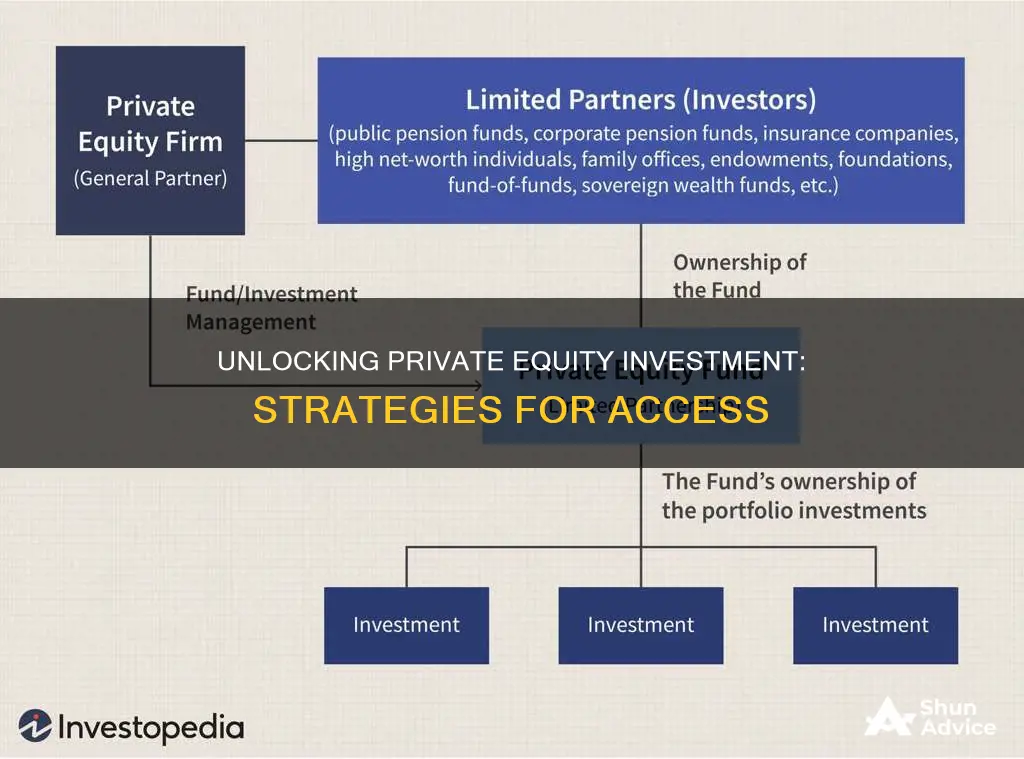

Private equity is an exciting opportunity for investors to support privately held companies that have not yet gone public. Private equity funds are managed by private equity firms that oversee funds that invest in companies. Investors contribute to these funds and are paid based on the profits that the companies generate. Private equity funds are the vehicles that firms use to raise funds and acquire businesses. These funds are typically run for 7-10 years and come with predefined fees and payout schedules. There are several ways to invest in private equity, including through mutual funds, exchange-traded funds, SPACs, and crowdfunding. However, it's important to note that many private equity opportunities are only offered to qualified investors and may require a sizable minimum commitment as well as a high net worth.

| Characteristics | Values |

|---|---|

| Minimum Investment | $25 million, though some firms have lowered this to $250,000 or even $25,000 |

| Types of Private Equity Investment | Venture Capital, Growth Equity, Leveraged Buyouts |

| Types of Private Equity Funds | Funds of Funds, Exchange-Traded Funds (ETFs), Special Purpose Acquisition Companies (SPACs) |

| Investment Period | 10-12 years |

| Investor Type | Institutional investors, Wealthy Individuals, Individual Investors |

What You'll Learn

Private equity funds

There are three key types of private equity strategies:

- Venture capital: This involves investing in early-stage startups, often in sectors such as software and healthcare, technology, or energy.

