Navigating long-term investments can be complex, especially when it comes to reporting them on tax forms. TurboTax offers a user-friendly platform to help you accurately report your long-term capital gains and losses on Form 8949. This guide will walk you through the process of entering your long-term investments, ensuring you stay compliant with tax regulations and potentially save money.

What You'll Learn

- Understanding 8949: Learn how to fill out Form 8949 for long-term capital gains

- Investment Types: Identify eligible investments for reporting on 8949

- Cost Basis Calculation: Understand how to calculate the cost basis for each investment

- Sales and Gains: Report sales and gains from long-term investments on Form 8949

- TurboTax Guidance: Use TurboTax's tools to ensure accurate reporting of long-term investments

Understanding 8949: Learn how to fill out Form 8949 for long-term capital gains

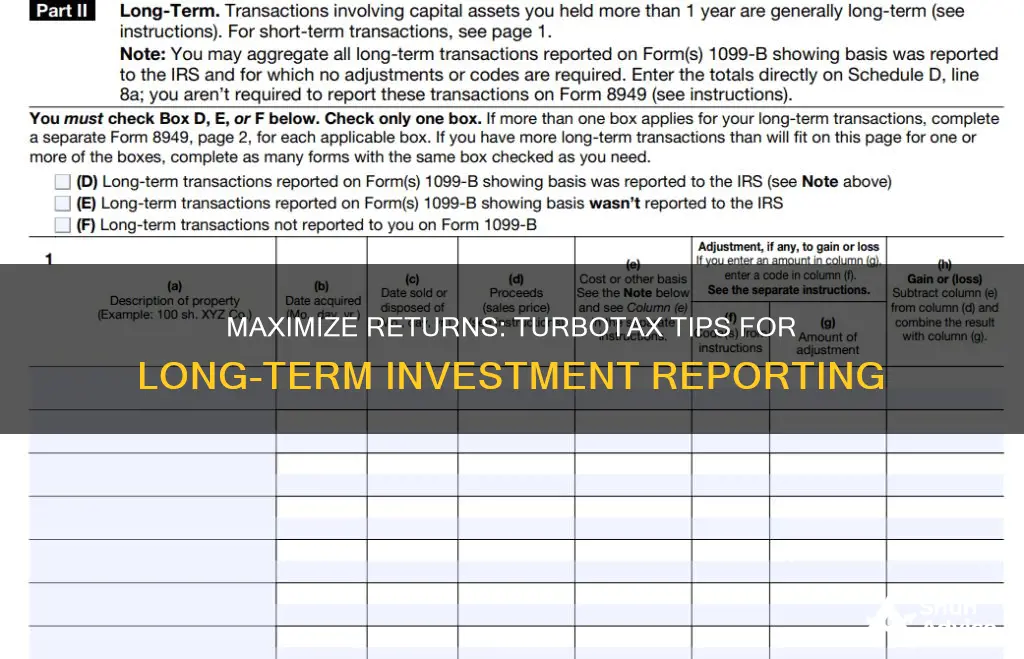

To understand how to fill out Form 8949 for long-term capital gains, it's important to grasp the basics of this tax form. Form 8949 is a crucial document for reporting the sale of assets, particularly those held for investment purposes, and it's especially relevant when dealing with long-term capital gains. This form is designed to help taxpayers calculate and report their capital gains or losses from the sale of various assets, including stocks, bonds, and other investments.

When you sell an asset that has been held for more than a year, it qualifies as a long-term capital gain, and Form 8949 is used to detail this transaction. The form requires you to provide specific information about each sale, including the date of the sale, the asset's purchase price, and its sale price. This level of detail is essential for accurately calculating the capital gain or loss. For instance, if you sold 100 shares of a stock at $10 each, the form would need to reflect the total purchase price, the total sale price, and any associated costs.

One of the key advantages of using Form 8949 is that it allows for the reporting of multiple sales throughout the year. If you've made several sales of different assets, you can list each transaction separately on the form. This is particularly useful for investors who frequently buy and sell various holdings. Each line on Form 8949 represents a single sale, making it easy to track and report multiple transactions.

Filling out Form 8949 accurately is crucial to ensure compliance with tax regulations. Turbotax, a popular tax preparation software, provides a user-friendly interface to guide users through the process. It prompts users to input relevant details, such as the asset's description, the number of units sold, and the tax basis (the original purchase price). The software then calculates the gain or loss for each transaction, making it easier to review and ensure the accuracy of the information provided.

