Investing in direct plans of mutual funds can be a rewarding step towards financial growth and independence. Direct plans allow investors to bypass intermediary commissions and potentially achieve higher returns on their investments. This approach empowers investors to take control of their portfolios, make informed decisions, and align their investments with their financial goals. To invest in direct plans of mutual funds, individuals can choose between online and offline methods, each offering unique advantages. Online investments provide convenience, ease of transactions, and access to various mutual fund schemes, while offline investments may be preferred by those who are uncomfortable with digital platforms. Understanding the different modes of investing in direct plans of mutual funds enables individuals to make informed choices that align with their financial objectives and risk tolerance.

| Characteristics | Values |

|---|---|

| Investment method | Online or offline |

| Investment plan | Direct plan or regular plan |

| Investment options | Lump sum or SIP |

| Investment process | Choose a platform, register, complete KYC, link bank account, explore mutual funds, select funds, specify amount and SIP, make payment, confirm, monitor |

| Benefits | Cost savings, higher returns, no distribution commissions, ease of online transactions, flexibility and control, instant NAV, access to information, paperless transactions, no intermediary bias |

| Documents required | PAN card, address proof, passport-sized photograph, KYC form, bank account details, cancelled cheque leaf, income proof, nomination form |

What You'll Learn

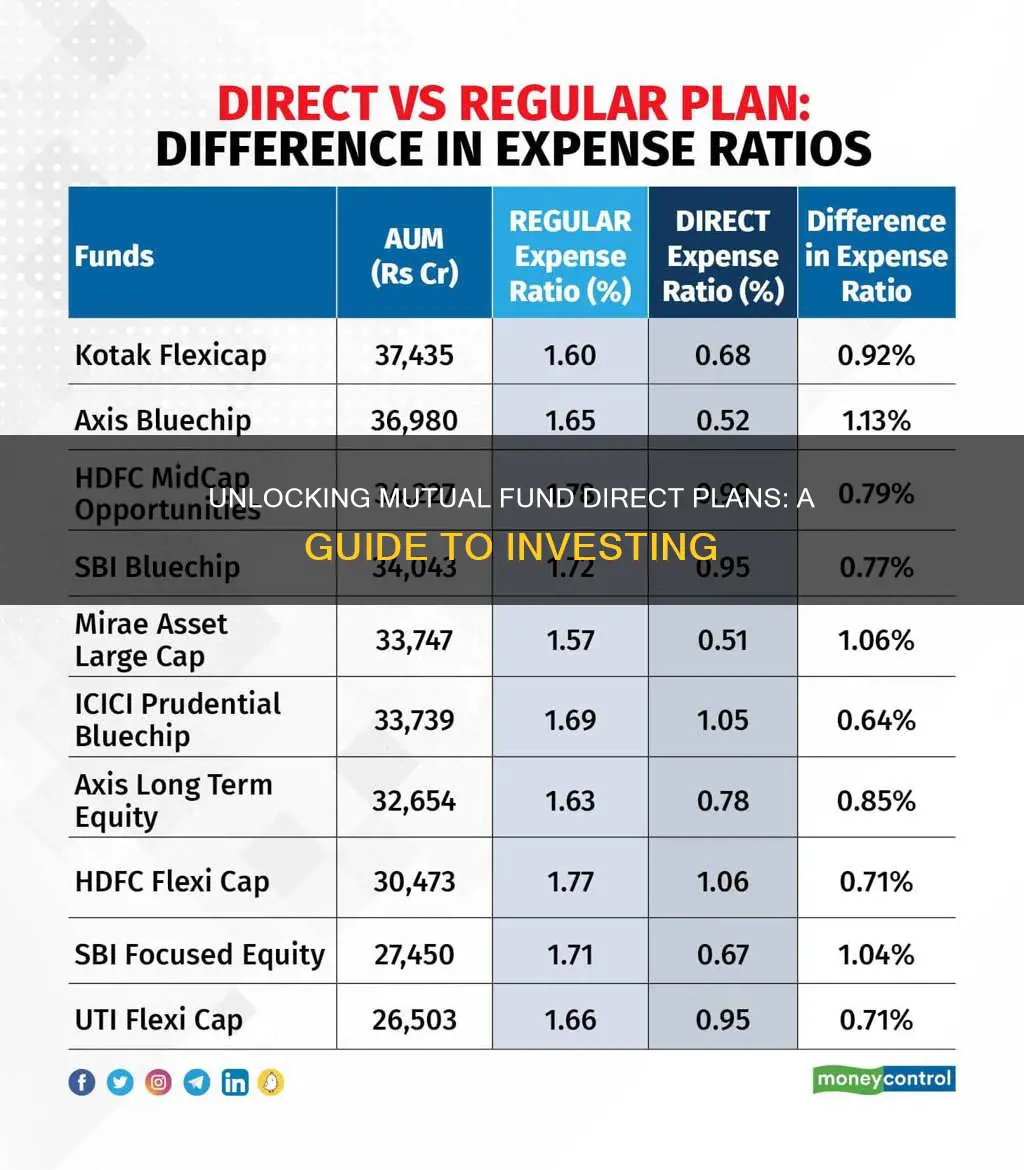

- Direct vs Regular Plans: Direct plans have lower expense ratios than regular plans, resulting in higher returns

