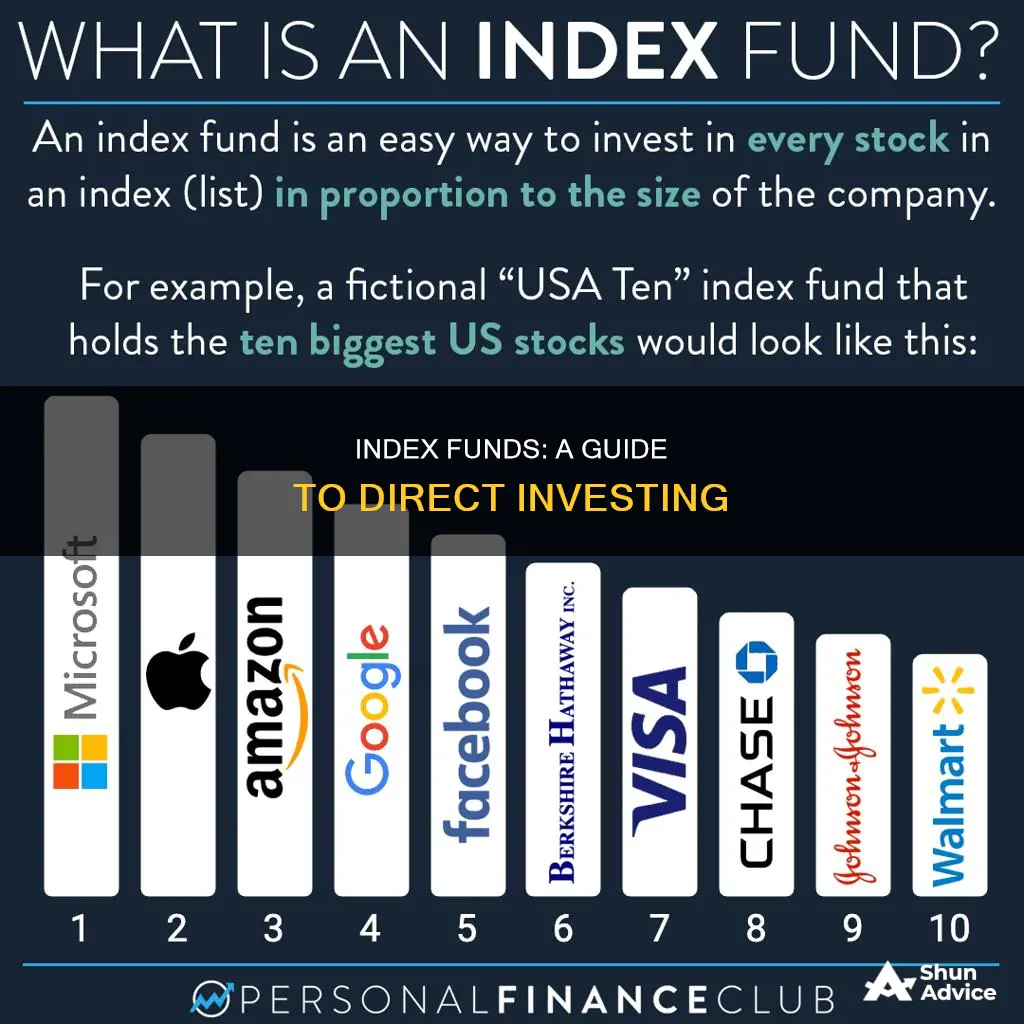

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks a market index, such as the S&P 500 or the Dow Jones Industrial Average. These funds are designed to mirror the performance of the index, aiming to match its returns. By investing in an index fund, you can get exposure to a diverse range of stocks or bonds without having to actively select and manage individual investments. Here's a quick guide on how to invest directly in index funds:

- Choose an index: Decide on the specific market index you want to track, such as the S&P 500, Dow Jones Industrial Average, or Nasdaq Composite.

- Select an index fund: Look for an index fund that tracks your chosen index and has low costs and minimal tracking errors.

- Open an investment account: You can open a brokerage account, individual retirement account (IRA), or Roth IRA to purchase shares of an index fund.

- Buy index fund shares: You can buy shares of the index fund directly from a mutual fund company or through a brokerage. Compare costs and features to find the most suitable option.

- Monitor your investment: While index funds are passively managed, it's important to periodically check that the fund is mirroring the performance of the underlying index and that fees are not stacking up.

Index funds offer a simple and cost-effective way to invest in the stock market, making them attractive to both beginner and experienced investors. Remember to consider your financial goals, risk tolerance, and investment horizon before investing.

| Characteristics | Values |

|---|---|

| Type of fund | Mutual fund or exchange-traded fund (ETF) |

| Investment strategy | Passive |

| Investment objective | To mirror the performance of a chosen index |

| Management style | Passive |

| Investment costs | Low fees, low expense ratios |

| Investment minimum | Varies, can be as low as $0 |

| Account minimum | Varies, can be as low as $0 |

| Investment selection | Based on chosen index |

| Investment returns | Comparable to chosen index, but not guaranteed |

| Investment risk | Lower than individual stocks, but still subject to market risk |

| Taxation | Taxed as regular mutual funds |

| Suitable for | Long-term investors, hands-off investors |

What You'll Learn

Choose an index fund with the lowest costs and closest index tracking

When choosing an index fund, it's important to select one with the lowest costs and closest index tracking. Here are some key considerations:

- Expense ratio: This is one of the main costs of an index fund, so look for funds with low expense ratios. The expense ratio is usually stated as a percentage of your overall investment. For example, the Vanguard S&P 500 ETF has an expense ratio of 0.03%, meaning you pay $3 annually for every $10,000 invested.

