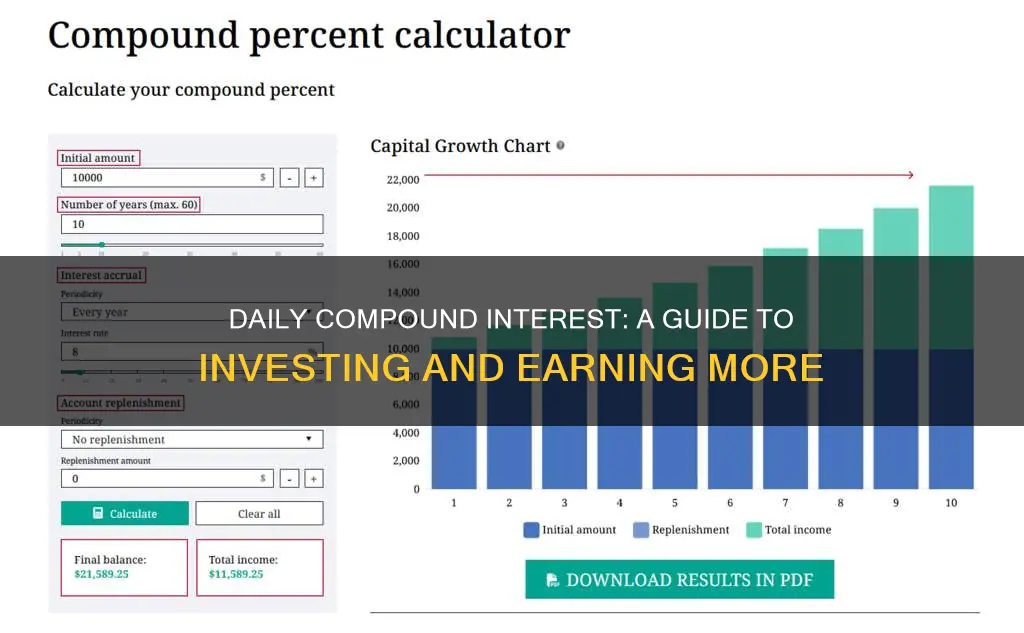

Daily compound interest is a way to grow your money faster. It involves earning interest on both the principal amount and previously accrued interest on a daily basis. The more often interest is compounded, the greater the potential for growth. You can invest in daily compound interest through savings accounts, money market accounts, or trading where margin is used, such as CFD trading, Forex trading, spread-betting, or options for assets like stocks and shares. It's important to note that this is a high-risk way of investing as you can also end up paying compound interest from your account depending on the direction of the trade.

| Characteristics | Values |

|---|---|

| Start early | The earlier you start investing, the more time your money has to grow |

| Regular contributions | Consistently adding to your investment enhances the compounding effect |

| Higher compounding frequencies | The more often interest is compounded, the greater the potential for growth |

| Savings accounts | Banks lend out the cash you put into a savings account and pay you interest in exchange for not withdrawing the funds |

| Money market accounts | Almost the same as savings accounts, except they allow you to write cheques and make ATM withdrawals |

| Trading | You can borrow money to trade, but this is a very high-risk way of investing as you can also end up paying compound interest from your account depending on the direction of the trade |

| Daily compound interest calculation | Take your daily interest rate and add 1 to it, then raise that figure to the power of the number of days you want to compound for |

What You'll Learn

- Start early: The earlier you start investing, the more time your money has to grow

- Regular contributions: Consistently adding to your investment enhances the compounding effect

- Higher compounding frequencies: The more often interest is compounded, the greater the potential for growth

- Savings accounts: Banks lend out the cash you put into a savings account and pay you interest

- Money market accounts: These are similar to savings accounts but allow you to write cheques and make ATM withdrawals

Start early: The earlier you start investing, the more time your money has to grow

The earlier you start investing, the more time your money has to grow. This is because time plays an important role in compound interest. For example, if you invest $5,000 with a 0.5% daily interest rate, your interest after the first day will be $25. If you choose an 80% daily reinvestment rate, $20 will be added to your investment balance, giving you a total of $5020 at the end of day one. The remaining $5 will be withdrawn as cash.

Starting early means that even with smaller amounts, your money has more time to grow and for the interest to compound. This is because each new contribution starts earning its own interest, adding to the overall growth. For example, savings accounts that compound daily, as opposed to weekly or monthly, are better because frequently compounding interest increases your account balance faster.

You can also enhance the compounding effect by consistently adding to your investment. This is known as the snowball effect. The more often interest is compounded, the greater the potential for growth. However, the difference may be minimal at lower interest rates.

There are several ways to take advantage of compounding interest to build wealth. For example, you can open a savings account with any local or online bank. You can also invest in money market accounts, which are almost the same as savings accounts, except that they allow you to write checks and make ATM withdrawals.

Investing Strategies for Rising Interest Rates: Where to Focus

You may want to see also

Regular contributions: Consistently adding to your investment enhances the compounding effect

Regular contributions to your investment portfolio can significantly enhance the compounding effect. By consistently adding to your investments, you can take advantage of the power of compound interest, which allows you to earn interest on both your principal amount and previously accrued interest. This is often referred to as the "snowball effect".

Each new contribution starts earning its own interest, adding to the overall growth of your portfolio. For example, if you invest $5,000 with a 0.5% daily interest rate, you will earn $25 in interest on the first day. If you choose to reinvest 80% of this interest, your investment balance will increase to $5,020 at the end of the first day.

