Investing $1,000 a month for retirement can be a great way to build wealth and secure your financial future. The power of compound interest means that starting early is key, and even a relatively modest amount invested regularly can result in impressive returns over time. By investing $1,000 per month, you can take advantage of compound interest to grow your savings and potentially become a millionaire by the time you retire. However, it's important to remember that investment returns may vary, and there are several factors that can impact your portfolio's growth, including taxes, fees, and market downturns. Seeking advice from a financial advisor can help you navigate these variables and develop a plan that works best for your goals and risk tolerance.

What You'll Learn

Starting early lets you take advantage of compound interest

Starting early on investing for retirement is beneficial because it lets you take advantage of compound interest. Compound interest is interest that applies not just to the initial principal of an investment but also to the accumulated interest from previous periods. In other words, you get to earn interest on your interest.

The power of compounding helps your money grow faster than if simple interest were calculated on the principal alone. The more time your money has to grow, the more growth potential it has. The higher the starting amount and the higher the investment return, the faster your savings compound. Over time, it can seriously add up.

For example, if you start saving $100 a month at age 20, earning an average of 4% annually, compounded monthly across 45 years, you would have earned $151,550 by age 65. Your principal investment was just $54,100. If you have a twin, and they don't start investing until age 50, investing $5,000 initially, then $500 monthly for 15 years, also averaging a monthly compounded 4% return, by age 65, they would have only earned $132,147, with a principal investment of $95,000.

The secret to compounding is time. The earlier you start, the more your money grows. The longer you leave your money invested, the more it will benefit from the earning power of compounding.

Shares: Investing for Growth and Income

You may want to see also

How to save $1,000 a month

Saving $1,000 a month is a great way to build a substantial nest egg for the future. Here are some detailed and direct instructions on how to achieve this:

Start Early:

The power of compound interest means that the earlier you start saving, the more your savings will grow over time. If you can start in your 20s, you'll be giving your savings a significant head start. For example, if you start saving $1,000 a month at age 20, you could have over $2 million by the time you retire.

Live Below Your Means:

Consider adopting the principles of the FIRE movement (Financial Independence, Retire Early). This involves living well below your means and investing as much as possible into retirement, with the goal of retiring early. Even if early retirement isn't your goal, these principles can help you prioritize and maximize your retirement savings.

Reduce Living Expenses:

One of the biggest expenses for many people is accommodation. If possible, consider living with family or sharing accommodation to reduce your living costs. This can be a temporary measure while you build up your savings.

Take Advantage of Employer Matching:

If your employer matches your retirement contributions, try to qualify for the maximum available match. This is essentially free money that can boost your retirement savings. Typically, this match is 6% of your compensation, but it can be as high as 25%.

Avoid Lifestyle Inflation:

When your income increases, avoid the temptation to increase your spending. Instead, redirect the additional income into your savings. This will help you save more each month and accelerate your progress towards your $1,000 monthly savings goal.

High-Interest Debt:

If you have high-interest credit card debt, focus on paying this off first. The average interest rate on credit cards is currently over 20%, so paying off this debt is like getting a 20% return on your money. Similarly, if you have a high monthly car payment, consider paying off the loan to free up cash flow that can then be redirected into your savings or investments.

Emergency Fund:

Build an emergency fund to cover unexpected expenses or income disruptions. Most financial advisors recommend having between three and six months' worth of living expenses in a high-yield savings account. This will help you avoid dipping into your retirement savings or taking on additional debt during emergencies.

Consult a Financial Advisor:

Consider consulting a fee-only financial advisor who charges a flat or hourly fee. They can provide personalized advice and help you develop a comprehensive plan to achieve your savings and investment goals.

Remember, saving $1,000 a month may not be feasible for everyone, especially those with lower incomes. It's important to assess your individual circumstances and make adjustments where necessary. Additionally, ensure you have some emergency savings to avoid withdrawing from your retirement accounts prematurely and incurring fees and taxes.

