Buying on credit can be classified as either an operating or investing activity, depending on the context and the specific accounting standards being used.

Operating activities are the daily functions of a business directly related to providing its goods and services to the market. These include manufacturing, distributing, marketing, and selling a product or service. Investing activities, on the other hand, are transactions related to a company's investments in long-term assets, such as purchasing or disposing of property, equipment, or other investment assets.

When a company buys on credit, it is typically purchasing goods or services that are necessary for its operations. In this case, the transaction would be classified as an operating activity. However, if a company takes out a loan or uses credit to invest in long-term assets, this would be considered an investing activity.

It's important to note that different accounting standards and practices may have specific guidelines for classifying certain transactions, and the context of the purchase can also play a role in determining the appropriate classification.

What You'll Learn

Buying on credit is a form of financing activity

Financing activities are one of the three types of cash flow activities, the other two being operating and investing activities. Operating activities are the functions of a business directly related to providing its goods and/or services to the market. These are the company's core business activities, such as manufacturing, distributing, marketing, and selling a product or service. Investing activities, on the other hand, are cash business transactions related to a business's investments in long-term assets.

Financing activities include cash transactions related to the business raising money from debt or stock, or repaying that debt. Examples include cash proceeds from the issuance of debt instruments such as notes or bonds payable, cash proceeds from the issuance of capital stock, cash payments for dividend distributions, and principal repayment or redemption of notes or bonds payable.

When a company buys on credit, it is essentially borrowing money to purchase goods or services. This falls under the category of financing activities because it involves borrowing money and is not directly related to the provision of goods and services or long-term asset investments. Therefore, buying on credit is considered a financing activity.

Strategic Retirement: Investing $200K for a Secure Future

You may want to see also

Financing activities include raising money through debt

Financing activities are a crucial aspect of a company's financial health and future plans. They involve transactions that impact a company's long-term liabilities, owners' equity, and short-term debts. The cash flow from these activities is the net amount of funding generated by a company over a specific period, and it comes from transactions with investors and creditors.

A company's cash inflows occur when it issues notes payable to creditors or stocks to investors. Conversely, cash outflows occur when it pays off debts or distributes dividends to shareholders. These activities are reflected in the company's cash flow statement, which provides valuable insights into its financial management and capital structure.

When a company raises money through debt, it typically does so by selling fixed-income products, such as bonds, bills, or notes, to investors. This is known as debt financing, and it is distinct from equity financing, where the company issues stock to raise funds. Debt financing must be repaid, whereas equity financing does not require repayment, but it also does not give up a portion of ownership.

Debt financing is particularly important for small and new companies, as it allows them to access the resources necessary for growth. It enables businesses to leverage a small amount of capital to stimulate growth and retain ownership control. However, it is important to consider the potential drawbacks, such as the obligation to pay interest and the risk associated with inconsistent cash flow.

Avoid These Investment Traps

You may want to see also

Operating activities are a company's core business activities

Operating activities are the core functions of a business directly related to providing its goods and services to the market. They are the company's primary business activities, such as manufacturing, distributing, marketing, and selling products or services. These activities are generally responsible for the majority of a company's cash flow and play a significant role in determining its profitability.

Some common operating activities include cash receipts from goods sold, payments to employees, taxes, and payments to suppliers. These activities are typically recorded in a company's financial statements, specifically the income statement and cash flow statement. Operating activities are distinct from investing or financing activities, which are not directly related to the provision of goods and services but are crucial for the company's long-term optimal functioning.

Key operating activities for a company encompass manufacturing, sales, advertising, and marketing. These activities are considered revenue-generating activities, as they directly contribute to the company's income and profits. For instance, a spa business may provide massage services while also selling health and beauty products to generate additional revenue.

Operating activities also involve general administrative and maintenance tasks, such as accounting, purchasing, human resources, facility maintenance, and information technology. These functions are essential for the normal operations of a business and contribute to its overall financial performance.

The operating income reflected in a company's financial statements is calculated by deducting operating expenses from operating revenues. This figure provides insight into the company's profitability and financial health. The operating activities section in these statements is of utmost importance as it offers stakeholders valuable information about the business's viability and ability to meet current expenses.

Global Bargain Hunting

You may want to see also

Investing activities are a company's long-term investments

Investing activities include the acquisition of long-term assets, such as property, vehicles, or other requisite machinery, as well as investments in stocks, bonds, real estate, and cash. These are assets that a company intends to hold for more than a year and will not be sold for years, or in some cases, ever.

