Investing $6,000,000 for retirement is a complex task that requires careful planning and consideration. The first step is to assess your financial situation and determine your risk tolerance. This includes evaluating your investment time horizon, future financial needs, and risk appetite. It is crucial to remember that financial needs evolve over time, so regularly reassessing your situation is essential.

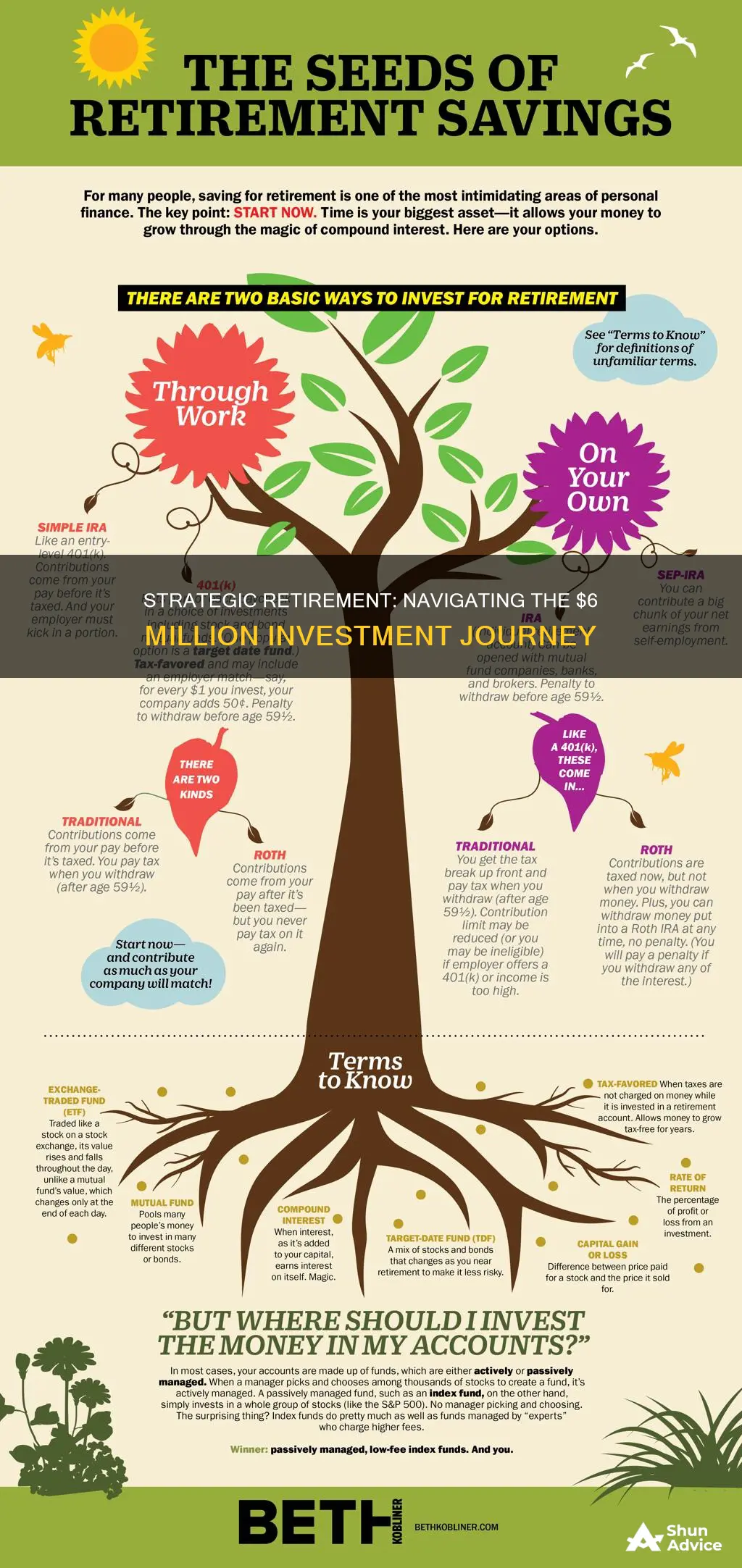

Once you have a clear understanding of your financial landscape, you can explore various investment options. This may include investing in stocks, mutual funds, exchange-traded funds (ETFs), index funds, or dividend-paying stocks. Additionally, consider retirement accounts such as IRAs and 401(k)s, which offer tax advantages.

