Superannuation is one of the largest investments most people will ever make, so it's important to understand how super funds invest your money. Super funds typically have a team of experts who focus on long-term strategies to meet the investment objectives of the fund. This could mean investing in infrastructure projects, innovative companies, or fields with strong prospects, such as renewable energy. The investments your super fund makes on your behalf depend on the type of fund and the investment options it offers. There are generally two types of investment strategies: conservative and growth. A conservative strategy will have a higher allocation of defensive assets, such as cash and fixed interest, while a growth strategy focuses on growth assets, such as shares and property, to achieve higher returns over time.

| Characteristics | Values |

|---|---|

| Investment Options | Managed funds, listed equities, term deposits, bank accounts, SMAs, ETFs, MDAs, IMAs, listed property, unlisted property, direct property, unit trusts, private equity, diversified pre-mix options, cash accounts, ASX-listed shares, etc. |

| Investment Mix | Conservative, moderate, balanced, growth, or high-growth. |

| Investment Decision Factors | Risk tolerance, age, income, time until fund access, specific goals, and required income upon retirement. |

| Investment Goals | Enhance member returns, long-term financial gains, and retirement planning. |

| Investment Strategies | Active management, asset allocation, stock selection, diversification, and lifecycle investment. |

| Investment Beliefs/Responsibilities | Enhancing member returns, active management, using scale to reduce costs, community responsibility, and maximising benefits for members. |

| Investment Expertise | Internal investment teams, external managers, and specialists for due diligence and governance. |

| Investment Performance | Aim for strong long-term performance, higher average returns, and risk management. |

| Investment Disclosure | Comprehensive lists of investments, updated periodically, and available on websites or product disclosure statements (PDS). |

What You'll Learn

Growth assets vs defensive assets

Superannuation is one of the largest investments a person will ever make. As such, it's important to understand the different types of investment strategies and the assets that super funds invest in.

Growth and defensive are two types of investment strategies. The difference between the two lies in the level of risk and expected returns.

Growth investments are assets that have the potential to grow in value over time. They are considered riskier than defensive investments because their value is susceptible to market changes. However, they offer the possibility of higher returns over time. Shares, for example, are growth investments that represent ownership in a company. While they can be volatile in the short term, they have historically provided higher returns over the long term.

Defensive investments, on the other hand, are lower-risk assets designed to provide stable returns and protect capital against market fluctuations. They tend to generate lower returns over time and may not keep up with inflation. Examples of defensive investments include bonds and certain types of managed funds, which provide regular interest or dividends and can be a good source of passive income.

It's worth noting that some investments, such as unlisted property, unlisted infrastructure, and private equity, can be considered either growth or defensive assets, depending on the fund's classification.

When deciding between growth and defensive investments, individuals should consider their financial goals, risk tolerance, age, income, and investment horizon. Younger investors with a higher risk tolerance may opt for a strategy with more growth assets, such as shares and property. On the other hand, those with a lower risk tolerance may prefer a more defensive approach, investing more in bonds and cash to protect against market volatility.

Investment Options

Super funds typically offer a range of pre-mixed investment options, allowing individuals to choose a strategy that aligns with their goals and risk tolerance. These options vary in terms of the mix of growth and defensive assets they include.

A conservative option, for instance, may comprise mainly defensive assets, with around 30% in shares and property and the remainder in cash and fixed interest. In contrast, a growth option aims for high returns over the long term, with approximately 85% of investments in high-growth asset classes like shares and property and minimal investment in defensive assets.

A balanced option aims to strike a balance between risk and reward, typically with a 50/50 split between growth and defensive assets. However, it's important to note that there is a lack of consistency and clarity in the naming and categorisation of these investment options, and individuals should carefully review the underlying asset mix before making a decision.

Diversification

To further manage risk, super funds may employ diversification strategies by spreading investments across different asset classes. This helps reduce the impact of negative returns in any one asset class, as not all investments perform the same way simultaneously.

By investing in a mix of growth and defensive assets, super funds aim to maximise returns and protect members' savings while navigating market risks.

Understanding IRA Fund Investment Timing

You may want to see also

Investment options and risk tolerance

There are thousands of superannuation investment options available, from managed funds to listed equities, term deposits, bank accounts, and more. The range of investment options you will have available depends on what your super fund offers.

Industry Super Funds traditionally offered low-cost investment choices limited to a handful of pre-mix options, such as Defensive, Moderate, Balanced, Growth, and High Growth. However, many have expanded their offerings to include a wider range of investments, including ASX-listed shares. Retail Super Funds, on the other hand, have generally provided a broader range of investment options, including access to hundreds of managed funds and ASX-listed shares.

