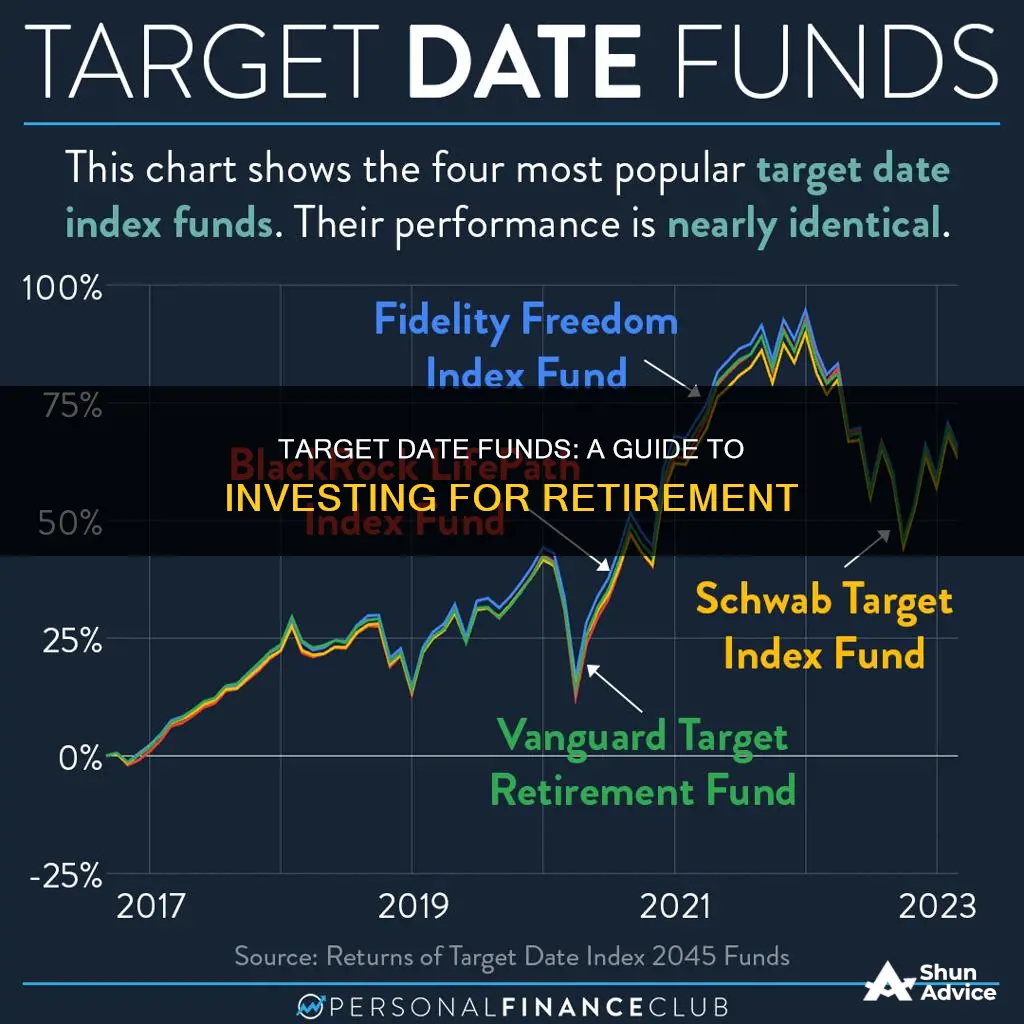

Target-date funds are a popular investment choice for those saving for retirement. They are designed to be a set it and forget it investment option, where investors pick the year they plan to retire, and the fund management company handles the rest. These funds automatically rebalance and reallocate assets as the investor gets closer to retirement, typically shifting from riskier investments, such as stocks, to more conservative investments, such as bonds and cash. While target-date funds offer a convenient, hands-off approach to retirement savings, they also have some drawbacks, including potentially high fees and the risk of becoming too conservative too quickly. In this article, we will discuss the pros and cons of investing in target-date funds and provide guidance on how to choose the right fund for your needs.

| Characteristics | Values |

|---|---|

| Purpose | Retirement savings |

| Who is it for? | Investors who want a hands-off approach to retirement savings |

| Management | Managed by a professional |

| Investment type | Mix of stocks, bonds and other investments |

| Risk | Becomes more conservative as the investor gets closer to retirement |

| Enrollment | Easy |

| Rebalancing | Automatic |

| Diversification | Full |

| Cost | Expense ratios vary but have been decreasing |

What You'll Learn

How to choose the right target date fund

Target-date funds are a popular choice for investors saving for retirement. They are designed to reduce the complexity of retirement planning by automatically rebalancing your portfolio based on your time until retirement. Here are some key considerations to help you choose the right target-date fund:

- Retirement timeline: Target-date funds are named according to the anticipated year of retirement, so choose a fund with a target year that aligns with your planned retirement date. Most target-date funds are named in five-year increments, so select the one closest to your target retirement year.

