Cash flow from investing activities (CFI) is a crucial aspect of a company's financial health, providing insights into its investment strategies and performance. It is one of the three sections of a company's cash flow statement, detailing the inflow and outflow of cash from various investment activities over a specific period. This includes the purchase or sale of physical assets, investments in securities, and acquisitions or disposals of businesses. A key component of CFI is the investment in property, plant, and equipment (PP&E), which are long-term tangible assets vital to business operations. PP&E includes items such as equipment, machinery, buildings, and vehicles. While negative cash flow in CFI can be concerning, it is not always negative, as it may indicate investments in the long-term health and growth of the company.

| Characteristics | Values |

|---|---|

| What it is | Cash Flow from Investing Activities (CFI) is a section of a company's cash flow statement that shows the cash inflow and outflow from investing activities in a specific period. |

| Types of activities | Investing activities include purchasing and selling investments, as well as earnings from investments. |

| Types of investments | Investments can be made to generate income on their own, or they may be long-term investments in the health or performance of the company. |

| Types of assets | Current assets are short-term assets that are likely to be converted into cash within one year. Non-current assets (long-term assets) are expected to deliver value and benefits in the long run (more than one year). |

| Types of non-current assets | Property, Plant and Equipment (PP&E), also known as fixed assets. |

| PP&E characteristics | PP&E are tangible long-term assets that are not easily converted into cash. They are vital to business operations. |

| Calculating PP&E | Gross PP&E + Capital Expenditures – Accumulated Depreciation |

| Calculating CFI | CapEx/purchase of non-current assets + marketable securities + business acquisitions – divestitures. |

| CFI interpretation | A negative cash flow from investing activities is not always a bad sign. It can indicate that a company is investing in future growth. |

What You'll Learn

Purchase of property, plant, and equipment (PPE)

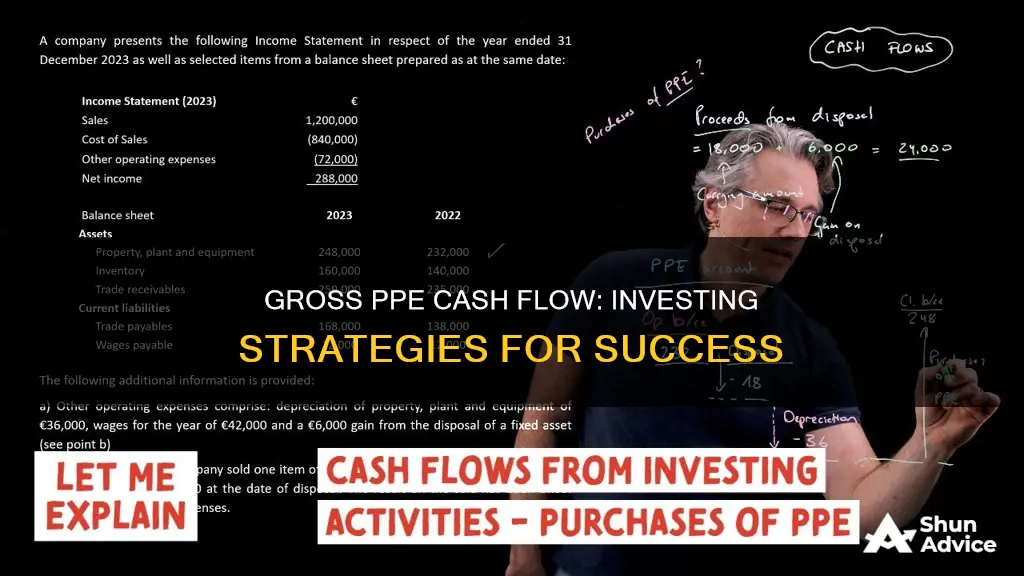

Property, plant, and equipment (PPE) are long-term tangible assets that are vital to business operations. They are also called fixed assets. PPE is a capital expenditure (CapEx) and is recorded on a company's balance sheet. PPE is a non-current asset and is not easily converted into cash. The purchase of PPE is, therefore, a negative cash flow from investing activity.

The purchase of PPE is an important aspect of growth and capital for a company. It is a large line item on the balance sheet and is considered an investing activity. When investors and analysts want to know how much a company spends on PPE, they can refer to the sources and uses of funds in the investing section of the cash flow statement.

The formula for calculating the ending PPE balance is: Ending PPE, net = Beginning PPE, net + Capex – Depreciation.

The purchase of PPE is a signal that management expects long-term profitability. It is also a sign that the company is investing in its future operations and is, therefore, a good sign for investors.

For example, Texas Roadhouse, a restaurant chain, spends a lot on CAPEX to open new restaurant locations across the United States. In its 10-K filing with the SEC, the company details that it spends money on remodelling existing stores, building new ones, and acquiring land.

In summary, the purchase of PPE is a negative cash flow from investing activity but it is an important investment in the future growth and operations of a company.

Best Places to Invest Your Cash Today

You may want to see also

Selling off PPE

When a company sells its PPE, it may be a sign that the company is experiencing financial difficulties and needs to raise cash or net income. This can be a cause for concern for investors, as it may indicate that the company is struggling to fund its business operations.

However, there are also cases where selling off PPE can be a strategic decision made by the company. For example, a company may choose to sell off outdated or unused equipment to invest in more modern and efficient technology. This can be a positive move for the company, as it allows them to upgrade their operations and potentially increase their productivity.

