As you approach retirement, your investment portfolio mix should gradually shift from aggressive to conservative. The general rule of thumb is to subtract your age from 100 – the resulting figure is the percentage of your portfolio that should comprise stocks. For instance, if you're 67, your portfolio should include 33% stocks. However, with increased life expectancy, financial planners now suggest subtracting your age from 110 or 120 instead. This adjustment accounts for the need to make your money last longer and leverage the growth potential of stocks.

What You'll Learn

Stocks

According to the Rule of 100, a common guideline for asset allocation, you should subtract your age from 100 to determine the percentage of stocks in your portfolio. For example, if you are 67, this rule suggests that 33% of your portfolio should be in stocks. However, with increasing life expectancies, some financial planners now recommend using 110 or 120 minus your age as the basis for stock allocation. This would mean that a 67-year-old should hold between 43% and 53% of their portfolio in stocks.

It is important to note that these rules are just guidelines, and your individual circumstances and risk tolerance should also be considered when determining your asset allocation. For example, if you are comfortable with taking on more risk, you may want to allocate a higher percentage of your portfolio to stocks. On the other hand, if you are approaching retirement and want to preserve your capital, you may want to reduce your stock allocation further.

When allocating your portfolio across different stocks, it is essential to diversify your holdings. This means investing in a variety of individual stocks or mutual funds/exchange-traded funds (ETFs) across different company types and market sectors. Utility companies, consumer staples, and healthcare companies tend to be more stable, while the technology and financial sectors are more reactive to economic cycles. By diversifying your stock holdings, you can reduce the risk of significant losses if one particular stock or sector underperforms.

Additionally, it is crucial to periodically review and rebalance your portfolio to ensure it aligns with your investment goals and risk tolerance. Over time, market movements can shift your asset allocation, and you may need to adjust your holdings to bring them back in line with your desired allocation. For example, if stocks have performed well and exceed your intended allocation, you may consider selling some of your stock positions and using the proceeds to invest in other asset classes, such as bonds or cash.

Adjusting Your Investment Portfolio: Strategies for Success

You may want to see also

Bonds

Government bonds are considered one of the safest investments as they are backed by the full faith and credit of the issuing government. In the US, these are Treasury bonds, which are issued by the US Department of the Treasury. They are considered a stable investment as the likelihood of the US government defaulting on its debt is very low.

Municipal bonds, also known as "munis", are issued by local governments or government agencies. The income from these bonds is often exempt from federal taxes and can be exempt from state and local taxes, depending on the state where the bond is issued and where the investor resides.

Corporate bonds are issued by companies and are generally considered riskier than government or municipal bonds. They can provide higher returns than government or municipal bonds, but investors need to be cautious and assess the risk of default.

Bond funds are another option. These are mutual funds or exchange-traded funds (ETFs) that invest in a basket of bonds. They can be a good option for investors who want to diversify their bond holdings without having to purchase individual bonds.

When considering bonds for your portfolio, it's important to assess your risk tolerance, investment timeline, and overall financial goals. Bonds are generally considered a more conservative investment than stocks, and as you approach retirement, it is common to shift a larger portion of your portfolio into bonds. This is because bonds typically have lower returns than stocks but are less volatile, providing more stable returns and reducing the risk of large losses.

For someone aged 67, a common rule of thumb is to subtract your age from 100 to determine the percentage of your portfolio that should be in stocks. In this case, that would mean having 33% of your portfolio in stocks. The remaining 67% could be in bonds, cash, or other assets. However, this is a general guideline, and the optimal allocation will depend on your individual circumstances, risk tolerance, and financial goals.

It's also important to note that while bonds are considered less risky than stocks, they are not completely risk-free. For example, in 2022, the aggregate bond market saw a significant decline, and even US Treasury bonds can fluctuate in value. As such, it's crucial to understand the risks associated with any investment and to diversify your bond holdings accordingly.

In conclusion, bonds are an important part of a well-diversified portfolio, especially for those approaching retirement. They provide stable returns and reduce the overall risk of your portfolio. When considering your bond allocation, it's essential to assess your financial goals, risk tolerance, and investment timeline to determine the optimal mix of bond types for your needs.

Loans: Saving or Investing? Understanding the Financial Impact

You may want to see also

Cash

At 67, your investment portfolio mix should be moving from aggressive to more conservative. While stocks remain an important part of your portfolio regardless of age, you may want to consider adding a meaningful allocation to bonds and cash.

As you near retirement, you may want to cut back on the amount of risk in your portfolio as you won't have time to lose and replenish your capital. Cash holdings can be an important part of your portfolio, offering stability and liquidity.