- Investment strategy: Understand the fund's investment strategy and how it will adjust its asset allocation over time. Evaluate the mix of stocks, bonds, and other investments and ensure it aligns with your risk tolerance and financial goals. Some funds may be too conservative, especially as you approach retirement, so review the fund's "glide path" to ensure it matches your needs.

- Fees and expenses: Consider the expense ratio, which is the annual fee charged by the fund. Lower expense ratios mean more of your investment returns remain with you. Target-date funds that use passive investing strategies tend to have lower fees than those that use actively managed accounts.

- Diversification: Evaluate the diversification of the fund's portfolio. Ensure it includes a mix of domestic and international stocks, small-cap, mid-cap, and large-cap stocks, and bonds to reduce risk.

- Performance: While target-date funds are designed for a hands-off approach, it's important to review their performance annually to ensure they still meet your needs and investment goals.

- Suitability: Target-date funds may not be suitable for everyone. They are designed for investors who want a hands-off approach and may benefit those who tend to change their fund allocation frequently. If you prefer to be actively involved in investment choices, other options like mixed portfolios or index funds may be more suitable.

Tips Mutual Funds: When to Invest for Maximum Returns

You may want to see also

The benefits of target date funds

Target date funds are a popular choice for investors saving for retirement. They are designed to be the only investment vehicle that an investor needs to save for retirement. Here are some of the benefits of target date funds:

Simplicity

Target date funds are often referred to as "set it and forget it" funds. They are simple to use and require little maintenance. You pick a fund, put as much money into it as you can, and then forget about it until you reach retirement age. The target year is identified in the name of the fund, so it is easy to choose one that matches your retirement timeline.

Instant Diversification

Target date funds offer instant diversification among various asset classes, such as equities and bonds. This diversification can help reduce risk and provide a more balanced investment portfolio.

Professionally Managed Portfolios

Target date funds are professionally managed, which means you don't have to worry about making ongoing investment decisions. The funds automatically rebalance and adjust their asset allocation as you get closer to retirement, becoming more conservative to preserve wealth.

Low Minimum Investments

Target date funds typically have low minimum investment requirements, making them accessible to a wide range of investors.

Easy Enrollment

Target date funds are a common preset choice for 401(k) plans and often have an easy enrollment process for both employees and employers.

Balanced Funds: Diversified, Stable, and Smart Investment Strategy

You may want to see also

The drawbacks of target date funds

Target-date funds are a popular choice for retirement savings, but they have some drawbacks that investors need to consider. Here are some of the key disadvantages:

One-Size-Fits-All Approach

Target-date funds use the target retirement date as the only metric to determine how they manage investments. This approach does not account for individual investors' risk tolerance, investment goals, or financial needs. As a result, these funds often have too much or too little equity exposure for specific investors. The one-size-fits-all nature of target-date funds can lead to suboptimal asset allocation and may not meet the diverse needs of retirees.

Limited Investment Choices

Target-date funds limit investors' choices and decisions regarding their investments. The funds are typically composed of underlying funds offered by the same company, restricting investors to a single fund family. This limitation may result in investors being stuck with some subpar funds in their portfolio and reduces their ability to shop for funds with lower fees or better performance.

Lack of Individualization

Target-date funds treat all investors retiring in a certain year as the same, without considering their unique income needs, lifestyles, and resources in retirement. These funds cannot provide an individualized income plan for retirement, which is crucial for ensuring a secure financial future.

Expensive Relative to Index Funds

Target-date funds can be relatively expensive compared to index funds. The average expense ratio for target-date funds was 0.52% in 2020, higher than what is typically found in most index funds (less than 0.2%). The lack of competition among the underlying funds within a target-date fund can lead to higher fees, as investors are locked into a single fund company for each index fund component.

Poor Asset Allocation in Retirement

Some target-date funds have a fundamental flaw in retirement. They may stop changing their asset allocation once the target date is reached, or they may continue allocating more money toward bonds, following a one-size-fits-all approach. This can result in poor investment choices as they fail to account for other factors influencing retirees' asset allocation, such as Social Security benefits and individual financial needs.

