Passive investing is a popular strategy for investors who want to minimise risk and fees. It involves investing in a pre-determined portfolio of securities that mirrors a market index or a specific sector. Passive investors aim to match the returns of the market rather than outperform it.

Passive investing requires less research and expertise than active investing, making it a more accessible option for many investors. It is also typically less expensive, as fees are generally lower than those associated with active investing. However, passive investing produces lower returns than active investing.

Passive investing is transparent, meaning investors know exactly what they are investing in and how their money is being managed. It is also a long-term strategy that requires patience and discipline. By investing in a portfolio that tracks an index, investors can avoid making impulsive decisions based on short-term market fluctuations and stay focused on their long-term goals.

Passive investing is not a temporary fad and will likely continue to grow due to its lower cost compared to active investing. Passive funds have overtaken active funds because they are much cheaper, as they do not require ongoing research efforts or high management fees.

However, passive investing has its limitations. It offers limited diversification since it involves investing in a pre-determined index or benchmark. Investors may miss out on other investment opportunities that are not included in the index. Additionally, passive investing provides no control over the portfolio, as investors cannot make changes to take advantage of market opportunities or mitigate risks.

In conclusion, passive investing is a viable option for investors who want a low-cost, low-risk approach, even though it may produce lower returns. The best approach for an investor depends on their personal goals, risk tolerance, and expertise.

| Characteristics | Values |

|---|---|

| Investment strategy | Passive investment |

| Management style | Passive portfolio management |

| Investment approach | Long-term investment strategy |

| Asset allocation | Diversified portfolio of assets |

| Risk | Lower risk |

| Returns | Lower returns |

| Research and expertise required | Less research and expertise required |

| Fees | Lower fees |

| Control | Less control |

What You'll Learn

Strategic Asset Allocation

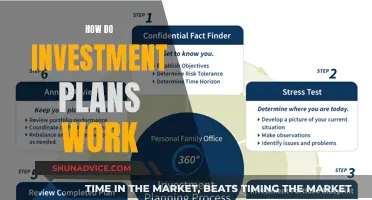

When determining an SAA strategy, it is important to consider factors such as age, goals, risk tolerance, and time horizon. For example, an investor who is closer to retirement age will likely have a lower risk tolerance and therefore opt for a more conservative approach, investing more in fixed-income assets than stocks. On the other hand, a younger investor at the beginning of their career may have a higher risk tolerance and adopt a more aggressive strategy, investing a larger proportion of their portfolio in stocks.

The Rule of 100 is a popular approach to determining the asset allocation between stocks and other asset classes. This involves subtracting your age from 100 and allocating the result as a percentage of stocks. For example, an investor who is 35 years old would allocate 65% of their portfolio to stocks (100 - 35 = 65).

It is important to note that SAA is a long-term strategy and may not be suitable for those looking to take advantage of short-term market opportunities. Tactical Asset Allocation (TAA) is another approach that focuses on short-term market forecasts and actively shifting the portfolio's allocations to exploit market trends or economic conditions. However, research has shown that such tactical adjustments are counterproductive over time and can add a degree of active management risk.

In summary, SAA is a wealth management strategy that aims to minimise risk, maximise returns, and provide diversification by setting target allocations for different asset classes and periodically rebalancing the portfolio. The specific SAA strategy will depend on the individual's unique factors, including risk tolerance, time horizon, age, and investment objectives.

Black People: Investing Fears

You may want to see also

Active vs Passive Management

Active and passive portfolio management are two investment strategies used to generate returns on investment accounts. Active portfolio management involves buying and selling stocks in an attempt to outperform a specific index, such as the Standard & Poor's 500 Index or the Russell 1000 Index. Actively managed investment funds rely on in-depth research, market forecasting, and the expertise of the management team to make investment decisions. They follow market trends, shifts in the economy, and changes to the political landscape to time the purchase or sale of assets. Active management portfolios strive for superior returns but take on greater risks and entail larger fees.