- Know Your Customer (KYC): Complete KYC requirements online or in-person to verify your identity and address

- Online Platforms: Choose a reputable online platform or app, create an account, and link your bank

- Investment Selection: Research and evaluate funds based on performance, expertise, expense ratio, and strategy

- Investment Type: Decide between a lump sum or Systematic Investment Plan (SIP) for regular monthly investments

Direct vs Regular Plans: Direct plans have lower expense ratios than regular plans, resulting in higher returns

Direct plans and regular plans are two different ways of investing in mutual funds. Both are part of the same mutual fund scheme, have the same portfolio, and are managed by the same fund manager. However, direct plans have a lower expense ratio than regular plans, which results in higher returns.

Direct plans are purchased directly from the fund house, without involving any distributor or agent. This means there are no intermediary distribution commissions, resulting in lower costs for investors. On the other hand, regular plans involve investing through a broker, mutual fund distributor, or relationship manager of a bank, who receives a commission from the fund house for selling their schemes.

The expense ratio of a mutual fund includes management fees, administrative fees, and other expenses associated with running the fund. Direct plans have lower expense ratios because they exclude distributor commissions and other distribution costs. This leads to direct plans having a higher Net Asset Value (NAV) and, ultimately, higher returns for investors.

For example, if an investor puts Rs. 25,000 monthly through a Systematic Investment Plan (SIP) in a mutual fund scheme for 30 years with an expected rate of return of 12%, the accumulated corpus would be Rs. 6.3 crore in a regular plan with a 1.5% expense ratio. However, with a direct plan and a 1% expense ratio, the accumulated amount would be Rs. 7.8 crore. The 0.5% difference in the expense ratio results in a difference of Rs. 1.5 crore, or approximately 25% more than the regular plan.

Direct plans are suitable for investors who have adequate knowledge of mutual funds and are capable of making their own investment decisions. On the other hand, regular plans can be beneficial for those who are new or inexperienced investors, as they can seek guidance and assistance from a mutual fund distributor.

In summary, direct plans offer higher returns than regular plans due to their lower expense ratios, making them attractive for investors who want to maximise their gains. However, regular plans can also be advantageous for those who need help navigating the world of mutual fund investments.

Best Funds to Invest in NPS: Where to Start?

You may want to see also

Know Your Customer (KYC): Complete KYC requirements online or in-person to verify your identity and address

Know Your Customer (KYC) is a critical step in the process of investing in direct plans of mutual funds. This involves completing the necessary formalities to verify your identity and address. Here's a detailed guide on how to complete the KYC requirements:

Online KYC Process:

- Registration: Start by creating an account on a chosen platform, such as the website of a reputable online mutual fund app, a fund house, or a fund registrar and transfer agent (RTA). You will need to provide personal details, such as your name, email address, and mobile number.

- Document Submission: Submit the required documents, which typically include your PAN card (Permanent Account Number), Aadhar card or other address proof documents (like a passport, voter ID, utility bills, or bank statements), and a passport-sized photograph. Some platforms offer paperless or Aadhar-based e-KYC for faster processing.

- Bank Account Linking: Link your bank account to the platform or RTA. This is essential for facilitating both investments and redemption proceeds.

In-Person KYC Process:

- Visit the Branch: If you're uncomfortable with online transactions, you can visit the nearest branch office of the Asset Management Company (AMC) or the registrar and transfer agent (RTA) associated with the mutual fund.

- Complete KYC Form: At the branch, you will be asked to fill out and submit the KYC form if you haven't already done so. This form will require your personal information, contact details, and financial information.

- Document Submission: Along with the KYC form, provide self-attested copies of your PAN card and address proof documents, such as a passport, utility bills, bank statements, driving license, or rent agreement.

It's important to note that the KYC process is typically a one-time requirement, and once completed, you can use the same information across all platforms for investing in direct mutual fund plans.

Real Estate Mutual Funds: Diversify Your Investment Portfolio

You may want to see also

Online Platforms: Choose a reputable online platform or app, create an account, and link your bank

Online platforms offer a convenient and user-friendly way to invest in direct plans of mutual funds. Here is a step-by-step guide to help you get started:

Choose a Reputable Online Platform or App:

Select a well-known and trusted online mutual fund platform or mobile application. Look for platforms that are user-friendly and provide all the necessary information for investors. Examples of popular platforms include Kuvera, Groww, Zerodha Coin, ET Money, Paytm Money, and ICICI Direct.

Create an Account:

Register and create an account on the chosen platform. This typically involves providing personal details such as your name, email address, mobile number, and Know Your Customer (KYC) information. The KYC process may vary slightly depending on the platform and your country of residence, but it generally includes submitting documents such as a PAN card, Aadhar card (for Indian residents), passport, or other accepted identity and address proofs. Some platforms may offer paperless or digital KYC options for a quicker process.

