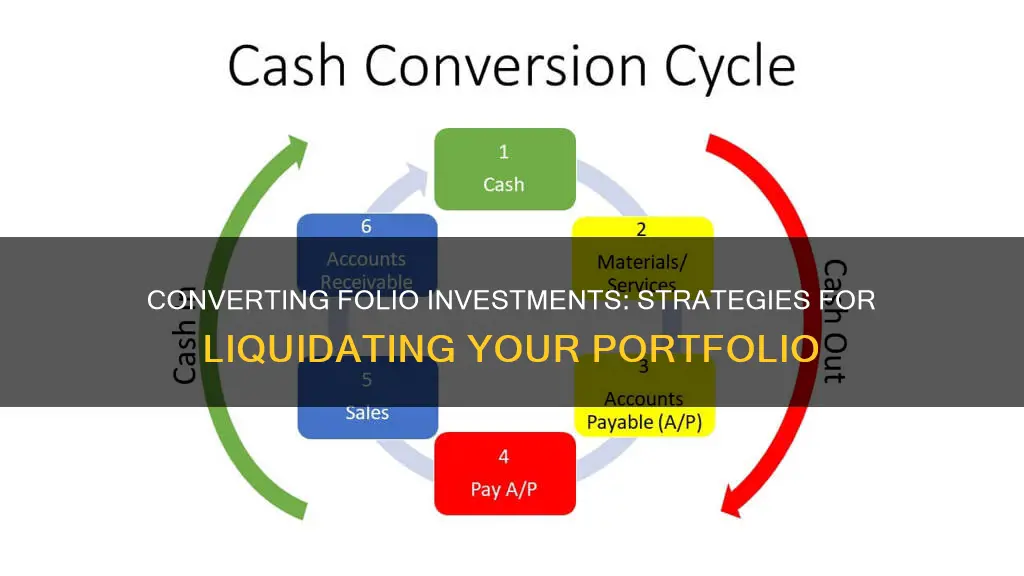

There are several ways to convert Folio Investing into cash. You can withdraw funds from your Folio Investing account via electronic funds transfer (EFT), check, or by transferring money between your accounts. To withdraw funds, open your Accounts page, select 'Transfer Money' from the dropdown menu, and then open the Withdrawal tab. From there, choose a withdrawal type and follow the instructions. It's important to note that there are maximum limits on withdrawals, and the availability of funds for withdrawal depends on factors such as the type of deposit and the settlement timing of securities sold.

What You'll Learn

Transfer money between folios within the same account

To transfer money between folios within the same account, you will need to follow these steps:

- Open your Accounts page: Log in to your Folio Investing account and navigate to your Accounts page. This is where you will manage your funds and perform transfers.

- Select "Transfer within Account": From the Accounts page, locate the option to transfer money within the same account. This is typically found under a dropdown menu or an "Actions" menu. Select this option to initiate the transfer process.

- Follow the instructions: After selecting "Transfer within Account," you will be guided through a series of instructions to complete the transfer. Follow these instructions carefully, as they will vary depending on the specific type of account you hold and the amount you wish to transfer.

- Understand transfer rules and restrictions: It is important to note that there may be certain rules and restrictions regarding transfers between folios within the same account. These rules can vary depending on the type of accounts involved (individual, joint, IRA, etc.) and the ownership structure. Be sure to review the transfer rules provided by Folio Investing to ensure your transfer can be completed successfully.

- Consider transfer timing: Keep in mind that the timing of your transfer can impact fund availability for trading or withdrawal. Generally, funds from sales of securities that settle two days after trading (T+2) will be available for withdrawal two trading days after the sale date. For securities that settle one day after trading (T+1), the funds will typically be available for withdrawal on the trading day after the sale date.

- Seek assistance if needed: If you encounter any issues or have questions during the transfer process, don't hesitate to contact Folio Investing's customer service representatives. They can guide you through the process and ensure your transfer is completed smoothly.

By following these steps, you can effectively transfer money between folios within the same account on the Folio Investing platform. Remember to review the transfer rules and consider any timing constraints to ensure a seamless transfer experience.

Invest Cash Safely: Strategies for Secure Financial Growth

You may want to see also

Withdraw funds via EFT, check, or internal transfer

To withdraw funds from your Folio Investing account, you can use electronic funds transfer (EFT), check, or internal transfer. Here's a detailed guide on how to do it:

Withdrawing Funds via Electronic Funds Transfer (EFT):

- Go to the Folio Investing website and log in to your account.

- Navigate to your Accounts page.

- Locate and select the "Transfer Money" option from the dropdown menu.

- Choose the "Withdrawal" tab and select "EFT" as your withdrawal type.

- Follow the instructions provided to complete the EFT withdrawal.

- Note that EFT withdrawals initiated on the Folio Investing website will typically take 1-2 business days to complete.

Withdrawing Funds via Check:

- Access your Accounts page on the Folio Investing website.

- Select "Transfer Money" from the dropdown menu.

- Open the "Withdrawal" tab and choose "Check" as your preferred withdrawal method.

- Follow the provided instructions to request a check withdrawal.

- Check withdrawals are usually delivered within 1-5 business days, depending on the delivery option you choose.

Withdrawing Funds via Internal Transfer:

- Go to your Accounts page.

- Select "Transfer within Account" from the dropdown menu.

- Follow the instructions provided to transfer funds between your folios or sub-accounts within the same Folio Investing account.

- Note that internal transfers are subject to the availability of funds in the source account.

It's important to remember that withdrawal options may vary based on account type, restrictions, and permission levels. Ensure that you have the necessary permissions to initiate withdrawals. Additionally, there may be withdrawal limitations for certain account types, such as IRAs. Always refer to the Funds Availability Policy and any applicable fees before making a withdrawal.