It is also important to diversify your portfolio to reduce risk. This can be achieved by investing in various asset classes, such as equities, bonds, cash, and alternative investments like real estate or cryptocurrencies.

Before investing, it is recommended to prioritize financial objectives, such as paying off high-interest debt and building an emergency fund. Consulting with a financial advisor can also provide valuable guidance and ensure that your investment strategy aligns with your retirement goals.

| Characteristics | Values |

|---|---|

| Retirement age | The older you get, the larger the portion of your paycheck you'll need to put away each month. |

| Retirement lifestyle | The type of retirement you want to have will determine how much you need to invest. |

| Investment risk | Assess your risk tolerance and plan accordingly. |

| Investment time horizon | How much longer do you want to keep working? |

| Investment types | Stocks, stock funds, annuities, T-bills, bonds, savings accounts, retirement accounts, mutual funds, ETFs, index funds, dividend stocks, alternative investments, real estate, HSAs, CDs, etc. |

What You'll Learn

Pay off high-interest debt

Paying Off High-Interest Debt

Paying off high-interest debt is often cited as a crucial step in any retirement plan, especially when dealing with large sums of money. Here are some reasons why this is an important strategy when investing $6,000,000 for retirement:

Interest Rates Can Be Crippling

High-interest debt, such as credit card debt, can have interest rates of 15% or more. These high rates can quickly eat away at your finances, making it difficult to get ahead and save for retirement. By prioritising the repayment of these debts, you reduce the amount of money lost to interest over time.

It Provides a Solid Foundation for Further Investing

Before investing large sums of money for retirement, it is important to stabilise your financial situation. Paying off high-interest debt can free up cash flow, allowing you to allocate more money towards your retirement fund. It also reduces the number of financial obligations you have, giving you more flexibility and stability.

The Avalanche Method

The "avalanche method" is a debt repayment strategy that focuses on paying off the debt with the highest interest rate first. This method can save you money in the long run by minimising the amount of interest you pay over time. While it may take longer to see progress with this method, it is a smart financial decision.

Peace of Mind

Carrying high-interest debt can be stressful and overwhelming. By prioritising the repayment of these debts, you can gain peace of mind and improve your state of mind. This can also help you stay motivated to continue saving and investing for retirement.

Alternative Strategies

While the avalanche method is a popular choice, it is not the only option. The "snowball method" involves paying off the smallest debt first, regardless of interest rate. This strategy can be beneficial for staying motivated, as it provides quick wins and a sense of progress. However, you may end up paying more in interest with this approach.

In conclusion, paying off high-interest debt is an important step when investing $6,000,000 for retirement. It provides a solid foundation for your financial future, reduces the amount of money lost to interest, and can give you the motivation to continue saving and investing. By considering the different strategies available, you can make an informed decision about how to tackle your debt and work towards a comfortable retirement.

S&P 500: Invest Now or Wait?

You may want to see also

Build an emergency fund

Building an emergency fund is an essential step in protecting yourself financially and one of the first steps you can take to start saving for retirement. An emergency fund is a cash reserve set aside for unplanned expenses or financial emergencies, such as car repairs, home repairs, medical bills, or a loss of income. By having this fund, you can recover quicker from unexpected costs and get back on track with your retirement savings goals.

- Create a savings habit: Setting a specific goal for your emergency fund can help you stay motivated and on track. You can use a savings planning tool to calculate how much and how often you need to save to reach your goal. Creating a system for consistent contributions, such as automatic recurring transfers, is an effective way to build your savings over time.

