Investing for retirement is a multistep process that requires careful planning and consideration. It's important to start as early as possible to take advantage of the power of compounding. The first step is to determine your time horizon, or how long you have until retirement. This will impact the level of risk you can take on with your investments. Younger investors can generally afford to take on more risk, while those closer to retirement should be more conservative. It's also crucial to assess your risk tolerance and investment goals, ensuring you are comfortable with the level of risk in your portfolio.

When it comes to choosing specific investments, diversification is key. This means spreading your money across different types of assets, such as stocks, bonds, mutual funds, index funds, and exchange-traded funds (ETFs). These investment options offer varying levels of risk and potential return, so it's important to understand their differences. For example, stocks and mutual funds tend to be more volatile but offer higher potential returns, while bonds are considered lower-risk but may provide lower yields.

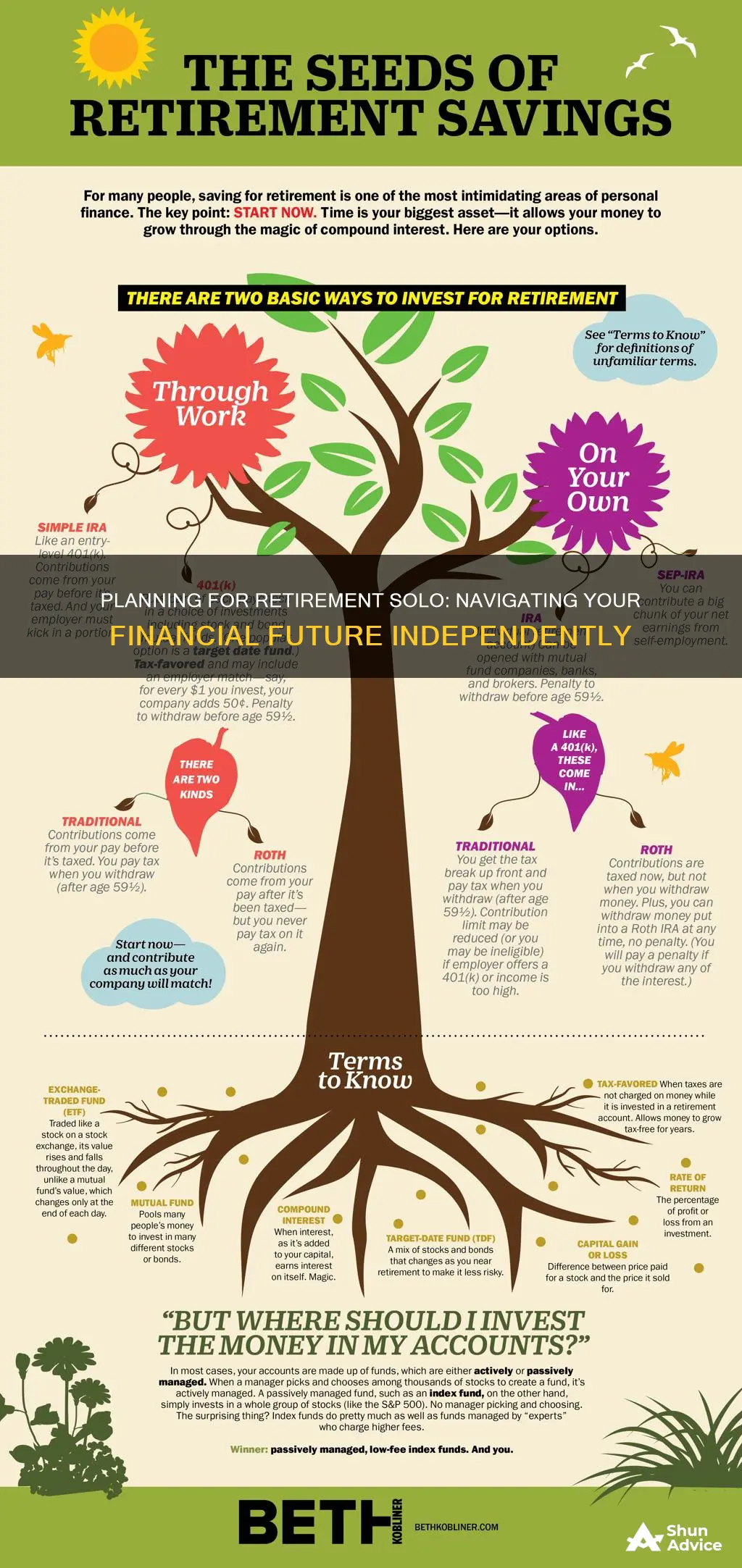

In addition to selecting the right investments, choosing the right retirement account is crucial. This could include employer-sponsored plans like 401(k)s or IRAs, or self-employed plans like SEP IRAs or solo 401(k)s. These accounts offer tax advantages that can help your savings grow over time.

Finally, it's important to regularly review and rebalance your portfolio as you get closer to retirement, gradually shifting towards more conservative investments to preserve your capital and generate income.

| Characteristics | Values |

|---|---|

| Investment options | Tax-advantaged accounts (401(k)s, IRAs), dividend-paying stocks, rental property, annuities, bonds, total return investment approach, income-producing equities, mutual funds, index funds, ETFs, individual stocks and bonds, robo-advisors, target-date funds |

| Asset allocation | 90% to 100% stocks, zero to 10% bonds (20s & 30s), 80% to 100% stocks, zero to 20% bonds (40s), 65% to 85% stocks, 15% to 35% bonds (50s), 45% to 65% stocks, 30% to 50% bonds, zero to 10% cash/cash-equivalents (60s), 30% to 50% stocks, 40% to 60% bonds, zero to 20% cash/cash-equivalents (70+) |

| Time horizon | The longer the time until retirement, the higher the level of risk the portfolio can withstand |

| Risk tolerance | Younger investors can take more risk, while older investors should be more conservative |

| Estate planning | Powers of attorney, wills, trusts, life insurance, tax planning |

