Investing 50 lakhs rupees in India can be a wise financial move, offering a stable source of funds to support your lifestyle, plan for retirement, or achieve your financial goals. There are several investment options available, each with its own risks, returns, and tax implications. In this paragraph, we will discuss some of the most popular investment avenues in India for individuals looking to invest 50 lakhs and generate a steady monthly income.

| Characteristics | Values |

|---|---|

| Investment Options | Real Estate Structured Debt, Fixed Deposits, Post Office Monthly Income Scheme, Real Estate Investment Trusts, Systematic Withdrawal Plans, Unit-Linked Insurance Plans, Debt Mutual Funds, Monthly Income Plans, Senior Citizen Savings Scheme, Systematic Investment Plans |

| Risks Involved | High-risk individuals invest in risky instruments to generate higher income. Risk-averse individuals invest in low-risk instruments for moderate returns. |

| Returns | Returns vary depending on the investment option chosen. |

| Tax Implications | Interest income from some investment options is taxable. |

What You'll Learn

Diversify your portfolio with stocks, bonds, mutual funds and real estate

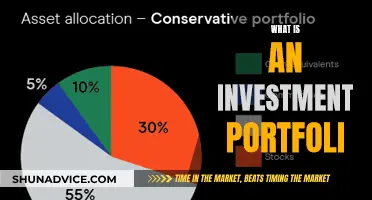

When investing a sum of 50 lakhs in India, it is essential to diversify your portfolio to spread the risk and maximise returns. Here is how you can diversify your investments across stocks, bonds, mutual funds, and real estate:

Stocks

Investing in the stock market can be a rewarding opportunity in India, with various companies issuing shares to be bought and sold. Here are the steps to invest in stocks:

- Select a reputable broker with a solid reputation, reliable customer service, and user-friendly trading platforms.

- Open a Demat (dematerialised) and a trading account. The Demat account holds your shares in electronic form, while the trading account facilitates buying and selling.

- Transfer funds into your trading account via net banking, UPI, or other payment methods.

- Research and select stocks to invest in based on the company's financial health, market position, and growth prospects.

- Decide on the investment amount, keeping in mind your investment strategy, risk tolerance, and financial goals. Diversifying your investments across different sectors and companies is essential to mitigate risk.

- Purchase the stock by placing a buy order at the current market price or setting a limit order at your preferred price.

- Execute the purchase order through your trading account, ensuring all details are correct.

- Regularly monitor the performance of your investments to make timely decisions.

Bonds

Bonds are a type of security traded in the share market. You can buy bonds and other fixed-income assets through platforms such as GoldenPi.

Mutual Funds

Mutual funds are another popular investment option in India. Here's how you can invest in them:

- Submit a duly completed application form along with a cheque or bank draft at the branch office or designated Investor Service Centres (ISC) of mutual funds or their Registrar and Transfer Agents.

- Invest online through the websites of the respective mutual funds.

- Invest through a financial intermediary, such as a Mutual Fund Distributor registered with the Association of Mutual Funds in India (AMFI).

- Invest directly without routing your investment through any distributor.

- Before investing, complete the Know Your Customer (KYC) process, which establishes your identity and address.

Real Estate

Real estate is a significant asset class in India, offering various investment opportunities. Here are some ways to invest in real estate:

- Buying Physical Property: This is the traditional way of investing, where you buy a property outright or through a loan and own it for the long term. It offers full control and ownership, regular rental income, capital appreciation, tax benefits, and protection against inflation. However, it also comes with high costs, lack of liquidity, legal issues, and market risks.

- Fix and Flip: This strategy involves buying a property that needs maintenance, renovating it, and then selling it at a higher price. It can provide quick returns and high profits but requires more skill and effort, and carries higher risk and uncertainty.

- REITs (Real Estate Investment Trusts): A more passive way to invest, where you buy units of a REIT, which owns and operates income-generating real estate assets. REITs offer low investment costs, high liquidity, regular dividends, and professional management. However, they have low capital appreciation, regulatory restrictions, and market risks.

