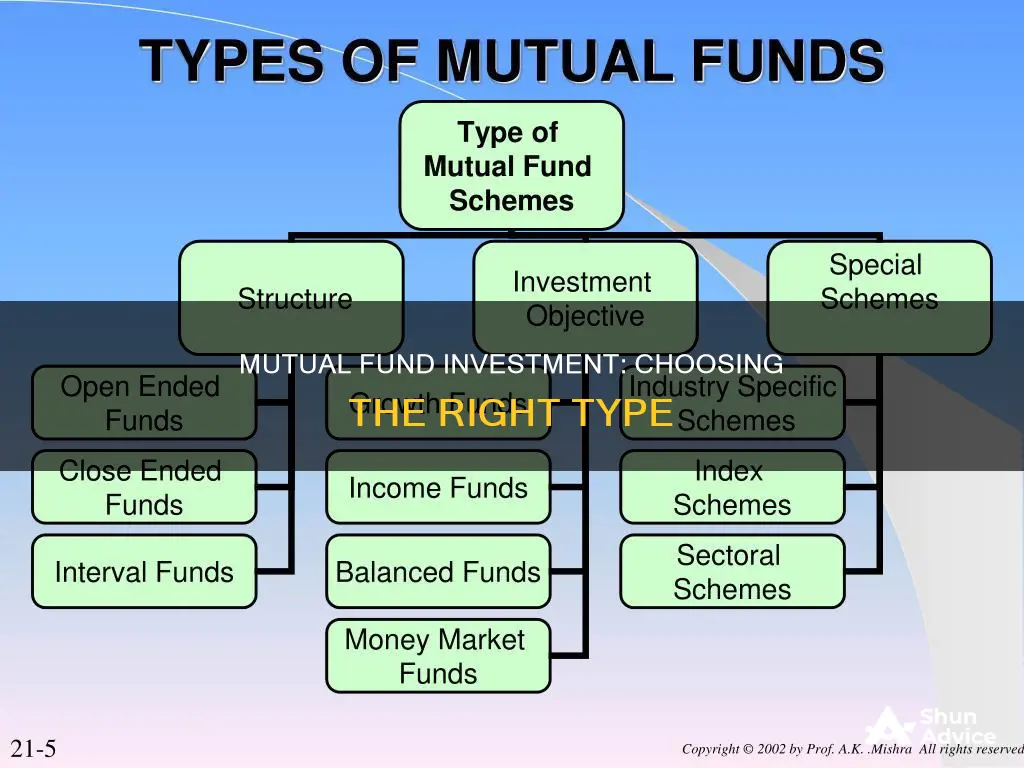

Mutual funds are a popular investment option for individuals. They are a type of investment product where the funds of many investors are pooled into an investment product, which then focuses on using those assets to invest in a group of assets to reach the fund's investment goals.

There are several types of mutual funds available through brokerage platforms or the funds themselves. These include stock funds, bond funds, money market funds, balanced funds, and target-date funds. Each of these funds will have different investment profiles, risk levels, performance results, and fees.

When choosing a mutual fund, it is important to first identify your goals for the investment and your personal risk tolerance. You should also consider the fund's history, expense ratio, and the fund manager's performance.

Some of the best mutual funds, with performance data as of October 30, 2024, include:

- Fidelity Blue Chip Growth (FBGRX)

- Shelton Nasdaq-100 Index Investor (NASDX)

- Victory Nasdaq-100 Index (USNQX)

- Fidelity Large Cap Growth Index (FSPGX)

- Fidelity Contrafund (FCNTX)

- State Street US Core Equity Fund (SSAQX)

- T. Rowe Price U.S. Equity Research Fund (PRCOX)

| Characteristics | Values |

|---|---|

| Risk tolerance | High-risk funds for higher returns for long-term goals |

| Investors with a low-risk appetite can invest in low-risk funds for their short-term goals | |

| Investment goals | Long-term goals that are decades in the future may be best served by stock mutual funds with more growth potential |

| Shorter-term goals in the next few years may require the relative stability of a bond fund | |

| Fees | The industry average expense ratio is 0.57%, but many funds charge much less |

| There are even zero expense ratio funds, such as Fidelity Investment’s Zero Funds | |

| Diversification | Mutual funds offer an attractive combination of features that make them a good option for many individual investors |

| They offer diversification, affordability, professional management and liquidity |

What You'll Learn

Stock mutual funds

Before investing in stock mutual funds, it is important to identify your investment goals and risk tolerance. If you are seeking long-term capital gains, you may be willing to take on more risk. On the other hand, if current income is your priority, a more conservative investment strategy may be more suitable. It is also crucial to consider the desired time horizon for your investment. Mutual funds have sales charges, so an investment horizon of at least five years is ideal to mitigate the impact of these charges.