According to Empower data, retirees in their 70s hold 35.3% of their assets in cash, while those in their 80s and 90s hold 39.8% and 43.9% respectively. The median cash balance in the portfolios of those in their 70s is $100,122.

Holding cash can be a good option if you're looking to reduce risk in your portfolio. However, keeping a large proportion of your assets in low-yielding cash instruments like savings and money market accounts may mean missing out on opportunities for long-term compounding that could help grow your portfolio.

High-yield savings accounts can be a good alternative, offering higher interest rates than traditional savings accounts. They are FDIC-insured, so you won't have to worry about major financial risks or monthly fees. The interest is compounded daily, which can be an incentive to save and watch your money grow.

Money market accounts are another option, offering higher interest rates and incentives the more money you deposit. They are also FDIC-insured and provide easy access to your money for emergencies.

Ultimately, the right mix of investments depends on your individual goals, risk tolerance, and timeline. It's important to periodically review and rebalance your portfolio to ensure it remains aligned with your objectives.

Investing vs. Saving: Brainly's Guide to Financial Strategies

You may want to see also

Risk tolerance

At 67, an individual is likely to be retired or close to retirement, which typically translates to a more conservative investment approach with a lower risk tolerance. This means that they are less likely to take on high-risk investments and will seek more stable and guaranteed returns. As such, their portfolio mix should reflect this reduced risk appetite.

For those with a conservative risk tolerance, investments like stocks may still play a role, but the focus shifts to capital preservation rather than aggressive growth. This could mean favouring more stable, large-cap stocks or dividend-paying blue-chip stocks over high-growth, volatile stocks. Additionally, alternative investments like real estate investment trusts (REITs) can provide stable income through regular dividends while also offering some diversification benefits.

Fixed-income investments, such as bonds, become a more significant part of a conservative investor's portfolio. This includes corporate, Treasury, and high-yield bonds, which provide diversification across industries and interest rates. Municipal bonds, or muni bonds, issued by state or local governments, offer stable and tax-free income with lower risk, making them attractive for capital preservation.

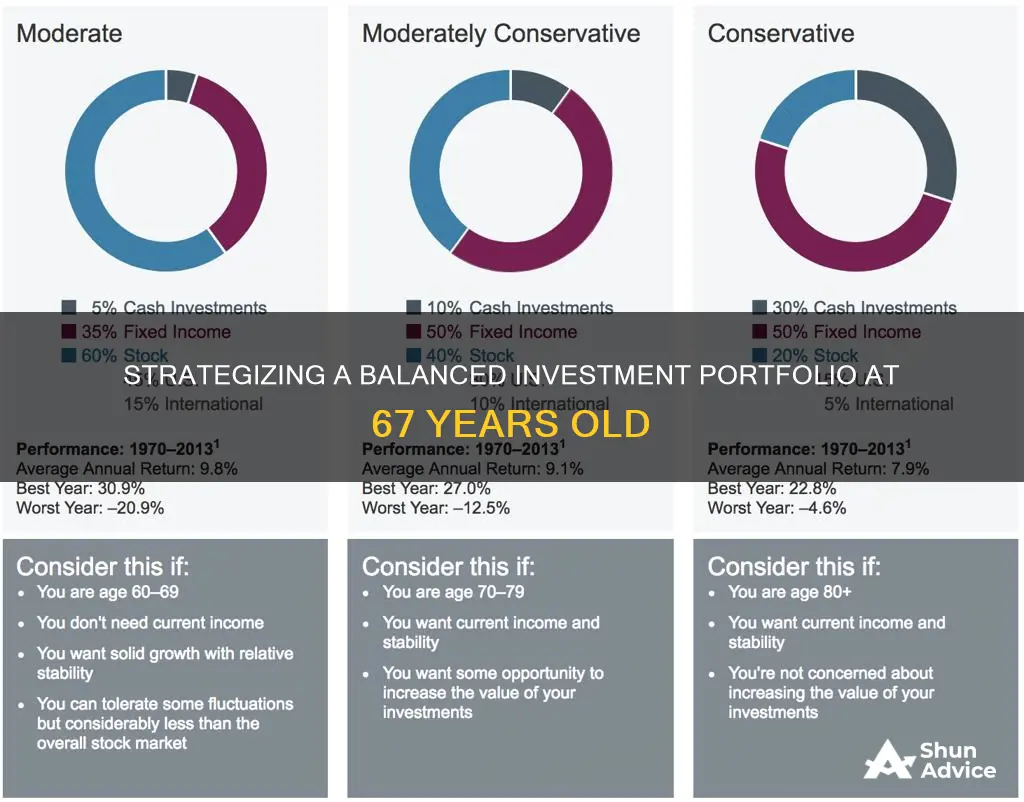

The exact mix of stocks, bonds, and alternative investments will depend on the individual's specific circumstances, goals, and risk tolerance. However, a common rule of thumb for stock allocation is to subtract your age from 110 or 120. So, at 67, this would suggest a stock allocation of around 43-53%. The remaining portion of the portfolio can be allocated to bonds and alternative investments based on the investor's preferences and risk tolerance.

