A company's cash flow statement is one of its most important financial reports, offering a detailed insight into its cash flow performance over a specific period. One of the key components of a cash flow statement is the net change in cash, which can be calculated by adding together three or four entries: the starting cash balance, net cash provided by operating activities, net cash used in investing activities, and net cash used in financing activities. Net cash flow from investing activities is calculated by adding together the purchases or sales of property, equipment, other businesses, and marketable securities. This figure can be found on a company's cash flow statement, which is one of three fundamental financial statements used by financial leaders, the other two being income statements and balance sheets.

| Characteristics | Values |

|---|---|

| Definition | Cash Flow from Investing Activities (CFI) is a section of a company's cash flow statement that displays how much money has been used in or generated from making investments during a specific time period. |

| Purpose | To reveal a company's investment performance and capital allocation decisions. |

| Formula | Net cash flow from investing activities = CapEx/purchase of non-current assets + marketable securities + business acquisitions – divestitures (sale of investments). |

| Calculation | Sum up all cash inflows and outflows related to investing activities. Subtract the total outflows from the total inflows to calculate the net cash flow. |

| Examples of Investing Activities | Purchase of property, plant, and equipment (PP&E), acquisitions of other businesses, and investments in marketable securities (stocks and bonds). |

| Examples of Cash Outflow | Purchase of PP&E, purchase of marketable securities, acquisitions, and payment of dividends. |

| Examples of Cash Inflow | Proceeds from the sale of PP&E, proceeds from the sale of marketable securities, and proceeds from asset sales. |

| What It Indicates | A positive net cash flow from investing activities indicates that a company is generating more cash from its investing activities than it is spending. |

What You'll Learn

Calculating net cash flow

Understanding Cash Flow from Investing Activities:

Cash Flow from Investing Activities (CFI) is a critical section of a company's cash flow statement. It provides insights into the cash inflows and outflows from various investment activities over a specific period, typically an accounting period. CFI includes cash spent on purchasing long-term assets, acquisitions, and investments in marketable securities, as well as cash generated from the sale of assets, securities, or businesses.

Identifying Investing Activities:

Investing activities encompass a range of transactions, including:

- Purchase of property, plant, and equipment (PP&E) or capital expenditures (CapEx)

- Proceeds from the sale of PP&E

- Acquisitions of other businesses

- Proceeds from the sale of businesses

- Purchases of marketable securities (stocks, bonds, etc.)

- Proceeds from the sale of marketable securities

- Lending money

- Collection of loans

Calculation Formula:

There is no universally agreed-upon formula for calculating CFI. However, a commonly accepted formula is as follows:

Cash Flow from Investing Activities = CapEx/Purchase of non-current assets + Marketable securities + Business acquisitions - Divestitures

Where:

- Divestitures refer to the sale of investments

- CapEx represents capital expenditures, which are investments in physical assets like property, equipment, or technology

Example Calculation:

Let's consider an example to illustrate the calculation. Suppose a company has the following investing activities during a specific accounting period:

- Purchase of PP&E: $200,000

- Sale of marketable securities: $50,000

- Acquisition of a new business: $300,000

- Collection of loans: $20,000

Using the formula, the calculation would be:

Cash Flow from Investing Activities = $200,000 - $50,000 + $300,000 + $20,000 = $470,000

So, the net cash flow from investing activities for this period is $470,000.

Interpreting Results:

A negative cash flow from investing activities does not necessarily indicate poor financial health. It often means that the company is investing in long-term growth and development, which may lead to significant future gains. However, consistent negative cash flow could be a concern if it continues over an extended period without corresponding increases in operating cash flow, potentially indicating overcapitalization.