- Investment minimum: The minimum amount required to invest in a mutual fund can vary, so look for funds with low or no investment minimums.

- Account minimum: This is different from the investment minimum and refers to the minimum balance required in your brokerage account. Some brokers may not have an account minimum, but this doesn't remove the investment minimum for a particular index fund.

- Trading costs: Consider the trading costs associated with buying or selling the index fund. Mutual fund commissions tend to be higher than stock trading commissions.

- Performance: While past performance doesn't guarantee future results, it's worth reviewing the long-term performance of the index fund and how closely it tracks its target index.

- Diversification: Index funds provide diversification across various sectors and asset classes, so choose a fund that aligns with your investment goals and risk tolerance.

- Fund size: Bigger funds tend to have lower fees, so this may be a factor to consider when choosing an index fund.

Remember to do your research and compare multiple index funds before making your decision. By selecting a fund with low costs and close index tracking, you can maximize your investment returns over time.

Climate Change Mitigation: Investing for a Sustainable Future

You may want to see also

Invest through a brokerage or directly with a fund provider

There are two main ways to invest in index funds: through a brokerage or directly with a fund provider. Here's a detailed breakdown of what you need to know about each option:

Investing Through a Brokerage

Brokerages provide a platform for buying and selling various financial products, including index funds. Here are some key considerations when choosing a brokerage:

- Fund selection: Brokerages typically offer a wide range of index funds from different fund families, allowing you to choose the ones that align with your investment goals and preferences.

- Convenience: Some brokerages offer a comprehensive suite of investment services, enabling you to manage all your investments in one place. This can be especially convenient if you plan to invest in multiple types of financial products.

- Trading costs: Brokerages may charge commissions or transaction fees for buying or selling index funds. These fees can vary between brokerages, so it's important to compare them before making a decision.

- Impact investing: If you want your investments to align with specific values or causes, some brokerages offer impact investing options that focus on environmental or social justice initiatives.

- Commission-free options: Many brokerages offer commission-free ETFs or no-transaction-fee mutual funds, which can help minimize your investment costs.

Investing Directly with a Fund Provider

Investing directly with a fund provider, such as a mutual fund company, is another option for purchasing index funds. Here are some advantages and considerations of this approach:

- Lower fees: Investing directly with a fund provider may result in lower fees compared to using a brokerage. By eliminating the middleman, you can avoid paying brokerage commissions or transaction fees.

- Streamlined process: Dealing directly with the fund provider can simplify the investment process, as you won't need to go through a broker or manage multiple investment accounts.

- Limited fund selection: When investing directly with a fund provider, you will only have access to the funds offered by that specific company. This may limit your investment options compared to using a brokerage.

- Account requirements: Some fund providers may have specific requirements for opening an account, such as minimum investment amounts or other criteria. Be sure to review these requirements before choosing a fund provider.

Factors to Consider

When deciding between investing through a brokerage or directly with a fund provider, here are some additional factors to keep in mind:

- Costs: Compare the overall costs associated with each option, including fees, commissions, and account minimums. Consider the potential impact of these costs on your long-term investment returns.

- Investment goals: Evaluate how each option aligns with your investment goals and risk tolerance. Consider the level of diversification, fund performance, and the level of active management you desire.

- Convenience and accessibility: Assess the convenience and accessibility of each option. Consider factors such as the ease of managing your investments, the availability of research tools, and the quality of customer support.

Pension Funds' Investment Choices: What, Why, and How?

You may want to see also

Understand the benefits and drawbacks of index funds

Index funds are a great investment option for building wealth over the long term. They are a low-cost, easy way to build wealth and are less expensive than actively managed funds. Index funds are passively managed, meaning they don't require a fund manager to decide which investments to buy or sell. Instead, they are designed to mirror the performance of a designated stock market index, such as the S&P 500.

Benefits of Index Funds:

- Low fees: Index funds have much lower management fees than other funds because they are passively managed.

- Low risk: Index funds are highly diversified, which lowers your overall risk.

- Tax advantages: Index funds generate less taxable income and can provide tax benefits.

- Strong performance: Over the long term, index funds have generally outperformed other types of mutual funds.

- Ease of use: Index funds are easy to invest in and provide a simple way to build wealth.

Drawbacks of Index Funds:

- Lack of downside protection: If the market drops, your index fund will drop as well.

- Lack of flexibility: Index funds are limited to well-established investment styles and sectors.

- Limited control: You have no control over the individual holdings in the index fund.

