Investing 1 crore in mutual funds is a big decision, and it's important to understand your financial goals and risk tolerance before making any choices. The right investment vehicle will depend on your time horizon and risk appetite. If you're looking for a steady income stream, there are several options to consider, each with its own complexities. Here's an introduction to help you get started on investing 1 crore in mutual funds.

What You'll Learn

Understanding your risk profile

Risk Profile and Investment Choices:

Your risk profile is a fundamental aspect of your investment strategy. It defines your comfort level with taking risks and guides the types of investments you should consider. Understanding your risk tolerance is essential for investing 1 crore in mutual funds. Here are some key points to consider:

- Risk Tolerance and Return Expectations: Risk tolerance refers to your ability and willingness to withstand negative changes in your investment's value. It's essential to recognise that higher returns typically come with higher risks. If you want potentially higher returns, you need to be comfortable with the possibility of more significant losses. Understanding your risk tolerance will help you decide how much of your 1 crore to invest in mutual funds and which types to choose.

- Time Horizon: The time you plan to stay invested significantly impacts your risk profile. If you have a longer time horizon, you can generally take on more risk, as there is more opportunity for your investments to recover from short-term losses. For example, if you're investing for retirement, you may have a longer time horizon and can consider riskier options. Conversely, if you're investing for a short-term financial goal, you may opt for more conservative investments.

- Diversification and Asset Allocation: Diversification is a risk management strategy that involves spreading your investments across various asset classes, sectors, and investment types. By diversifying your portfolio, you reduce the impact of any single investment loss. Proper asset allocation, based on your risk profile, is essential for managing risk effectively. For example, if you are a moderate risk-taker, you might allocate a larger portion of your portfolio to hybrid funds, which offer a balance between equity and debt.

- Risk Capacity and Financial Situation: Risk capacity refers to your financial ability to take on investment risk. It considers your income, expenses, savings, and overall financial stability. If you have a stable income, ample savings, and can withstand potential losses without significant impact on your financial well-being, you may have a higher risk capacity. Understanding your financial situation is crucial for defining your risk profile.

- Risk Appetite and Personality: Risk appetite is influenced by your personality, investment goals, and emotional tolerance for volatility. Some people are naturally more comfortable with risk and volatility, while others prefer a more stable and predictable investment journey. Understanding your risk appetite involves being honest with yourself about how you would react to potential losses or market downturns.

Choosing Mutual Funds Based on Your Risk Profile:

Once you have a clear understanding of your risk profile, you can choose mutual funds that align with your risk tolerance and financial goals:

- Conservative or Low-Risk Profile: If you have a conservative risk profile, you prioritise capital preservation over high returns. You are comfortable with slower but steadier growth and prefer stable, low-risk investments. For such a profile, debt funds or low-duration funds are a good option. These funds invest in fixed-income instruments and are less volatile than equity funds. They provide stable returns with relatively lower risk.

- Moderate or Balanced-Risk Profile: A moderate risk-taker seeks a balance between risk and stability. You are willing to take on some risk to achieve moderate returns. Hybrid funds are an excellent choice for this profile. These funds invest in a mix of equity and debt instruments, providing exposure to potential equity gains while cushioning against extreme market volatility. Large-cap funds are another option, as they invest in well-established companies, offering a more conservative approach to equity investments.

- Aggressive or High-Risk Profile: If you have an aggressive risk profile, you are comfortable with significant volatility and potential losses to pursue higher returns. For this profile, equity funds, particularly multi-cap, mid-cap, and small-cap funds, are suitable. These funds invest in a range of companies, from established businesses to newer, faster-growing ones. While they carry higher risk, they offer the potential for substantial returns over the long term.

Remember, understanding your risk profile is a dynamic process. Your risk tolerance may change over time due to shifts in your financial situation, life stage, or personal circumstances. Regularly reviewing and reassessing your risk profile is essential to ensure your investment strategy remains aligned with your goals and comfort level.

Vision Fund's WeWork Investment: A Bold Move?

You may want to see also

Choosing the right mutual fund category

When it comes to investing 1 crore in mutual funds, there are several factors to consider when choosing the right mutual fund category. Here are some key considerations to help you make an informed decision:

Investment Horizon

The first step is to determine your investment horizon, which is the length of time you plan to hold your investments. This will impact the type of mutual funds you should choose. For example, if your investment horizon is relatively short, such as 1 to 5 years, liquid funds, hybrid funds, or large-cap funds might be more suitable. On the other hand, if you have a longer investment horizon of more than 5 years, you may want to consider a diversified equity portfolio, including multi-cap, mid-cap, and small-cap funds.

