Cash flow investing is a strategy to generate regular cash distributions from an investment. This can be achieved by buying a portion or all of an asset that can be leased or used to generate income. For example, in real estate investing, cash flow is the result of proceeds from rent payments.

There are a variety of investing activities that can generate cash flow, including the purchase of physical assets, investments in securities, or the sale of securities or assets. These can be long-term investments in the health or performance of a company, or they can be made to generate income on their own.

Generating cash flow from investments is a way to build wealth steadily and design your own lifestyle. It is also a way to create financial freedom and can be an effective strategy for entrepreneurs to build wealth for the long term.

| Characteristics | Values |

|---|---|

| Investment types | Real estate, dividend stocks, REITs, P2P lending, online businesses, savings accounts, CDs, bonds, rental properties, farmland, timberland, franchises, royalties |

| Investment goals | Wealth generation, financial freedom, retirement funds, passive income |

| Investor profile | Entrepreneurs, small business owners, investors looking for diversification |

| Investment approach | Long-term, short-term, passive, active |

| Investment risks | Market volatility, default risk, liquidity risk |

What You'll Learn

Reinvesting in your business

- Marketing and Advertising: Digital marketing is essential for small businesses to gain exposure and capture a significant market share. Invest in search engine optimization (SEO), content marketing, influencer marketing, and online ads to effectively reach your target audience.

- Human Capital: Hire new personnel and provide training opportunities and benefits to retain top talent. A skilled and motivated team is invaluable to your business's success.

- Capital Improvements: Purchase new infrastructure, equipment, and assets to improve your business operations and product quality. This includes investing in new technology, vehicles, or real estate to support your business's growth.

- External Acquisitions: Consider acquiring or merging with competitors to gain access to new technologies, increase market share, and improve your competitive position.

- Emergency Fund: Build an emergency fund to safeguard your business against unforeseen events, such as temporary losses of income or unexpected expenses. This provides a financial cushion to help your business survive during challenging times.

- Research and Development: Invest in improving your products and services. Conduct market research, gather customer feedback, and test new systems to enhance your offerings and stay ahead of the competition.

- Inventory: Ensure you have sufficient inventory to meet customer demand. Regularly review your stock levels and supply chain to avoid stockouts and maximize sales.

- Continuing Education: Invest in your professional development and that of your employees. Enroll in courses, seminars, or workshops to stay up-to-date with industry best practices and enhance your skills and those of your team.

Investing Cash: Strategies for Smart Money Allocation

You may want to see also

Long-term investments in the right places

Long-term investments are a great way to secure your financial future. Here are some of the best long-term investment options:

Stocks

Stocks are considered one of the best long-term investments due to their strong historical performance. When you buy a stock, you own a small part of a company. As the company grows its revenue and earnings over time, the stock price rises.

There are different types of stocks to consider for long-term investments:

- Growth stocks are companies expected to grow their revenues and earnings at a higher rate than their industry peers. They come with more potential upside but can be riskier. Examples include Amazon, Nvidia, and Tesla.

- Value stocks are companies whose shares are priced lower than their actual value based on metrics like earnings and sales. They are considered safer but may have less upside potential. Examples include Exxon Mobil, Johnson & Johnson, and Verizon Communications.

- Dividend stocks are companies that distribute a portion of their earnings to investors in the form of cash or additional shares. Examples include AT&T, Walgreens Boots Alliance, and 3M, which offer dividend yields above 5%.

Bonds

Bonds are a type of fixed-income investment. When you buy a bond, you lend money to a company or government entity for a set period, and they pay you a fixed interest rate. Bonds can help balance out a stock-heavy portfolio and provide stability.

There are different types of bonds to consider:

- Corporate bonds are issued by companies and can be investment-grade (lower interest rates, strong credit ratings) or high-yield/junk bonds (higher yields, higher default risk).

- U.S. Treasury securities are considered the safest type of bond as they are backed by the U.S. government. They include Treasury bills, notes, bonds, and Treasury Inflation-Protected Securities (TIPS).