- InvITs (Infrastructure Investment Trusts): Similar to REITs, InvITs invest in infrastructure assets such as roads and power plants. They offer low costs, high liquidity, regular dividends, and professional management but have low capital appreciation and market risks.

- Real Estate Mutual Funds: These funds invest in the securities of companies engaged in the real estate sector. They provide low investment costs, high liquidity, and professional management but have no direct exposure to physical property and may have high expense ratios.

- ETFs (Exchange Traded Funds): ETFs track the performance of an index, such as the Nifty Realty Index, providing returns similar to the index. They offer low costs, high liquidity, and passive management but lack direct exposure to physical property and may have tracking errors.

- Fractional Ownership: This allows you to buy a fraction or share of a property, providing partial ownership and control, regular rental income, and capital appreciation. However, it may lack liquidity, have legal issues, and be subject to market risks.

Invest or Save? Where Should Your Money Go?

You may want to see also

Take advantage of compound interest

When investing a large sum of money, such as 50 lakhs of rupees, it is important to consider your risk tolerance, investment goals, and current market conditions. One strategy that can help you maximise your returns over time is to take advantage of compound interest. Here are some things to keep in mind:

Types of Compound Interest Investment Options

Compound interest investments can generally be classified into two categories: safe compound interest investments and aggressive compound interest investments.

Safe Compound Interest Investments

These investments offer a higher degree of safety with foreseeable and expected returns. They are ideal for low-risk investors who prioritise steady returns. Examples include:

- Public Provident Fund (PPF)

- National Savings Scheme (NSC)

- National Pension System (NPS)

- Life Insurance Savings Plans

Aggressive Compound Interest Investments

These investments aim to maximise returns but come with higher levels of risk. They offer the potential for large gains but also carry the risk of significant losses. Examples include:

- Equity-Linked Savings Scheme (ELSS)

- Unit-Linked Insurance Plans (ULIPs) with Equity Fund investment

- Stock Market Investments

- ULIPs with Debt Fund investment

Best Compound Interest Investment Options in India

- Public Provident Fund (PPF): A long-term, government-backed investment option with competitive interest and return rates. It is considered safe and offers tax benefits, making it attractive for low-risk investors seeking long-term savings and tax advantages.

- National Savings Scheme (NSC): A government-sponsored scheme that promotes small savings among individuals, offering fixed returns over a specified period. It is known for its safety and tax benefits, making it suitable for risk-averse investors.

- National Pension Scheme (NPS): A long-term retirement savings scheme where your savings are invested in various portfolios, including government bonds, debentures, and shares. It offers tax benefits and is ideal for those seeking to build a robust retirement fund.

- Life Insurance Savings Plans: These plans offer guaranteed returns and protection for the policyholder's family. They are safe, long-term investments that can provide regular income options upon maturity.

- Equity-Linked Savings Scheme (ELSS): A type of mutual fund that invests primarily in equities or stock markets, offering tax benefits and the potential for high returns. However, these are high-risk investments.

- Unit-Linked Insurance Plans (ULIPs) with Equity Fund investment: ULIPs combine insurance coverage with investment options, providing both protection and growth. Investing in equity funds carries higher risk but offers the potential for significant returns.

- ULIPs with Debt Fund investment: These ULIPs are generally considered less risky than those investing in equity funds. They offer tax benefits and combine insurance and investment under one plan.

Key Considerations

When considering compound interest investments, keep the following in mind:

- Time: The core factor in compound interest is time. The more time your investment has to grow, the higher your potential returns.

- Risk: Different compound interest investments carry varying levels of risk. Safe compound interest investments are more stable, while aggressive compound interest investments aim for higher returns but come with a greater risk of loss.

- Tax implications: Many compound interest investments offer tax benefits, either through deductions on the initial investment or tax-deferred growth.

- Investment horizon: Compound interest works best over the long term, allowing your investment to grow exponentially over time.

- Diversification: Diversifying your investments across different asset classes can help manage risk and enhance overall returns.

