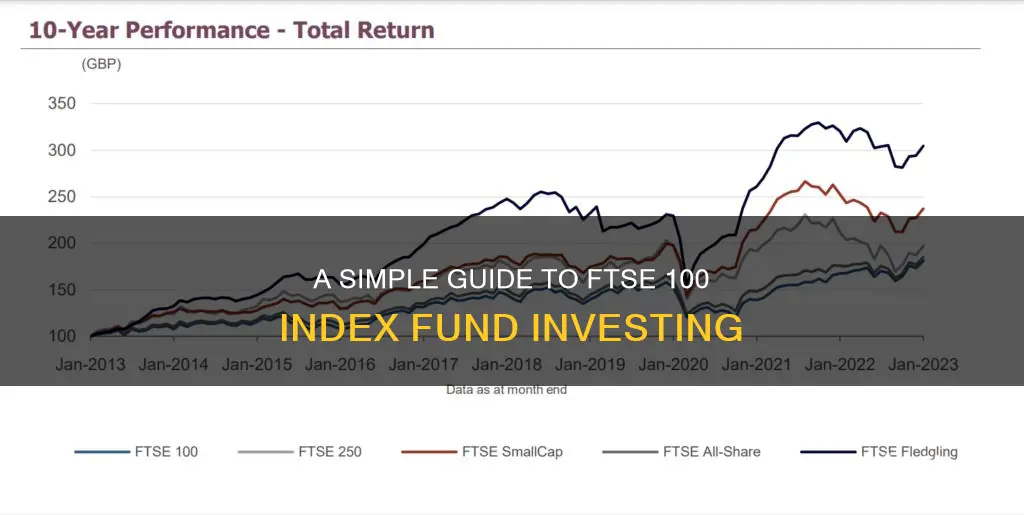

The FTSE 100 is an index of the 100 largest stocks on the London Stock Exchange. It is one of the world's most famous stock market indices and acts as a benchmark for the UK stock market globally. There are several ways to invest in the FTSE 100, including buying individual shares, investing in index tracker funds, or trading exchange-traded funds (ETFs). Each option has its own advantages and disadvantages, and it is important to understand the risks involved before investing.

| Characteristics | Values |

|---|---|

| What is the FTSE 100? | The FTSE 100 is an index of the 100 largest stocks on the London Stock Exchange in the premium listing category. It acts as the benchmark for the UK stock market globally. |

| How does the FTSE 100 work? | The index is weighted by market capitalisation. The index provider FTSE Russell takes the 100 biggest companies on the London Stock Exchange that meet certain criteria for listing category and liquidity. |

| How to invest in the FTSE 100 | There are several ways to invest in the FTSE 100: FTSE 100 tracker funds, FTSE 100 ETFs, and buying shares in individual companies in the index. |

| Benefits of investing in the FTSE 100 | Investors can benefit from the generous dividends paid by companies in the index, and diversification by investing in multiple companies across different industries. |

| Risks of investing in the FTSE 100 | Shares can go up and down in value, so investors could get back less than they invest. |

| Costs of investing in the FTSE 100 | Costs include platform charges or account fees, ongoing fund charges, and fixed fees for each trade. |

What You'll Learn

Buying individual shares of FTSE 100 companies

If you're looking for a more direct way to invest in the FTSE 100, you can consider buying individual shares of FTSE 100 companies on a share dealing platform. This approach offers the potential for higher profits if the shares you purchase increase in value, and you may also receive regular dividends linked to the company's profits. However, it's important to remember that share prices can fluctuate, so there is a risk of losing part or all of your investment.

To increase your chances of making profits and managing risk, consider investing in shares from multiple companies across different industries. This type of diversification can help spread your risk and potentially mitigate losses. FTSE 100 companies tend to be relatively stable due to their size and reputation, but they are not immune to downturns, so diversifying your investments is always a wise strategy.

