DBS offers a range of investment options for individuals looking to maximise their Supplementary Retirement Scheme (SRS) savings. By investing SRS funds, individuals can combat inflation and potentially achieve higher returns compared to the low-interest rate offered by idle SRS accounts. DBS customers can invest their SRS savings in various assets, including stocks, exchange-traded funds (ETFs), unit trusts, Singapore Savings Bonds (SSBs), insurance, and fixed deposits. Before investing, individuals should carefully consider their financial goals, risk tolerance, and seek professional advice if needed. DBS provides resources such as the NAV Planner and Wealth Planning Manager to help customers make informed financial decisions.

| Characteristics | Values |

|---|---|

| What is SRS? | Supplementary Retirement Scheme |

| Interest rate | 0.05% per annum |

| How to invest using SRS? | Stocks, Exchange Traded Funds (ETFs), Unit Trusts, Singapore Savings Bonds (SSBs), Insurance, Fixed Deposits, Bonds, REITs, Gold Shares, Singapore Government Securities, Single Premium Insurance |

| DBS SRS account opening requirements | Be at least 18 years old, not be an undischarged bankrupt, not be mentally disordered and capable of managing yourself and your affairs |

| DBS Vickers Online Trading Account requirements | Link your CPF/SRS account to your DBS Vickers Online Trading Account |

| Settlement currency for CPF/SRS trades | Singapore Dollars |

| Transaction fee for SSB application and redemption request | S$2 |

| Other third-party charges | Central Depository (CDP) administrative fees |

What You'll Learn

How to open an SRS account

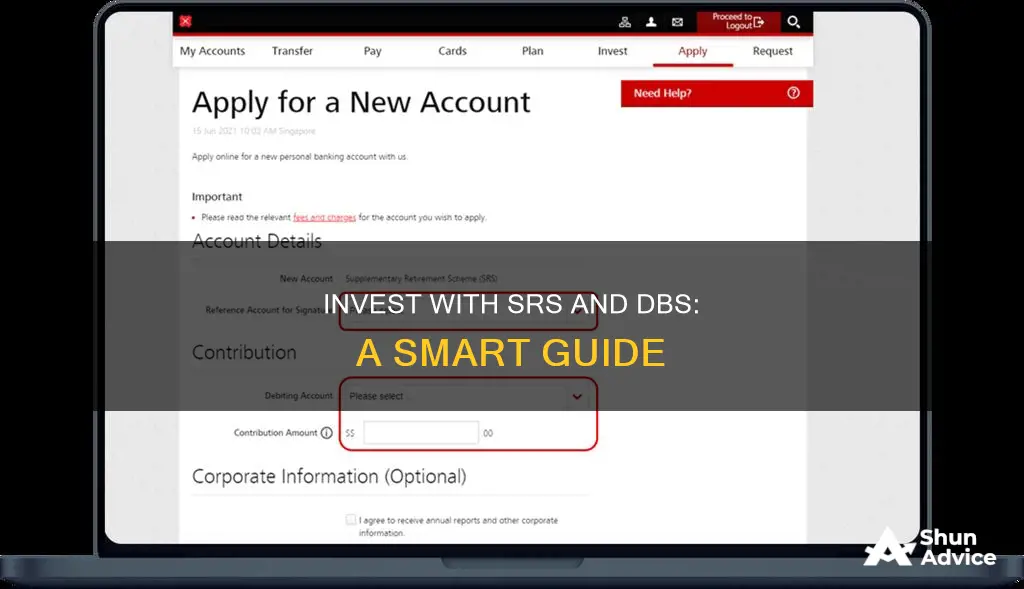

To open an SRS account, you must be at least 18 years old and not bankrupt. You can open an account instantly via digibank Online or by visiting a DBS/POSB branch with your NRIC/Passport.

- Log in to digibank Online with your User ID and PIN.

- Complete the Authentication Process.

- Under "Apply", click on "Supplementary Retirement Scheme (SRS)".

- Click on "Instant Apply" under Supplementary Retirement Scheme.

- Select your Reference Account for Signature, choose your Debiting Account, and indicate a Contribution Amount. You can choose to make a contribution now or later via Funds Transfer.