Scams: Why People Fall for Investment Schemes

You may want to see also

How to get a 4% return on your investments

Investing $1,000 a month for retirement can potentially make you a millionaire, but it depends on a few factors. These include the age at which you start investing, the age at which you plan to retire, and the average annual return on your investments.

Assuming you put the money in a retirement account, you get a 4% return on your investments, and you retire at 67, here are some options for how to get a 4% return on your investments:

Municipal Bonds

The debt of state and local governments generally pays interest that is exempt from federal taxes. Yields vary depending on maturity, the borrower's credit rating, and the source of the money for debt service. For example, a Massachusetts Bay Transportation Authority revenue bond maturing in 2037 yields 2.9%, equivalent to a taxable yield of 4.5% for someone in the 35% federal bracket.

Investment-grade Bonds

Investment-grade bonds, especially those issued by financial companies, can provide a yield of around 4%. For example, Goldman Sachs debt rated A- by S&P and due in January 2022 recently yielded 3.4%, while Morgan Stanley bonds, rated slightly lower and maturing around the same time, yielded 4.5%.

Junk Bonds

Junk bonds, or high-yield corporate bonds, are securities rated below triple-B. While they carry more risk, they can provide higher yields. For example, a Beazer Homes USA bond maturing in May 2019 and rated CCC by S&P had a current yield of 7.4%.

Stocks

While stocks come with more risk, as there is no guarantee of repayment or dividends, investing in sound companies can provide a yield of 4% or more. For example, Southern Co. (utilities) and Intel (semiconductors) had yields of 4.5% and 4.6%, respectively.

Real Estate Investment Trusts (REITs)

REITs allow you to invest in real estate without the hands-on work of being a landlord, and they often provide better returns over the long term. For example, the Vanguard Real Estate Index Fund (VGSIX) has averaged approximately 8.8% per year over the last 15 years.

By considering these options and starting to invest early, you can work towards achieving a 4% return on your investments and potentially reach your retirement goals.

Retirement Investments: Safe Options for the Elderly

You may want to see also

How to choose the best retirement account

Investing $1,000 a month for retirement is a great way to build a substantial nest egg for your golden years. To make the most of your investments, choosing the right retirement account is crucial. Here are some factors to consider when selecting the best retirement account for your needs:

Types of Retirement Accounts

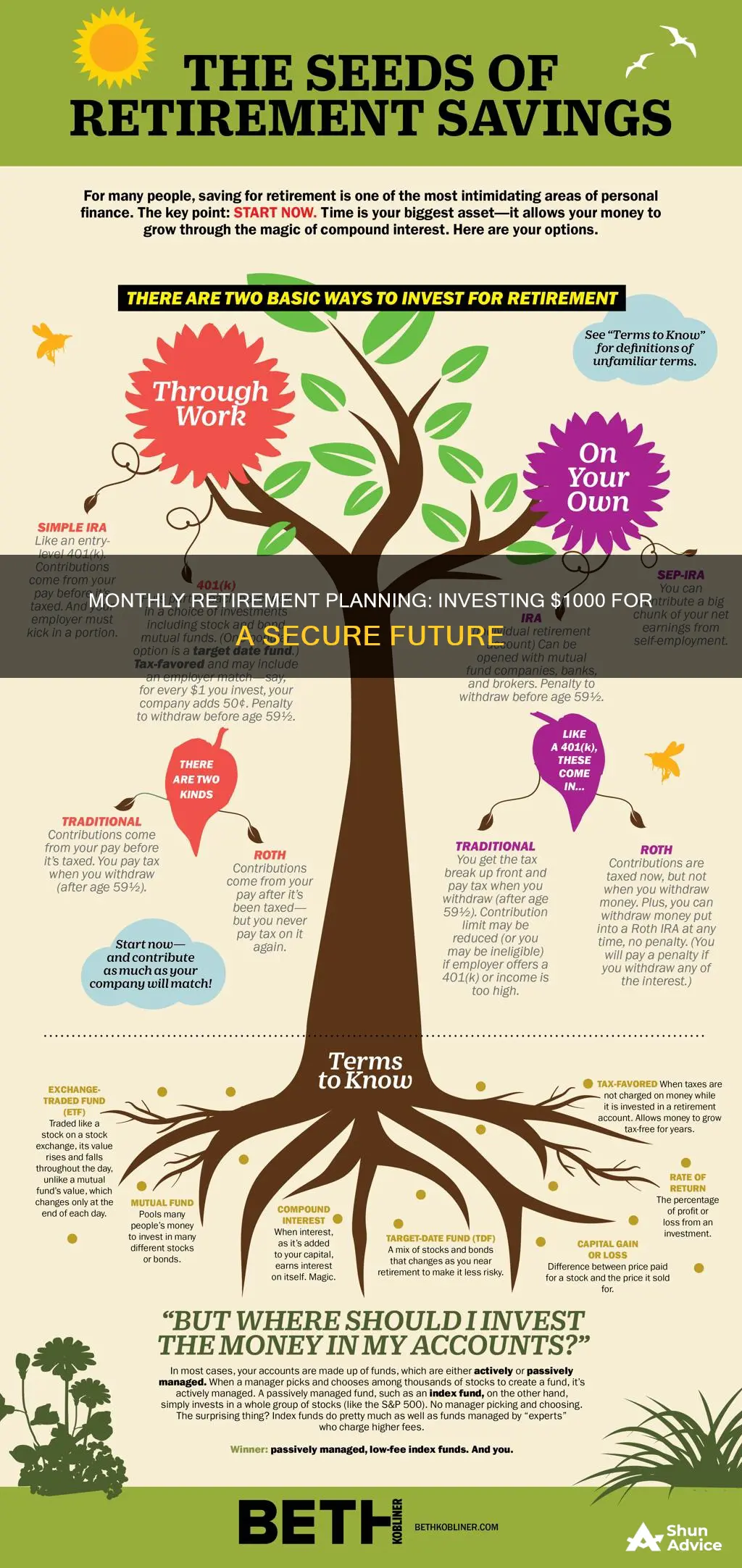

There are two main categories of retirement accounts: employer-sponsored plans and individual retirement accounts (IRAs).

Employer-Sponsored Plans:

- Defined Contribution Plans: These are the most common type of workplace retirement plan, including 401(k)s and 403(b)s. They are relatively easy to set up and allow employees to contribute through payroll deductions. Employer matching contributions and tax advantages are often available with these plans.

- Defined Benefit Plans: These plans, also known as pension plans, are less common nowadays. They provide a fixed monthly benefit in retirement, funded entirely by the employer.

Individual Retirement Accounts (IRAs):

- Traditional IRA: This is a popular option that offers tax advantages. Contributions may be tax-deductible, and investments grow tax-deferred until withdrawal in retirement.

- Roth IRA: This account type offers tax-free withdrawals in retirement, and there are no income restrictions. Additionally, you can withdraw contributions without penalty before retirement, making it a flexible option.

- Spousal IRA: This is a strategy for married couples to maximize their retirement savings. It allows a non-working spouse or a spouse with lower earnings to contribute to an IRA based on household income.

Factors to Consider when Choosing a Retirement Account:

- Availability: Your choice of retirement account will depend on what is offered by your employer or available to self-employed individuals.

- Tax Advantages: Consider the tax implications of each account type. Some offer tax deductions on contributions, while others provide tax-free withdrawals in retirement.

- Contribution Limits: Different accounts have varying annual contribution limits. Choose an account that aligns with your financial capacity and savings goals.

- Investment Choices: Some retirement plans offer a wider range of investment options than others. If you prefer more control over your investments, this is an important factor.

- Flexibility: Certain accounts, like the Roth IRA, offer the flexibility to withdraw contributions without penalties, providing easier access to your funds if needed.

- Employer Matching: If your employer offers matching contributions, it can significantly boost your retirement savings. Ensure you understand the vesting schedule and take advantage of this benefit.

- Fees and Administrative Costs: Retirement accounts may have management and administrative fees that can impact your investment returns over time. Compare these costs when selecting an account.