- Municipal bonds are issued by local governments and tend to be unique, so investors face liquidity risks if they plan to sell before maturation.

Real Estate

Real estate is a popular long-term investment option. It can provide stable income through renting or leasing properties and potential profit from rising real estate prices over time.

One way to invest in real estate is through Real Estate Investment Trusts (REITs). REITs are companies that own, operate, or finance a portfolio of real estate properties. They are required to distribute at least 90% of their taxable income to shareholders as dividends, offering attractive dividend yields.

Investment Funds

Investment funds pool money from multiple investors to buy a portfolio of stocks, bonds, or other securities. They are managed by professionals and provide easy diversification at a relatively low cost.

There are two main types of investment funds:

- Mutual funds trade once a day at the fund's closing market price. They usually have higher investment minimums and management fees.

- Exchange-Traded Funds (ETFs) trade throughout the day, similar to stocks. They typically have lower investment minimums and management fees than mutual funds.

Commodities

Commodities are raw materials used to produce goods and services, such as gold, silver, oil, and agricultural products. Instead of buying commodities directly, regular investors should consider investing in commodities funds, which provide diversification and hedge against inflation.

Online Businesses

Online businesses are an often-overlooked investment opportunity. They offer low start-up capital, unlimited earning potential, and the ability to generate passive income. You can start with a small investment, such as an affiliate business, and gradually build your asset.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending allows individuals to lend money directly to borrowers outside of traditional financial institutions. Qualified applicants can use P2P platforms like Lending Club to connect with lenders, who can then earn cash flow from loan interest.

High-Yield Savings Accounts

While not as lucrative as other investments, high-yield savings accounts can provide a safe and easily accessible place to park your money. They are ideal for short-term savings and offer higher interest rates than traditional bank savings accounts.

Robo-Advisor Portfolios

Robo-advisors are automated services that build and manage investment portfolios based on your goals, time horizon, and risk tolerance. They offer a hands-off approach to investing and typically invest in low-cost, diversified funds like ETFs.

Retirement Accounts

Retirement accounts like Roth IRAs and 401(k)s are excellent vehicles for long-term investing. They offer tax advantages, such as tax-free growth and withdrawals, and can hold a variety of investments, including stocks, bonds, and funds.

When considering long-term investments, it's important to understand the risks and potential returns of each option and choose a strategy that aligns with your financial goals and risk tolerance. Diversification is also key to long-term investing success.

Investments and Cash Equivalents: What's the Real Difference?

You may want to see also

Short-term wealth-building tactics

- Set Clear and Realistic Investment Goals: Define specific and measurable goals that align with your financial situation and objectives. For example, aim for a certain percentage of annual returns or target a specific amount for retirement by a particular age. This provides a roadmap and benchmark for your investments.

- Focus on Short-Term Income Generation: If your priority is short-term wealth accumulation, consider investment opportunities that offer quicker returns. This could include investing in dividend stocks, which provide quarterly or annual distributions, or exploring peer-to-peer lending platforms, where you can earn interest on micro-loans.

- Take Advantage of Compound Interest: Start investing early to maximize the benefits of compound interest. By reinvesting the interest earned, your portfolio can experience exponential growth over time, allowing your short-term investments to snowball into significant wealth.

- Diversify Your Investments: Diversification is a powerful tool to manage risk. Spread your investments across various asset classes, such as stocks, bonds, and real estate. This ensures that even if one investment or sector underperforms, others can offset those losses.

- Automate Your Financial Life: Set up automatic transfers for savings and investments. Automation ensures consistency in building wealth, reduces the temptation to spend, and eliminates the risk of missing payment deadlines.

- Stay Up-to-Date with Market Trends: Keep yourself informed about market trends and investment opportunities. For example, consider investing in growth sectors like technology, where you can aim for above-average returns, or explore online business opportunities, which offer flexibility and the potential for high returns with limited start-up capital.

Remember, short-term wealth-building requires a strategic and disciplined approach, and it's important to carefully consider your financial situation, risk tolerance, and goals when making investment decisions.

