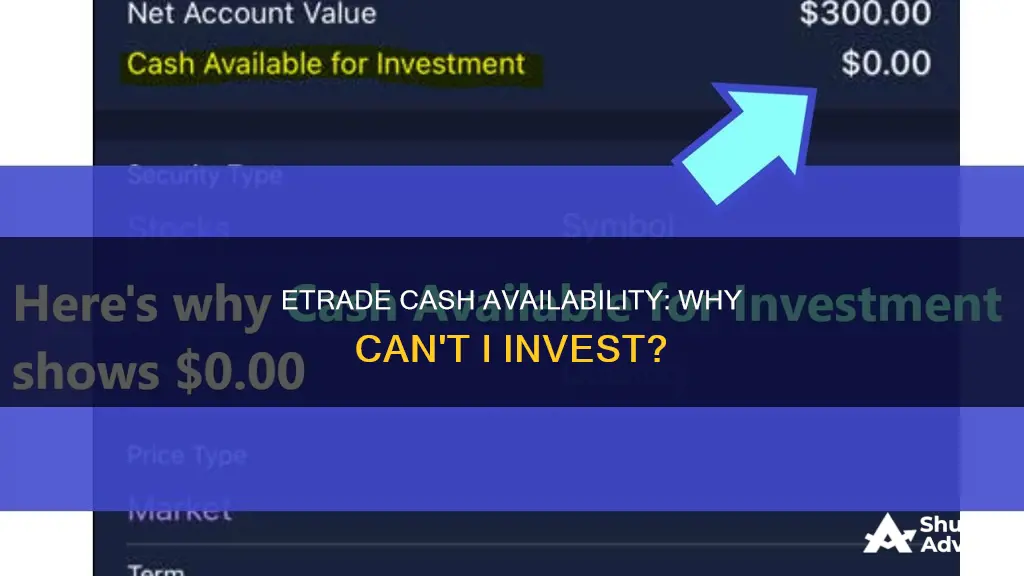

If your cash is not available to invest on Etrade, it could be due to a few reasons. One reason could be that the settlement period, which is the time between the trade date and the settlement date, has not yet been completed. Another reason could be that the transfer of funds to your Etrade account is still pending and has not been fully processed. It is also possible that there may be restrictions on your account due to good faith or freeride violations. To resolve this issue, you can check the status of your funds transfer, wait for the settlement period to complete, or contact Etrade customer support for further assistance.

What You'll Learn

Delayed transfer

Firstly, it is important to understand the settlement period. This is the time between the trade date, when the transaction occurs, and the settlement date, when the payment is made and the ownership of securities is transferred. In general, stock settlements take one business day after the trade date, known as T+1. However, it is worth noting that banking holidays are non-settlement days, and while you can trade on these days, they are not included in the settlement period.

Secondly, the buying power of your cash account determines the maximum amount available for placing trades. This is calculated using settled funds, unsettled funds available, and unsettled funds unavailable. Unsettled funds from the sale of securities are not available for trading until the closing trade has settled. This can result in a good-faith violation if the position is closed before the funds from the initial trade have settled. A good-faith violation will be issued on the account for a 12-month rolling period. If the account receives three good-faith violations within this time, it will be restricted to settled-cash status for 90 days, meaning you will be required to have settled cash before placing any trades during this period.

Additionally, the method of transfer can impact the timing of your funds' availability. For example, ACH and check deposits typically become available for trading on the third business day after being received. Wire transfers, on the other hand, are usually faster and more secure, with funds becoming available on the same business day if received before 6 pm ET.

Finally, it is worth noting that transferring funds between different types of accounts may have different timelines. For instance, transferring from an external account to an E*TRADE Brokerage account may take until the third business day after the transfer request is entered, provided it was submitted before 4 pm ET.

If you are experiencing a delayed transfer, it may be due to one of the reasons outlined above. It is always a good idea to check the status of your transfer and refer to Etrade's guidelines for specific transfer methods and account types.

Cash App Investing: Free or Fee-Based?

You may want to see also

Good faith violation

When you buy securities, you must fully pay for them on or before the settlement date. If you don't, you risk creating good faith or freeride violations.

A good faith violation (GFV) is issued when a position is opened using unsettled funds, and that position is then closed before the funds used to make the opening trade have settled. The settlement period for a stock or options trade is the trade date plus one business day (T+1).

If you are issued a GFV, it will remain on that account for a 12-month rolling period. If an account is issued its third GFV within a 12-month rolling period, then the account will be restricted to settled-cash status for 90 days from the due date of the third GFV. This means you will be required to have settled cash in that account before placing an opening trade during those 90 days.

On Tuesday, February 3, a customer sells 100 settled shares of stock ABC, which generates proceeds of $5,000. This trade will settle on T+1, which is Wednesday, February 4. The customer then uses the funds to purchase shares of stock XYZ on the same day. On Tuesday, February 3, the customer sells the shares of XYZ. Because the shares of XYZ were bought and then sold using unsettled funds from the ABC sale, a GFV will be issued. To avoid a GFV, the customer would need to hold the XYZ shares until Wednesday, February 4 (when the sale of ABC settles), before selling them.