There are several ways to make regular contributions to your investments. You can open a savings account with a local or online bank, which will pay you interest in exchange for not withdrawing your funds. Savings accounts that compound daily will increase your account balance faster than those that compound weekly or monthly. Money market accounts are similar to savings accounts but offer the added benefit of allowing you to write cheques and make ATM withdrawals.

Another option for regular contributions is to invest in trading or margin accounts, where you borrow money to trade. Examples of these types of investments include CFD trading, Forex trading, spread-betting, and options for assets like stocks, shares, commodities, and cryptocurrencies. However, it is important to note that this is a high-risk way of investing, as you can also end up paying compound interest from your account depending on the direction of the trade.

By making regular contributions and taking advantage of compound interest, you can enhance the growth of your investment portfolio over time.

Investments: Compounding Interest Options for Your Money

You may want to see also

Higher compounding frequencies: The more often interest is compounded, the greater the potential for growth

When it comes to investing, time is money. The earlier you start investing, the more time your money has to grow. One way to maximise the growth of your investments is to pay attention to compounding frequencies. The more often interest is compounded, the greater the potential for growth.

For example, if you invest $5,000 with a 0.5% daily interest rate, your interest after the first day will be $25. If you choose an 80% daily reinvestment rate, $20 will be added to your investment balance, giving you a total of $5020 at the end of day one.

There are several ways to take advantage of compounding interest. One option is to open a savings account with a bank, which will pay you interest in exchange for not withdrawing your funds. Savings accounts that compound daily will increase your account balance faster than those that compound weekly or monthly. Another option is to invest in money market accounts, which are similar to savings accounts but allow you to write cheques and make ATM withdrawals.

It's important to note that some types of investments that offer daily compound interest, such as CFD trading, Forex trading, spread-betting, and options for assets like stocks and shares, are considered very high-risk. With these investments, you can also end up paying compound interest from your account depending on the direction of the trade.

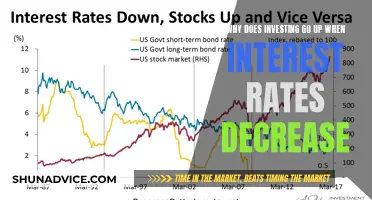

Interest Rates: Impacting Investment Strategies and Returns

You may want to see also

Savings accounts: Banks lend out the cash you put into a savings account and pay you interest

There are several options for taking advantage of compounding interest to build wealth. One of these is savings accounts. Banks lend out the cash you put into a savings account and pay you interest in exchange for not withdrawing the funds. Savings accounts that compound daily are the best because frequently compounding interest increases your account balance faster. You can open a savings account with any local or online bank.

The more often interest is compounded, the greater the potential for growth. This is because you are earning interest on both the principal amount and previously accrued interest on a daily basis. For example, if your initial investment is $5,000 with a 0.5% daily interest rate, your interest after the first day will be $25. If you choose an 80% daily reinvestment rate, $20 will be added to your investment balance, giving you a total of $5020 at the end of day one.

You can also take advantage of compound interest by opening a money market account. These are almost the same as savings accounts, except that they allow you to write cheques and make ATM withdrawals.

It is important to start your investments early, even with smaller amounts, as this gives your money more time to grow and for the interest to compound. You can also enhance the compounding effect by making regular contributions to your investment. Each new contribution starts earning its own interest, adding to the overall growth.

Investment Interest Expense: What Can Be Deducted?

You may want to see also

Money market accounts: These are similar to savings accounts but allow you to write cheques and make ATM withdrawals

Money market accounts are similar to savings accounts, but they allow you to write cheques and make ATM withdrawals. They are a good way to build wealth through compounding interest. Banks lend out the cash you put into a money market account and pay you interest in exchange for not withdrawing the funds. The more often interest is compounded, the greater the potential for growth. Therefore, money market accounts that compound daily are the best option for increasing your account balance quickly.

You can open a money market account with any local or online bank. When choosing an account, it is important to consider the compounding frequency. The more often interest is compounded, the greater the potential for growth. While the difference may be minimal at lower interest rates, higher compounding frequencies can lead to significant gains over time.

Starting early is also key when it comes to compound interest. Even with smaller amounts, starting early gives your money more time to grow and for the interest to compound. Making regular contributions is another way to enhance the compounding effect. Each new contribution starts earning its own interest, adding to the overall growth.

Additionally, you may want to consider investing in other types of assets that offer daily compound interest, such as CFD trading, Forex trading, spread-betting, or options for stocks, shares, commodities, and cryptocurrencies. However, it is important to note that these types of investments come with a higher risk. For example, you may end up paying compound interest from your account depending on the direction of the trade.

Overall, money market accounts can be a great way to take advantage of compounding interest and build wealth. By understanding the factors that impact compound interest, such as compounding frequency and regular contributions, you can maximise the growth of your investments over time.

Invest Wisely, Live Comfortably Off Your Interest

You may want to see also

Frequently asked questions

You can open a savings account with any local or online bank. You can also look into money market accounts, which are almost the same as savings accounts, except that they allow you to write cheques and make ATM withdrawals.

Daily compound interest is calculated using a version of the compound interest formula. To begin your calculation, take your daily interest rate and add 1 to it. Then, raise that figure to the power of the number of days you want to compound for.

Start early. Time plays an important role in compound interest, so starting your investments early, even with smaller amounts, gives your money more time to grow and for the interest to compound. Make regular contributions to enhance the compounding effect. The more often interest is compounded, the greater the potential for growth.