When choosing a stock mutual fund, you can look at factors such as fees, performance, and fund type. Actively managed funds tend to have higher fees as they involve portfolio managers who make decisions about which securities and assets to include in the fund. Passively managed funds, often called index funds, aim to track and duplicate the performance of a benchmark index and usually have lower fees. It is also essential to research a fund's past performance and evaluate the fund manager's track record.

Some popular stock mutual funds include the Vanguard Total Stock Market Index Fund, Fidelity 500 Index Fund, and Fidelity Select Pharmaceuticals Portfolio. These funds offer exposure to a diverse range of stocks and have relatively low expense ratios.

Overall, stock mutual funds can be a great option for investors seeking higher potential returns, but it is important to carefully consider your investment goals, risk tolerance, and time horizon before investing.

Large-Cap Funds: Where Do They Invest Your Money?

You may want to see also

Bond mutual funds

Benefits

- Professional management: Bond funds are managed by professionals who specialize in certain bond sectors or strategies and leverage extensive research and market information to align the fund with its stated objectives.

- Diversification: Investing in bonds and other debt securities can help lower the overall risk of your portfolio. Bond funds can also provide diverse ways to stabilize your portfolio.

- Liquidity: Bond mutual funds tend to be liquid as they can be bought and sold at the closing net asset value (NAV) each day.

- Low investment minimums: Bond mutual funds can have minimum investments as low as $1, making them accessible to a wide range of investors.

- Automatic investing: Some brokers offer automatic investment plans that allow investors to invest a fixed amount regularly in one or more mutual funds.

- Reinvestment of dividends and capital gains: Bond mutual funds offer the option to automatically reinvest interest and capital gains, allowing for compound interest and growth of your investment over time.

Risks

- Trading limitations: Bond mutual funds only trade once a day after the market closes, so you won't know the exact price when placing an order.

- Limited transparency: Mutual funds typically disclose their portfolio holdings quarterly, which may not be frequent enough for investors seeking more transparency.

- Lack of customization: Bond funds are managed according to the stated objectives in the prospectus and cannot be customized to individual investor needs.

- Potential tax inefficiency: Bond funds may distribute capital gains to investors, leading to potential tax inefficiencies and limited opportunities for tax-saving strategies.

- Lack of control: The bond fund manager determines the timing and securities for buying and selling, and may be forced to sell positions to meet liquidations, which may not align with your investment goals or preferences.

When considering bond mutual funds, it's important to evaluate your investment goals, risk tolerance, and time horizon. Additionally, compare the fees and performance of different bond funds to make an informed decision.

Fixed Income Funds: Where Are Your Investments Going?

You may want to see also

Money market mutual funds

Money market funds are a good option for those with a low tolerance for volatility or those looking to diversify with a more conservative investment. They are also a good choice for those who need a very liquid investment or are saving for short-term goals.

There are three main types of money market funds, defined by the U.S. Securities and Exchange Commission (SEC) based on the fund's investments:

- Government: These funds invest in short-term U.S. government debt securities, such as U.S. Treasury obligations or repurchase agreements.

- Prime: These funds invest in taxable short-term debt issued by corporations and banks, as well as repurchase agreements and asset-backed commercial paper.

- Municipal: These funds invest in short-term municipal money market securities issued by states, local governments, and other municipal agencies. Municipal funds pay interest that is generally exempt from federal income tax.

Money market funds are considered very stable, with low volatility and strict maturity, credit quality, diversification, and liquidity requirements. However, it is important to note that money market funds are not insured by the Federal Deposit Insurance Corporation (FDIC) and there is a risk of losing money.

Money market funds typically have a low expense ratio, ranging from 0.09% to 0.16%, or $9 to $16 for every $10,000 invested. They are a good option for those looking for a conservative, low-risk investment with potential earnings on savings.

High-Yield Dividend Index Funds: Smart Investment or Trap?

You may want to see also

Balanced mutual funds

Balanced funds are a good option for investors who want a "set-it-and-forget-it" diversified portfolio. They automatically maintain your asset mix, so you never have to worry about rebalancing. This type of fund can add stability to your portfolio as the bond portion helps to offset the risks associated with the stock portion.