- Early Withdrawal Penalties: Understand the rules and potential penalties associated with early withdrawals, as they vary among different retirement accounts.

- Portability: If you change jobs, consider a retirement account that you can easily roll over or transfer to another employer or IRA.

By considering these factors and understanding the features of different retirement accounts, you can make an informed decision about which account best suits your financial goals and needs. Remember to seek professional advice if needed, as this will help you choose the most appropriate retirement account for your circumstances.

Retirement Readiness: Grad Student Edition

You may want to see also

How to diversify your portfolio

Diversifying your portfolio is a crucial step in ensuring your investments are protected and maximised. Here are some ways to diversify your portfolio for retirement:

Set Aside Cash

It is recommended to have one year's worth of cash set aside at the beginning of each year. This cash supplement should be separate from your annual income and be kept in a safe, liquid account such as an interest-bearing bank account or money market fund. This ensures that you have financial security and don't have to worry about the markets or your monthly paycheck. You can spend from this account and replenish it with funds from your investment portfolio.

Create a Short-Term Reserve

Creating a short-term reserve is an important step in diversifying your portfolio. This reserve should be equivalent to two to four years' worth of living expenses, after accounting for other regular income sources. This money can be invested in high-quality, short-term bonds, or other fixed-income investments. Alternatively, you can create a short-term CD or bond ladder, investing in CDs or bonds with staggered maturity dates to collect proceeds at regular intervals. The interest income from this reserve can be used to cover withdrawals from your primary account and can also help you avoid tapping into more volatile investments during a market downturn.

Invest in Stocks, Bonds, and Cash

With your short-term reserves in place, you can invest the rest of your portfolio in a mix of stocks, bonds, and cash investments. The allocation of these investments should be based on your goals, risk tolerance, and time horizon. Stocks provide growth potential, helping investors keep pace with inflation and taxes, while bonds and cash offer more stability and income generation. As you approach retirement age, you may want to shift your focus towards more conservative investments to preserve your capital and generate income.

Diversify Across Asset Types and Investment Vehicles

When you're younger, you may want to diversify your portfolio among different types of equities, such as large-, mid-, and small-cap stocks, and even real estate. As you get older, consider moving some of your holdings into more conservative sectors like corporate bonds, preferred stock offerings, and other moderate instruments that offer competitive returns with lower risk. Alternative investments such as precious metals, derivatives, and oil and gas leases can also help reduce portfolio volatility and improve returns when traditional asset classes are idle.

Avoid Over-Investing in Company Stock

It is important not to weigh your retirement portfolio too heavily in shares of company stock. A significant drop in the value of a single company could drastically impact your retirement plans if it constitutes a large portion of your savings.

Consider Active vs Passive Management

Active portfolio management tends to result in higher investment returns but also incurs higher transaction fees. Passive management, on the other hand, typically involves investing in index funds with lower fees but may not offer the same level of returns. Another option is to use a robo-advisor, a digital platform that manages your portfolio based on preset algorithms, although these may lack the sophistication of human management and may not be suitable for advanced services like estate planning or tax management.

Investment Influx: Output Demand Shift

You may want to see also

Frequently asked questions

If you invest $1,000 per month until you retire, you could become a millionaire. CNBC calculated that a 20-year-old would need to invest a total of $564,000 to reach over $1 million by the time they retire.

The best way to invest $1,000 per month depends on your financial goals and risk tolerance. You can choose to invest in stocks, bonds, mutual funds, exchange-traded funds (ETFs), or alternative investments such as real estate or artwork. You can also invest through a robo-advisor or with the help of a financial advisor.

The amount of money you should invest each month for retirement depends on your age, income, and financial goals. A good rule of thumb is to start saving for retirement as early as possible and contribute as much as you can afford. According to the Bureau of Labor Statistics, it may be difficult for full-time workers aged 20 to 24 to save $1,000 per month for retirement.

The average return on retirement investments can vary depending on the type of investment and market conditions. A conservative estimate for long-term annual investment is 4%, while a more aggressive estimate is 8%. The average annual return in the stock market over the past century has been roughly 10%.