In summary, Form 8949 is a critical tool for investors to report long-term capital gains and losses. By providing a detailed breakdown of sales, it enables taxpayers to calculate and report their capital gains accurately. Utilizing tax preparation software like Turbotax can simplify the process, ensuring that all transactions are correctly entered and the tax implications are properly addressed. Understanding and completing Form 8949 is an essential step in managing one's investment portfolio and fulfilling tax obligations.

Unraveling Short-Term Investment Accounting: A Comprehensive Guide

You may want to see also

Investment Types: Identify eligible investments for reporting on 8949

When it comes to filing your taxes and reporting long-term investments, understanding the eligible investments is crucial. Form 8949, which is used to report stock and securities transactions, requires you to detail specific types of investments. Here's a breakdown of the investment types you should consider:

Stocks and Bonds: These are the most common long-term investments. If you've purchased and held stocks or bonds for more than a year, they qualify for reporting on Form 8949. This includes individual stocks, mutual funds, and exchange-traded funds (ETFs) that are held as long-term investments. For example, if you bought 100 shares of ABC Inc. stock three years ago and still hold them, you need to report any sales or transactions related to these shares.

Real Estate: Investing in real estate can be a significant long-term investment. This includes the purchase and sale of primary residences, rental properties, or other real estate holdings. If you've sold a property held for investment or used for rental purposes, you must report the transaction on Form 8949. Additionally, if you've exchanged one property for another (like a 1031 exchange), this also falls under the scope of reporting.

Collectibles: Certain collectibles can be considered long-term investments. This category includes items like precious metals, coins, stamps, fine art, and antiques. If you've made significant sales or acquisitions in these collectible markets, you should report them. However, it's important to note that the rules for collectibles can be more complex, and you may need to provide additional documentation.

Cryptocurrency and Digital Assets: With the rise of digital currencies, it's essential to understand how they fit into tax reporting. If you've invested in cryptocurrencies or other digital assets and experienced a gain or loss, you must report these transactions. This includes buying, selling, or exchanging digital currencies and tokens. Turbotax provides tools to help you track and report these investments, ensuring compliance with tax regulations.

When entering these investments on Turbotax, you'll need to provide details such as the date of purchase, sale price, and any relevant transaction costs. The software will guide you through the process, ensuring that you report all eligible investments accurately. Remember, proper reporting of long-term investments is essential to avoid any potential tax issues and to keep your financial records in order.

Securities: Cash Equivalent or Long-Term Investment?

You may want to see also

Cost Basis Calculation: Understand how to calculate the cost basis for each investment

When it comes to reporting long-term capital gains on your tax return, understanding the cost basis of your investments is crucial. The cost basis represents the original price you paid for an investment plus any associated costs, and it's essential for calculating the profit or loss when you sell or dispose of the investment. Here's a step-by-step guide to calculating the cost basis for each investment:

- Identify the Investment Details: Start by gathering information about each long-term investment you held during the tax year. This includes the purchase date, purchase price, any additional costs (such as commissions or fees), and the number of shares or units you acquired. Make sure to have your investment statements or records readily available.

- Calculate the Total Cost: Add up all the costs associated with acquiring the investment. This includes the purchase price and any applicable expenses. For example, if you bought 100 shares of a stock at $50 per share, the initial cost would be $5,000. Additionally, if you incurred a $100 commission fee, you would add this to the total cost.

- Consider Adjustments: In some cases, you may need to make adjustments to the cost basis. This can include expenses like legal or accounting fees related to the investment, or costs incurred to protect or improve the value of the investment. These adjustments should be supported by proper documentation.

- Track Basis Over Time: Keep a record of any changes in the investment's value, such as dividends or distributions received. These amounts should be added to the original cost basis. For example, if you received $500 in dividends over the years, you would add this to the initial cost basis.

- Use TurboTax's Cost Basis Calculator (if available): TurboTax, the popular tax preparation software, often provides tools to help calculate cost basis. These calculators can simplify the process, especially for investors with multiple transactions. Enter the relevant details, and the calculator will provide the cost basis for each investment, making it easier to fill out Form 8949 accurately.

Remember, accurate cost basis calculations are essential for reporting capital gains correctly on your tax return. It's a detailed process, but by following these steps, you can ensure that you're providing the necessary information to the tax authorities.

Crafting Your Future: A Guide to Long-Term Investment Success

You may want to see also

Sales and Gains: Report sales and gains from long-term investments on Form 8949

When it comes to filing your taxes, accurately reporting sales and gains from long-term investments is crucial. Form 8949, 'Sales and Other Dispositions of Assets,' is specifically designed for this purpose. Here's a step-by-step guide on how to navigate this process using TurboTax:

Start by gathering all the necessary information. You'll need details about each long-term investment sale, including the date of sale, the adjusted basis of the investment, the sales price, and any commissions or fees associated with the transaction. TurboTax provides a user-friendly interface to help you input this data. You can import your investment transactions directly into the software, making the process more efficient. If you have multiple sales, you'll create a separate entry for each one.

