Target-date funds are a popular choice for investors saving for retirement. They are designed to reduce the need for investors to constantly monitor and adjust their portfolio, and they can be particularly useful for those who don't have the time or inclination to review their fund's holdings annually. However, the one-size-fits-all approach of target-date funds can limit the potential of an investor's nest egg. So, what are the pros and cons of target-date funds, and should you invest in them during a period of rising interest rates?

| Characteristics | Values |

|---|---|

| Purpose | To build a nest egg and then protect it as you approach retirement |

| Investment Direction | From high-risk, high-reward to low-risk, low-reward |

| Investment Options | Aggressive investments (e.g. single stocks); Conservative investments (e.g. bonds, CDs, money market funds) |

| Investor Role | Set it and forget it; No need to constantly monitor and adjust your portfolio |

| Fund Management | Automatic rebalancing and reallocation of assets; Gradual shift from stocks to bonds and cash |

| Glide Path | Gradual change in asset allocation over time; Aims for a gentle landing into retirement by reducing the risk of a market crash |

| Fund Types | "To" funds; "Through" funds |

| Fund Expenses | Expense ratios; Fund fees |

| Fund Performance | Not guaranteed; Subject to risk and underperformance |

What You'll Learn

- Target-date funds are a set it and forget it investment option

- Target-date funds are designed to help manage investment risk

- Target-date funds are a popular choice among investors saving for retirement

- Target-date funds can be relatively expensive in terms of fees

- Target-date funds are not a perfect solution

Target-date funds are a set it and forget it investment option

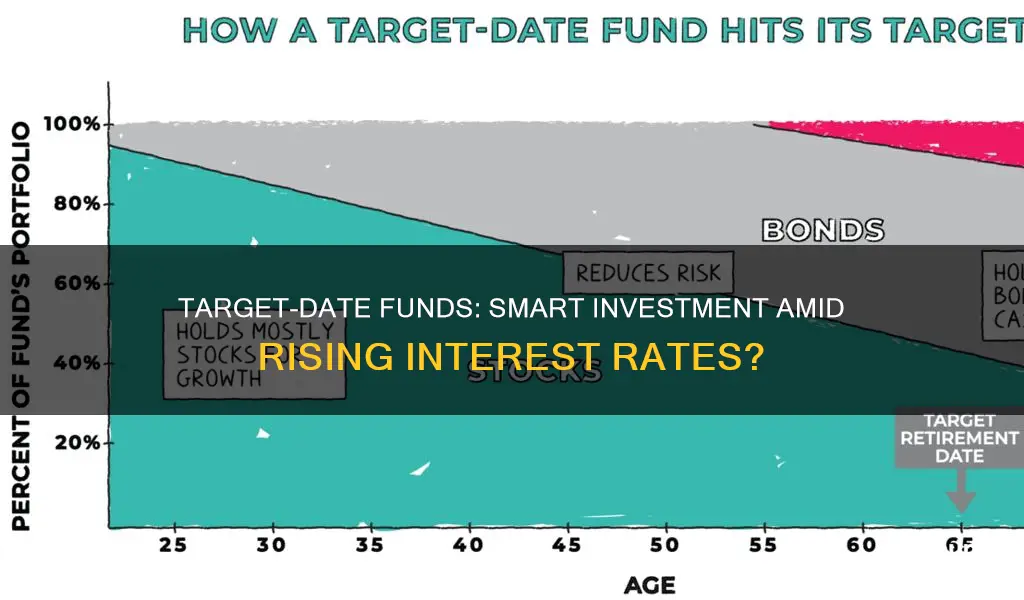

Target-date funds are a "set it and forget it" investment option. They are designed to be a simple, one-stop investment shop with a diversified set of asset classes. They are a type of mutual fund that automatically rebalances your portfolio from growth investments toward more conservative ones as you get older and closer to retirement. This is known as a "glide path".

Target-date funds are often chosen as a default investment option for employer-backed retirement plans such as 401(k) accounts. They are also available through brokerage accounts with fund managers or online brokers, or directly from fund providers like Vanguard, Fidelity or T. Rowe Price.

The "set it and forget it" nature of target-date funds means that investors don't need to constantly monitor and adjust their portfolio. However, experts advise checking in on the fund's performance at least once a year to ensure it still works for your needs and broader financial situation.

Target-date funds are named according to the year an investor plans to retire. For example, if you are 40 years old and plan to retire at 65, you would choose a target-date fund with a target date of 2040 or 2045.

Funds with an earlier target date will have a more conservative portfolio of assets, with a larger slice of fixed-income investments like bonds and cash, and fewer stocks. Funds with a later target date will have a more aggressive portfolio, with a larger slice of stocks and other high-risk, high-reward investments.

The main appeal of target-date funds is their simplicity. They are also popular because they remove the stress and complexity of having to decide on a mix of assets and then having to rebalance those investments over time.

A Beginner's Guide to Investing in Mutual Funds via HDFC Demat

You may want to see also

Target-date funds are designed to help manage investment risk

The glide path is designed to reduce investment risk over time, but it's important to note that target-date funds are not risk-free. They do not guarantee income and can lose money if the stocks and bonds owned by the fund drop in value. Additionally, even funds with identical target dates may have different investment strategies and asset allocations, affecting their level of risk.

