Investing in bond index funds can be a great way to increase your exposure to safer, low-fee securities. Bond index funds are a type of investment fund that holds a diversified portfolio of bonds chosen to match the performance of a specific bond index. They are designed to provide investors with a simple and low-cost way to invest in bonds, which are typically loans made to governments or companies in exchange for regular income payments.

When you invest in a bond index fund, you are buying shares in a fund that invests in a variety of bonds, such as government, corporate, or municipal bonds. These funds are managed by professionals who buy and sell bonds according to market conditions, rarely holding them until maturity. The primary goal of bond index funds is to generate monthly income for investors, which can be an attractive alternative to the traditional semi-annual payments of individual bonds.

While bond index funds offer several benefits, it's important to consider the potential drawbacks as well. One of the main disadvantages is the volatility associated with rate changes, as most broad-based bond index funds invest heavily in government securities. Additionally, bond index funds may underperform compared to other fund-based investments.

Before investing in bond index funds, it's crucial to understand your financial goals, risk tolerance, and time horizon. Consulting with a financial advisor can help you make informed decisions and ensure that bond index funds align with your investment strategy.

What You'll Learn

Bond funds vs individual bonds

There are several factors to consider when deciding between investing in bond funds or individual bonds. Both options have their own advantages and drawbacks, and the right choice depends on your financial goals, risk tolerance, and behavioural preferences. Here is a detailed comparison of the two options:

Diversification

- Bond funds offer greater diversification per dollar invested as they hold a large number of bonds with different issuers, maturity dates, coupon rates, and credit ratings. This diversification can be challenging to achieve with individual bonds, especially for investors with a limited amount to invest.

- Individual bonds, on the other hand, offer more control over what's in your portfolio. You decide which bonds to buy and whether to hold them until maturity or sell them beforehand.

Convenience

- Bond funds are more convenient as they are managed by professionals, saving you time and effort in researching and monitoring individual bonds.

- Individual bonds require significant research and ongoing monitoring to assemble and manage a diversified portfolio.

Costs

- Bond funds typically charge management fees, which can lead to higher costs and potentially lower returns.

- Individual bonds usually have a commission charged when purchased and may have transaction costs when sold, but there are generally no ongoing management fees.

Control over Maturity

- Bond funds do not have a definite maturity date, and their net asset value (NAV) fluctuates with interest rate changes, making it unpredictable.

- Individual bonds have a fixed maturity date, providing a predictable value at maturity and a reliable income stream.

Other Considerations

- Bond funds offer automatic dividend reinvestment, making it more convenient during the accumulation phase.

- Individual bonds may be preferable for investors seeking predictable value and certainty, especially for those with a known future expense or liability.

- Bond funds provide better liquidity as investors can buy or sell shares at any time, while individual bonds may be more challenging to sell before maturity.

- Bond funds offer broader diversification, which is essential for corporate or municipal bonds to minimise the impact of a single default.

- Individual bonds may be preferred for Treasury bonds as there is no diversification benefit from a bond fund, and individual bonds can be purchased at auctions for free.

In conclusion, the decision between bond funds and individual bonds depends on your specific needs and circumstances. Bond funds offer broader diversification, professional management, and convenience, while individual bonds provide more control, predictability, and potentially lower costs.

Black Money in Mutual Funds: Strategies for Investing Illicit Gains

You may want to see also

Pros and cons of bond index funds

Bond index funds are a type of investment that can provide diversification, professional management, liquidity, convenience, and income streams. They are also a simple and cheap way to invest in bonds, providing investors with a window to diversified, low-fee investing. However, bond index funds also have several disadvantages, such as volatility related to rate changes and lower performance than other fund-based investments.

Pros of Bond Index Funds

Bond index funds are a diversified portfolio of bonds chosen to align with the performance of a specific bond index. They are a form of passive investing, aiming to mimic the bond market rather than outperform it. This results in lower management and operating costs, which can be passed on to investors in the form of lower fees. The Barclays Aggregate U.S. Bond Index is commonly used as it covers most U.S.-traded bonds and some foreign bonds.

Bond index funds are easily accessible through investment firms or online brokerages, and they provide consistent performance over time. They are also highly diversified, allowing investors to achieve a diversified bond portfolio with a smaller investment. Additionally, bond index funds provide access to institutional pricing, which can lead to higher yields.

Cons of Bond Index Funds

The main disadvantage of bond index funds is their sensitivity to fluctuations in the interest rate environment, leading to long-term volatility. This is especially true for funds that invest heavily in government-backed securities, which may be highly volatile in a high-interest-rate environment.

While bonds are generally considered safe investments, safer investments tend to generate smaller returns in the long term. Additionally, with bond funds, there is no guarantee of recovering your principal at a specific time, and you may not know when or if you will get your principal back.

Bond index funds may also have management fees, which can lead to lower returns. The performance of bond index funds may also be lower than other fund-based investments.