What You'll Learn

Understand tax-advantaged accounts

Tax-advantaged accounts are a great way to save for retirement, as they offer tax benefits that encourage you to reach your savings goals. These accounts allow you to reduce your taxable income, defer paying taxes on earnings, or let your money grow tax-free while it sits in your account.

There are two main types of tax-advantaged accounts: tax-deferred and tax-exempt. Tax-deferred accounts, such as traditional 401(k)s and IRAs, offer tax savings when you contribute to the account. You will pay taxes when you withdraw the money in retirement. On the other hand, tax-exempt accounts, such as Roth 401(k)s and Roth IRAs, are funded with after-tax dollars, but you can spend the money tax-free in retirement.

- 401(k)s: These are one of the best-known retirement account options. They are typically offered by employers and are funded through a combination of employer contributions and voluntary deductions from an employee's paycheck. 401(k)s can be either tax-deferred or tax-exempt.

- Individual Retirement Accounts (IRAs): IRAs are independent retirement plans that you can open with any financial institution. Traditional IRAs are tax-deferred, while Roth IRAs are tax-exempt.

- 529 Plans: These are tax-advantaged accounts that allow you to save for college or other qualifying educational expenses. You can contribute pre-tax income and withdraw it tax-free when paying for education expenses.

- Health Savings Accounts (HSAs): HSAs are tax-advantaged accounts that allow you to save for qualified medical expenses. You can contribute pre-tax income, which remains tax-free as long as it is used for medical expenses.

- Flexible Spending Accounts (FSAs): FSAs are funded with tax-free money and can be used for qualified medical expenses. Any unused funds at the end of the year may be rolled over to the following year.

- Coverdell Education Savings Accounts: These accounts are similar to 529 Plans but are typically used for K-12 education expenses. Contributions are not tax-deductible, but withdrawals are tax-free if used for qualifying educational expenses.

By utilising these tax-advantaged accounts, you can maximise your savings and minimise your tax burden, helping you to reach your retirement goals more efficiently.

Airline Investment: Profits Take Flight

You may want to see also

Learn about asset allocation

Asset allocation is a strategy that helps you choose how much money to put into stocks, bonds, and cash when investing for retirement. It is about striking a balance between these three core asset classes.