You can avoid a GFV by waiting until the funds from the sale of your settled shares have settled before using them to buy more shares.

Square Cash: A Smart Investment Strategy for Beginners

You may want to see also

Freeride violation

A freeride violation is a violation of the Federal Reserve Board's Regulation T. It occurs when a position is opened without sufficient funds and is then closed before funds are deposited into the account. In other words, it is the practice of buying shares or other securities in a cash account and then selling them before the purchase has settled. This can happen even if the trader has enough money to pay for the trade.

Freeriding can occur when there are different settlement dates for different securities. For example, stock and ETF transactions settle in two business days (T+2), while mutual fund and options transactions settle in one day (T+1). If a trader buys shares in a company, and the sale settles two days after the purchase, the trader's account will be credited with the proceeds immediately. The trader can then use those proceeds to cover the original purchase when it settles. In effect, the trader has sold the shares before they bought them.

Freeriding can also refer to an illegal practice in which a member of an underwriting syndicate withholds part of a new securities issue and later sells it at a higher price. This practice is prohibited by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

If a trader is suspected of freeriding, their cash account must be suspended or restricted for 90 days. During this time, the trader may still buy securities, but the purchase must be made using cash on the same day, rather than on the settlement date.

To avoid freeriding violations, traders can use a margin account. A margin account is a loan issued to an investor by a broker or dealer, allowing them to conduct trades. The securities purchased and any cash deposited by the investor act as collateral, and the investor agrees to pay interest on the loan.

In summary, a freeride violation occurs when a trader buys and sells securities without having enough capital in their account to cover the purchase. This is a violation of Regulation T, which requires that investors fully pay for securities on or before the settlement date. To avoid freeriding, traders can use margin accounts or wait until their deposits have settled before trading.

Understanding Dividends: Cash Dividends and Their Nature

You may want to see also

Verification delay

If your cash is not available to invest on E-Trade, it could be due to a verification delay.

E-Trade requires that all stock purchases be paid in full on or before the settlement date. The settlement period is the time between the trade date (the date when the transaction occurs) and the settlement date (the date when the payment is made and the transfer of the securities' ownership occurs). In general, stocks settle one business day after the trade date. However, it's important to note that banking holidays are non-settlement days, and while you can trade on these days, they are not included in the settlement period.

When you transfer money to your E-Trade account, it usually takes some time for the funds to become available for investment. This delay can be due to the verification process, which ensures that the actual money is available and that there are no issues with the transfer. The time it takes for the funds to become available can vary, but it can often take several business days or even up to a week.

During this verification delay, the funds may show up in your account balance, but they may not be available for immediate investment. This delay can be frustrating, but it is a standard procedure to ensure the security and integrity of the transactions.

To avoid any issues, it's important to plan ahead when transferring funds to your E-Trade account. Allow for sufficient time, especially if you are transferring a large sum of money or if it is your first deposit. Additionally, be mindful of banking holidays, as they can extend the time it takes for your funds to become available for investment.

Cash Advance Investment Strategies: A Guide to Getting Started

You may want to see also

Holiday disruption

When you sell securities, the cash is not immediately available. There is a settlement period of up to two days for most stocks, mutual funds, and ETFs; bonds typically take slightly longer. The settlement period is the time between the trade date and the settlement date. In general, stocks settle on the trade date plus one business day. However, banking holidays, like Columbus Day and Veterans Day, are non-settlement days where the securities markets remain open. While trading can occur on these days, they are not included in the settlement period.

For example, if you sell a stock on Monday, it will settle on Wednesday. The cash will be available on Wednesday for withdrawal or transfer. If you sell it on Thursday, it will settle on the following Monday (weekends are not counted). If there is a market holiday, it will be skipped over. So, if you sell a stock the Thursday before Memorial Day weekend, the cash will be available when it settles on the following Tuesday.

It is important to note that if you check your account's cash balance on Friday (in the Memorial Day example), it will show the proceeds from your stock sale. However, these are not settled funds and are therefore not available for withdrawal until Tuesday.

To avoid issues with holiday disruptions, always check to make sure you have enough available cash before attempting a withdrawal from your investment account. Planning ahead is essential, as investment accounts are not the same as bank accounts, and funds may take several days to settle.

Investing vs Financing Activities: Cash Flow Impact

You may want to see also

Frequently asked questions

There could be a few reasons for this. It may be that the funds are still settling, which can take up to one business day for stocks and options trades. It could also be that the cash is being held due to a purchasing power hold, which can take up to a week. If you believe there is an error, you can check your balance page for available cash for investment and contact Etrade customer support for further assistance.

For stocks and options trades, the settlement period is the trade date plus one business day (T+1). Banking holidays, such as Columbus Day and Veterans Day, are non-settlement days, so while you can trade on these days, they are not included in the settlement period.

A purchasing power hold is when Etrade places a hold on your funds for a period of time, usually up to a week, before they are available for investment. This can happen for various reasons, such as to verify the actual money or due to a good faith or freeride violation.