Link Your Bank Account:

Linking your bank account is a crucial step. It enables you to seamlessly invest money and receive redemption proceeds. During this step, you will need to provide your bank account details, including the account number, IFSC code, bank name, and account type.

By following these steps, you will be well on your way to investing in direct plans of mutual funds through a reputable online platform or app. Remember to research the platform's security measures and ensure your personal and financial information is protected.

Smart Mutual Fund Investments with 10 Lakhs

You may want to see also

Investment Selection: Research and evaluate funds based on performance, expertise, expense ratio, and strategy

When selecting a mutual fund for investment, it is essential to conduct thorough research and evaluation to ensure it aligns with your financial goals and risk tolerance. Here are the key factors to consider:

Performance

Analysing a mutual fund's performance involves evaluating its historical returns and how it has navigated different market cycles. Compare its returns against benchmarks, such as indexes or similar funds, to assess if it has performed poorly, satisfactorily, or excellently. Check if the returns are consistent or fluctuate over time. Additionally, consider the fund's performance during periods of market volatility and managerial changes. This analysis will provide insights into how well the fund aligns with your risk tolerance and financial objectives.

Expertise

Evaluating the expertise of the fund manager is crucial. Consider their experience, track record, and investment philosophy. Assess whether their investment strategy aligns with your financial goals. For instance, if you seek income stability, opt for fund managers focusing on debt funds rather than dynamic approaches. Longevity in the role also ensures strategy consistency and better performance over time.

Expense Ratio

The expense ratio represents the annual fees and costs associated with managing the fund, including management fees, administrative costs, and marketing expenses. It is crucial to consider as it directly impacts your returns. The expense ratio is typically higher for mutual funds than for exchange-traded funds (ETFs) due to the active management involved. A reasonable expense ratio for an actively managed portfolio is about 0.5% to 0.75%, while a ratio above 1.5% is generally considered high. Lower expense ratios are preferable as they maximise your returns over time.

Strategy

Understanding the investment strategy of the fund is essential. Evaluate the types of assets the fund holds and whether it follows a growth, value, or income-focused approach. Consider if this strategy aligns with your financial goals and risk tolerance. For example, equity funds offer higher returns but come with greater volatility, while debt funds provide lower risk and steady income. Hybrid funds offer a balance between equities and debt. Additionally, assess the fund's maturity periods to ensure they align with your investment timeline.

Index Funds: When to Start Investing for Maximum Returns

You may want to see also

Investment Type: Decide between a lump sum or Systematic Investment Plan (SIP) for regular monthly investments

When deciding between a lump sum or Systematic Investment Plan (SIP) for regular monthly investments, it's important to understand the differences between these two investment types and how they align with your financial goals and risk tolerance.

Lump Sum Investments

Lump sum investments involve investing a large amount of money in a mutual fund in a one-time payment made in full at the beginning of the investment period. This method is typically chosen when individuals have a significant sum of money available for investment and want to take advantage of immediate growth potential or market opportunities. Lump sum investments can be riskier due to potential market volatility, but they offer the potential for higher returns if market timing is favourable. They are generally chosen for short-term investment goals and are suitable for investors who are comfortable with market fluctuations.

Systematic Investment Plans (SIPs)

On the other hand, SIPs involve investing smaller amounts of money at regular intervals, such as monthly, quarterly, or yearly. This approach helps investors build wealth over time and is particularly beneficial for those with consistent income streams. By investing a fixed amount regularly, SIPs promote investment discipline and mitigate the risk of market volatility. They are an excellent choice for first-time investors, as they offer a simple and disciplined approach without requiring in-depth financial knowledge. SIPs are ideal for long-term financial goals and are suitable for investors seeking a more stable and resilient investment portfolio.

Factors to Consider

When deciding between lump sum and SIP investments, consider the following factors:

- Investment Goals: Ensure your investment choice aligns with your financial objectives, whether it's wealth creation, retirement planning, or other goals.

- Risk Tolerance: Assess your risk comfort level and choose investments that match your tolerance.

- Market Conditions: Understand that lump sum investments are more sensitive to market timing, while SIPs offer protection from market timing risks.

- Investment Horizon: Consider your investment timeframe, as different funds are suitable for short-term, medium-term, or long-term investments.

- Amount Available: Evaluate the amount of money you have available for investment. Lump sum investments require a large sum, while SIPs allow for smaller, regular contributions.

- Discipline: SIPs instil financial discipline by requiring regular, fixed investments, making it easier to stay committed to your investment goals.

- Flexibility: SIPs offer more flexibility, allowing investors to start with a small amount and gradually increase their investment over time.

- Convenience: If you have a regular income, SIPs can automate your investments, making them a convenient choice.

- Cost Averaging: SIPs benefit from cost averaging, where you buy more units when prices are low and fewer units when prices are high, averaging out the cost per unit over time.

Axis Quant Fund: A Smart Investment Strategy

You may want to see also