Investments, Cash Flows, and the Impact of Gains

You may want to see also

Deposit funds via EFT, direct deposit, or payroll deduction

To deposit funds via EFT, direct deposit, or payroll deduction, you will need to open your Accounts page and select 'Transfer Money' from the dropdown menu. From there, open the Deposit tab and select 'EFT, direct deposit, or payroll deduction' as your deposit type. Then, follow the instructions provided.

There is no maximum limit on deposits by EFT, direct deposit, or payroll deduction. However, it is important to note that there is a 5-business-day waiting period after depositing funds before you can withdraw them.

If you are depositing funds into an IRA account, you will need to include your account number and the year of the IRA contribution.

If you are depositing funds into a client's account, you will need to open the client's Accounts page and select 'Transfer Money' from the Actions dropdown menu next to 'Cash Available'. Then, select the method of deposit and follow the instructions provided.

If you are setting up an EFT bank link, you will need the bank's routing and account numbers. After setting it up, you must verify the bank link before it can be used to schedule transfers.

Investing Cash: Strategies for Smart Money Allocation

You may want to see also

Transfer securities from another brokerage

To transfer securities from another brokerage, you must first ensure that you have an account with Folio Investing. If you do, you can make an online account transfer. If you don't, you must open the same account type as the one you are transferring. For example, if you are transferring a Roth IRA from another brokerage, you must open a Roth IRA account with Folio Investing.

To make a securities transfer, go to your Accounts page and select "Transfer Securities" from the dropdown menu. Then, follow the instructions provided.

You have two options for transferring your securities:

- Select the specific securities and/or cash amount that you want to transfer.

- Ask the brokerage currently holding your assets to sell specific assets and then transfer the proceeds to Folio Investing as cash.

For a partial transfer, go to your Accounts page, select "Transfer Securities" from the dropdown menu, and follow the detailed instructions given. You will be asked if you wish to transfer your entire account or just a portion of it.

If you need assistance, you can contact Folio Investing, and a customer service representative will guide you through the process.

Please note that generally, transfers can only be done between the same account types and account owners (e.g., Roth IRA to Roth IRA). If you need more information about transferring between specific account types, Folio Investing provides detailed instructions on their website.

Uncertain Future Cash Flows: Navigating Investment Project Analysis

You may want to see also

Transfer money between joint and individual accounts

To convert your Folio Investments into cash, you can withdraw funds from your account via electronic funds transfer (EFT), wire transfer, or check. The maximum amount that can be withdrawn from an account via EFT initiated with Folio is $100,000 over a 30-day period, while wire transfers are limited to $25,000 over the same period. Withdrawals by check or EFT initiated at your financial institution may be for any amount up to the available cash in your account.

Now, regarding transferring money between joint and individual accounts, here is some detailed information:

Transferring Money Between Joint and Individual Accounts:

Folio Investing allows online money transfers between accounts that meet certain criteria. Specifically, the accounts must have been opened by the same person and share the same social security or tax identification number. This applies to transfers between individual accounts, joint accounts, and transfers between joint and individual accounts.

In the case of joint and individual accounts, you can transfer money from an individual account to a joint account if they have the same social security or tax identification number. However, you cannot transfer money from the joint account to the individual account online. If you need to make such a transfer, you will need to contact Folio Investing to inquire about alternative methods.

It is important to note that the ability to transfer funds between accounts may be influenced by factors such as the type of assets (e.g., stocks, cash), the relationship between account owners (spouses, non-spouses), and tax considerations, including gift tax rules and annual exclusions.

Additionally, some users have shared their experiences transferring assets between joint and individual accounts. While some have reported being able to transfer funds online with little difficulty, others have encountered challenges, especially when transferring from a joint account to an individual account. In such cases, additional paperwork, notarization, or approval from both account holders may be required.

Steps to Transfer Money:

To transfer money between accounts in Folio Investing, follow these steps:

- Open your Accounts page.

- Select "Transfer Money" from the dropdown menu.

- Choose the appropriate tab for your desired action (deposit, withdrawal, or transfer within the account).

- Follow the instructions provided for the type of transfer you wish to make.

Additional Forms for Transfers:

If you encounter a situation where you need to transfer funds between accounts that cannot be completed online, Folio Investing provides an "Internal Account Transfer Form" for such instances. Additionally, if you are transferring assets from another institution to your Folio Investing account, you may need to use the "Account Transfer Form" or the "Account Transfer Letter of Authorization Form" if the sending firm does not accept electronic signatures.

Positive Cash Flows: A Smart Investment Strategy?

You may want to see also

Frequently asked questions

You can transfer money from your Folio Investing account to another account by electronic funds transfer (EFT), direct deposit, payroll deduction, or by transferring money between accounts with Folio Investing.

To transfer money between folios, open your Accounts page, select "Transfer within Account" from the dropdown menu, and follow the instructions provided.

Open your Accounts page, select "Transfer Money" from the dropdown menu, and open the Withdrawal tab. Then choose a withdrawal type, and follow the instructions given. You can withdraw funds from your account via EFT, check, or by transferring money between your accounts with Folio Investing.

You can convert physical stock certificates for publicly-traded companies into electronic form (also known as "street name") and then transfer them to Folio Investing using the Transfer Securities process. Check with the issuer of the security, your current broker, or your financial institution to see if they can convert your physical stock certificate into electronic form.

If you already have an account with Folio Investing, you can make an online account transfer. If you don’t have an account with Folio Investing, you must open the same account type as the account you are transferring.