- Manage your cash flow: Understanding your cash flow, which is the timing of your income and expenses, can help you identify opportunities to adjust your spending and increase your savings. For example, you can work with your creditors to adjust due dates for bills or save more during weeks when you have extra money.

- Take advantage of one-time opportunities: If you receive a large sum of money, such as a tax refund or a cash gift, consider saving all or a portion of it to quickly build your emergency fund.

- Make your saving automatic: Setting up automatic transfers from your checking account to your savings account is a convenient way to save consistently. You can decide the amount and frequency of transfers while ensuring that you have enough money in your checking account to avoid overdraft fees.

- Save through work: Another way to save automatically is through your employer. You can split your paycheck between your checking and savings accounts through direct deposit, making it easy to put money aside without much effort.

When building your emergency fund, it's important to consider where to keep your money. Options include a dedicated bank or credit union account, a prepaid card, or keeping cash on hand. The goal is to ensure your emergency fund is safe, accessible, and separate from your everyday spending money.

While it's important to plan for emergencies, don't forget to also consider your lifestyle and expenses when creating your retirement plan. This will help ensure that your $6,000,000 is managed wisely and provides the comfortable retirement you desire.

Dogecoin: Invest Now or Never?

You may want to see also

Invest in stocks and stock funds

Stocks are an important part of a retirement portfolio. While they are riskier than bonds, they are necessary to protect your savings from inflation. The general rule of thumb is that the percentage of stocks in your portfolio should equal 100 minus your age. However, in an era of long lifespans, experts recommend even higher equity weightings for retirees who have a moderate or high-risk tolerance.

When investing in stocks for retirement, it is important to focus on dividend-paying stocks. Dividend-paying stocks provide a steady income in the form of quarterly payouts. Not all stocks pay dividends, so it is important to review a company's dividend-paying history before investing. Stocks with a reliable history of consistent or steadily increasing dividend payouts are likely to be the most attractive options.

Some of the best retirement stocks have attractive dividends that can be sustained, leading to steady income and long-term value for retirees. It is important to pick high-quality companies that can afford to cover their dividends from their free cash flow and that have good upside potential.

- Visa (V): Visa is a data network company that sells its payment processing network to debt, credit card, and other payments companies. It has few capital expenditures, allowing it to generate a large amount of free cash flow. Visa has a history of 15 years of consecutive dividend growth and its dividend yield is 0.8%.

- Microsoft (MSFT): Microsoft is a global company with a large market share in personal computer software. It is also gaining ground in enterprise and software services through its Azure cloud computing platform. Microsoft has a history of 19 years of consecutive dividend growth and its dividend yield is 0.7%.

- Lockheed Martin (LMT): Lockheed Martin is an aeronautics, defence, and space technology company with a strong and consistent free cash flow. It has raised its dividend per share annually for the past 21 years and its dividend yield is 2.7%.

- Chevron (CVX): Chevron is a large oil and gas company that generates substantial free cash flow. It has a history of 37 years of consecutive dividend growth and its dividend yield is 4.2%.

- Domino's Pizza (DPZ): Domino's Pizza is the largest pizza company in the world, generating significant and consistent amounts of free cash flow at high margins. It has a history of 10 years of consecutive dividend growth and its dividend yield is 1.2%.

In addition to individual stocks, you can also invest in stock funds, which are professionally managed portfolios of stocks. Some examples of stock funds that have been recommended for retirement investors include:

- T. Rowe Price Dividend Growth Fund (PRDGX): This fund focuses on dividend-paying stocks with strong performance and low price volatility. It has a Morningstar gold star rating.

- Schwab International Index Fund (SWISX): This fund tracks the performance of large and mid-cap stocks across 21 developed markets in Europe and Asia. International stocks tend to pay high dividends.

When investing in stocks and stock funds for retirement, it is important to consider your risk tolerance and time horizon. Stocks are generally more aggressive than fixed-income investments like bonds, so they may be more suitable for younger investors who have a longer time horizon and a higher risk tolerance. As you approach retirement, you may need to adjust your asset allocation to include a higher proportion of lower-risk investments.