Your investment options will depend on your risk tolerance and retirement goals. A conservative investment strategy typically comprises mainly defensive assets, such as cash and fixed interest, with a small percentage in shares and property. A balanced strategy aims for reasonable growth with a bit of risk and usually involves investing about 70% in growth assets, such as shares and property, and the remaining 30% in defensive assets. A growth strategy aims for higher returns over the long term and can involve higher risk, with around 80-85% in growth assets and the remainder in defensive assets.

Your age and the time until you retire should also be considered when choosing an investment strategy. For example, if you are in your early 20s and new to the workforce, you may seek a growth or balanced investment strategy and be prepared to withstand greater volatility in search of returns. On the other hand, if you are in your 50s and approaching retirement, you may opt for a more conservative strategy to reduce the risk of losses and preserve your portfolio.

It is important to remember that every super fund is different, and the most appropriate investment option may change over time depending on various factors such as your age, life situation, risk tolerance, and the state of the economy. Therefore, it is recommended to review your investments regularly.

Lumpsum Mutual Fund Investment: Timing for Maximum Returns

You may want to see also

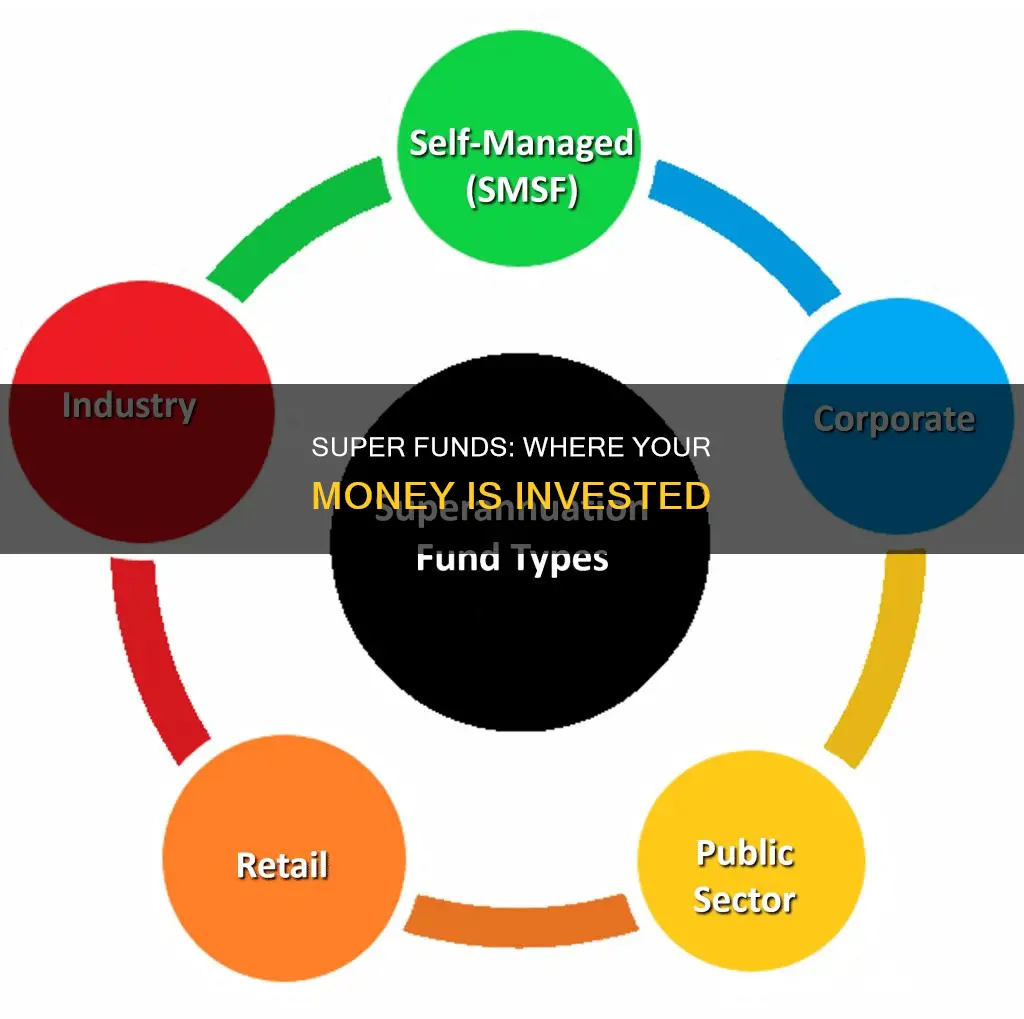

Industry Super Funds vs Retail Super Funds

When it comes to super funds, there are two main categories: retail super funds and industry super funds. Both types of funds offer a range of investment options, from conservative to growth, and aim to maximise investment returns for their members. However, there are some key differences between the two.

Industry SuperFunds were established in the 1980s to protect Australian workers from the high fees and commission products that were common in the retail superannuation market at the time. These funds are run solely to profit their members and do not pay profits or dividends to shareholders. They are governed by trustee boards that include both employer and employee organisation representatives. Industry super funds aim to keep management fees low while providing above-average investment returns. They are committed to investing in quality long-term infrastructure and building investments in Australia, as these benefit their members through broader economic growth and healthy investment returns. Over the last 15 years, Industry SuperFunds have consistently outperformed retail funds.

