To calculate the future value of these cash flows, we use the formula: FV = PV(1 + r)^t. The future value in Year 4 at a discount rate of 9% is $6,161.04.