When purchasing individual shares, you can use an online share dealing platform such as InvestDirect, which may offer a user-friendly interface and competitive fees. Before investing, be sure to review the eligibility criteria and fees associated with the platform to ensure it aligns with your investment goals and budget.

Keep in mind that investing in individual shares of FTSE 100 companies can be a more hands-on approach compared to other investment options. You may need to actively monitor the performance of your investments and make decisions about buying or selling shares based on market conditions and your risk tolerance.

Additionally, when investing in individual shares, you may incur various fees and charges, such as account fees, dealing fees, and platform fees. Be sure to review the fee structure of your chosen platform to understand the overall cost of your investment.

Overall, buying individual shares of FTSE 100 companies can be a rewarding investment strategy, but it's important to carefully consider your risk tolerance, diversification, and the associated fees to make informed investment decisions.

Venture Funds That Invested in Theranos: A Comprehensive List

You may want to see also

Buying FTSE 100 tracker funds

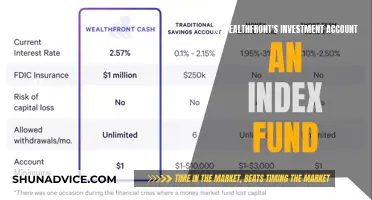

FTSE 100 tracker funds, also known as index funds, are a popular way to invest in the FTSE 100. They are designed to mirror the performance of the index and are passively managed. As you need to buy them directly from the fund manager, they can be slightly harder to invest in compared to other options.

Tracker funds are beneficial because they are diversified and low-cost. If some companies in the fund perform poorly, this could be offset by others in the fund that perform better. They also usually have low ongoing charges because they don't require a fund manager to research and select companies.

There are two main types of tracker funds: Open-ended Investment Companies (OEICs) and Exchange-Traded Funds (ETFs). OEICs track the index directly or may invest in a subset of the index, such as UK large-cap shares. ETFs are more common and aim to replicate an index with a 'live' price, meaning investors know the execution price when placing a trade.

Tracker funds use two methods to replicate an index: 'full replication' and 'partial replication'. Full replication involves the fund buying shares in each company in the FTSE 100 index in proportion to its weighting. Partial replication involves holding a representative sample of companies to replicate the index, which is used when there are a high number of companies in an index or when companies are less liquid.

The average annual management fee for a tracker fund is around 0.05% to 0.20%, compared to 0.5% to 1.0% for an actively-managed fund. Investors may also need to pay a transaction fee on buying or selling a tracker fund, as well as an annual platform fee for holding the fund.

Tracker funds can be bought within a tax-efficient wrapper such as an Individual Savings Account (ISA) or Self-Invested Personal Pension (SIPP), which are free from capital gains and income tax.

Example Providers of FTSE 100 Tracker Funds

- Vanguard FTSE 100 Index Accumulation

- IShares Core FTSE 100 UCITS ETF

Malaysia's Best Mutual Funds: Where to Invest?

You may want to see also

Buying FTSE 100 exchange-traded funds (ETFs)

ETFs are one of the most common ways of investing in a tracker fund. They aim to replicate an index but have a 'live' price, meaning that investors know the execution price when they place the trade.

There are two methods used by tracker funds to replicate an index:

- Full replication: The tracker fund buys shares in each of the companies in the FTSE 100 index in proportion to its weighting.

- Partial replication: The tracker fund holds a representative sample of companies to replicate the index, rather than every company. Partial replication is typically used when there is a high number of companies in an index or where the companies are less liquid.

The average annual management fee for a tracker fund is around 0.05% to 0.20%.

- IShares Core FTSE 100 UCITS ETF (Dist): The largest FTSE 100 ETF by fund size in EUR.

- Vanguard FTSE 100 UCITS ETF Distributing: The cheapest FTSE 100 ETF by total expense ratio.

- Xtrackers FTSE 100 UCITS ETF 1C: The best FTSE 100 ETF by 1-year fund return as of 30.09.24.