Real Estate Mutual Funds: Diversify Your Investment Portfolio

You may want to see also

How to manage your target date fund

Managing your target-date fund is all about ensuring it stays on track with your retirement plans and goals. Here are some key considerations for managing your target-date fund:

Regularly Review Your Fund's Performance

While target-date funds are designed to be a "set it and forget it" investment option, it's important to periodically review their performance to ensure they still align with your needs. This includes assessing the fund's returns and its asset allocation strategy to ensure it matches your risk tolerance and investment goals.

Understand the Glide Path

Target-date funds operate on a "glide path", which means they gradually shift from higher-risk, higher-reward assets to more conservative investments as you approach retirement. This is an important concept to understand when managing your expectations and ensuring your fund is on the right trajectory.

Be Mindful of Fees

Target-date funds typically have expense ratios, which are annual fees expressed as a percentage of your investment. While these fees have been decreasing due to competition, they can still impact your overall returns. Compare expense ratios and try to keep these fees as low as possible.

Consider a Financial Advisor

If you're unsure about the suitability of your target-date fund, consider enlisting the services of a fee-only certified financial planner. They can help you pick the best retirement portfolio for your specific goals and provide guidance on how your target-date fund fits into your overall financial plan.

Adjust Your Fund as Needed

If your retirement plans change, such as deciding to work for a few more years, be sure to adjust your target-date fund accordingly. You can switch to a fund with a later target date to ensure your investments remain aligned with your new timeline.

Diversify Your Investments

While target-date funds offer easy diversification, they may not always be tailored to your specific needs. Consider diversifying your retirement savings by investing in other funds or accounts outside of your target-date fund. This can help ensure you have a well-rounded portfolio that meets all your financial goals.

Be Aware of Potential Downsides

Target-date funds have some potential disadvantages, such as becoming too conservative too quickly or underperforming in certain market conditions. Be mindful of these potential drawbacks and be prepared to make adjustments if needed.

Remember, managing your target-date fund is an ongoing process. Regularly review and adjust your investments to ensure they remain aligned with your retirement plans and goals.

Index Funds: A Beginner's Guide to Investing

You may want to see also

When to seek professional advice

Target-date funds are a popular choice for investors saving for retirement. They are designed to be a "set it and forget it" option, removing the need for investors to decide on a mix of assets and rebalance those investments over time. While target-date funds are a convenient choice for many, there are situations in which you may want to seek professional advice.

Firstly, consider seeking advice if you have a complex financial situation or are planning to retire early or late. Target-date funds are a one-size-fits-most approach, and may not be suitable if your circumstances are unusual. For example, if you have other assets or sources of income, you may not need an investment strategy that becomes more conservative over time. A financial advisor can help you evaluate your financial plan and make adjustments as needed.

Secondly, if you have specific investment preferences, such as a desire for full transparency into each position you own, a target-date fund may not be the best option. Target-date funds are often a fund of funds, meaning they invest in multiple mutual funds, which in turn hold many individual investments. This can make it difficult to understand exactly what you are investing in. A financial advisor can help you construct a portfolio that aligns with your preferences and goals.

Thirdly, if you are concerned about fees and expenses, it may be worth seeking advice. While target-date funds offer simplicity and professional management, they may come with higher fees than other investment options. Be sure to consider the ongoing fees you will pay, as well as the initial deposit. The cost of a mutual fund is typically expressed as an expense ratio, which represents the ratio of your investment that goes towards the fund's expenses. The higher the fees, the more they can erode total returns.

Finally, consider seeking advice if you are unsure about the glide path of a particular target-date fund. The glide path refers to how the fund shifts from a high ratio of riskier equity funds to safer investments like bonds as you age. Some funds may be too conservative or not conservative enough depending on your risk appetite. A financial advisor can help you understand the different glide paths and choose one that aligns with your goals and risk tolerance.

Mutual Funds vs. ETFs: Pros, Cons, and Your Investment Choice

You may want to see also

Frequently asked questions

A target-date fund is a mutual fund or exchange-traded fund that automatically rebalances and reallocates assets as you get closer to retirement, typically shifting from riskier investments to more conservative investments. The fund is designed as a one-stop investment shop with a diversified set of asset classes.

You can invest in a target-date fund through a 401(k) plan, a brokerage account with a fund manager or online broker, or directly from a fund provider. The fund may require a minimum initial investment, which can range from $500 to $3,000 or more, but some funds will waive the investment minimum if you make monthly deposits to your account.

Advantages include the ability to put your investing activities on autopilot, the convenience of automatic asset allocation, and increasingly lower fund fees. Disadvantages include potential high fund expenses, the possibility of losing money, and the risk of the fund becoming too conservative too quickly, reducing your overall potential return.