Non-cash investments are those that do not require a cash outlay or the incurring of a liability to pay money. In accounting, non-cash items are expenses that are included in the business's net income but do not affect cash flow. They are important for the users of financial statements as they can have a significant impact on the entity's current and future performance in terms of revenues, profits, and the ability to generate positive cash flows. Non-cash expenses include depreciation, amortization, stock-based compensation, and unrealized gains and losses.

| Characteristics | Values |

|---|---|

| Definition | A non-cash item has two different meanings. In banking, it is a negotiable instrument, such as a check or bank draft, deposited but not yet credited. In accounting, it is an expense listed on an income statement that does not involve a cash payment. |

| Examples | Depreciation, amortization, deferred income tax, unrealized gains and losses, provisions or contingencies for future losses, asset write-downs, goodwill impairments, stock-based compensation, issuance of stock to retire a debt, exchange of non-cash assets, conversion of debt to common stock, and more. |

| Impact | Non-cash items are important for users of financial statements as they can significantly impact an entity's current and future performance in terms of revenues, profits, and the ability to generate positive cash flows. |

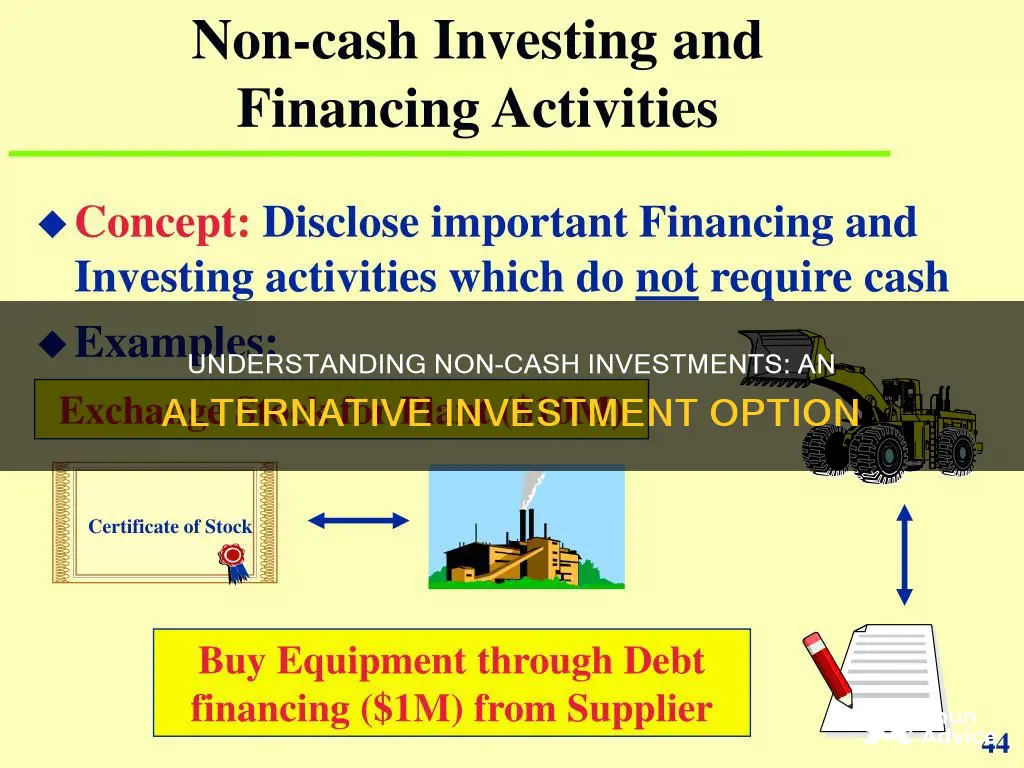

| Disclosure | Both IFRS and US GAAP require companies to disclose all significant non-cash investing and financing activities either at the bottom of the statement of cash flows as a footnote or in the notes to the financial statements. |

What You'll Learn

Non-cash investing and financing activities

- Issuing stock to retire debt

- Purchasing an asset by issuing stock, bonds, or a note payable

- Exchanging non-cash assets

- Converting debt to common stock

- Converting preferred stock to common stock

- Paying for services with stock instead of cash

In financial statements, non-cash items are expenses that do not involve a cash payment but are listed on an income statement. Examples include capital depreciation, investment gains or losses, deferred income tax, and employee stock-based compensation.

Both IFRS and US GAAP require companies to disclose all significant non-cash investing and financing activities either at the bottom of the statement of cash flows as a footnote or in the notes to the financial statements. This disclosure provides transparency and helps investors understand the company's financial health and prospects.

Unlocking the Power of Idle Cash: Smart Investment Strategies

You may want to see also

Non-cash transactions

In banking, a non-cash item is a negotiable instrument, such as a cheque or bank draft, that has been deposited but cannot be credited until it clears the issuer's account. In accounting, a non-cash item refers to an expense listed on an income statement, such as capital depreciation, investment gains or losses, that does not involve a cash payment.