Retail super funds, on the other hand, are owned by banks, insurance companies, and private investors. These funds help generate corporate profits, which are returned as dividends to shareholders rather than fund members. While some banks are selling their wealth management businesses, it is expected that investors will continue to divert profits to shareholders. Historically, the banks, insurance companies, and shareholders behind retail superannuation funds have made enormous profits, while the average retail fund has delivered significantly lower returns to their members compared to Industry SuperFunds.

In terms of investment options, both industry and retail super funds offer pre-mixed investment options, which typically include a mix of shares, property, fixed interest, and cash. The specific allocation across these asset classes depends on the risk profile of the investment strategy chosen. Conservative strategies tend to favour defensive assets, while growth strategies focus on high-growth assets. Retail funds often provide a wider range of investment options and may be recommended by financial advisors who charge a fee for their services.

When choosing between an Industry SuperFund and a retail super fund, it is essential to consider factors such as fees, investment returns, and the alignment of the fund's profits with your interests. It is also important to remember that past performance does not guarantee future results, and individual funds within each category may vary in their specific offerings and performance.

Mutual Fund Investment: Key Factors to Consider

You may want to see also

Active vs passive investment management

Superannuation is one of the largest investments most people will ever have, so it's important to understand how super funds invest your money and the different types of investment strategies available.

Super funds invest with the goal of helping members achieve their best financial position in retirement. They do this by investing in a diversified mix of assets to grow members' savings over time, while also balancing this with an understanding of the risks.

There are two main approaches to investment management: active and passive. Active management involves using skill or knowledge of the market to select individual stocks to buy and sell. It's a more hands-on approach that tries to identify undervalued stocks to buy and overvalued stocks to sell. Active management requires a deeper analysis of the market and individual companies and can be more costly due to higher transaction fees and salaries for analyst teams. However, it offers the advantage of flexibility, as active managers can buy stocks they believe are undervalued and can use various techniques to hedge their bets.

On the other hand, passive management aims to replicate a specific index, such as a stock market, rather than trying to pick individual companies. It's a more passive approach that invests in the market as a whole. Passive management generally costs less as there are no active buying and selling decisions, resulting in lower transaction fees. It also offers good transparency, as investors always know what stocks or bonds are included in the index.

While both approaches have their advantages and disadvantages, the choice between active and passive investment management depends on various factors, including an individual's risk tolerance, age, income, and investment goals. Some super funds may even blend these strategies to take advantage of the strengths of both.

Liquid Fund Investment: Timing for Optimal Returns

You may want to see also

Ethical and ESG considerations

Superannuation is one of the largest investments a person will ever make, so it's important to understand the different investment options and strategies available. Ethical and ESG considerations are becoming increasingly important to consumers, with consumer demand for ethical and responsible superannuation options increasing dramatically over the past decade. This shift in consumer behaviour has been driven by disappointment with government inaction, leading consumers to put their money where their values are.

There are several strategies that super funds may use to invest ethically. One common approach is Environmental, Social, and Governance (ESG) screening, which involves assessing a company's environmental, social, and governance risk. Companies with poor ESG practices are more likely to face fines or lawsuits, and therefore pose a higher risk to investors. By considering ESG factors, super funds can identify companies that are well-managed and committed to environmentally sustainable and socially responsible practices, which are more likely to be good long-term investments.

Another strategy is negative screening or divestment, where super funds avoid investing in, or sell their shares in, companies that engage in activities that conflict with their values. This approach allows super funds to exclude unethical or undesirable companies or industries from their investment portfolios. Positive screening is another strategy, where super funds actively seek out companies that offer a net benefit to society or the environment, such as those in renewable energy, healthcare, or education.

Engagement is a less common strategy, where a super fund retains shares in a company despite disagreeing with some of its activities. In this case, the fund uses its role as a shareholder to influence and change the company's behaviour. This strategy may not appeal to members who have specifically chosen an ethical or sustainable fund, as it involves maintaining investments in companies that may not align with their values.

When considering ethical and ESG super funds, it is important to remember that the primary goal of super funds is to maximise investment returns. While ethical and ESG considerations are important, they should not come at the expense of lower returns or higher fees for fund members. It is also crucial for super funds to be transparent and accurate in their marketing and communication about their ethical and ESG practices to avoid misleading consumers.

Overall, ethical and ESG considerations are playing an increasingly significant role in the superannuation industry, with a growing number of consumers demanding responsible and sustainable investment options. Super funds are responding to this shift by incorporating these considerations into their investment strategies and decision-making processes.

Mutual Fund Investment: Strategies, Risks, and Rewards

You may want to see also