General Partners: Cash Investment Strategies and Decisions

You may want to see also

Dividend-paying stocks

Dividend yields are the dividend amount paid per share, expressed as a percentage of the company's share price. For example, if a company's board of directors decides to issue an annual 5% dividend per share, and the company's shares are worth $100, the dividend is $5. If the dividends are issued quarterly, each distribution is $1.25. Dividend yields of 3-5% are often realistic returns, and dividends can be a good way to generate meaningful income over time.

When investing in dividend-paying stocks, it's important to evaluate the dividend yield and payout ratio compared to similar companies. A very high dividend yield can be a red flag, indicating that the payout may be unsustainable or that the company is going into debt to pay dividends. A payout ratio above 80% means the company is putting a large percentage of its income towards dividends.

Some examples of companies that pay dividends include Walmart Inc. (WMT) and Unilever (UL), which make regular quarterly dividend payments. Realty Income (O) is also known as "the monthly dividend company" and has paid a dividend every month for over 650 consecutive months. Costco Wholesale (COST) is another example of a company that pays special dividends in addition to its regular quarterly dividend.

Easy Ways to Earn Paytm Cash Without Investment

You may want to see also

Real estate

Buy Positive Cash Flow Rentals

This may seem obvious, but it's important to buy rental properties that generate positive cash flow. Here are some steps to create positive cash flow:

- Buy at a discount: Look for properties that are priced below market value to maximize your resulting cash flow.

- Perform a full cash flow analysis: Understand how to analyze a rental property to ensure it's profitable from the start. Seek inexpensive training if needed.

- Ensure proper property management: Closely manage your property to maintain positive cash flow. Consider hiring a property management company, especially if you have multiple rental properties.

- Find ways to add value: Look for opportunities to create additional cash flow from the same property, such as renting out parking spots or garages.

Buy and Renovate Properties

Another strategy is to buy properties at a discount, renovate them, and then sell them at a higher price. However, be cautious as property flipping can be labour-intensive and time-consuming. Ensure you factor in all costs, including labour, repairs, and holding costs, to avoid losing money.

Charge Finder's Fees

If you're raising capital for joint venture deals, you can charge a finder's fee, typically 1%-2% of the deal value. This can provide extra cash flow without much additional work.

Become a Mortgage Agent

If you're already dealing with private lenders and real estate investors, consider becoming a licensed mortgage agent. This will allow you to connect private lenders with homeowners or investors seeking mortgage financing, earning you a commission.

Bird-Dogging

If you're part of a real estate network, you can offer to find investment properties for other investors in exchange for a finder's fee. This involves driving around neighbourhoods or searching real estate listings for potential deals. You don't need to make offers or represent the investor, making it a relatively simple way to earn extra cash.

Assigning Deals to Investors

Once you have some experience, you can take it a step further by not only finding deals but also negotiating and locking up properties under contract with attractive terms for other investors. You can then assign or transfer the contract to another investor for a fee, typically ranging from $2,000 to $10,000 or more.

Become a Licensed Realtor

If you want to get involved in the buying and selling process, consider becoming a licensed realtor. This will give you access to local real estate board resources and the ability to find the best deals before other investors.

Sever Land Lots/Convert a Single Property into Multiple Units

Look for properties with large attached lots that can be severed and sold separately, providing a chunk of cash to invest in other properties. Alternatively, look for properties that can be converted into multiple units, such as a duplex, to increase your rental income.

Take Advantage of Highest and Best Use

Sometimes, properties are not utilized to their full potential. By making minor changes, you can increase the cash flow. For example, you might acquire a triplex zoned for commercial use but currently rented to residential tenants. By switching to commercial tenants, you can often command higher rents and increase your cash flow.

Charge Property Management Fees

If you own multiple rental properties and are skilled at property management, consider offering property management services to other investors. This can be a great way to generate additional income while also benefiting from economies of scale in managing your own properties.

Charge Project Management Fees

If you're already managing renovations for your properties, you can offer project management services to other investors. This involves coordinating trades, dealing with permits, and ensuring a clean job site. You can charge a flat fee or a percentage of the total job cost.