Cashing Out on Robinhood: A Guide to Withdrawing Your Investments

You may want to see also

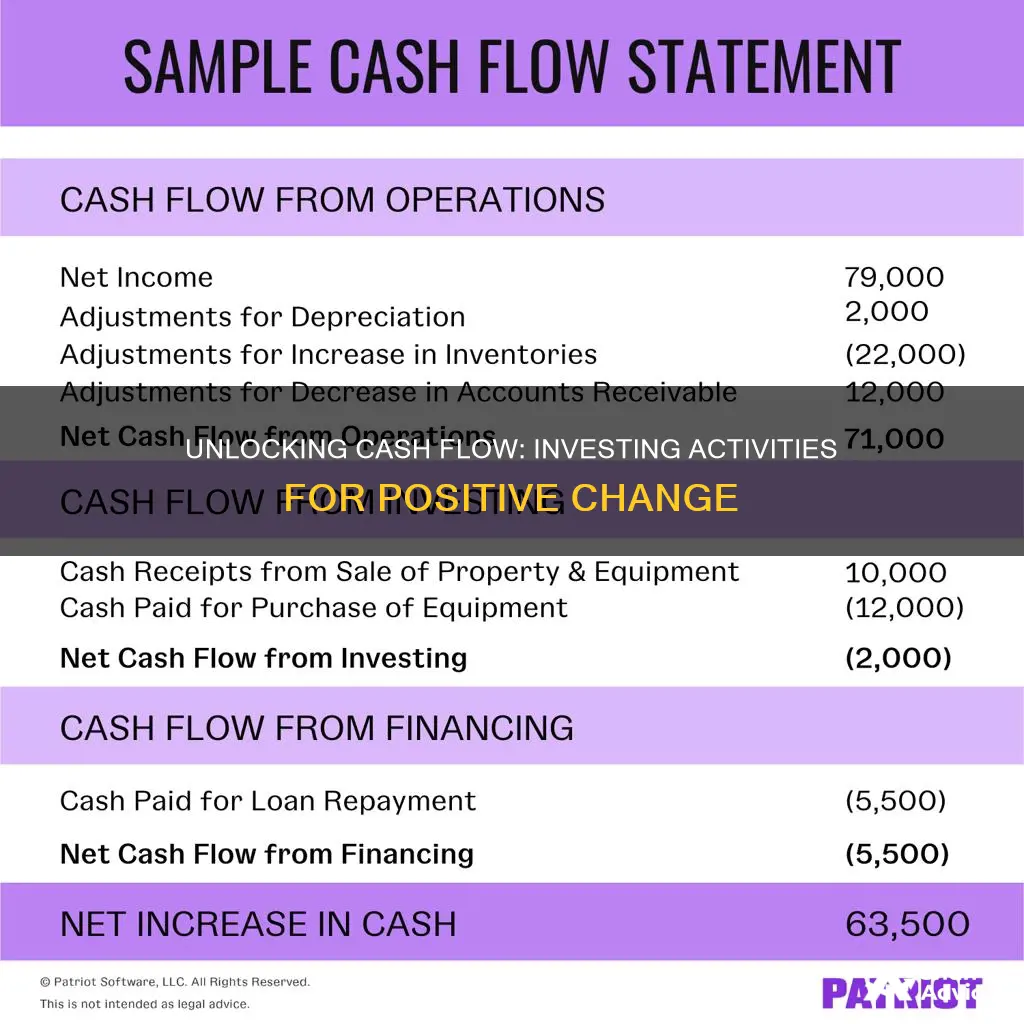

Cash flow statement components

A cash flow statement is a crucial tool for managing finances and tracking the cash flow of a company. It is one of the three primary financial reports that stakeholders closely monitor. The other two are the income statement and the balance sheet.

The cash flow statement is comprised of three sections: operating activities, investing activities, and financing activities. These sections are presented through cash inflow and outflow.

Operating Activities

This section reflects the cash flow generated by a company's main products or services. It includes sources and uses of cash from business activities, such as cash received from sales, commissions, and payments to suppliers or manufacturing costs. A positive figure in this section indicates that the company is earning money, while a negative figure may prompt a review of the business.

Investing Activities

The investing activities section includes changes during a reporting period related to investment losses or gains. It covers money from new investments, sales of fixed assets, and purchases of physical assets or investments in securities. Investing activities can also involve the sale of securities or assets, which can bring in cash.

Financing Activities

This section reflects all the money earned and spent by a company's owners or lenders. It includes transactions related to long-term funding or the return of funds, such as loans, proceeds from issuing stock, and repayment of debt. Dividends paid to shareholders during the reporting period are also included here.

Calculating Net Cash Flow from Investing Activities

To calculate the net cash flow from investing activities, one must identify the cash transactions related to investments. This includes cash spent on purchasing fixed assets, cash received from selling assets, and cash spent on or received from investing in securities. The net cash flow is then calculated by subtracting cash payments for investments from cash receipts from sales of investments.

