Forex trading, or foreign exchange trading, involves buying and selling currencies to profit from fluctuations in exchange rates. In India, forex trading is a popular way to invest due to its potential for high returns. However, it is important to note that forex trading is subject to strict regulations set by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). To start forex trading in India, investors must follow certain steps and consider specific factors to ensure compliance with the legal framework.

| Characteristics | Values |

|---|---|

| Legality | Forex trading is legal in India but is subject to stringent regulations set by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). |

| Currency Pairs | Indian residents can trade forex pairs that involve the Indian Rupee (INR) against major global currencies such as USD, EUR, GBP, and JPY. |

| Trading Platforms | 5Paisa, Zerodha, Fyers, and Upstox are some popular trading platforms in India. |

| Trading Hours | The Indian forex market is open from 9:00 AM to 5:00 PM IST, Monday to Friday. The best trading hours are during the overlapping London and New York sessions, from 1:30 PM to 10:30 PM IST. |

| Steps to Start Trading | 1. Select a SEBI-regulated forex broker offering INR currency pairs. 2. Open a trading account and complete the KYC process. 3. Deposit funds into the trading account. 4. Start trading using the broker's platform. |

| Illegal Forex Trading Consequences | Individuals involved in unauthorized forex trading can face severe penalties, including fines of up to 300% of the illegal transaction amount and imprisonment, under the Foreign Exchange Management Act (FEMA). |

What You'll Learn

Forex trading in India: legalities and regulations

Forex trading is legal in India but comes with strict regulations set by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Trading in India must be done through SEBI-regulated brokers and must involve the Indian Rupee (INR) against major global currencies such as the USD, EUR, GBP, and JPY. Trading in other currency pairs or through overseas platforms is illegal and can lead to severe penalties, including fines and imprisonment.

Regulatory Bodies

The legal provision of forex trading is controlled and managed by the Securities and Exchange Board of India (SEBI). The Reserve Bank of India (RBI) handles forex transactions.

Legal Consequences of Illegal Forex Trading in India

Under the Foreign Exchange Management Act (FEMA), individuals involved in unauthorized forex trading can face severe consequences, including fines and imprisonment. Fines can be up to 300% of the amount involved in the illegal transaction, and in cases of non-payment, enforcement authorities can seize assets. Severe violations can lead to criminal prosecution and imprisonment of up to 7 years if linked to money laundering or terrorist financing.