Risk Profile and Tolerance

Understanding your risk profile and tolerance is crucial when selecting a mutual fund category. Some funds offer low risk, while others come with higher risk. If you are a conservative or moderate risk-taker, large-cap funds or hybrid funds might align better with your risk appetite. These funds invest in financially strong large-cap companies, providing more stability. However, if you are comfortable with taking on more risk, you may explore options like mid-cap or small-cap funds, which can offer higher potential returns but also carry increased risk.

Market Volatility and Timing

Market volatility and timing play a significant role in choosing the right mutual fund category. Systematic Investment Plans (SIPs) are a popular option as they help mitigate market volatility. With SIPs, you can invest a fixed amount at regular intervals (monthly, quarterly, etc.) regardless of market fluctuations. This approach helps you benefit from buying more fund units at a lower price during market downturns and buying fewer units when the market is up.

Diversification

Diversification is a key principle in investing. By spreading your investments across various assets and sectors, you can manage risk more effectively. Consider investing in multiple mutual fund categories, such as large-cap, mid-cap, and small-cap funds, or even diversifying into other investment options like real estate or gold ETFs, to balance your portfolio and potentially maximize returns while managing risk.

Fund Performance and Ratings

When selecting a mutual fund category, it's essential to evaluate the performance and ratings of specific funds within that category. Look for funds with a strong track record of providing consistent returns. You can use resources like ETMONEY's Fund Report Card to assess various indicators, such as return consistency, downside protection, and fund rankings. This will help you make a more informed decision about which funds to choose within a particular category.

Investor Personality and Goals

Finally, consider your investor personality and financial goals. Are you seeking aggressive growth, or are you more conservative? Do you prioritize capital preservation or higher returns? Understanding your investment goals and risk tolerance will help guide your choice of mutual fund categories. For example, if you want to balance growth and risk management, equity-oriented hybrid funds might be a suitable option.

In conclusion, choosing the right mutual fund category involves careful consideration of your investment horizon, risk tolerance, market conditions, diversification strategies, fund performance, and your unique financial goals. Remember to conduct thorough research and, if needed, consult with financial professionals to make informed investment decisions.

Savings Strategy: Mutual Funds Investment Allocation

You may want to see also

Determining your risk appetite

When investing a large sum of money, such as 1 crore rupees, it is important to determine your risk appetite. This means understanding how much risk you are willing to take on in pursuit of potential returns. Different investments carry different levels of risk, so matching your risk tolerance to your investment choices is crucial.

Firstly, it is important to note that investing in mutual funds carries less risk than investing directly in stocks. Mutual funds are managed by professionals and are typically well-diversified, reducing risk. However, there are still different types of mutual funds with varying levels of risk. For example, large-cap funds are considered a more conservative option, while small-cap funds are higher risk. If you have a low-risk appetite, you may also consider hybrid funds, which offer better returns than debt but are safer than equity.

If you are investing for the long term, you may be able to take on more risk, as short-term market volatility will have less impact on your investments over a longer time horizon. Additionally, if you are investing through a Systematic Investment Plan (SIP), you can benefit from rupee cost averaging, which helps to mitigate market risk.

It is also important to assess your own financial situation and how much risk you can comfortably take on. Consider your income, expenses, and financial goals when determining your risk appetite. Remember that investing always carries some level of risk, and you could lose money.

The Securities and Exchange Board of India (SEBI) has mandated that fund houses categorise risk as moderate, moderately high, high, or very high. Understanding these parameters and your own risk tolerance will help you make informed investment decisions.

In conclusion, determining your risk appetite is a critical step in investing 1 crore in mutual funds. By assessing the level of risk you are comfortable with, you can choose the most suitable investment options and create a portfolio that aligns with your financial goals and tolerance for risk.

Mutual Funds: When to Hold Back on Investments

You may want to see also

Deciding on a time frame

Short-Term vs Long-Term Investments

When investing in mutual funds, you can choose between short-term and long-term investment horizons. Short-term investments typically range from a few months to a few years, while long-term investments can span decades. For example, if you want to invest in mutual funds to save for retirement, you might choose a longer time frame, whereas if you're saving for a down payment on a house, you might opt for a shorter time frame.