It is important to note that risk tolerance is just one factor in determining an investment portfolio mix. Other factors, such as the individual's financial goals, income, and overall investment horizon, also play a significant role. Consulting with a financial advisor can help tailor a portfolio strategy that aligns with an individual's specific needs and risk tolerance.

Diversifying Your Investment Portfolio: Strategies for Success

You may want to see also

Retirement goals

Retirement planning is a critical aspect of financial management, and it's important to define clear retirement goals to ensure a comfortable post-work life. Here are some detailed and focused instructions on retirement goals for a 67-year-old individual:

Review Your Current Financial Situation:

The first step is to assess your current financial health. Calculate your net worth, including all your assets (investments, properties, savings, etc.) and liabilities (debts, loans, etc.). This will give you a clear picture of where you stand and what adjustments you may need to make to achieve your retirement goals.

Determine Your Retirement Income Sources:

Identify all the sources of income you expect to have during retirement. This may include Social Security benefits, pension plans, 401(k) accounts, IRAs, and other investments. Understand the rules and restrictions associated with each income stream, such as minimum distribution requirements and tax implications.

Calculate Your Expected Expenses in Retirement:

Estimate your monthly and annual expenses during retirement, including essentials like housing, utilities, groceries, and healthcare. Don't forget to include discretionary spending, such as travel, hobbies, and gifts. It's important to be realistic and comprehensive in your expense calculations to ensure your retirement income can cover these costs.

Assess Your Risk Tolerance:

Risk tolerance is a key factor in investment decisions. As you approach retirement, your risk tolerance may decrease since you have less time to recover from potential losses. Evaluate your comfort level with different types of investments and their associated risks. This will guide your asset allocation decisions.

Adjust Your Investment Portfolio:

Based on your risk tolerance and retirement goals, adjust your investment portfolio accordingly. Traditionally, the rule of 100 suggested that the percentage of stocks in your portfolio should be 100 minus your age. So, at 67, this would mean 33% of your portfolio should be in stocks. However, with increasing life expectancies, some experts now recommend the rule of 110 or 120 minus your age, resulting in a higher stock allocation.

While stocks remain an important part of your portfolio, consider increasing your allocation to bonds and cash or cash equivalents. These are generally considered lower-risk investments. For example, you may allocate 50% of your portfolio to stocks, 30% to bonds, and 20% to cash or cash-equivalent assets.

Seek Professional Advice:

Consult a trusted financial advisor or planner who can provide personalized guidance based on your specific circumstances. They can help you review your retirement goals, investment options, and risk tolerance to create a tailored plan.

Remember, retirement planning is an ongoing process, and it's important to periodically review and adjust your strategies as needed to ensure a secure and comfortable retirement.

Our Social Security Savings: Where Are They Invested?

You may want to see also

Frequently asked questions

As a general rule, the older you get, the less risk you can tolerate and the less time you have to recover from losses. At 67, you are likely retired and focused on income generation rather than growth. Your portfolio should be conservative, with a mix of stocks, bonds, and cash/cash equivalents.

The old rule of thumb was to subtract your age from 100, and that was the percentage of stocks in your portfolio. So, at 67, you would have 33% of stocks. However, with people living longer, this rule has evolved to subtracting your age from 110 or 120. This would mean having between 43% and 53% of stocks in your portfolio.

This depends on your risk tolerance and overall investment strategy. As you near retirement, you may want to shift some of your investments from stocks to more stable, low-earning funds like bonds. A common recommendation is to have a higher percentage of bonds than stocks in your portfolio once you retire.

Cash holdings are important, especially for emergencies. It is recommended to have three to six months' worth of living expenses in a savings account or liquid assets. While cash doesn't lose value like stocks or bonds, it is still important to diversify your cash holdings to maximize liquidity and interest earnings.

In addition to your age, you should consider your risk tolerance, investment goals, time horizon, and current market conditions. It is important to periodically review and rebalance your portfolio to ensure it aligns with your objectives. Consulting a financial professional can also help you make more tailored decisions based on your individual circumstances.