Charge Consulting Fees

Once you have experience and expertise in real estate investing, you can offer consulting services to new investors. Your knowledge can help others avoid costly mistakes, and they will be willing to pay for your advice and guidance.

Apply for Government Funding

Research government grant and loan programs related to real estate. There are often funds available for down payments, renovations, tenant support, and mortgage payments. These can provide additional financial support to boost your cash flow.

Buyers' Strategies to Minimize Cash Outlay During Acquisitions

You may want to see also

Frequently asked questions

Cash flow investments are assets that provide regular income. Examples include real estate, dividend stocks, and peer-to-peer lending.

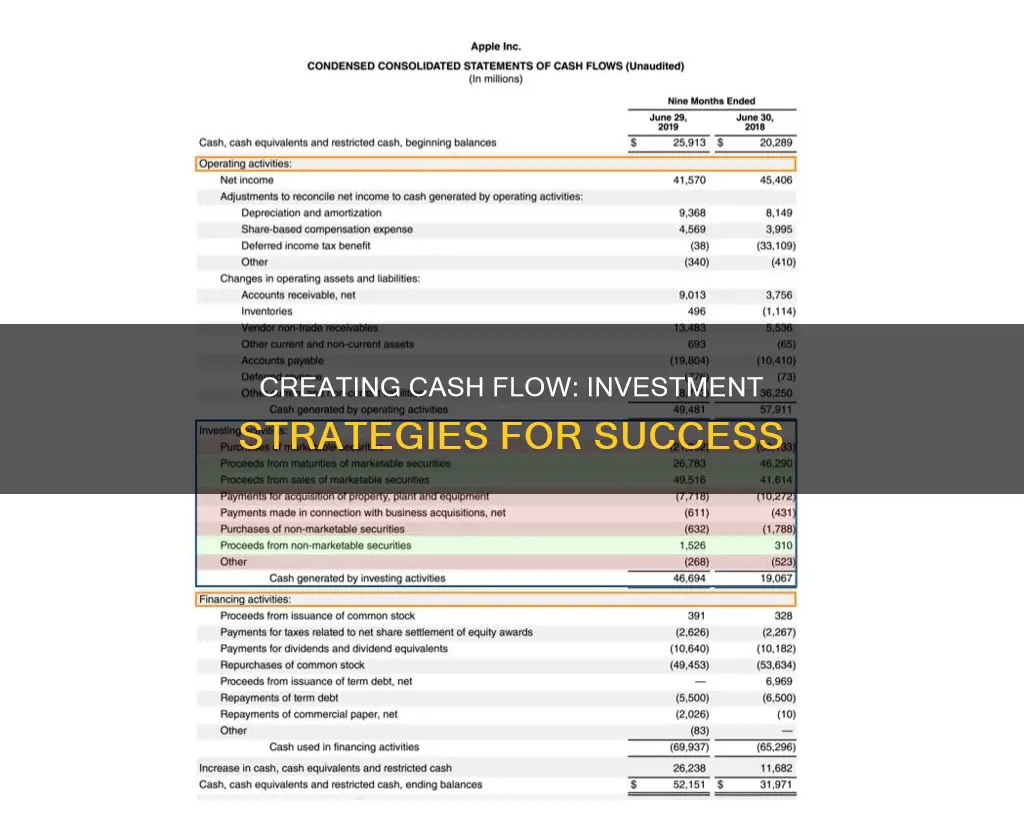

Cash flow is the difference between the money coming in (income) and the money going out (expenses). A positive cash flow indicates that a business has money to reinvest and grow, while a negative cash flow may indicate financial issues.

Here are some tips for investing for cash flow:

- Diversify your investments to reduce risk.

- Consider investing in assets that provide consistent and stable income, such as dividend stocks or rental properties.

- Research and understand the potential risks and returns of each investment before committing.

- Seek advice from a qualified financial advisor to ensure your investments align with your financial goals and risk tolerance.