Investment is a key driver of economic growth. When businesses see an improvement in economic forecasts, they will increase investment to meet future demand. This can cause a substantial rise in investment, which in turn can increase the rate of economic growth. However, there are other factors that affect economic growth, such as consumer spending, exports, interest rates, business confidence, technological progress and government regulations.

| Characteristics | Values |

|---|---|

| Investment and GDP | Investment increases when GDP increases |

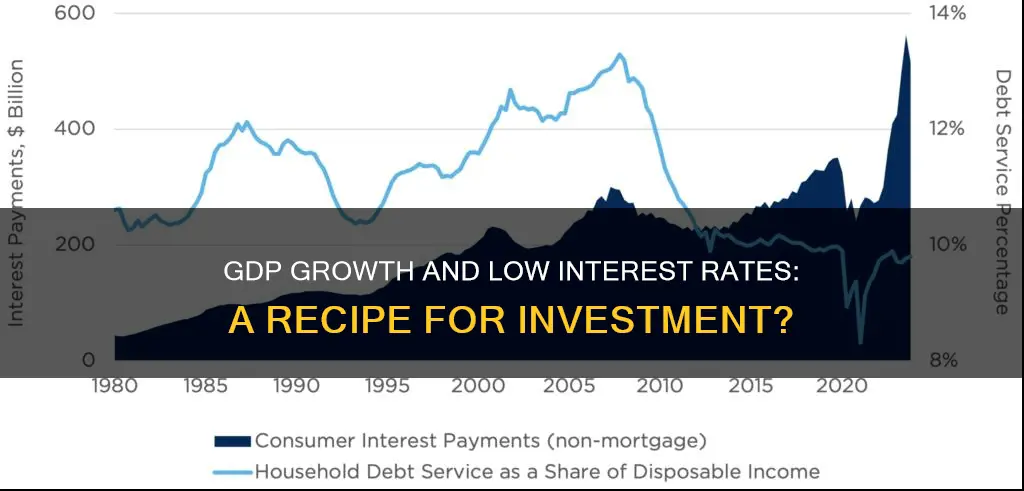

| Investment and interest rates | Investment increases when interest rates decrease |

What You'll Learn

The accelerator theory

There are other factors that affect investment apart from economic growth. For example, if there was a fall in consumer spending or a fall in exports, then a rise in investment may not actually increase AD. Investment is not the biggest component of AD (approx 16%); the biggest component of AD is consumer spending (approx 66%). Additionally, the level of investment depends on the rate of interest, business confidence, technological progress and government regulations.

Therefore, it can be said that investment will increase when GDP increases, as long as other factors remain constant. However, if interest rates decrease, this may also cause an increase in investment, as businesses will be more confident to invest.

Acorn Investments: Interest Payments and Your Money

You may want to see also

Business confidence

If businesses are confident about the future of the economy, they are more likely to increase investment to meet rising demand. This is particularly true if there is spare capacity in the economy, as increased investment can lead to a higher rate of economic growth. However, if the economy is close to full capacity, rising demand may only cause inflation without a corresponding increase in real GDP.

The accelerator theory suggests that the level of investment is closely tied to the rate of change in economic growth. When the economy is growing, businesses will invest more to expand their operations and take advantage of new opportunities. Conversely, during an economic downturn, businesses may cut back on investment to reduce costs and preserve cash flow.

In addition to economic growth and interest rates, business confidence is also influenced by other factors such as technological progress and government regulations. For example, businesses may be more willing to invest if they anticipate new technologies that can improve their operations or if they expect favourable policies from the government.

Overall, business confidence plays a crucial role in investment decisions. Businesses will increase investment when they are confident about the future of the economy, particularly if they expect rising demand and have the capacity to expand their operations. However, other factors such as consumer spending and exports can also impact investment decisions, and a rise in investment does not always lead to an increase in economic growth.

Compounding Interest: Annual vs. Quarterly, Which is Better?

You may want to see also

Technological progress

However, it is important to note that the relationship between technological progress and investment is not always linear. The level of investment also depends on other factors, such as the rate of interest, business confidence, and government regulations. For example, if there is an economic downturn, businesses may cut back on investment, even if there have been technological advancements.

Additionally, technological progress can impact the efficiency of investments. For example, if a business invests in new technology that increases its production capacity, it may be able to produce more with less input, thereby increasing its efficiency. This can have a positive impact on the business's bottom line and may encourage further investment in technology.

Overall, technological progress can play a significant role in investment decisions. Businesses that are able to stay at the forefront of technological advancements and adapt to new technologies may be better positioned to increase their investment and meet future demand. However, it is important to consider the interplay between technological progress and other factors, such as interest rates and business confidence, to fully understand the complex dynamics of investment behaviour.

Interest Rates: The Investment Influencer

You may want to see also

Government regulations

The accelerator theory states that the level of investment is directly linked to the rate of change in economic growth. In addition to economic growth, investment levels are also influenced by interest rates, business confidence, and technological progress. Government regulations play a crucial role in shaping these factors and, ultimately, investment decisions.

For instance, government policies that encourage economic growth, such as fiscal stimulus packages or favourable trade agreements, can boost business confidence and increase investment. On the other hand, regulations that impose additional costs or restrictions on businesses may dampen their confidence and lead to reduced investment.

Moreover, government regulations can directly impact investment through policies that either incentivise or discourage investment. For example, tax breaks or subsidies for specific industries can encourage businesses to invest more, while stringent environmental or labour regulations may require businesses to invest in compliance measures, potentially reducing their overall investment levels.

Overall, government regulations are a critical factor influencing investment decisions. By shaping the economic landscape, business confidence, and the regulatory environment, governments can either encourage or deter investment, which has a significant impact on economic growth and development.

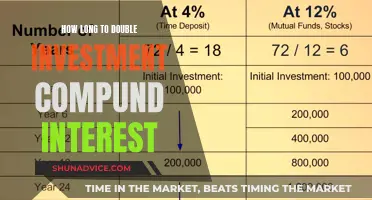

Unlocking Compound Interest: Smart Investments for Long-Term Growth

You may want to see also

Consumer spending

Business investment tends to be quite volatile. If businesses see an improvement in economic forecasts, they will increase investment to meet future demand. Therefore, an improvement in the rate of economic growth can cause a substantial rise in investment. But, if there is an economic downturn and a fall in the rate of economic growth, business will cut back on investment. The accelerator theory states that the level of investment is dependent on the rate of change of economic growth. However, in addition to the rate of economic growth, the level of investment also depends on the rate of interest, business confidence, technological progress and government regulations.

Monthly Interest Payments: Do Investments Reap Benefits?

You may want to see also

Frequently asked questions

Yes, if there is spare capacity, then increased investment and a rise in AD will increase the rate of economic growth.

Yes, if interest rates decrease, then the cost of borrowing money decreases, which can encourage businesses to invest more.

In addition to the rate of economic growth, the level of investment also depends on business confidence, technological progress and government regulations.

The accelerator theory states that the level of investment is dependent on the rate of change of economic growth.