- Ensure your details are updated, check the Acknowledgement, and click Next.

- Verify the details and click Submit to complete the application.

If you apply via digibank Online between 0700 and 2200 hours daily or between 0700 and 1900 on the last business day of the month, your account will be opened instantly.

Fidelity Investments: Sport Clips' Financial Management Partner

You may want to see also

Investment options

DBS Vickers offers a range of investment options for those looking to utilise their Supplementary Retirement Scheme (SRS) savings. Here are some of the investment options available:

- Stocks: You can invest in stocks through a DBS Vickers account. Stocks allow you to invest in specific companies and industries, offering the potential for higher returns but also carrying higher risks.

- Exchange-Traded Funds (ETFs) : ETFs are investment funds traded on stock exchanges, offering diversification like unit trusts. They are designed to mimic the performance of a stock, bond, or commodity index. ETFs can be purchased with cash, CPF, and SRS funds, providing flexibility for investors.

- Unit Trusts: Unit trusts are a type of investment fund that pools money from multiple investors to purchase a diversified portfolio of assets. They are managed by professional fund managers and can provide access to a wide range of investments, such as stocks, bonds, or other securities.

- Singapore Savings Bonds (SSBs): SSBs are government-issued bonds that offer a safe and low-risk investment option. They can be purchased with SRS funds and provide stable returns over the long term.

- Insurance: You can use your SRS funds to purchase insurance policies, such as single-premium insurance or investment-linked policies. This helps protect your financial well-being and can provide additional benefits for retirement planning.

- Fixed Deposits: Fixed deposits are a low-risk investment option, offering guaranteed returns over a fixed period. They can be a good choice for conservative investors or those seeking stable returns.

- Singapore Government Securities (SGS): SGS are another low-risk investment option, backed by the Singapore government. They are considered a safe investment and can provide stable returns.

- Foreign Currency Fixed Deposits: These investments allow you to hold funds in foreign currencies, which can offer potential benefits due to exchange rate fluctuations.

- REITs: Real Estate Investment Trusts (REITs) are investment funds that focus on income-producing real estate. They provide exposure to the real estate market and can offer stable returns through rental income and property value appreciation.

It is important to carefully consider your investment options and understand the associated risks and potential returns. Seeking advice from a financial advisor can help you make informed decisions that align with your financial goals.

Cash Payments for Trading Securities: An Investment Activity?

You may want to see also

Buying stocks and ETFs

Before you start trading with your DBS Vickers Online Trading Account, you must link your SRS account to it. It is also recommended that you check your shareholdings, available trading limits, and funds in your SRS account before selecting SRS as the settlement mode. The settlement currency for SRS trades must be in Singapore Dollars.

If you don't already have an SRS account, you can open one with DBS if you are at least 18 years old, are not an undischarged bankrupt, have taken the Self-Awareness Questionnaire (SAQ), and have more than S$20,000 in your OA.

Once you have set up your SRS account and linked it to your DBS Vickers Online Trading Account, you can start buying stocks and ETFs. Log in to DBS Vickers Online, click on Trade, and select Place Order. Then, choose SRS as the settlement mode.

When buying stocks with your SRS account, keep in mind that any shares you buy must be returned to your SRS account. If you sell the shares, the proceeds must also flow back into your SRS account.

ETFs, or exchange-traded funds, are a type of investment fund traded on stock exchanges. They can be traded like stocks and offer diversification like a unit trust as they are a collection of assets. However, ETFs are designed to mimic the performance of a stock, bond, or commodity index. This is useful for those who want to invest in a specific market rather than a particular stock.

With SRS funds, you can choose from the full suite of SGX-listed ETFs. Some popular ETFs include the SDPR Straits Times Index ETF, which tracks the performance of the Singapore benchmark Straits Times Index (STI), and the SPDR Gold Shares ETF, which allows you to invest in gold.

Remember that past performance is not a guarantee of future returns, and investing always carries an element of risk. It is important to carefully consider your risk profile and understand the specific risks associated with any investment product before investing.

QuickBooks Owner Investment: Where Does Cash Fit?