You can buy or sell holdings in a FTSE 100 ETF through a Stocks and Shares ISA, Lifetime ISA, SIPP or Fund and Share Account.

Artemis Vega Fund: A Smart Investment Strategy

You may want to see also

Trading the FTSE 100 index directly

How to Trade the FTSE 100 Index Directly

Going Long or Short

When trading the FTSE 100 index, you can go 'long' if you think the price will rise or go 'short' if you believe the price will fall.

Trading Charges

Short-Term vs Long-Term Trading

If you're looking to take a short-term position, you can choose the FTSE 100 'cash' (spot) market. For longer-term positions, you can opt for the FTSE 100 futures or options markets.

Trading Hours

The FTSE 100 can be traded almost 24/7, except from 10 pm Friday to 8 am on Saturday and 10:40 pm to 11 pm on Sunday.

Trading Account

To start trading the FTSE 100 index directly, you'll need to open a trading account with a broker that offers this service.

Risk and Volatility

It's important to remember that trading the FTSE 100 index directly involves risk and potential for rapid loss due to leverage. Understanding the risks and implementing risk management strategies is crucial. Additionally, the FTSE 100 can be volatile, influenced by various factors such as economic events, exchange rates, news releases, earnings reports, and commodity prices.

Trading Strategies

Developing and refining your trading strategies is essential. This includes deciding on your trading style (such as scalping, day trading, swing trading, or position trading), studying charts and price action, using technical analysis and indicators, setting trading alerts, and staying up-to-date with news and economic data.

Understanding the FTSE 100

Knowing how the FTSE 100 is calculated and what factors influence its price is crucial. The FTSE 100 comprises the 100 largest companies listed on the London Stock Exchange by market capitalisation, and its price is determined by the price movement of these constituent stocks, weighted by their market capitalisation.

In summary, trading the FTSE 100 index directly offers a way to access the performance of the UK's largest companies, with the potential for both gains and losses. It's important to approach this trading strategy with a thorough understanding of the risks and market dynamics, along with a well-defined trading plan.

Invest Wisely: Strategies for Your Child's College Fund

You may want to see also

Trading or investing in FTSE 100 shares

The FTSE 100 is the UK's most popular index, comprising the 100 largest companies listed on the London Stock Exchange by market capitalisation. It is a benchmark for the UK stock market globally and is one of the world's most famous stock market indices.

How to trade or invest in the FTSE 100

There are several ways to gain exposure to the FTSE 100, including trading or investing in ETFs and individual shares, or trading on the index's value.

Trading the FTSE 100

When trading the FTSE 100, you will use spread bets or CFDs (contracts for difference). These are financial derivatives, meaning you never take ownership of any underlying assets. Instead, you speculate on the underlying asset's price movements—in this case, the index level of the FTSE 100 or the prices of FTSE 100 ETFs or shares.

Investing in the FTSE 100

When investing in the FTSE 100, you buy and own actual assets—for example, shares in a FTSE 100-tracking ETF or a constituent company. As a shareholder, you are entitled to dividends if any are paid and are granted voting rights.

Trading or investing in ETFs

ETFs (exchange-traded funds) are a way to invest in a range of bonds or shares in a single package. They are traded on the stock market, so you can buy or sell them at any time during the market day. When buying or selling an ETF, you will see two prices: the 'ask' price, which is what you pay to buy, and the 'bid' price, which is what you receive when you sell. The difference between these prices is called the 'spread'.

Trading or investing in individual shares

You can also trade or invest in the individual companies that make up the FTSE 100. Shares are tradeable during normal UK stock market hours, 8 am to 4.30 pm, Monday to Friday.

Important considerations

All trading and investment carry risk, and you may lose money. It is important to understand the risks involved and consider whether you can afford potential losses before trading or investing.

Mutual Funds: A Smart, Secure Investment Choice

You may want to see also