Bond index funds offer investors a way to increase their exposure to safer, low-fee securities. However, it is important to consider the potential drawbacks, such as volatility and lower performance. Diversification and a careful assessment of risk tolerance and time horizon are crucial when determining the right investment approach.

Corporate Bond Funds: Smart, Secure Investment Strategy

You may want to see also

Different types of bond funds

Bond index funds are a type of investment that provides access to a diversified portfolio of bonds selected to match the performance of a specific bond index. They are considered a form of passive investing, aiming to mirror the performance of the bond market rather than seeking to outperform it. Here is an overview of some different types of bond funds:

Bond Mutual Funds

Bond mutual funds are a type of bond index fund that holds a large number of bonds with different characteristics such as maturity dates, coupon rates, and credit ratings. They usually make monthly distributions, offering a more frequent income stream compared to individual bonds, which typically pay interest semi-annually. Bond mutual funds provide greater diversification per dollar invested and access to institutional pricing, but they also come with management fees that may lead to lower returns.

Exchange-Traded Funds (ETFs)

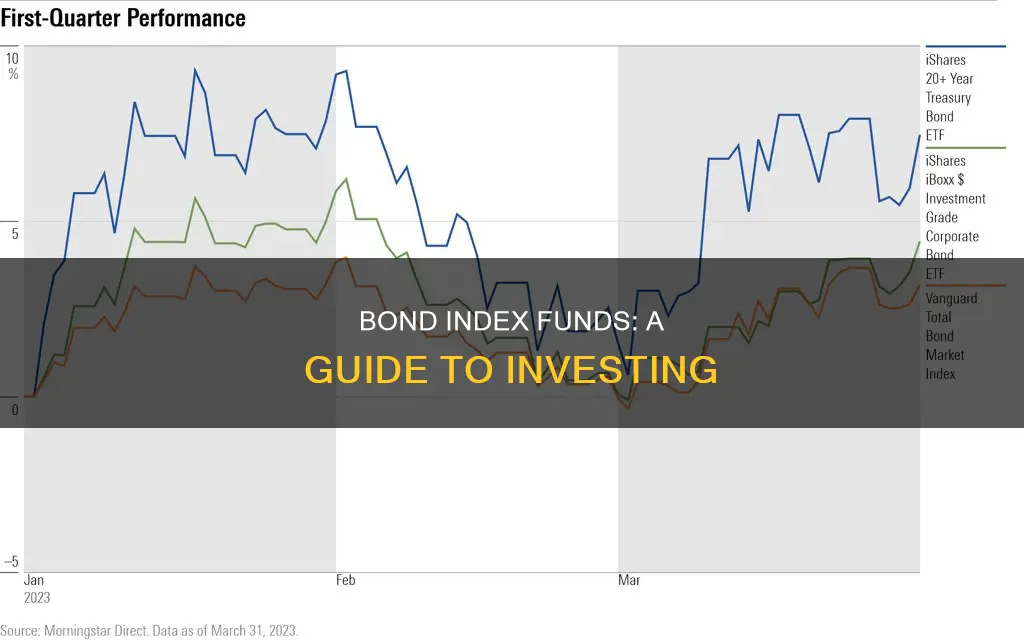

Bond ETFs are another type of bond index fund that can be purchased through an online brokerage. They provide exposure to a basket of bonds, aiming to match the performance of a specific bond index. ETFs are known for their low fees, as they involve a smaller degree of management and operating costs. However, they may be subject to the same volatility and performance drawbacks as other bond index funds.

Total Bond Market Index Funds

Total bond market index funds provide exposure to the entire bond market, including U.S. Treasury bonds, agency bonds, corporate bonds, and other fixed-income investments. These funds aim to lower portfolio volatility and generate income. They are well-diversified, holding thousands of individual bonds, and typically have low expense ratios. Total bond market index funds are suitable for long-term investing, helping investors weather short-term volatility.

Sustainable or ESG Bond Funds

Some bond index funds, like the Fidelity Sustainability Bond Index Fund (FNDSX), focus on sustainable or ESG (environmental, social, and governance) investing. These funds invest in bonds that meet certain ESG standards while also aiming to match the performance of a broader bond index, such as the Bloomberg U.S. Aggregate Bond Index. Sustainable bond funds allow investors to align their investments with their values while potentially benefiting from the diversification and low fees associated with bond index funds.

Investing in Index Funds: A Minor's Guide

You may want to see also

How to buy bond index funds

Bond index funds are a type of investment that can provide a window into diversified, low-fee investing. They are a form of passive investing, where rather than seeking to outperform the bond market, fund managers instead aim to mimic it. This results in a smaller degree of management and operating costs, which can be passed on to investors in the form of lower fees.

There are several ways to buy bond index funds. You can invest through an investment firm, or buy shares of a bond exchange-traded fund (ETF) through an online brokerage.