On the other hand, passive portfolio management, also known as index fund management, aims to mimic the investment holdings of a particular index to achieve similar results. A passive portfolio is designed to parallel the returns of a market index or benchmark as closely as possible. Passive management does not involve a management team making investment decisions and can be structured as an exchange-traded fund (ETF), a mutual fund, or a unit investment trust (UIT). Passive management strategies have lower management fees than active management strategies since they do not involve proactive investment decisions.

Asset allocation is an important aspect of creating and balancing an investment portfolio. It involves establishing an appropriate mix of assets such as stocks, bonds, cash, and real estate, reflecting an investor's goals, risk tolerance, and investment time frame. While active portfolio management focuses on outperforming a benchmark, passive management aims to replicate a benchmark's performance. This difference in approach affects the asset allocation decisions made by active and passive investors.

Active investors aim to beat the market and, therefore, are willing to take on greater risks. They actively buy and sell securities to outperform a specific index. Their asset allocation decisions are based on market trends, economic data, and political landscape changes. Active investors may use tactical asset allocation, which involves short-term deviations from the strategic asset mix to capitalise on exceptional investment opportunities.

On the other hand, passive investors seek to replicate the performance of a chosen index and are less concerned with beating the market. They allocate their portfolios similarly to a market index, applying similar weightings. Passive investors may prefer strategic asset allocation, which involves setting targets and rebalancing the portfolio occasionally. Passive investors may also use indexed mutual funds or ETFs, which automatically adjust their asset allocation to track a specific index.

In summary, active portfolio management involves frequent trades and strives for superior returns, while passive portfolio management involves fewer trades and aims to replicate the performance of a chosen index. These differences lead to variations in asset allocation approaches, with active investors taking on more risk and making more dynamic allocation decisions, while passive investors seek to mirror the asset allocation of their chosen index.

TFSA Dividend-Paying Investments: Maximizing Tax-Free Returns

You may want to see also

Passive Equity Investing

Passive equity investors seek to track the return of their chosen benchmark index by constructing portfolios that reflect the index's characteristics, such as the constituent securities and their weights. The selection of a benchmark index is driven by the investor's objectives and constraints, as outlined in their investment policy statement. The benchmark must be rules-based, transparent, and investable, with specific characteristics like the market covered, market capitalization of constituent stocks, and risk factors.

In conclusion, passive equity investing is a popular strategy that offers investors a low-cost, diversified approach to tracking the performance of benchmark indexes. While it may produce lower returns compared to active investing, it mitigates risks and is more accessible to investors with varying expertise levels.

Smart Places to Invest $1 Million

You may want to see also

Index Funds

When choosing an index fund, investors should consider the geographic location of the investments, the market sector, and the market opportunity. It is also important to compare the expenses of different funds and consider the tax implications, investment minimums, and trading costs.

While index funds offer broad diversification, they may lack flexibility as they are designed to mirror a specific market. Additionally, they may include overvalued or weak companies, and their performance is tied to the market, so they cannot pivot when the market shifts.

In summary, index funds are a passive investment strategy that aims to replicate the performance of a chosen index. They offer investors a low-cost, diversified, and relatively safe option for long-term investing.

The Future: Invest in AI Now

You may want to see also

Tactical Asset Allocation

There are several tactical asset allocation strategies, depending on the investor's goals. These include systematic, sector rotation, and global macro strategies. Systematic strategies use a quantitative investment model to exploit temporary imbalances in equilibrium pricing across different asset classes. Sector rotation strategies focus on the tendencies of certain sectors to outperform during certain parts of the economic cycle. Global macro strategies shift asset allocations based on global market trends.

ETFs: Invest Now or Later?

You may want to see also

Frequently asked questions

Active portfolio management involves buying and selling securities, such as stocks, options and futures, with the aim of outperforming a benchmark index like the S&P 500. Passive portfolio management, on the other hand, aims to replicate the holdings of a particular index to achieve similar results.

Passive investing is a low-cost, low-risk approach that requires less expertise and time to manage. It provides broad diversification and tax efficiency, and has historically delivered solid long-term returns.

Passive investing may not provide the same level of diversification as other strategies and limits investors' control over their portfolios. It also does not offer the potential for outperformance and has limited flexibility.