- Limited strategy: Index funds only allow for a single strategy and may not provide access to other successful strategies.

- Dampened personal satisfaction: Index funds may not provide the same level of excitement and satisfaction as actively selecting stocks.

Bond Index Funds: A Smart, Diversified Investment Strategy

You may want to see also

Learn how to buy index funds

Index funds are a great way to build wealth over the long term. They are a group of stocks that mirror the performance of an existing stock market index, such as the Standard & Poor's 500. Index funds don't beat the market, but they aim to be the market by buying stocks of every firm listed on a market index. This makes them a passive management strategy, which means they don't require active decision-making about which investments to buy or sell.

Here's how you can buy index funds:

- Have a goal for your index funds: Know what you want your money to do for you. If you're looking for slow and steady growth over time, index funds may be a good option.

- Research index funds: There are hundreds of indexes you can track using index funds. The most popular index is the S&P 500, but there are also indexes for large and small U.S. stocks, international stocks, and bonds. You can also find sector indexes tied to specific industries, country indexes, and style indexes.

- Choose an index: Once you've decided on an index to track, you can find an index fund that matches it. For example, if you choose the S&P 500, you'll have a variety of index funds to choose from.

- Consider factors: When selecting an index fund, consider which fund most closely tracks the performance of the index, which has the lowest costs, whether there are any limitations or restrictions on investing, and if the fund provider has other index funds that interest you.

- Pick your index fund: Consider costs when choosing an index fund. Index funds are typically low-cost because they are automated to follow shifts in value in an index, but management costs can vary.

- Decide where to buy your index funds: You can purchase an index fund directly from a mutual fund company or a brokerage. Consider factors such as fund selection, convenience, trading costs, impact investing, and commission-free options.

- Open an investment account: To purchase shares of an index fund, you'll need an investment account. This could be a brokerage account, individual retirement account (IRA), or Roth IRA.

- Buy the fund: When purchasing the fund, you may be able to select a fixed dollar amount or choose a number of shares based on the share price and your budget.

- Keep an eye on your index funds: Index funds are passive management, but it's still important to monitor their performance over time. Check if the index fund is mirroring the performance of the underlying index, and keep an eye on fees and performance compared to the index.

Index funds are a simple and effective way to build wealth over time without the need to become a stock market expert. They offer minimal investment research, managed investment risk, a wide range of choices, low fees, and tax efficiency. However, they also have some drawbacks, including no chance to beat the market, short-term downside risk, and a lack of control over the specific stocks in the fund.

IRA Investments: Understanding Fund Unavailability

You may want to see also

Decide how much money to invest in index funds

When deciding how much money to invest in index funds, there are a few key factors to consider. Firstly, it's important to understand the costs associated with index funds. Index funds have lower fees compared to actively managed funds, but there are still some costs to be aware of. These include the investment minimum, account minimum, expense ratio, and tax-cost ratio. The expense ratio, which is the cost subtracted from each fund shareholder's returns as a percentage of their overall investment, is one of the main expenses to consider. It's also important to compare the expense ratios of different index funds, as they can vary significantly.

Another factor to consider when deciding how much to invest is your investment goal and risk tolerance. Index funds are generally considered a lower-risk investment option since they track a diverse range of stocks or bonds in an index. However, it's important to remember that the value of your investment can still fluctuate with the market. If you're investing for the long term, such as for retirement, index funds can be a good option as they tend to provide slow and steady growth over time. On the other hand, if you're looking for quicker and higher returns, you may want to consider other investment options.

Additionally, when deciding how much to invest in index funds, you should evaluate your financial situation and ensure you have enough funds to meet your essential needs and other financial goals. Diversifying your investments across different asset classes and sectors is also important to manage risk. You don't want to put all your money into index funds, especially if you're not comfortable with the level of risk.

Lastly, when deciding how much to invest, it's crucial to consider the performance of the index fund you're interested in. Look at the long-term performance of the fund, ideally over a period of at least five to ten years, to get an idea of the potential future returns. Remember that past performance doesn't guarantee future results, but it can give you an indication of what to expect.

Corporations' Hesitance Towards Mutual Funds: Exploring the Why

You may want to see also

Frequently asked questions

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks a market index, such as the S&P 500 or the Dow Jones Industrial Average. They are designed to mirror the performance of the index by investing in the same securities in the same proportions.

Index funds offer a number of benefits, including low fees, tax advantages, and low risk due to diversification. They are also easy to invest in and have consistently outperformed actively managed funds over the long term.

One drawback of index funds is that they rise and fall with the market. If the market is performing well, your index fund will benefit, but if the market drops, your fund will be vulnerable. Index funds also offer less opportunity for beating the market, as they are designed to match its performance.

When choosing an index fund, look for one with low costs and close index tracking. You may also want to consider the fund provider's other offerings and any limitations or restrictions on investing.

You can buy index funds through a brokerage account or directly from a fund provider. If you choose to use a brokerage, look for one with a wide selection of index funds and low trading costs.

As with any investment, there is a risk of losing money when investing in index funds. However, if you invest for the long term, the risk of losing money is minimal.