Currency Pairs Allowed for Trading in India

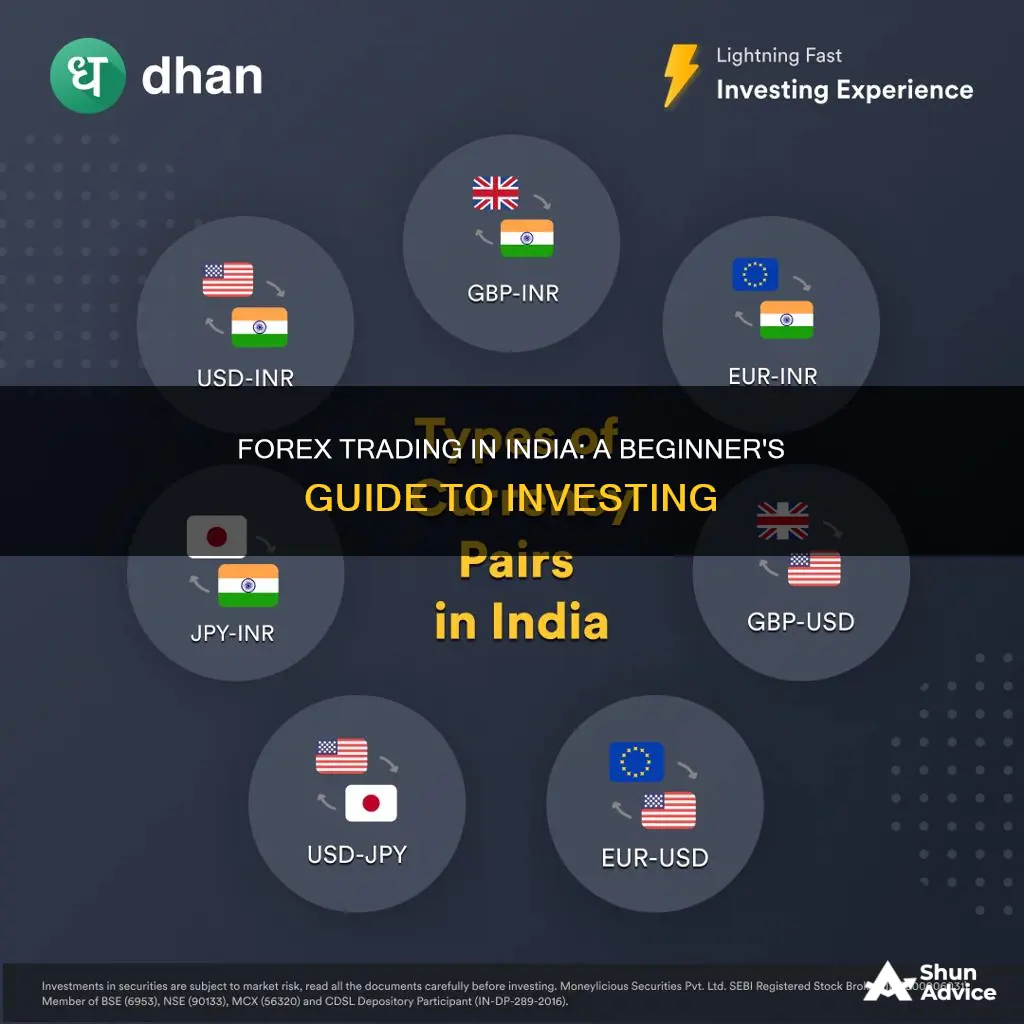

Currency trading in India is allowed only in the following seven pairs: USD/INR, EUR/INR, JPY/INR, GBP/INR, EUR/USD, GBP/USD, and USD/JPY. The Indian Rupee is the quote currency in these pairs, and trading takes place within specific hours during the functioning of the RBI.

Demat Account Requirements

A Demat account is not mandatory for forex trading in India, as transactions are typically cash-settled. However, a trading account linked to a bank account is necessary for funding and withdrawing purposes.

Assessing Investment Managers: Strategies for Performance Evaluation

You may want to see also

Choosing a forex broker and trading platform

Regulatory Compliance:

Ensure that your broker is authorised and regulated by the Securities and Exchange Board of India (SEBI) and compliant with the rules and regulations set by SEBI and the Reserve Bank of India (RBI). Trading with unregulated brokers is illegal and can lead to severe penalties.

Reputation and Trustworthiness:

Look for a broker with a good reputation and a strong presence in the market. Check reviews, seek recommendations, and ensure they have a track record of fair and transparent practices.

Trading Platform Features:

The trading platform provided by the broker should be user-friendly, reliable, and packed with features that enhance your trading experience. Look for a platform with advanced charting tools, indicators, and technical analysis tools. A platform that offers a demo account for practice and a seamless trading experience is ideal.

Trading Costs:

Consider the fee structure of the broker. Compare brokerage fees, account fees, inactivity fees, price-per-trade fees, and currency conversion charges. Choose a broker that offers competitive rates and ensures that these extra costs do not eat into your profits.

Trading Hours and Support:

As forex is a 24/5 global market, opt for a broker that provides round-the-clock trading services and reliable customer support. This ensures that you can capitalise on trading opportunities at any time and receive assistance when needed.

Leverage and Risk Management:

Brokers offering high operating leveraging ratios at smaller margins can be advantageous. However, always assess the risks associated with leverage and ensure that the broker provides risk management tools like stop-loss orders and take-profit orders to help you manage your trades effectively.

Currency Pairs:

Check the range of currency pairs offered by the broker. In India, trading is permitted only on specific pairs that include the Indian Rupee (INR). Ensure that the broker allows you to trade on pairs like USD/INR, EUR/INR, JPY/INR, and GBP/INR.

Trading Tools and Resources:

Choose a broker that provides additional tools and resources to support your trading journey. This could include educational resources, market analysis, trading signals, and access to research and data that can enhance your decision-making process.

Testing the Platform:

Before committing, test the trading platform to ensure it meets your needs. Explore the platform's features, place demo trades, and assess the platform's performance, speed, and reliability.

Additional Services:

Consider any additional services the broker may offer, such as personalised trading advice, automated trading, or investment management. These services can add value to your trading experience, depending on your requirements.

Remember, choosing the right broker and trading platform is essential for a seamless and successful trading journey. Conduct thorough research, compare multiple brokers, and select the one that best aligns with your trading goals, strategy, and risk appetite.

Saving's Leakage and Planned Investment: A Balancing Act

You may want to see also

Opening a trading account and depositing funds

To open a trading account, you must first select a broker. The broker should be licensed and governed by the Securities and Exchange Board of India (SEBI) and offer a dependable trading platform with a user-friendly interface. They should also offer competitive fees and spreads, as these directly impact your profits. Additionally, consider choosing a broker that provides 24/5 trading services to ensure you don't miss out on any trading opportunities.

Once you've selected a broker, you can proceed to open a trading account. This typically involves completing a web application and providing the necessary Know Your Customer (KYC) documents, such as ID and address proof. Some platforms may also require you to make an initial deposit to fund your account. After submitting your application, the broker will verify your information and reactivate your account.

After your trading account has been activated, you can proceed to deposit funds. The amount you deposit will depend on the minimum deposit required by your broker. It is important to note that, according to SEBI regulations, you must also maintain a particular margin quota in cash, with the remaining margin considered as additional funds.

With your trading account funded, you are now ready to start trading. It is generally advisable to initiate trades with smaller amounts and low leverage, especially if you are new to trading. As you gain experience and become more comfortable with the market, you can adjust your trading strategies accordingly.

Savings and Investments: A Comprehensive Guide

You may want to see also

Understanding currency pairs and exchange rates

Currency trading, also known as foreign exchange or forex trading, involves buying and selling currencies from different countries to make a profit. The currencies are traded in pairs, with the value of one currency quoted against the other. For example, the EUR/USD pair indicates that one euro is worth $1.3045. Here, the euro (EUR) is the base currency, and the US dollar (USD) is the quote or secondary currency.