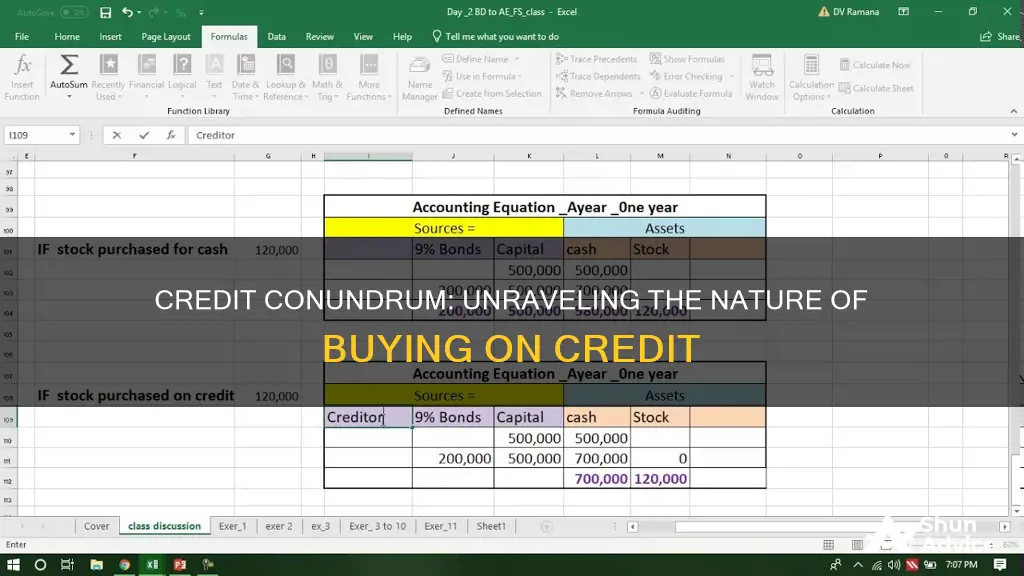

Fixed assets, for example, are often acquired using credit rather than cash, as they tend to be among the more expensive purchases. Each time a company makes a payment on the loan used to acquire that fixed asset, the principal amount of that payment will appear as a decrease in the cash flow in the investing activities section of the statement of cash flows.

A company's balance sheet generally reflects investing activities as one of the major net cash entries for any accounting period. It is important to understand the difference between investing and operating activities. Operating activities are those that a company performs to secure income, such as manufacturing, distributing, marketing, and selling a product or service.

A negative cash flow from investing activities is not necessarily a bad sign, as it may indicate that management is investing in the long-term health of the company, such as research and development.

Investment Strategies: Navigating the World of Smart Spending

You may want to see also

Operating activities are the daily activities of a company

Operating activities are the daily functions of a business that directly relate to providing its goods and services to the market. They are the core business activities that generate revenue and determine profitability. These activities include manufacturing, distributing, marketing, and selling a product or service.

Some common operating activities include cash receipts from goods sold, payments to employees, taxes, and payments to suppliers. These activities are reflected in a company's financial statements, particularly the income statement and cash flow statement. The cash flow statement shows the inflows and outflows of cash resulting from these operating activities.

Other key operating activities for a company include sales, advertising, and marketing. For example, a tax accountant might organize introductory training sessions for small businesses as a marketing strategy. Functions such as accounting, purchasing, human resources, facility maintenance, and information technology are also considered operational activities.

Operating activities are distinct from investing or financing activities, which are functions that support the company's long-term goals but are not directly related to the provision of goods and services.

Mastering the Mental Game of Investing: Strategies for Success

You may want to see also

Frequently asked questions

Operating activities are the functions of a business directly related to providing its goods and/or services to the market. These are the company's core business activities, such as manufacturing, distributing, marketing, and selling a product or service.

Investing activities include making and collecting loans, purchasing and selling debt or equity instruments of other reporting entities, and acquiring and disposing of property, plant, and equipment.

Financing activities include borrowing money, repaying or settling the obligation, obtaining equity from owners, as well as providing owners with a return on, or return of, their investment.

Some examples of operating activities include cash receipts from sales of goods and services, payments to employees, taxes, and payments to suppliers.

Buying on credit is an operating activity.