Personal loan interest rates are expressed as a percentage of the amount you borrow. The annual percentage rate (APR) represents the total cost of the loan, including the interest rate and any fees. This can vary depending on the lender and your credit and financial information. A good personal loan rate is the lowest one you qualify for. APRs are typically between 6% and 36%, but payday lenders may charge as much as 780% APR.

| Characteristics | Values |

|---|---|

| How interest rates are calculated | As a percentage of the amount borrowed |

| Typical APR | Between 6% and 36% |

| Payday lenders' APR | Up to 780% |

| Credit card rates | 20% or higher |

| Types of fees | Origination fees, prepayment penalties, late fees, returned payment fees |

| Collateral | Not usually required |

| Risk | Depends on the borrower's credit and financial information |

What You'll Learn

How to determine the best interest rate for your personal loan

When determining the best interest rate for your personal loan, there are a few key things to consider. Firstly, personal loan interest rates are expressed as a percentage of the amount you borrow. The annual percentage rate (APR) represents the total cost of the loan, including the interest rate and any fees. APRs are typically between 6% and 36%, but payday lenders may charge as much as 780% APR, and credit card rates can be 20% or higher.

Most personal loans are unsecured, meaning they are not backed up by a recoverable asset or collateral. As a result, unsecured personal loans tend to charge a higher interest rate than secured loans. When deciding on a personal loan, it is important to compare APRs from multiple lenders, as this will determine how much you pay to borrow the money. Keep in mind that some lenders charge origination fees, prepayment penalties, late fees, and returned payment fees.

Personal loan interest is typically calculated using one of three methods: simple, compound, or add-on. The simple interest method is the most common. The interest rate on a personal loan reflects the cost to the bank of borrowing money, as well as the inherent risk of lending money with no guarantee of repayment. As such, a good personal loan rate is the lowest one you qualify for, based on your credit and financial information.

Minimum-interest rules require that some rate of interest be charged on any loan transaction between two parties. However, there are exceptions for direct gift loans between individuals if the amount is below $10,000, or up to $100,000 under certain circumstances, such as when the loan is granted to a relative or child for buying a home or starting a business, and the borrower's net investment income is $1,000 or less for the year.

Interest Rates, Investments, and Planned Spending: What's the Link?

You may want to see also

The difference between secured and unsecured personal loans

The annual percentage rate (APR) of a personal loan is the total cost of a loan, including the interest rate and any fees. This can vary from 6% to 36% for personal loans, although payday lenders may charge as much as 780% APR. The interest rate on a personal loan reflects how much it costs a bank to borrow money and the inherent risk of lending money when there is no guarantee that it will be repaid.

Understanding Your Investment: Interest Made Simple

You may want to see also

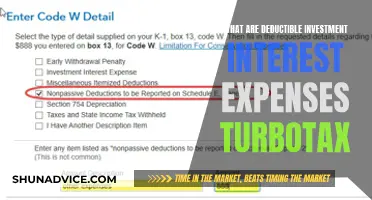

How to compare APRs from multiple lenders

When deciding what to charge for a personal investment interest rates loan, it's important to compare APRs from multiple lenders. The APR of a personal loan is the total cost of a loan, including the interest rate and any fees. This means that the APR will determine how much you pay to borrow the money.

When comparing APRs, it's important to consider the interest rate on the loan. The interest rate on a personal loan reflects how much it costs a bank to borrow money and the inherent risk of lending money when there is no guarantee that it will be repaid. A higher interest rate is typically charged on unsecured personal loans, which are not backed up by a recoverable asset or collateral.

It's also important to look out for any fees associated with the loan. Common personal loan fees include origination fees, prepayment penalties, late fees, and returned payment fees. Some lenders may charge an origination fee, which is a one-time administrative fee taken before the loan is sent to the borrower. Prepayment penalties are less common but may be charged by some lenders if the loan is paid off early.

By comparing APRs from multiple lenders, you can determine which lender is offering the best loan for your needs. It's important to remember that the lowest APR you qualify for is typically the best option, as it will result in lower overall costs. However, it's also crucial to consider other factors such as the loan term, repayment options, and customer service when making your decision.

Overall, by taking the time to compare APRs and understand the associated fees and interest rates, you can make an informed decision about which personal investment interest rates loan is the best option for you.

Simple Interest: Understanding the Core Math of Investments

You may want to see also

The most common personal loan fees

The interest rate you charge for a personal loan depends on a number of factors. Personal loan interest rates are expressed as a percentage of the amount borrowed. Unsecured personal loans charge a higher interest rate than secured loans. The interest rate on a personal loan reflects how much it costs a bank to borrow money and the inherent risk of lending money when there is no guarantee that it will be repaid. Payday lenders may charge as much as 780% APR, and credit card rates can run to 20% or even higher.

- Origination fees: These are a common cost when borrowing a personal loan, especially if you choose to go with an online lender. Origination fees are deducted from your total loan amount, so make sure you account for it when you determine how much you need to borrow. Expect to pay anywhere from 1% to 10% of the total loan amount, though the exact fee varies based on factors such as your credit profile and the amount borrowed.

- Prepayment penalties: These are less common, but some lenders do charge a fee for paying off a loan early.

- Late fees: These are charged when you miss a payment.

- Returned payment fees: These are charged when a payment is returned due to insufficient funds.

- Application fees: Some lenders charge a fee to process a new loan application.

When considering a personal loan, it is important to compare APRs from multiple lenders before committing to one, as this rate will determine how much you pay to borrow the money.

Understanding Investment and Interest Rates: Are They Synonymous?

You may want to see also

Minimum-interest rules and exceptions

Minimum-interest rules require that some rate of interest be charged on any loan transaction between two parties. The annual percentage rate (APR) of a personal loan is the total cost of a loan, including the interest rate and any fees. The APR represents the cost of the loan and includes the interest rate plus any other fees a lender charges, like an origination fee.

According to Section 7872 of the Internal Revenue Code, there are some exceptions to the rules for direct gift loans between individuals if the amount is below $10,000. However, this exception does not apply to gift loans made for the acquisition of income-producing assets. Gift loans up to $100,000 might also qualify as an exception to the rules under particular circumstances. For example, the loan must be granted to a relative or child to buy a home or launch a business. Furthermore, the borrower’s net investment income must be $1,000 or less for the year.

Personal loan interest rates are expressed as a percentage of the amount you borrow. Most personal loans are unsecured, meaning they are not backed up by a recoverable asset or collateral. Unsecured personal loans charge a higher interest rate than secured loans. Personal loan interest is calculated using one of three methods: simple, compound, or add-on. The simple interest method is the most common.

When choosing a personal loan, it is important to compare APRs from multiple lenders before committing to one, as this rate will determine how much you pay to borrow the money. A good personal loan rate is the lowest one you qualify for. APRs are typically between 6% and 36%, which is a wide range compared to other types of loans like mortgages and auto loans. However, payday lenders may charge as much as 780% APR, and credit card rates can run to 20% or even higher.

Interest Revenue: An Investment or a Collection?

You may want to see also

Frequently asked questions

A personal loan is a loan that is not backed up by a recoverable asset or collateral, such as a house or car.

The interest rate on a personal loan is calculated as a percentage of the amount you borrow.

APR stands for annual percentage rate and represents the total cost of a loan, including the interest rate and any fees.

A good personal loan rate is the lowest one you qualify for. APRs are typically between 6% and 36%.

Some common personal loan fees include origination fees, prepayment penalties, late fees and returned payment fees.