In forex trading, the base currency is always expressed as one unit, and the exchange rate shows how much of the quote currency is required to buy one unit of the base currency. For instance, if the exchange rate for the EUR/USD pair is 1.3045, you would need $1.3045 (the quote currency, USD) to buy €1 (the base currency, EUR).

The Indian Rupee is usually the quote currency in trades involving Rupees and Dollars, with the USD as the base currency. So, when we see USD 1 to INR = ₹79, the USD is the base currency, the INR is the reference currency, and ₹79 is the value.

The exchange rate between two currencies in a pair is called the foreign exchange rate. This rate is determined by the supply and demand for each currency in the market, which is influenced by various economic, political, and social factors. The exchange rates are constantly fluctuating based on the changing values of the currencies in the pair. These changes in currency exchange rates are known as the percentage-in-point movement (PIP). A PIP is typically the fourth digit after the decimal point of the currency pair. For example, if the EUR/USD pair moves from 1.0630 to 1.0631, that is a one-pip movement.

In forex trading, it is important to understand the different types of currency pairs. The three main types are majors, minors (also known as crosses), and exotics. Major currency pairs include the US dollar (USD) and are the most commonly traded and liquid. Examples of major pairs are:

- EUR/USD (euro/US dollar)

- USD/JPY (US dollar/Japanese yen)

- GBP/USD (British pound/US dollar)

- AUD/USD (Australian dollar/US dollar)

Minor currency pairs do not include the US dollar. They are less liquid and commonly traded than major pairs. Examples include:

- EUR/GBP (euro/British pound sterling)

- CAD/JPY (Canadian dollar/Japanese yen)

Exotic currency pairs are the least traded and liquid. They are more volatile and have wider spreads due to the lower volume of trades. Examples include:

- USD/HKD (US dollar/Hong Kong dollar)

- USD/CNY (US dollar/Chinese renminbi)

It is worth noting that while forex trading in India is legal, there are specific regulations to follow. Indian residents can trade forex pairs that involve the Indian Rupee (INR) against major global currencies such as USD, EUR, GBP, and JPY. Trading in other currency pairs is illegal and can lead to severe penalties.

Strategizing a Balanced Investment Portfolio at 67 Years Old

You may want to see also

Managing risk with stop-loss and take-profit orders

Forex trading in India involves buying and selling foreign currencies to profit from fluctuations in exchange rates. While this market offers the potential for high returns, it also carries significant risks. Therefore, it is crucial for traders to implement risk management strategies such as stop-loss and take-profit orders to protect their capital.

A stop-loss order is a risk management tool used by traders to limit losses or lock in remaining profits on an open position. It is designed to trigger the sale of an asset when it reaches a specified price, known as the stop price. This helps traders control their risk exposure and prevent excessive losses. For example, if a trader purchases a stock and sets a stop-loss order 5% below the purchase price, the stock will be sold automatically if it falls by 5%, limiting the trader's loss.

On the other hand, a take-profit order, also known as a limit closing order, is used to secure profits. Traders set a specific price at which their trading provider will close their position, ensuring they realise their profits. For instance, if a trader expects an asset to rise by 20%, they may place a take-profit order 20% higher than the purchase price. If the asset reaches this level, the order is executed, and the position is closed for a gain.

Stop-loss and take-profit orders are often used in conjunction to manage risk effectively. They enable traders to define their risk-reward ratio for a trade. By setting these orders, traders can exit positions automatically when their desired profit targets are met or when losses exceed a predetermined threshold. This helps remove emotions from trading decisions and provides discipline, especially in volatile markets.

However, it is important to note that these orders may not be suitable for all trading scenarios. For instance, long-term investors using take-profit orders may limit their potential profits, and in highly volatile markets, stop-loss orders may be triggered prematurely. Therefore, traders should carefully consider their investment goals, risk tolerance, and market conditions before employing these strategies.

Saving and Investment: Synergistic Strategies for Financial Growth

You may want to see also

Frequently asked questions

Forex trading is legal in India, but it is subject to strict regulations. It is only permitted through SEBI-regulated brokers and INR currency pairs. Failure to comply with authorised agents or permitted pairs of currencies constitutes a criminal offence under the Foreign Exchange Management Act (FEMA).

Popular forex trading platforms in India include 5Paisa, known for its user-friendly interface and competitive rates; Zerodha, which offers low brokerage fees; Fyers, suitable for beginners and experienced traders; and Upstox, which provides a smooth trading experience and educational resources.

To start forex trading in India, you need to select a SEBI-regulated broker that offers INR currency pairs, open a trading account, complete the KYC process, deposit funds into your account, and then start trading.

The forex market in India is open 24 hours a day, five days a week. However, the Reserve Bank of India's trading hours are from 9:00 AM to 5:00 PM IST, Monday to Friday. The best times to trade in India are typically during the overlapping hours of the London and New York sessions, from 1:30 PM to 10:30 PM IST.