Some common examples of non-cash transactions include:

- Stock-based compensation

- Provision for discount expenses

- Deferred income taxes

- Provisions for future losses

- Depreciation

- Amortization

- Unrealized gains and losses

- Goodwill impairments

- Asset write-downs

Noncash transactions are important to consider when creating accurate financial statements and understanding a company's financial health. They can also help reduce a company's taxable income and provide a more accurate view of its financial viability and long-term prospects.

Cashing Out of Circle Invest: A Step-by-Step Guide

You may want to see also

Non-cash expenses

In banking, a non-cash item is a negotiable instrument, such as a cheque or bank draft, that is deposited but cannot be credited until it clears the issuer's account. In accounting, a non-cash item is an expense that is listed on an income statement, such as capital depreciation, investment gains, or losses.

Some common examples of non-cash expenses include:

- Depreciation: This calculates the decline in the value of a tangible asset over a period, and it is a tax-deductible expense.

- Amortization: This is a non-cash expense of a company's long-term intangible assets, such as patents and copyrights, over their expected lifetime.

- Unrealized gains and losses: These are increases and declines in the value of a company's assets or investments that it hasn't sold for cash.

- Provisions or contingencies for future losses: Companies may estimate future losses in revenue and set aside funds to cover these losses.

- Asset write-downs: This involves reducing the book value of an asset when its fair market value declines below the carrying book value, making it an impaired asset.

- Goodwill impairments: These are charges a company incurs when its goodwill's carrying book value exceeds its fair market value, resulting in a loss.

- Stock-based compensation: This occurs when a company rewards managers and staff with equity in the business instead of monetary wages and bonuses.

It is important to note that non-cash expenses are based on estimates, and businesses need to be careful when accounting for these items.

Cash Allocation Strategies: Investing Your Money Wisely

You may want to see also

Non-cash assets

Noncash expenses are common costs that affect a company's net income, which is crucial for attracting potential investors and lenders and for determining dividends issued to owners. They are intangible and don't generate cash, but accountants consider them to be assets in financial statements. Examples of noncash expenses include depreciation, amortisation, unrealised gains and losses, provisions or contingencies for future losses, asset write-downs, goodwill impairments, and stock-based compensation.

Understanding noncash expenses is important for creating accurate financial statements and recognising the total value of a business and its assets. Noncash expenses are accounted for at the time of the original purchase, which is why they don't affect the cash flow statement. They can also provide insights into the actual money a company has available for its operations and provide a more accurate view of a company's financial viability and long-term prospects.

Additionally, non-cash assets can be donated to charitable causes, allowing individuals to make a significant impact on their favourite causes. Examples of non-cash assets that can be donated include real estate, stock, cryptocurrency, farm equipment, land, and life insurance policies. These donations can provide income during an individual's lifetime, significant tax benefits, or both.

Investing vs. Saving: Where Should Your Cash Go?

You may want to see also

Non-cash charges

In accounting, a non-cash item refers to an expense listed on an income statement, such as capital depreciation, investment gains or losses, that does not involve a cash payment. Non-cash charges are included in the business's net income but do not affect cash flow. While they do not impact the net cash flow, these expenses do impact the bottom line of the income statement and result in lower reported earnings.

Some common examples of non-cash charges include:

- Depreciation: This is a common example of a non-cash expense, as it calculates the decline in the value of a tangible asset over a period. For example, if a company purchases a machine for $3,000 with a useful life of five years, the depreciation expense would be $600 per year. This is recorded as a non-cash expense and spread across the five years.

- Amortization: Amortization is a non-cash expense related to a company's long-term intangible assets, such as patents and copyrights. These expenses are recorded as non-cash expenses because they do not require immediate cash payments.

- Unrealized gains and losses: These are increases or decreases in the value of a company's assets or investments that it has not sold for cash.

- Provisions or contingencies for future losses: Companies may estimate future losses in revenue and set aside funds to cover these losses. As these are hypothetical expenditures, they are listed as non-cash expenses.

- Asset write-downs: This involves reducing the book value of an asset when its fair market value declines below the carrying book value.

- Stock-based compensation: This occurs when a company rewards employees with equity in the business instead of monetary wages or bonuses.

Is Paying for Ads with Cash an Investment?

You may want to see also

Frequently asked questions

A non-cash investment is an investment that does not require an outlay of money or the incurring of a liability to pay money. In other words, it is an investment that does not involve a cash transaction.

Some examples of non-cash investments include:

- Stock-based compensation

- Depreciation

- Amortization

- Unrealized gains and losses

- Goodwill impairments

- Asset write-downs

Non-cash investments impact a company's net income, which is crucial for attracting potential investors and lenders and determining dividends issued to owners. While non-cash investments do not affect cash flow, they are considered assets in financial statements and can provide insights into the total value of a company and its assets.