- Research and expert advice: Conduct thorough research on different investment options and consider consulting a financial advisor to make informed investment decisions.

Is the CIMA Exam a Challenge?

You may want to see also

Invest in growth stocks

If you are looking to invest 50 lakhs rupees in India, one strategy to consider is investing in growth stocks. Growth stocks are those that are expected to grow at a faster rate than the overall market, providing the potential for higher returns. This strategy is well suited to a long-term investment approach and can be a rewarding way to build wealth over time.

When considering growth stocks in India, it is important to conduct thorough research and carefully evaluate each stock. Look for companies with a history of high revenue and earnings growth, a strong market position, innovative products or services, and a competent management team.

There are several ways to invest in growth stocks. One way is through traditional stock market investing, which involves researching individual companies and buying shares directly. Another option is to invest in exchange-traded funds (ETFs), which provide exposure to a diversified portfolio of growth companies. Mutual funds are also an option; these are professionally managed investment portfolios that pool money from multiple investors to buy a diversified range of stocks.

- Ahluwalia Contracts (India) Ltd (Construction & Engineering)

- Caplin Point Laboratories Ltd (Pharmaceuticals, Biotechnology & Life Sciences)

- EClerx Services Limited (Commercial & Professional Services, Data Processing & Outsourced Services)

- GMM Pfaudler (Industrial Machinery & Supplies & Components)

- Jindal Stainless Ltd (Diversified Financial Services)

- Man Infraconstruction Ltd (Construction & Engineering)

- Marksans Pharma (Pharmaceuticals, Biotechnology & Life Sciences)

- Mahanagar Gas Ltd (Sharia-compliant stocks)

- Sharda Motor Industries Ltd (Automobiles & Components)

- Utkarsh Small Finance Bank Ltd (Diversified Financials)

It is important to remember that growth stocks carry a higher risk than other investment categories, as they are dependent on market conditions and can be prone to price fluctuations. Therefore, it is crucial to align your investment choices with your goals, risk tolerance, and conduct diligent research before investing.

The Workday of an Investment Management Analyst at Goldman Sachs

You may want to see also

Take a long-term approach

When it comes to investing 50 lakhs rupees in India, taking a long-term approach can be a prudent strategy. Here are some key considerations for investors looking to adopt a long-term perspective:

Time Horizon

Define your investment time horizon, which is the length of time you plan to invest for. For long-term investing, this typically means a time horizon of at least several years, if not decades. A longer time horizon gives your investments more time to grow and ride out any short-term market fluctuations.

Risk Tolerance

Assess your risk tolerance, which refers to how comfortable you are with potential losses in exchange for higher potential gains. Generally, long-term investing allows for a higher risk tolerance since you have more time to recover from any short-term setbacks. Younger investors, in particular, can benefit from taking on more risk, as they have a longer investment horizon.

Diversification

Diversification is a key principle in long-term investing. It involves spreading your investments across different asset classes, sectors, and geographic regions. By diversifying your portfolio, you can reduce the impact of any single investment loss and increase your potential for overall gains. Consider a mix of stocks, bonds, mutual funds, and real estate to balance risk and return.

Regular Investing

Commit to investing regularly and consistently over the long term. This strategy, known as rupee-cost averaging, involves investing a fixed amount of money at regular intervals, regardless of market conditions. By investing a set amount periodically, you purchase more units when prices are low and fewer units when prices are high, ultimately reducing the average cost per unit over time.

Compound Interest

Take advantage of compound interest, which is the interest earned on both the initial principal amount and any accumulated interest from previous periods. Over time, compound interest can significantly boost your investment returns. Even a relatively conservative investment strategy, when coupled with compound interest over a long period, can lead to substantial growth.

Growth Opportunities

Look for growth opportunities in your investment portfolio. Consider investing in growth stocks, which are expected to increase at a faster rate than the overall market. These stocks typically offer higher returns but may also come with higher risks. Identifying companies with strong growth potential and investing for the long term can lead to substantial gains.