- Growth equity: This strategy focuses on middle-stage companies that are beyond the startup phase and are seeking capital for growth.

- Buyouts: This is when a mature company is purchased outright, often with the goal of internal improvements or restructuring.

The minimum investment in private equity funds is typically $25 million, although some firms have lowered this minimum to as low as $250,000 or even $25,000. However, this is still out of reach for most individual investors. To become an accredited investor, you must meet certain income or net worth requirements.

There are a few ways to invest in private equity funds:

- Primary investments: These are investments in private equity funds managed by general partners, providing diversified exposure to various sectors through multiple underlying portfolio companies.

- Co-investments: These provide exposure to a single portfolio company, alongside a general partner, who typically offers co-investment opportunities to current and prospective limited partners.

- Secondary investments: This involves acquiring existing interests in a private equity fund through the secondary market, allowing buyers to achieve diversification through investing in a more mature portfolio of identified assets.

When investing in private equity funds, due diligence is critical. It is important to research and select a reputable private equity firm, consider their investment minimums, areas of expertise, and exit strategies. Additionally, investors should be aware of the risks associated with private equity, including the illiquid nature of the investment and the potential for higher fees.

A Guide to Investing in G-Secs in India

You may want to see also

Exchange-traded funds (ETFs)

ETFs are an excellent way to gain access to private equity investments, which involve deploying capital to private companies not publicly traded on stock exchanges. Private equity ETFs hold companies that can be financially complicated as they are strongly transaction-oriented and use leverage. However, they provide investors with exposure to private equity and can offer significant and attractive returns on investment.

- Diversification and Risk Management: ETFs provide instant diversification by allowing investors to buy multiple stocks or bonds at once. They are also considered safer than individual stocks due to their wide array of underlying holdings, which helps to reduce the risk of exposure to individual securities. Additionally, ETFs that focus on targeted industries or sectors can further enhance diversification.

- Lower Fees and Expenses: ETFs often have lower fees and expense ratios compared to other types of funds, including mutual funds. This is because ETFs typically have lower management costs and, in some cases, no commission fees. However, it is important to evaluate the management expenses and commissions of the specific ETF you are considering.

- Tax Efficiency: ETFs are generally more tax-efficient than mutual funds. Since most buying and selling occur through an exchange, there is no need to redeem shares each time an investor wishes to sell or issue new shares for a purchase. This results in lower tax liabilities for ETF shareholders.

- No Minimum Investment Requirements: Unlike mutual funds, ETFs do not typically have minimum investment requirements. However, since ETFs trade on a per-share basis, you will need enough to purchase at least one share to get started, unless your broker offers fractional shares.

- Liquidity: ETFs are more liquid than mutual funds, meaning they are easier to buy and sell. Online brokers make it convenient to trade ETFs with just a click of a mouse.

- Passive vs. Active ETFs: There are two main types of ETFs: passive and active. Passive ETFs are also known as index funds and aim to replicate the performance of a stock index like the S&P 500. Active ETFs, on the other hand, hire portfolio managers to actively make investment decisions to try to beat the index's performance. Passive ETFs tend to be cheaper, while active ETFs may offer the potential for higher returns but come with higher fees.

- Popular Private Equity ETFs: Two of the most popular private equity ETFs currently available are the Invesco Global Listed Private Equity Portfolio (PSP) and the ProShares Global Listed Private Equity ETF (PEX). PSP provides exposure to approximately 70 publicly-listed private equity companies worldwide and has an expense ratio of 1.44%. PEX aims to provide returns similar to the performance of the LPX Direct Listed Private Equity Index and has a higher expense ratio of 3.31%.

In conclusion, ETFs offer a viable option for gaining access to private equity investments. They provide diversification, lower fees, tax efficiency, and flexibility in terms of investment amounts. When considering ETFs, it is important to evaluate factors such as management expenses, commission fees, investment objectives, and the level of diversification offered.