Target-date funds are typically structured as mutual funds or exchange-traded funds (ETFs) and are a popular choice for investors saving for retirement. They offer a "set it and forget it" approach, automatically rebalancing the portfolio based on the investor's time until retirement. This means that investors don't need to constantly monitor and adjust their portfolio, reducing the stress associated with financial planning.

However, one potential disadvantage of target-date funds is that they may become too conservative too quickly as the target date approaches. This could lower the overall potential return and impact the investor's retirement income. Therefore, it's important for investors to carefully consider their risk tolerance and investment goals when choosing a target-date fund.

Mutual Funds: Hedge Fund Investment Strategies Explored

You may want to see also

Target-date funds are a popular choice among investors saving for retirement

A target-date fund is a mutual fund (or exchange-traded fund) that gradually rebalances and reallocates assets as you get closer to retirement, typically shifting the majority of assets from riskier investments such as stocks to more conservative investments such as bonds and cash. The fund is designed as a one-stop investment shop with a diversified set of asset classes.

With a target-date fund, investors pick the year they think they’ll need to access the funds, say, 2040, and then the fund management company manages everything from there. This makes it a “set it and forget it” investment option.

Target-date funds are popular because they simplify the process for participants. Building a well-diversified portfolio can be overwhelming for individuals who are not investing experts. Target-date funds offer investors the convenience of automatically allocating assets in the fund from day one.

Target-date funds are also popular because they can improve returns for investors. Some studies have shown that up to 90% of an investor’s return depends on how money is divided between various asset classes, from equities such as domestic and global stocks to fixed-income investments such as bonds and cash.

However, it's important to note that target-date funds may not be suitable for everyone. The one-size-fits-all approach can keep your nest egg from reaching its full potential. Additionally, fund expenses can add up, and there are no guaranteed earnings. It's also important to monitor the fund's performance and assess whether its investments continue to meet your needs and risk tolerance over time.

Superannuation Fund: A Managed Investment Scheme?

You may want to see also

Target-date funds can be relatively expensive in terms of fees

Target-date funds are a type of mutual fund that is rebalanced periodically to optimise returns over the long term. They are designed to invest heavily in riskier growth stocks in the early years, with the aim of accumulating gains while the investor has time to recover from any short-term losses. As the target date approaches, the fund's asset allocation shifts to more conservative investments to preserve gains.

The average target-date fund had an expense ratio of 0.52% in 2020, according to research from Morningstar. However, these fees can range from as low as 0.1% to more than 1.5%. In general, target-date funds may have higher expense ratios than standard mutual funds because they are funds of funds. Additionally, since target-date funds rebalance regularly, they are more active than standard index funds.

Despite the potential for higher fees, many target-date index funds available today have low expense ratios of 0.10% or lower. It is important for investors to consider the fees associated with target-date funds and compare them to other investment options.

Covered Funds: A Smart Investment Strategy?

You may want to see also

Target-date funds are not a perfect solution

Firstly, target-date funds can be relatively expensive in terms of fees. As a "fund of funds", they invest in other mutual funds or exchange-traded funds (ETFs), resulting in a double layer of fees paid by the investor. While fees have been decreasing, this is still something to watch out for, especially if your fund invests in a lot of passively managed vehicles.

Secondly, target-date funds may become too conservative too quickly, lowering your overall potential return. As you approach your target retirement date, these funds move more of your money from stocks to bonds, which can severely hit your potential retirement income. This is especially important given that many seniors live more than two decades after retiring.

Thirdly, target-date funds are not guaranteed to generate a certain amount of income or gains. As with all investments, these funds are subject to risk and underperformance. For example, the Vanguard Target Retirement 2025 Fund (VTTVX) fell more than 15% in 2022, despite being close to its target date.

Finally, target-date funds may not suit individuals whose goals and needs change over time. The predetermined shifting of portfolio assets may not align with an investor's changing circumstances, such as retiring earlier or later than expected.

Therefore, while target-date funds offer a convenient and diversified investment solution, they are not without their drawbacks. It is important for investors to carefully consider the advantages and disadvantages before deciding to invest in target-date funds.

How Do Funds Benefit from Investing in CDs?

You may want to see also

Frequently asked questions

A target date fund is a type of investment fund that automatically adjusts its asset allocation over time, becoming more conservative as the investor approaches a specific milestone, typically retirement. The goal is to balance growth and risk management by investing in riskier assets early on and gradually shifting to lower-risk assets as the target date approaches.

Target date funds are typically structured as mutual funds or exchange-traded funds (ETFs) that invest in a diversified portfolio of assets. The funds are named based on their target retirement year, such as the "2045 Fund" or "2060 Fund". As the target date approaches, the fund's asset allocation gradually shifts from riskier investments like stocks to more conservative investments like bonds and cash.

Target date funds offer a "set it and forget it" approach to investing, making them attractive to investors who want a hands-off, low-maintenance investment strategy. They provide automatic diversification and rebalancing of assets, and can help investors stay disciplined by reducing the temptation to make frequent changes to their portfolio.

One of the main disadvantages of target date funds is that they may become too conservative too quickly, reducing the potential for higher returns. Additionally, target date funds may have higher fees compared to other types of funds, and they may not be suitable for investors whose retirement plans change or who want more control over their investment choices.

When choosing a target date fund, it's important to consider factors such as the fund's investment strategy, risk level, and fee structure. Compare funds with similar target dates and assess their investment strategies to find one that aligns with your risk tolerance and retirement goals. It's also crucial to monitor the fund's performance and adjust your investment plan as needed.