Investment Goals

Consider what you want to achieve with your 1 crore investment. Are you looking to generate regular income, save for a specific goal, or grow your wealth over time? Different investment goals may require different time frames. For instance, if you're investing for retirement, you might choose a longer time horizon to benefit from the power of compound interest.

Risk Tolerance

Your risk tolerance, or how much risk you're comfortable taking, is an important factor in determining your time frame. Generally, longer investment horizons allow for riding out short-term market fluctuations, making them more suitable for those with a lower risk tolerance. If you're investing for a shorter period, you might need to tolerate higher risks to achieve your desired returns.

Market Conditions

The state of the market can also influence your time frame decision. For example, if you believe the market is about to enter a bull market, you might opt for a shorter investment horizon to take advantage of potential gains. On the other hand, if a bear market is predicted, a longer time frame could be more appropriate to weather potential downturns.

Investment Vehicle

The type of mutual fund you choose can also impact your time frame decision. Some funds, like equity mutual funds, are better suited for long-term investment horizons due to their potential for higher returns over time. On the other hand, debt mutual funds or liquid funds might be more appropriate for shorter-term goals as they offer stable returns and instant access to your investments.

Flexibility

Remember that your investment time frame doesn't have to be set in stone. You can adjust it based on changing market conditions, your financial situation, or other factors. Being flexible can help you take advantage of opportunities or mitigate potential risks along the way.

India's Alternative Investment Funds: Exploring the Options

You may want to see also

Using a SIP calculator

A SIP calculator is a valuable tool that helps investors estimate the future value of their mutual fund investments made through a Systematic Investment Plan (SIP). It is a simple tool that allows individuals to get an idea of the returns on their mutual fund investments.

To use a SIP calculator, you will need to input the following details:

- Monthly SIP amount

- Investment duration

- Expected rate of return

The calculator will then show you the estimated corpus with a break-up of earned interest and the invested amount.

Let's say you want to invest Rs. 1,000 per month for 12 months at a periodic rate of interest of 12%. The monthly rate of return will be 12%/12 = 1/100=0.01.

Using the formula: M = P x ({ [1 + i]^n – 1} / i) x (1 + i)

Where:

- M is the amount you receive upon maturity

- P is the amount you invest at regular intervals

- N is the number of payments you have made

- I is the periodic rate of interest

We can calculate the approximate returns as follows:

M = 1,000X ({ [1 +0.01]^12 – 1} / 0.01) x (1 + 0.01)

M = Rs 12,809 approximately in a year.

The rate of interest on a SIP will differ according to market conditions and may increase or decrease, which will, in turn, change the estimated returns.

- Accurate Planning: SIP calculators forecast the future growth of an investment based on specific input criteria, including the amount to be funded, the duration, and the expected return.

- Comparison of Several Scenarios: By changing the input components (such as amount, duration, and anticipated rate), SIP calculators help users evaluate various investment conditions and make informed choices based on their economic objectives.

- Visualisation of Potential Returns: SIP calculators help buyers visualise how their money can grow through systematic investing. Graphs and charts are also available to help them understand the power of compounding.

- Goal Setting and Progress Monitoring: SIP calculators aid investors in setting attainable financial targets and monitoring their progress. By entering their specific financial goals, investors can estimate the required investment amount and track their progress over time.

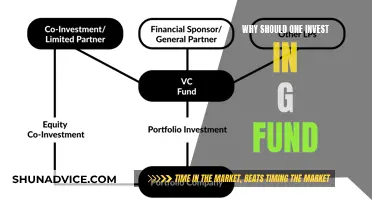

Co-Invest Funds: Higher Returns, Lower Risk?

You may want to see also

Frequently asked questions

To get 1 crore in 10 years, you can invest in Equity Mutual Funds. The monthly SIP amount you will require depends on the returns you earn from your investments. For example, to get a 15% annual return, you would need to invest INR 38,050 per month.

Mutual funds are one of the best options for long-term financial planning. You do not need a lump sum to make profitable investments. You can invest small amounts periodically in mutual funds via systematic investment plans (SIPs).

You can select one Equity Fund or a couple of Equity Funds from different categories such as Large & Mid Cap, Flexi Cap, ELSS, etc. To find the best Equity Funds, you can use ETMONEY's Fund Report Card and check various indicators of the scheme such as return consistency and their ability to protect the downside.