India: A Smart Investment Choice?

You may want to see also

Mutual funds

The minimum investment for mutual funds can be in the range of $100,000 to $250,000, and the fund manager may require a net worth of $1 million to $5 million to allow participation.

Additionally, mutual funds typically have their own rules restricting investment in illiquid equity and debt securities. They also have a finite term of 10 to 12 years, and the money invested is not available for subsequent withdrawals.

Understanding Managed Investment Solutions: Your Money, Managed

You may want to see also

Special Purpose Acquisition Companies (SPACs)

Here's how SPACs typically work:

- Formation: An experienced management team or sponsor forms a SPAC with nominal invested capital, usually translating to a ~20% interest in the SPAC (founder shares).

- Initial Public Offering (IPO): The SPAC raises capital through an IPO, offering "units" consisting of a share of common stock and a fraction of a warrant. The remaining ~80% interest is held by public shareholders.

- Target Company Identification: The SPAC typically has 18-24 months to identify and complete a merger with a target company (de-SPACing). The SPAC management team usually targets an industry or sector but not a specific company.

- Merger or Acquisition: Once a target company is identified, the SPAC announces the merger. Public shareholders of the SPAC can choose to redeem their shares if they disagree with the transaction. The target company then becomes a public entity through the merger.

- Post-Merger: The target company must quickly prepare itself to operate as a public company, addressing accounting, reporting, and other public company readiness requirements.

SPACs offer several advantages, including providing access to capital, higher valuations for target companies, reduced transaction fees, and a faster route to becoming a public company. However, challenges include meeting accelerated timelines and complex accounting, financial reporting, and registration requirements.

SPACs are a risky investment option due to the accelerated timelines and potential for inadequate due diligence. Investors should carefully consider their risk appetite and seek expert advice before investing in SPACs or other private equity opportunities.

Inventories Management and Inter-corporate Investments: Strategies for Success

You may want to see also

Crowdfunding

Pros of Equity Crowdfunding:

- Access to a wider pool of investors, including both accredited investors and everyday consumers.

- The potential to raise more cash by selling shares to multiple investors.

- No loan repayments or debt-related credit checks required.

- Potential buzz and marketing for your business, as well as connections to potential customers.

- Streamlined accounting and financial reporting, as equity platforms may pool funds into a single investment.

Cons of Equity Crowdfunding:

- Selling part of your business may be problematic if investors want a say in your operations or decision-making.

- Time and effort are needed to create a persuasive presentation, including marketing plans, financial projections, and possibly a video.

- Compliance with state and federal security filing rules is necessary, and there is a fiduciary duty to keep shareholders informed about the company's performance.

Examples of Crowdfunding Platforms:

- MicroVentures

- Capital Cell

- Kickstarter

Tips:

If you participate in equity crowdfunding, ensure you do so as an investor and not as a donor. Donating does not imply a hope for a financial return, whereas investing does.

Final Thoughts:

Investment Management Fees: Are They Tax Deductible?

You may want to see also

Frequently asked questions

Private equity is a type of investment that allows investors to support privately held companies. Private equity is available to individual investors and large institutional investors alike.

Private equity is about investing in a small private company, using pooled investment funds managed by private equity firms. The companies that become investments are not publicly traded on any exchanges. Public markets, on the other hand, are open to investors of all types and are traded on various stock exchanges.

There are several key risks in any private equity investing. The fees of private-equity investments that cater to smaller investors can be higher than those of conventional investments. This could reduce returns. Additionally, the more private equity investing opens up to more people, the harder it could become for private equity firms to locate excellent investment opportunities.

The minimum investment in private equity funds is typically $25 million, although it sometimes can be as low as $250,000 or even $25,000.

There are several ways to branch into private equity investing, including through mutual funds, exchange-traded funds, SPACs, and crowdfunding. However, keep in mind that many private equity opportunities are only offered to qualified investors and may require a sizable minimum commitment as well as a high net worth.