Schwab's Cash Investment Options: What You Need to Know

You may want to see also

Investing activities

Types of Investing Activities

- Purchases of Physical Assets or Long-Term Assets: This includes the acquisition of property, plant, and equipment (PP&E), also known as capital expenditures. These are long-term investments that contribute to the company's growth and operations.

- Investments in Securities: Companies may invest in marketable securities such as stocks, bonds, debentures, or other financial instruments. These investments can generate income or support the company's financial strategy.

- Sale of Securities or Assets: Proceeds from the sale of fixed assets, investments, or other business units can result in positive cash flow.

- Acquisitions and Mergers: Investing activities also cover the acquisition of other businesses or companies, as well as any cash acquired during these transactions.

- Loans and Collections: Cash flow from investing activities includes loans made to third parties and the collection of loan repayments.

Calculating Cash Flow from Investing Activities

To calculate the cash flow from investing activities, you sum up all the cash inflows and outflows related to these investing activities. Inflows typically come from proceeds of asset sales, dividends, or interest earned on investments. Outflows include purchases of property, plant, equipment, and investments. The formula is as follows:

> Cash flow from investing activities = CapEx/purchase of non-current assets + marketable securities + business acquisitions – divestitures (sale of investments)

Importance of Cash Flow from Investing Activities

Analysing cash flow from investing activities is essential for understanding a company's capital expenditure and investment strategies. It provides stakeholders with insights into the company's ability to invest in growth opportunities, acquire assets, and manage its long-term financial health. A positive net cash flow from investing activities indicates effective management of investments, while a negative cash flow may not always be negative, as it could signal investments in the company's long-term health.

Cash App Investing: Dividends and Your Money

You may want to see also

Cash flow from operations

Operating activities include any spending or sources of cash that are part of a company's day-to-day business operations. This includes cash received from sales, cash expenses paid for direct costs, and funding for working capital. It also includes cash generated from customers and cash paid to suppliers. The difference between the two reflects cash generated from operations.

The International Financial Reporting Standards defines operating cash flow as cash generated from operations, less taxation and interest paid.

Analysts pay close attention to this section of the cash flow statement as it shows the viability of the business conducted by the company. For a company to remain solvent, cash flow from operations needs to remain net positive.

The formula for calculating cash flow from operations is:

Non-cash expenses include items such as depreciation and amortization, which are added back to the net income figure. Changes in working capital reflect the impact of changes in current assets and current liabilities on cash flow. For example, an increase in inventory represents a cash outflow, while an increase in accounts payable represents a cash inflow.

Supplies: Investing or Operating Cash?

You may want to see also

Cash flow from financing

Financing activities include the issuance and repayment of equity, payment of dividends, issuance and repayment of debt, and capital lease obligations. Companies that require capital will raise money by issuing debt or equity, and this will be reflected in the cash flow statement.

The formula for calculating the cash flow from financing section is as follows:

> Cash Flow from Financing = Debt Issuances + Equity Issuances + (Share Buybacks) + (Debt Repayment) + (Dividends)

Note that items in parentheses signify an outflow of cash (a negative number). Conversely, debt and equity issuances are shown as positive inflows of cash, as the company is raising capital.

To calculate the net change in cash, you add the following entries:

- Starting cash balance

- Net cash provided by operating activities

- Net cash used in investing activities

- Net cash used in financing activities

This calculation helps evaluate the strength of a business. A declining net change in cash can be a warning sign, depending on other factors.

Operating vs Investing: Where Do Customers Fit in Cash Flow?

You may want to see also

Frequently asked questions

Cash flow from investing activities (CFI) is a section of a company's cash flow statement that shows the cash generated by or spent on investment activities. It includes purchases of physical assets, investments in securities, or the sale of securities or assets.

To calculate cash flow from investing activities, add the purchases or sales of property and equipment, other businesses, and marketable securities. The formula is: Cash flow from investing activities = CapEx/purchase of non-current assets + marketable securities + business acquisitions – divestitures (sale of investments).

A positive net cash flow from investing activities indicates that a company is generating more cash from its investing activities than it is spending. This suggests that the company is effectively managing its investments and may be acquiring assets or making strategic investments to enhance future growth and profitability.