Avoid Market Timing

Resist the temptation to time the market or make quick trades. Trying to predict market movements is challenging, and short-term trading can lead to higher transaction costs and taxes. Instead, focus on your long-term investment strategy and stay invested through market ups and downs.

Consult Professionals

Consider consulting a financial advisor or investment professional, especially if you're new to investing. They can provide guidance tailored to your specific financial goals and risk tolerance. These experts can help you create a comprehensive investment plan that aligns with your long-term objectives.

Remember, long-term investing requires patience and discipline. Don't get discouraged by short-term market volatility. Stay committed to your investment strategy and make adjustments as needed to achieve your financial goals.

Savings: A Smart Investment for Your Future

You may want to see also

Consult a financial advisor

If you are looking to invest 50 lakhs rupees in India, consulting a financial advisor is a prudent step to take. Financial advisors are experts in investment strategies and can provide valuable insights to help you make informed decisions about your money. Here are some reasons why consulting a financial advisor is beneficial when investing a substantial amount like 50 lakhs rupees:

Expert Guidance

Financial advisors are qualified professionals who can offer tailored advice based on your financial goals and risk tolerance. They will assess your current financial situation, understand your investment objectives, and provide guidance on the best investment options available to you. This includes helping you navigate the complex world of investing, explaining different investment products, and ensuring that you make well-informed decisions.

Diversification Strategies

A financial advisor will assist you in diversifying your investment portfolio across various asset classes such as stocks, bonds, mutual funds, and real estate. By diversifying your investments, you can spread out the risk and increase the potential for higher returns. Financial advisors can identify the right mix of investments that match your risk profile and help you avoid putting all your eggs in one basket.

Regular Monitoring and Rebalancing

Once your investment portfolio is set up, a financial advisor will continuously monitor its performance and make necessary adjustments. They will help ensure that your portfolio remains aligned with your financial goals and market conditions. If certain investments are underperforming or market conditions change, they will advise you on rebalancing your portfolio to maintain a suitable asset allocation.

Long-Term Planning

Financial advisors take a long-term view of your investments and can provide guidance on how to build wealth over time. They will help you stay disciplined and focused on your financial goals, ensuring that you don't make impulsive decisions based on short-term market fluctuations. By taking a long-term approach, your financial advisor will work with you to create a sustainable investment plan that considers your future needs and aspirations.

Tax Implications and Legacy Planning

When investing a substantial amount, understanding the tax implications is crucial. Financial advisors can provide guidance on tax-efficient investment strategies and help you structure your investments in a way that minimises taxes. Additionally, they can assist with legacy planning, ensuring that your investments are aligned with your long-term goals and can provide financial security for future generations.

Access to Resources and Research

Financial advisors have access to sophisticated resources, tools, and research that may not be readily available to individual investors. They can provide you with in-depth market analysis, identify emerging trends, and offer insights into new investment opportunities. By leveraging their resources, you can make more informed decisions and stay ahead of the curve when it comes to investing your money.

In conclusion, consulting a financial advisor when investing 50 lakhs rupees in India is a prudent step towards achieving your financial goals. They will provide expert guidance, help you diversify your investments, monitor and rebalance your portfolio, and offer long-term planning advice. By working with a financial advisor, you can make more confident decisions about your money and increase the potential for successful investment outcomes.

Establishing a Managed Investment Trust: A Step-by-Step Guide

You may want to see also

Frequently asked questions

Some good investment options for a monthly income include fixed deposits, post office monthly income schemes, senior citizen savings schemes, and corporate deposits.

Monthly income plans are investments where a portion of the amount is invested in equity, and the rest is invested in debt. Fixed income plans, on the other hand, generally invest in debt instruments and provide a fixed rate of return.

Before investing, it is important to evaluate your risk tolerance, diversify your portfolio, determine your investment time horizon, and understand the tax implications of your chosen investment options.

Some alternatives to fixed deposits include post office monthly income schemes, real estate investment trusts, systematic withdrawal plans, and unit-linked insurance plans.