By holding hundreds or even thousands of bonds and stocks in a single fund, balanced funds provide more diversification than investing in individual bonds and stocks. They also allow you to benefit from the appreciation of stocks while generating income from the bonds.

When choosing a balanced fund, you can opt for a traditional balanced fund with a set asset allocation based on your risk tolerance, or you can choose a target retirement fund that gradually becomes more conservative as you approach retirement.

Some popular examples of balanced funds include:

- Vanguard Wellington Fund (VWELX)

- Vanguard Balanced Index Fund (VBIAX)

- Fidelity Balanced Fund (FBALX)

- Dodge & Cox Balanced Fund (DODBX)

It's important to note that balanced funds have a static asset allocation mix, which may not always be optimal for your investment horizon. They also tend to have a large-cap focus and limited international exposure. Therefore, it's crucial to consider your investment goals, risk tolerance, and time horizon before investing in balanced mutual funds.

What Constitutes an Investment Fund's Legal Entity Status?

You may want to see also

Target-date mutual funds

Target-date funds are offered by many company 401(k) plans and are also an option for people investing in individual retirement accounts (IRAs). They are a popular choice for 401(k) plan investors, particularly those who don't have the time or inclination to review their fund's holdings annually and revise their investment strategy.

Here's how target-date funds work:

- These funds are a type of asset allocation mutual fund where the mix of securities and asset classes gradually shifts as the target date for needing the money (usually retirement) draws near.

- The fund's asset mix is automatically adjusted over time and becomes more conservative as the target date gets closer.

- A target-date mutual fund can serve as an investor's sole fund in a portfolio, eliminating the need to select several funds to create a similar asset allocation mix.

- The fund managers use a predetermined time horizon to fashion their investment strategy according to a standard long-term asset allocation strategy. This strategy relies on riskier stocks in the early years, moving gradually towards fixed-income investments like bonds in the later years.

- The fund managers use the target date to determine the degree of risk currently appropriate for the investor and typically readjust portfolio risk levels annually.

- The asset allocation of a target-date fund gradually shifts to more conservative investment choices, reducing the risk of losses as the target date approaches.

Advantages:

- Long-term investing on autopilot

- Geared towards sensible retirement planning

- A diversified portfolio

Disadvantages:

- Higher expenses than other passive investments

- Results not guaranteed

- Little room for changing investor goals and needs

Singapore's Sovereign Wealth: Where Does the City-State Invest?

You may want to see also

Frequently asked questions

The different types of mutual funds are typically categorized as bond funds, equity funds, target-date funds, and money market funds. Each of these funds will have different investment profiles, risk levels, performance results, and fees.

Mutual funds offer an attractive combination of features that make them a good option for many individual investors. These include:

- Diversification: Mutual funds offer an easy way to diversify your portfolio.

- Affordability: Mutual funds typically have low minimum investment requirements and charge reasonable annual fees.

- Professional management: Mutual funds are managed by professionals, saving you time and effort.

- Liquidity: Mutual fund shares can be easily redeemed at any time.

However, there are also some potential downsides to investing in mutual funds, such as:

- High initial investment: Mutual funds typically require a high initial investment, often a few thousand dollars.

- Fees and sales charges: Mutual funds can come with high expense ratios and sales charges, which can eat into your returns.

- Tax events: If you hold mutual fund shares in non-retirement accounts, you may be subject to unexpected capital gains distributions.

- Limited trading: Mutual funds can only be bought and sold at the end of the trading day.

When choosing a mutual fund, it's important to consider your risk tolerance, time horizon, and the current composition of your portfolio. Ask yourself the following questions:

- When do you plan to access the money? If you need the money in the next year or two, you may want to opt for lower-risk bond or money market funds.

- Can you withstand temporary losses and hold on? If you can stick to your investing plan through market ups and downs, stock funds may be a better option.

- Do you have a specific gap in your portfolio? Consider whether you need to add more stocks, bonds, or other asset types to balance your portfolio.

Once you've found a few potential funds, evaluate them based on the following criteria:

- Long-term track record: Look for funds with a strong performance record over five or 10 years, rather than just the past year or two.

- Fees: Compare the expense ratios and sales loads of similar funds to find the most cost-effective option.

There are several alternatives to mutual funds, including:

- Exchange-traded funds (ETFs): ETFs are similar to mutual funds but trade more like stocks, offering greater flexibility and lower initial investment requirements.

- High-yield savings accounts: If you're looking for a safe, low-risk option, a high-yield savings account may be a good alternative to money market mutual funds.

- Individual stocks: You could also build a portfolio of individual stocks, but this may require a larger investment and more time and research.