When deciding whether to buy bond index funds, it is important to understand the difference between the benefits of bond index funds and individual bonds. Bonds typically pay an interest rate or coupon payment twice a year. If you sell at maturity, you will also get the principal back.

Bond funds, on the other hand, are composed of various bonds, each with a different maturity date. Fund managers can buy and sell these bonds at will. They typically make monthly payments, which can be reinvested, and may climb alongside interest rates. However, you won't know when or if you will get your principal back.

Some of the advantages of bond index funds include:

- Diversification: Bond funds can provide access to a wide range of bonds, including government securities, corporate bonds, and mortgage-backed securities. This diversification can help to reduce overall credit risk.

- Professional management: Actively managed bond funds allow fund managers to buy or sell bonds depending on the economic and interest rate environment, potentially increasing returns and income.

- Liquidity: Bond funds typically offer daily liquidity, allowing investors to buy or sell shares at any time.

- Convenience: Investing in bond funds requires less research and oversight compared to individual bonds.

- Income stream: Bond funds provide a steady income stream, with most funds making monthly distributions.

- Tax advantages: In some cases, income from bond funds may be tax-exempt or subject to lower tax rates.

However, there are also some disadvantages to consider:

- Volatility: Bond funds are highly sensitive to fluctuations in the interest rate environment, which can impact their value.

- Lower performance: Bond index funds may underperform compared to other fund-based investments or actively managed funds.

- Management fees: Actively managed bond funds may have higher management fees, which can lead to lower returns.

- Lack of control: When investing in bond funds, you have less control over the specific bonds in your portfolio.

Ultimately, the decision to invest in bond index funds depends on your financial goals, risk tolerance, and time horizon. It is important to carefully consider the advantages and disadvantages before making any investment decisions.

Invest in Tesla: Top Mutual Funds to Consider

You may want to see also

Risks of investing in bond index funds

Investing in bond index funds comes with several risks that you should be aware of. Here are some of the key risks to consider:

- Long-Term Volatility: Most broad-based bond index funds invest in government securities, which makes them highly sensitive to fluctuations in interest rates. While bonds are generally considered safe investments, the risk associated with bond funds can remain constant or even increase over time, unlike individual bonds, where risk tends to decrease as the maturity date approaches.

- Interest Rate Risk: Bond fund returns are highly dependent on changes in general interest rates. When interest rates increase, the value of bonds decreases, negatively impacting bond fund returns. This risk is measured by "duration," which indicates the sensitivity of a bond fund to interest rate changes. A higher duration means greater sensitivity to interest rate fluctuations.

- Credit Risk: While most bond funds diversify credit risk effectively, investing in lower-credit-quality bonds can lead to higher yields but also higher volatility. Bonds rated below investment grade, or "junk bonds," can be particularly volatile.

- Foreign Exchange Risk: Bond funds that invest in bonds not denominated in their domestic currency can face additional volatility due to fluctuations in currency values. Currency returns can sometimes dwarf the fixed-income return of these foreign currency bonds.

- Management Risk: Actively managed bond funds may underperform or lead to higher fees due to the fund manager's decisions. In contrast, passively managed index funds aim to mimic the performance of a specific index, resulting in lower management fees.

- Taxable Events and Fees: Investing in an actively managed bond portfolio may generate taxable events and higher fees, impacting your overall returns.

- Liquidity Risk: Liquidity issues can affect bond funds, making it challenging to sell or redeem bonds at certain times.

- Geopolitical Risk: Bond funds are also subject to geopolitical risks, which can influence the performance of the underlying bonds.

- Lower Performance: Bond index funds may underperform compared to other fund-based investments. Actively managed funds, for instance, aim to beat the index and may provide higher returns, although they also carry higher fees.

First-Time Funds: Why You Should Invest Now

You may want to see also

Frequently asked questions

Bond index funds are a type of investment fund that holds a diversified portfolio of bonds chosen to match the performance of a specific bond index. The fund's manager ensures that the fund's performance aligns with its target index.

Bond index funds offer investors a window to diversified, low-fee investing. They are a passive form of investing, aiming to mirror the performance of the bond market rather than seeking to outperform it. This results in lower management and operating costs, which can be passed on to investors in the form of reduced fees.

Bond index funds are subject to volatility, particularly due to changes in interest rates. They may also underperform compared to other fund-based investments. Additionally, there is a risk of default by the bond issuer, and the value of the fund may fluctuate with changes in the market.

When choosing a bond index fund, consider the following: how closely the fund tracks the performance of its target index, the fund's costs and fees, any limitations or restrictions on investing, and whether the fund provider offers other index funds that align with your investment goals.

You can invest in a bond index fund by opening a brokerage account that allows you to buy and sell shares of the fund, or by opening an account directly with a mutual fund company that offers the fund. Compare costs and features to determine the best option for you.