A simple asset allocation model can be a two- or three-fund portfolio based on mutual funds and exchange-traded funds (ETFs). One fund targets growth, like an S&P 500 index fund or an international stock index fund. The second fund, like a total bond market fund, generates stable income. You can further diversify with a third broad-market ETF or index fund.

Your decision on the percentage of your portfolio balance invested in these two or three stock and bond funds depends on your age and risk tolerance. Here is a simple allocation based on your age suggested by investment management firm T. Rowe Price:

- 20s and 30s: 90% to 100% stocks, zero to 10% bonds

- 40s: 80% to 100% stocks, zero to 20% bonds

- 50s: 65% to 85% stocks, 15% to 35% bonds

- 60s: 45% to 65% stocks, 30% to 50% bonds, zero to 10% cash/cash-equivalents

- 70+: 30% to 50% stocks, 40% to 60% bonds, zero to 20% cash/cash-equivalents

As you age, you will need to rebalance to keep your portfolio in line with your desired risk tolerance. The above asset allocations become more conservative with more fixed-income, bond investments as you get closer to retirement.

If you want the benefits of a simple asset allocation strategy but don't want the upkeep, you can invest with a robo-advisor or a target-date fund. They automatically rebalance your portfolio as you age and markets change, but they charge extra fees.

- Don't put all your eggs in one basket. Diversifying your investments can help you weather market ups and downs.

- Consider your time horizon, goals, investment objective, risk tolerance, and current and future income sources.

- Many investors split their portfolios between stocks, bonds, and cash to balance growth and risk versus income and safety.

- Having bonds in your portfolio may help reduce risk by providing diversification, income, and less volatility compared to stocks.

- Keep in mind that all investments involve risk, which is often defined by investors as volatility drops in price up to and including the loss of principal invested.

- Allocating your portfolio among different investments shouldn't be a one-time activity. Review your investments regularly and reallocate if your goals or investment objectives change.

- The financial markets are another reason to keep an eye on your asset allocation. Market fluctuations can cause your portfolio to become more aggressive or conservative than you intended.

Investing: Why the Fear?

You may want to see also

Robo-advisors and target date funds

Robo-advisors are digital investment advisors that use computer algorithms to create a recommended mix of investments based on your financial situation, goals, and risk tolerance. They are highly customizable and can be used to invest towards a variety of goals, including retirement. Robo-advisors typically charge an advisory fee, and the exchange-traded funds (ETFs) that they invest in charge an annual expense ratio.

Target date funds (TDFs), on the other hand, are mutual funds designed for retirement savings, serving as a diverse investment portfolio in one fund. They are a "one-size-fits-all" investment option, with the same diversified asset allocation strategy for everyone based on how many years they have until retirement. As the target date nears, TDFs adjust their holdings to reduce volatility and risk by investing in more conservative assets. Target date funds only charge an expense ratio, which is typically lower than the combined fees of a robo-advisor.

Robo-advisors offer more personalized and complex portfolios, while target date funds are simpler and more cookie-cutter. Robo-advisors tend to charge higher fees, but they can be used for a wider range of investment goals. Target date funds, on the other hand, are specifically designed for retirement savings and are often included in workplace retirement plans.

Both robo-advisors and target date funds offer a hands-off approach to investing for retirement, but they differ in terms of fees, customization, and flexibility. Robo-advisors provide more personalized portfolios and can be used for a variety of investment goals, while target date funds are simpler and more restricted to retirement savings.

Movie Investment: Why Take the Risk?

You may want to see also

Dividend-paying stocks

When considering dividend-paying stocks for your retirement portfolio, look for companies with a strong track record of paying dividends consistently and increasing those payments over time. This indicates that the company is committed to returning value to its shareholders and can be a more stable investment. Additionally, look for companies with high free cash flow, which is the money left after operating expenses and capital expenditures. High free cash flow means the company can easily cover its dividend payments and have money left over for growth or other initiatives.

- Visa (V): Visa is a data network company that processes payment transactions. It has low capital expenditures and benefits from increasing transaction volumes as economies grow. Visa has a strong free cash flow, allowing it to easily cover dividend payments and buy back shares, which helps push up its stock price.