In some cases, a company may also sell its PPE to take advantage of favourable market conditions. For instance, if the value of their PPE has increased significantly, they may choose to sell it to realise the gains and reinvest the proceeds in other areas of their business.

Overall, while selling off PPE can sometimes be a negative sign, it is important to consider the context and the company's overall financial health before making any conclusions. It may be a necessary step for a company to raise funds, restructure its operations, or take advantage of favourable market conditions.

Cash App Investing: Are There Any Fees Involved?

You may want to see also

Investment in marketable securities

When investing in marketable securities, it is essential to understand the different types, which can be broadly categorized into equity securities, debt securities, and hybrid securities. Equity securities represent ownership in a corporation, typically in the form of stocks. Debt securities are loans made to entities such as corporations or governments, including bonds, treasury bills, and commercial paper. Hybrid securities combine elements of equity and debt, offering unique benefits and risks, such as convertible bonds and preferred stocks with debt-like features.

The liquidity of marketable securities is advantageous for businesses as it allows them to act swiftly on opportunities, such as acquisitions, and meet contingent payments. Instead of holding cash reserves, companies can invest in short-term liquid securities to generate returns while maintaining the flexibility to liquidate these investments if sudden cash needs arise.

When evaluating the financial health of a company, analysts consider the impact of marketable securities on cash flow statements, particularly in the investing activities section. The purchase and sale of these securities are recorded as cash outflows and inflows, respectively, providing insights into the company's investment strategy and liquidity management.

In summary, investment in marketable securities offers benefits such as liquidity, diversification, and potential for short-term gains. It is an essential tool for businesses and investors to optimize their financial strategies and manage their cash flow effectively.

Investing Activities: Computing Cash Flows with GAAP

You may want to see also

Acquisition of businesses

Acquiring a business or company is a cash outflow, and it is a type of investing activity that should be included in the Cash Flow from Investing Activities (CFI) section of a company's cash flow statement. CFI is one of the three sections of a company's cash flow statement, alongside cash flow from operations and cash flow from financing activities.

CFI tracks the net amount of cash generated or lost in a specific period, known as the accounting period. It includes all transactions related to buying and selling non-current assets and marketable securities. Non-current assets, or long-term assets, are expected to deliver value in the long run (usually more than one year) and are highly illiquid, meaning they cannot be easily or quickly converted into cash. On the other hand, marketable securities such as stocks, bonds, and shares are more liquid and can be converted into cash more easily.

Acquiring a business or company is considered a cash outflow in the CFI statement. This means that money is being spent on this activity, which can be a significant investment for the acquiring company. However, it is important to note that negative cash flow from investing activities does not always indicate poor financial health. It often signifies that the company is making strategic investments in its long-term health and future growth.

When analysing the cash flow statement, it is crucial to consider the context and overall financial health of the company. A consistent negative investing cash flow can be a positive sign, indicating that the company is in a growth state and making investments for future returns.

Invest Cash Safely: Strategies for Secure Financial Growth

You may want to see also

Calculating cash flow from operating activities

Cash flow from operating activities (CFO) is a crucial metric for understanding a company's financial health and performance. It indicates the amount of money a company generates from its regular business operations, excluding long-term capital expenditures and investment-related income or expenses. This metric is often the first section of a company's cash flow statement and can be calculated using two methods: the direct method and the indirect method.

The direct method is a straightforward approach that involves taking all cash collections from operations and subtracting all cash disbursements. This method lists all transactions that resulted in cash inflows or outflows during the reporting period. While it provides a clear picture of cash flows, it can be time-consuming as it requires accounting for every transaction.

The indirect method, favoured by many accountants, starts with the net income from the income statement and then makes adjustments to account for the impact of accruals during the reporting period. This method is faster and closely linked to the balance sheet. Both methods are accepted by Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

To calculate CFO using the indirect method, you can use the following formula:

> Cash Flow from Operating Activities = Net Income + Adjustments to Net Income (non-cash items) + Changes in Working Capital

Net income is typically derived from the income statement and reflects a company's profitability. Non-cash items, such as depreciation and amortization, are added back to the net income. Changes in working capital reflect the difference between a company's current assets and current liabilities.

Positive cash flow from operating activities indicates that a company's core business activities are thriving, and it serves as an additional measure of profitability. It is an important benchmark for investors and analysts to assess the financial success and potential of a company's operations.

Investing Wisely: Understanding Cash Flow & Depreciation

You may want to see also

Frequently asked questions

Cash flow from investing activities (CFI) is one of three sections on a company's cash flow statement. It tracks the cash inflow and outflow from investing activities, giving the net amount of cash generated or lost in a specific period.

Investing activities include purchasing and selling investments, as well as earnings from investments. Examples include:

- Purchase of property, plant and equipment (PP&E)

- Sale of PP&E

- Investment in marketable securities

- Sale of marketable securities

- Acquisition of businesses

- Sale of businesses

- Lending money

- Collecting loans

CFI gives a clear breakdown of how much money has been spent on future growth and how consistently investments are being made. It can help track how cash is being allocated and whether investments have paid off. It can also show how much cash is in marketable securities, which can be used to free up cash when needed.

There is no singular formula for CFI, but a generally accepted one is:

CFI = CapEx/purchase of non-current assets + marketable securities + business acquisitions – divestitures.