Each entry on Form 8949 should include the investment's unique identifier, the type of asset (e.g., stock, bond), the quantity sold, and the specific tax lot if you have multiple lots of the same asset. TurboTax will guide you through selecting the appropriate tax lot method, such as FIFO (First-In, First-Out) or LIFO (Last-In, First-Out), which determines the order in which your investments are taxed.

The sales price is a critical component. You'll need to specify the proceeds from the sale, including any discounts or premiums. TurboTax allows you to input these details accurately. Additionally, you should report any related expenses, such as brokerage fees or legal costs, to ensure your tax liability is calculated correctly.

Once you've entered all the necessary information, TurboTax will help you calculate the gain or loss for each investment sale. It will then assist in filling out the appropriate sections of Form 8949, ensuring compliance with IRS regulations. Remember to review your entries carefully to avoid errors, as this form can be complex.

By following these steps and utilizing TurboTax's features, you can effectively report sales and gains from long-term investments, ensuring you meet your tax obligations accurately and efficiently.

Maximizing Returns: Understanding Investment Percentage Strategies

You may want to see also

TurboTax Guidance: Use TurboTax's tools to ensure accurate reporting of long-term investments

When it comes to filing your taxes and managing your long-term investments, TurboTax provides a comprehensive suite of tools to ensure accurate reporting. Here's a step-by-step guide on how to utilize TurboTax's features for this purpose:

- Access the Investment Center: TurboTax offers an intuitive Investment Center, which is a centralized hub for managing your investment activities. Start by logging into your TurboTax account and locating the Investment Center. This section allows you to track and report various types of investments, including stocks, bonds, mutual funds, and more.

- Import Investment Data: One of the most convenient features is the ability to import data from external sources. You can connect your investment accounts, such as brokerage statements or financial advisors' reports, to automatically pull in relevant information. This ensures that your TurboTax software has the most up-to-date data, making the reporting process more accurate and efficient.

- Categorize and Organize: TurboTax's tools enable you to categorize your investments based on their types. You can differentiate between long-term capital gains, short-term sales, dividends, and other investment-related income. Proper categorization is crucial for accurate reporting on Form 8949, which is used to report individual sales of stocks and securities.

- Use the Sale Proceeds Calculator: When you sell an investment, TurboTax's Sale Proceeds Calculator helps you determine the cost basis and sale proceeds. This tool considers factors like the purchase price, commissions, and any adjustments to calculate the proceeds accurately. It simplifies the process of reporting the sale on Form 8949, ensuring you stay compliant with tax regulations.

- Review and Adjust: After importing and categorizing your investment data, review the information carefully. TurboTax provides a clear overview of your investment activities, allowing you to identify any discrepancies or errors. You can then make the necessary adjustments to ensure the accuracy of your tax return.

By utilizing TurboTax's Investment Center and its associated tools, you can streamline the process of reporting long-term investments. This approach minimizes the risk of errors and ensures that your tax return reflects your investment activities accurately, providing a seamless and efficient tax-filing experience.

Unveiling the Tricks: How Short-Term Investments Are Manipulated

You may want to see also

Frequently asked questions

To report long-term capital gains on Form 8949, you need to provide details about each sale of a capital asset. Start by listing the asset's name, address, and the date of acquisition. Then, enter the sale price, the cost basis (the original purchase price plus any improvements), and the profit or loss. TurboTax will guide you through the process, ensuring you report the correct information for each transaction.

If you've sold multiple investments, you'll need to fill out a separate line for each sale on Form 8949. TurboTax allows you to input the necessary details for each transaction, including the type of asset, sale date, and financial information. You can also use the software's built-in calculator to determine the gain or loss for each sale.

Yes, TurboTax can help you calculate your total long-term capital gain. After inputting all the sales on Form 8949, the software will automatically calculate the overall gain or loss. It considers the specific tax rates and deductions applicable to long-term capital gains. You can then transfer this information to your tax return, ensuring accurate reporting.

Organization is key when dealing with investment records. Keep all relevant documents, such as purchase agreements, sale receipts, and any correspondence with brokers. Create a system to categorize and store these documents, making it easier to retrieve the information when filling out Form 8949 in TurboTax. Additionally, consider using TurboTax's import feature to directly transfer data from your investment accounts, streamlining the reporting process.