- Microsoft (MSFT): Microsoft is a well-known global company with a large market share in personal computer software. It also has a strong presence in enterprise software services through its Azure cloud computing platform. Microsoft consistently generates high free cash flow, which it uses for dividend payments and share buybacks.

- Lockheed Martin (LMT): Lockheed Martin is an aeronautics, defence, and space technology company with a strong and consistent free cash flow, supported by a large backlog of orders. It has a history of raising its dividend annually and has the potential for significant stock price appreciation.

- Chevron (CVX): Chevron is a large oil and gas company that generates substantial free cash flow. It has a long history of annual dividend increases and has the financial strength to continue those increases. Chevron also benefits from high oil and gas prices, which can result in higher dividend yields.

- Johnson & Johnson (JNJ): Johnson & Johnson is a diversified healthcare company with a strong presence in pharmaceuticals, medical devices, and consumer healthcare products. It has a robust pipeline of new drugs and a track record of successful acquisitions. Johnson & Johnson has been increasing its dividend annually since 1963 and is considered a stable and recession-resistant business.

- Coca-Cola: Coca-Cola is a well-known beverage company with a strong brand and a diverse range of products. It has been paying dividends since 1920 and has a long history of annual dividend increases. As a non-cyclical consumer staple, Coca-Cola can be a stable investment during economic downturns.

- American Electric Power (AEP): AEP is an electric utility company serving customers in the Midwest and Texas. It benefits from stable demand for its products and services and has a long history of paying dividends, making it a reliable choice for retirement portfolios.

Remember to diversify your portfolio and consider your risk tolerance, time horizon, and overall financial goals when selecting dividend-paying stocks for your retirement investments. Additionally, it is essential to consult with a financial professional or advisor before making any investment decisions to ensure they align with your specific circumstances.

College Loans or Investments: Navigating the Financial Crossroads

You may want to see also

Rental property

Rental properties can be a good way to generate a passive income for your retirement. However, it is not a completely passive investment, and there are several things to consider before investing.

Firstly, you need to think about how you will finance your rental property. If you plan to finance the property with a mortgage, you will need to do this before you retire, as mortgage lending guidelines require applicants to be in employment. You will also need to be able to afford a substantial down payment, which is typically 30% or more if you are not planning on occupying the property yourself.

You should also be aware of the various costs associated with owning a rental property. As well as the mortgage, you will need to pay for maintenance and repairs, taxes, and marketing, and you will need to factor in periods of vacancy when the property is not bringing in an income. You may also want to hire a property management company, which will take a percentage of your rental income.

When deciding on a property, it is important to choose a good location. It is better to buy in an area with high employment opportunities, as this is where rentals are often in demand. You should also consider the demographic of the area and buy a property that will appeal to the type of people living there.

Finally, you need to think about whether you have the temperament to be a landlord. Being a landlord involves dealing with a variety of personalities and screening tenants thoroughly to ensure you are entrusting your property to the right person.

Debt Freedom: Why I Chose to Invest in My Financial Future

You may want to see also

Frequently asked questions

There are several types of investments that can help you save for retirement, including:

- Tax-advantaged retirement accounts, such as 401(k)s and individual retirement accounts (IRAs)

- Dividend-paying stocks

- Rental properties

- Annuities

- Bonds

- Robo-advisors or target-date funds

There is no one-size-fits-all answer to this question, as it depends on various factors such as your annual income, age of retirement, and expected expenses. However, some rules of thumb include saving about $1 million or 12 times your pre-retirement annual income. Another rule of thumb is to save 10% to 15% of your gross annual earnings each year.

The best way to invest for retirement depends on your individual circumstances and goals. However, some general tips include:

- Starting to save as early as possible to take advantage of compound growth

- Diversifying your investments across different asset classes, industries, and geographies

- Considering your risk tolerance and adjusting your investments accordingly

- Using a robo-advisor or target-date fund to automate your investments

There are several types of retirement accounts available, including:

- Employer-sponsored plans such as 401(k)s, 403(b)s, and pension plans

- Traditional or Roth IRAs

- Self-employed or small-business plans such as SEP, SIMPLE, and solo 401(k)s