The Great Debate: Invest or Pay Off Your Home?

You may want to see also

Invest in mutual funds, ETFs, and index funds

Mutual funds, ETFs, and index funds are excellent investment vehicles for those looking to grow their money without having to become stock market experts. These investment options are also suitable for those who want to put their investments on autopilot.

Mutual Funds

Mutual funds are pooled investment vehicles managed by money management professionals. They are less risky than investing in individual stocks and bonds and offer built-in diversification. Mutual funds are only priced at the end of the day and usually have a flat-rate minimum initial investment.

ETFs (Exchange-Traded Funds)

ETFs are baskets of securities traded like stocks on an open exchange. They are more accessible and easier to trade for retail investors. ETFs can be bought and sold at any time and tend to have lower fees and better tax efficiency than mutual funds.

Index Funds

Index funds are a type of mutual fund or ETF that tracks a particular market index, such as the S&P 500, Russell 2000, or MSCI EAFE. They are passively managed, aiming to match the performance of the index rather than beat it. Index funds have lower costs than actively managed funds and are tax-efficient.

When deciding whether to invest in mutual funds, ETFs, or index funds, it is essential to consider your financial goals, risk tolerance, and investment style. These investment options provide access to a wide variety of U.S. and international stocks and bonds, allowing for broad or narrow investment strategies.

Additionally, it is worth noting that ETFs and index funds have historically performed well, and it is wise to compare the overall costs of each before deciding where to invest your money.

Millions Have $1M to Invest

You may want to see also

Invest in real estate

Investing in real estate is a great way to generate a stable income stream for your retirement. Real estate has historically been a consistent wealth generator, providing an added layer of security and stability for retirees.

Rental Properties

Rental properties can provide a steady stream of income, helping to cover expenses and generate profits. To maximise returns, choose locations with strong rental demand and consider the services of a property management company to handle the day-to-day tasks.

Real Estate Investment Trusts (REITs)

REITs are publicly traded companies that invest in a diversified portfolio of income-producing properties. They are an attractive option for passive real estate investment, as they distribute a significant portion of their income as dividends. With $6,000,000, you can invest in multiple REITs to diversify your portfolio and benefit from the expertise of professional property managers.

Real Estate Crowdfunding

Online platforms allow you to invest in real estate projects alongside other investors, providing an opportunity to diversify your portfolio without the burden of property management.

Fix-and-Flip Properties

If you have the skills and capital, buying distressed properties, renovating them, and selling them at a profit can be a lucrative strategy. This approach requires careful planning and a tolerance for risk, but it can result in significant returns.

Short-Term Rentals

Platforms like Airbnb or VRBO can provide higher rental income compared to traditional long-term leases. However, this option may require more active management and compliance with local regulations.

Real Estate Partnerships

Joining forces with others to invest in real estate can reduce the financial burden and risk. Limited partnerships or joint ventures allow you to combine resources and expertise, providing access to more significant investments.

When investing in real estate, it is important to consider factors such as property type, location, market conditions, property management, financing, and tax benefits. Additionally, remember to have a contingency fund for unforeseen expenses and be aware of the potential challenges, such as market volatility, property upkeep, and finding reliable tenants.

Green Energy's Golden Promise: Worth the Investment?

You may want to see also

Frequently asked questions

It is generally recommended to start investing for retirement as early as possible. Financial advisors suggest saving between 10% and 15% of your salary.

Safer investment options include target-date retirement funds, bonds, savings accounts, and money market funds.

The tax implications of investing for retirement depend on the type of account used. For example, contributions to traditional IRAs and 401(k) accounts are tax-deferred, while individual brokerage accounts are taxable.

The risks associated with investing for retirement include market downturns, volatility, and inflation.

To maximize your investments for retirement, consider diversifying your portfolio across various asset classes, such as stocks, bonds, and cash. Additionally, seek to lower overall portfolio risk by investing in exchange-traded funds (ETFs) rather than individual stocks.