You may want to see also

Managing your investments

DBS offers a range of investment options for those looking to boost their Supplementary Retirement Scheme (SRS) savings. These include stocks, exchange-traded funds (ETFs), unit trusts, Singapore Savings Bonds (SSBs), insurance and fixed deposits.

You can manage your investments (stocks, ETFs, SSBs, unit trusts) through your SRS account, and your insurance via DBS digibank or the insurer's e-portal. DBS digibank provides an overview of your SRS funds and investment assets.

DBS Vickers Online Trading Account allows you to trade online using your SRS funds. Before trading, ensure that you have linked your SRS Account to your DBS Vickers Online Trading Account. Check your shareholdings, available trading limits, and funds in your SRS account before selecting SRS as the settlement mode. The settlement currency for SRS trades must be in Singapore Dollars.

DBS also offers the NAV Planner tool to help you navigate your finances. It automatically calculates your money flows and provides financial tips.

For those with an existing SRS account at another bank, you can visit a DBS/POSB branch to transfer your account to DBS.

It is important to note that all investments carry inherent risks, and it is recommended to seek professional advice if needed.

Understanding the Cash Flows Statement: Investing Activities

You may want to see also

Withdrawing from your SRS account

Withdrawing from your Supplementary Retirement Scheme (SRS) account is an important aspect of your retirement financial planning. Here's a detailed guide on how to navigate withdrawals from your SRS account:

Timing of Withdrawals:

Tax Implications:

Withdrawals from your SRS account are subject to income tax. However, if you withdraw on or after reaching the statutory retirement age, only 50% of the withdrawal amount is taxable. This means that you can significantly reduce your tax burden by carefully planning your withdrawals during retirement. Additionally, the first $20,000 of an individual's chargeable income is not taxed, so if you have no other source of taxable income, you may not need to pay any income tax on your SRS withdrawals.

Withdrawal Period:

The Supplementary Retirement Scheme allows for a maximum withdrawal period of 10 years. This period starts from the date of your first penalty-free withdrawal, which is typically when you reach the statutory retirement age. During this 10-year window, you have the flexibility to determine your withdrawal amount and frequency. Spreading out your withdrawals over this period can help lower your tax bill, especially if you have a large sum in your SRS account.

Withdrawal Methods:

You have two main options for withdrawing from your SRS account: withdrawing everything at once or staggering your withdrawals over the 10-year period. Withdrawing everything at once may result in a substantial tax bill, especially if the total amount exceeds the taxable bracket. On the other hand, staggering your withdrawals can help minimise taxes and ensure a steady income stream during retirement.

Withdrawing Investments:

It's important to note that you can withdraw your SRS funds in the form of investments, instead of just cash. This option is available for specific types of penalty-free withdrawals, including withdrawals on or after the statutory retirement age, withdrawals on medical grounds, and withdrawals by foreigners meeting certain conditions. Withdrawing investments can help you avoid the transaction costs associated with liquidating investments before withdrawal.

Strategies for Optimisation:

To make the most of your SRS withdrawals, consider using annuity or insurance products. Investing part of your SRS funds into life annuities can provide a guaranteed income stream during retirement, and 50% of these payouts will be tax-free. Additionally, staggering your withdrawals and utilising the full 10-year withdrawal period can help maximise your savings and reduce your overall tax liability.

Understanding the Relationship Between Cash and Investments

You may want to see also

Frequently asked questions

You can start investing with your SRS money by first being clear about what you want to invest in. If you are unfamiliar with investment products, read up on the many types of investments permitted for SRS and understand their advantages and disadvantages. Familiarise yourself with basic investment concepts, such as risks vs returns, simple financial ratios, passive vs active investing, and diversification.

You can invest in stocks, exchange-traded funds (ETFs), unit trusts, Singapore Savings Bonds (SSBs), insurance, and fixed deposits.

If you have an existing SRS account with another bank and wish to transfer your account to DBS, you may visit any DBS/POSB branch to do so. Alternatively, you can plan your finances with the Plan & Invest tab in digibank and invest your SRS.

You will first need to link your SRS account to your DBS Vickers Online account, following which you can select CPF or SRS as the desired "Investment Type".